1-14 #LowBattery : Production costs for a TSMC 3nm wafer are estimated to exceed USD20,000; BOE is allegedly planning to build 2 new factories in Vietnam; Samsung seems to have shown interest in adopting a new mobile strategy; etc.

Alphabet’s Google has agreed to pay USD23M to resolve a long-running lawsuit brought by consumers who claimed its search engine shared their queries with advertisers or other third parties without their permission. The proposed settlement also requires Google to provide added disclosures to consumers about the sharing of search terms. The deal, which needs court approval, would bring an end to a privacy-focused consumer class action in California that has wound its way through federal courts over the past 12 years. (Android Headlines, Bloomberg)

In the last few years, Google has updated the original Nest Hub and the Nest Hub Max to run on the company’s Fuchsia operating system instead of “Cast OS”. Fuchsia developers submitted a new document explaining an upcoming project. Fuchsia is set to gain support for JavaScript development, intended to make it easier to manage and control a device’s features. More specifically, the work is being done to support “factories”, where new devices are tested while in production. Eventually, Fuchsia will be used as the operating system on devices when they are manufactured in factories. More importantly, Fuchsia’s JavaScript support apparently needs to be completed in 1H23 because a Fuchsia-powered device is being manufactured in the very near future. (Android Headlines, 9to5Google)

Samsung seems to have shown interest in adopting a new mobile strategy, where 2 Galaxy S handsets will be released instead of 3. Samsung is allegedly considering scrapping the “Plus” model in the Galaxy S24 series that will debut in 2024. Currently, the Galaxy S24 project is called DM internally. It currently has two sub-projects DM1 and DM3. There should be a DM2 but this is noticeably absent. If Samsung decides to go through without a Plus model for the Galaxy S24 series, it likely has to do with the current state of the smartphone market. Meanwhile, Samsung is also considering reducing the number of models in its A series, its mid-tier brand. Galaxy A1, A3, and A5 are likely to continue but A2 may be scrapped. (The Elec, Neowin)

According to TF Securities analyst Ming-Chi Kuo, Apple will be adding a budget model to its AirPods lineup by late 2024 at the earliest. He has outlined a timeline for the budget earbuds, stating that he believes they will begin shipping in 2H24 or 1H25. He stated that they will be priced under USD100. He has also claimed that Apple would release the second generation of its high-end AirPods Max, which were initially launched in late 2020. (Apple Insider, Twitter)

Fossil smartwatches may get updates more frequently and consistently in the future, at least the Gen 6 and newer models. Fossil’s vice president of product Brook Eaton said Wear OS 3 is a “very relevant platform for some time to come”. He referred to the Wear OS 3 update that arrived alongside the launch of the Gen 6 Wellness Edition a few months back. Fossil followed up with another feature update in late 2022 with some bug fixes and enhancements.(Android Headlines, CNET)

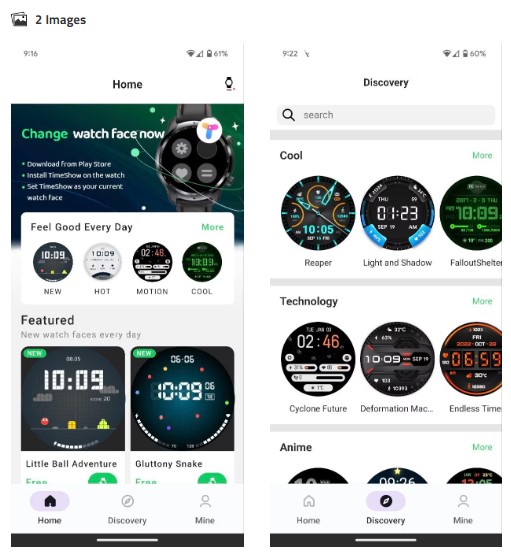

Mobvoi has introduced a new platform for creating and sharing smartwatch faces. The TicWatch maker is introducing its own watch face marketplace alongside the platform. The Mobvoi TimeShow app is a marketplace for watch faces for Wear OS and watchOS smartwatches. The TimeShow app also allows the user to create free watch faces, as well as paid designs. Both classic and modern design options are available in the marketplace. An additional layer of customization is achieved through user’s choice of fonts and effects.(Gizmo China, Android Police, XDA-Developers)

Microsoft plans to invest USD10B in OpenAI, the startup behind popular artificial intelligence (AI) tool ChatGPT. The deal is part of a funding round with other investors involved that would value OpenAI at a whopping USD29B. Microsoft will reportedly get a 75% share of OpenAI’s profits until it makes back the money on its investment, after which the company would assume a 49% stake in OpenAI.(CN Beta, Reuters, CNBC, Forbes, Semafor)

Samsung’s Android-based smartphones and tablets come with a feature called Nearby Device Scanning. This feature keeps scanning for compatible devices nearby, such as Galaxy Watch, Galaxy Buds, and Samsung SmartThings-enabled products. Whenever the feature detects a compatible device, it sends a notification or a pop-up asking if want to connect to the compatible device. Now, Samsung is pushing an update to Nearby Device Scanning, which adds support for Matter Easy Pair. With the new update, Nearby Device Scanning will send you a notification and / or show a pop-up on the screen whenever it detects a Matter-compatible device nearby.(Android Central, SamMobile, Samsung, Android Authority)

LG Electronics (LG) has announced a technical collaboration with Magna, a global mobility technology company and one of the largest suppliers in the automotive space. The two companies have signed an agreement to develop a proof of concept for an automated driving-infotainment solution, aimed at providing differentiated customer experiences and enabling readiness for the future of mobility. Under the agreement, LG and Magna will explore the technical feasibility of integrating LG’s infotainment capabilities with Magna’s Advanced Driver Assistance System (ADAS) and automated driving technologies.(Laoyaoba, LG, Asia Nikkei)

Meizu, which is acquired by a venture under Geely in 2022, will open a new 3-story flagship store in Wuhan, Hubei Province. The new store was being renovated and the enclosure was marked with “FlymeAuto”, Meizu’s vehicle system, indicating that the store may be used to sell vehicles. (CN Beta, Pandaily)

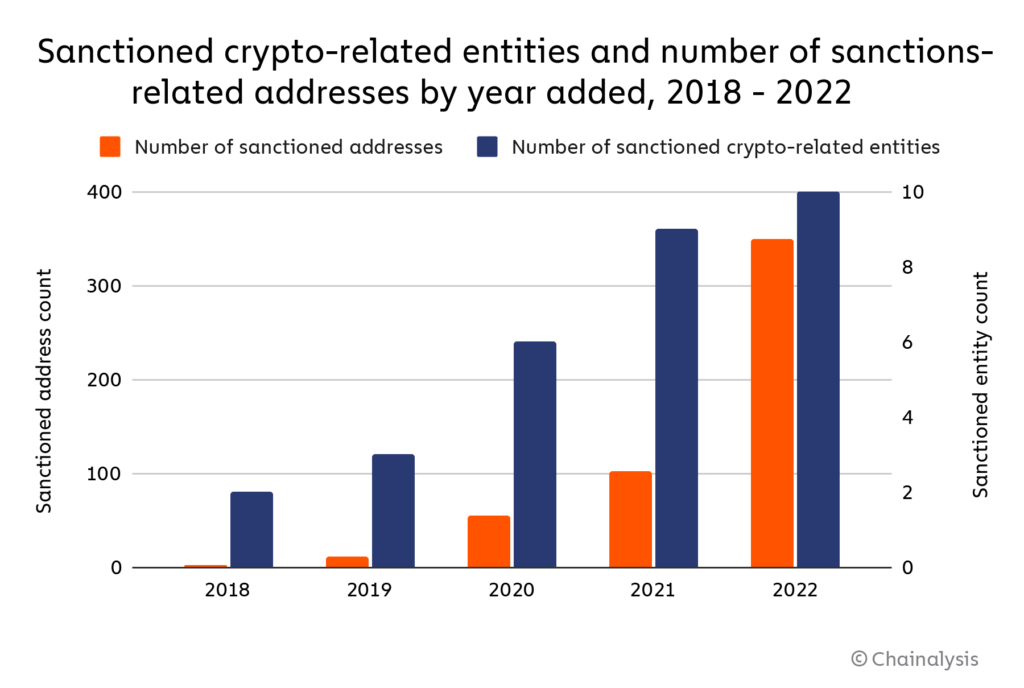

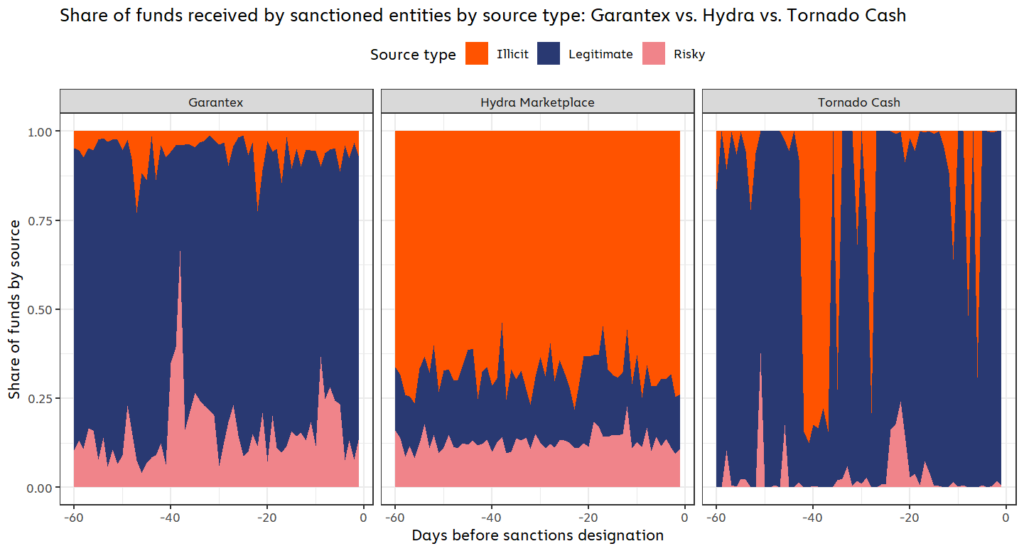

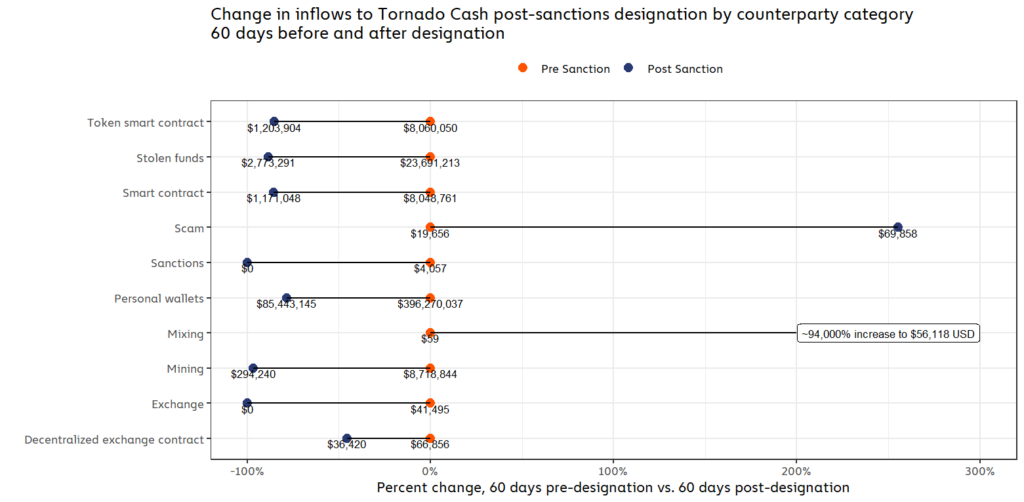

Illicit use of cryptocurrencies hit a record USD20.1B in 2022 as transactions involving companies targeted by U.S. sanctions skyrocketed, according to the data from blockchain analytics firm Chainalysis. Transactions associated with sanctioned entities increased more than 100,000-fold in 2022 and made up 44% of illicit activity in 2022. Funds received by the Russian exchange Garantex, which was sanctioned by the U.S. Treasury Department in Apr 2022, accounted for “much of 2022’s illicit volume”, adding that most of that activity is “likely Russian users using a Russian exchange”. Chainalysis said its USD20.1B estimate only includes activity recorded on blockchain, and excludes “off-chain” crime such as fraudulent accounting by crypto firms. The figure also excludes when cryptocurrencies are the proceeds of non-crypto-related crimes, such as when cryptocurrency is used as a means of payment in drug trafficking. (Chainalysis, Reuters, CN Beta)

Goldman Sachs’ newly formed technology and consumer unit made the equivalent of USD3B in pre-tax losses since 2020. The new units include its “Platform Solutions” division, which reported losses of USD1.2B for the first 9 months of 2022, USD1.05B for the full year in 2021 and USD783M in 2020. The Platform Solutions unit encompasses the technology Goldman uses to support credit cards for companies such as Apple and General Motors and online lending business GreenSky, which it acquired in 2022, as well as transaction banking services for corporate clients.(Apple Insider, Bloomberg, Reuters, Financial Times)

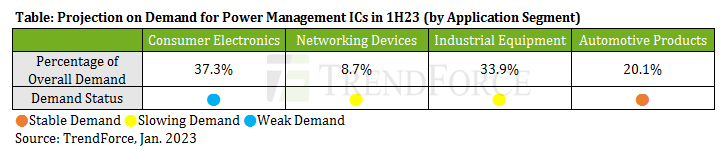

The effect of the low season, the planned scale-back of capital expenditure on the part of enterprises, and the ongoing slump in the wider consumer electronics market are going to constrain the demand for power management ICs during 1H23. On the supply side, Texas Instruments (TI) as the leading supplier for power management ICs will be activating the newly added production capacity at its production sites RFAB2 and LFAB in the same period. Given this circumstance, TrendForce projects that the global production capacity for power management ICs will increase by 4.7% YoY for 1H23. In the market for power management ICs, falling demand for products belonging to consumer electronics, networking devices, and industrial equipment continues to generate downward pressure on prices. Consequently, quotes for power management IC orders are projected to register a sequential drop of 5~10% during 1H23. Conversely, demand remains stable for automotive products thanks to the trend of vehicle electrification. Even though the weakening of the wider economy is causing uncertainties across the whole automotive market, prices are not expected to fluctuate significantly because of buyers and sellers of automotive products have mostly established long-term partnerships. Therefore, the demand coming from the automotive market is going to emerge as the only major driving force behind sales of power management ICs. (Laoyaoba, TrendForce, TrendForce)

Production costs for a 3nm wafer are estimated to exceed USD20,000 and these figures may not change until 2024. According to Digitimes, such high costs combined with uncertain market outlooks could prevent Qualcomm and MediaTek from releasing flagship 3 nm SoCs in 2023. MediaTek is well positioned on the market with mid-range and entry-level SoCs, but its flagship presence is not that well delineated and may not increase to a point where 3nm adoption would make sense this year. DigiTimes points out that “a quick migration to 3nm node may only serve symbolic purposes as far as technology upgrade is concerned, and will actually bring substantial pressure on its operating costs”. Qualcomm, on the other hand, is still evaluating the situation. Before making a final decision, Qualcomm will most likely need to assess inventory-related issues, as well as analyze investor and client needs. Big clients like Samsung could still push for a 3nm jump in order to compete with Apple, so Qualcomm might be forced to release flagship 3nm SoCs in late 2023, but this would also translate to significantly increased prices for Snapdragon-powered handhelds.(Notebook Check, Digitimes, China Times, CTEE)

Samsung Electronics has reportedly sharply increased its production yield of the industry’s most advanced 3nm chips for fabless clients. The 3nm technology is the first process node on which Samsung applied its s first-generation gate-all-around (GAA) structure transistors. In a GAA transistor, the gate surrounds all 4 faces of the channel where electric current flows, thereby increasing a chip’s performance and energy efficiency. By comparison, in the existing Fin field-effect transistor (FinFET) structure, the gate surrounds the channel from 3 sides. Taiwan Semiconductor Manufacturing Company (TSMC) sticks with the FinFET technology for 3 nm chips, which it started mass production late Dec 2022. (CN Beta, KED Global, WCCFtech, Sammy Fans)

Apple is working on a new in-house chip that would power cellular, Wi-Fi, and Bluetooth functionality on its devices. The company is also developing its own chip that would replace the Wi-Fi and Bluetooth chip it currently uses from Broadcom, which it wants to begin using in devices in 2025. Apple will use its own modems “by the end of 2024 or early 2025”. Apple will apparently start by using its custom modem in one product and fully transition them over the course of approximately 3 years. (Bloomberg, CN Beta, 9to5Mac)

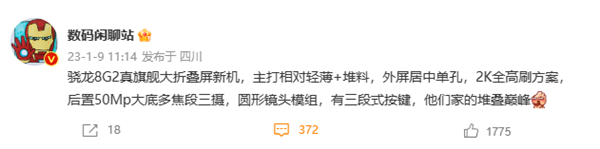

OPPO’s next-gen foldable smartphone allegedly will be powered by the latest and greatest second-generation Snapdragon 8 chip, which utilizes advanced 4nm process technology. This technology allows for significant improvements in CPU performance (up to 35% better) and energy efficiency (up to 40% more efficient) compared to the previous generation. Both the inner and outer screens will have a high-resolution 2K screen, which is an upgrade from the Find N2. The outer screen will also feature a unique hollowed-out design in the middle. (My Drivers, The Phone Talks)

Samsung Electronics and British nanotechnology company Nanoco Technologies told an East Texas federal court that they have settled Nanoco’s patent lawsuit over Samsung’s QLED televisions. The companies asked the court to halt the lawsuit over Samsung’s alleged infringement of Nanoco patents covering “quantum dot” technology for LED displays.(Laoyaoba, Reuters)

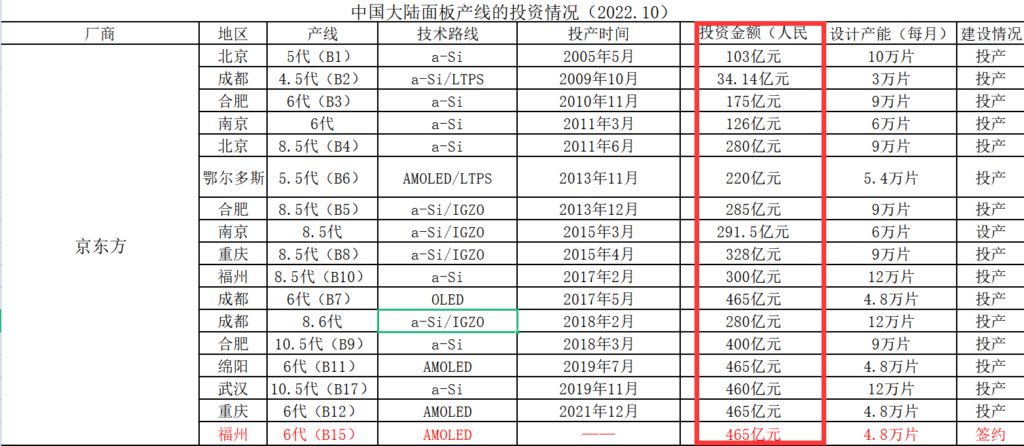

BOE is allegedly planning to build 2 new factories and is reportedly in discussions over renting dozens of hectares of land. BOE already has a small presence in South Vietnam, but these new plants will be in the north. In total, the company plans to rent up to 100 hectares of land, and around one fifth would be used for a USD150M plant to make remote control systems. The remainder of the space, and the remaining USD250M, will go to a display plant occupying 50 hectares. BOE plans to use the remaining space to house suppliers. (Apple Insider, Reuters, UDN, My Drivers)

Apple is reportedly planning to start using its own custom displays in mobile devices as early as 2024, in an effort to reduce its reliance on technology partners like Samsung Display and LG Display and bring more components in-house. The company aims to begin by swopping out the display in the highest-end Apple Watches by the end of 2024. The dsipaly upgrade the current OLED (organic light-emitting diode) standard to a technology called microLED, and Apple plans to eventually bring the displays to other devices, including the iPhone. (Apple Insider, Bloomberg, Strait Times)

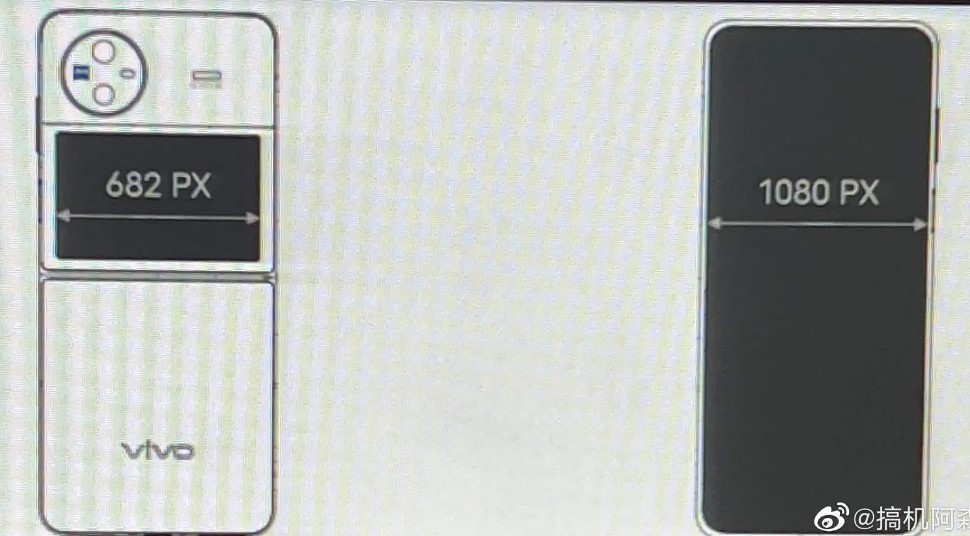

vivo is believed working on its first “flip” foldable phone, which will be tentatively called “vivo X Flip”. It will have a FHD foldable display. On the right is a volume button, and the regressed button below it seems to be a side-facing fingerprint scanner. In the upper half, there is a round-shaped camera module at the top-left corner, which seemingly houses a triple camera unit along with ZEISS branding. It is expected to release in 1H23. (GSM Arena, Weibo, Playfuldroid, Android Headlines)

TF Securities Ming-chi Kuo has indicated that Apple’s first OLED MacBook is coming by the end of 2024. Kuo says that OLED will bring a few advantages over the mini-LED Apple currently uses in the MacBook Pro 14 and 16, and the iPad Pro 12. It will allow for thinner and lighter devices with more diverse form factors. On a side note, OLED also allows for folding devices. (GSM Arena, Twitter)

Apple could launch MacBooks with touchscreens by 2025 as a part of a new MacBook Pro lineup. This lineup revamp could also see the company switching from LCD to OLED displays for the 14” and 16” Pro models. More recently, Apple senior VP Craig Federighi also referred to touchscreen PCs as “experiments” and said he is “not into touchscreens”.(MacRumors, Neowin, TechCrunch, Bloomberg)

Apple is allegedly planning to use hole-display for all four models of its iPhone 15 series. The two models, Pro and Pro Max, had a Dynamic Island feature thanks to this; there were two holes, one for the front camera and another for the Face ID. All four models of iPhone 15 are expected to have the Dynamic Island feature now. Samsung Display bought more laser etching equipment used to punch holes in its displays earlier Jan 2023 from supplier Philoptics. (The Elec, GSM Arena)

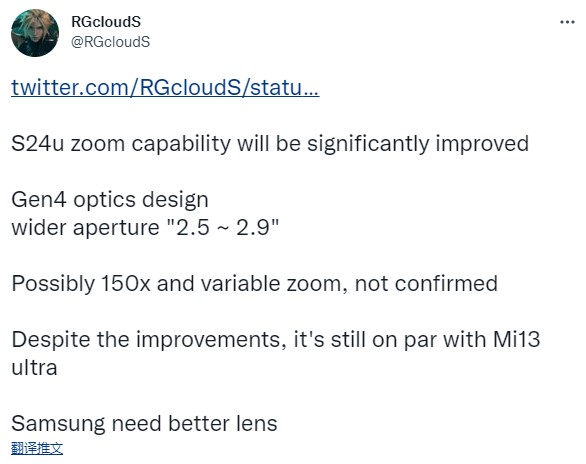

Samsung Galaxy S24 Ultra will allegedly have a telephoto camera with “Gen4” optics and an aperture between F2.5 and F.9. Both of these will enable the telephoto camera to capture images with 150x zoom, which is 50% more compared to 100x Space Zoom on the Galaxy S22. The telephoto camera on the Galaxy S24 could have variable zoom capability.(My Drivers, Android Headlines, SamMobile, Twitter)

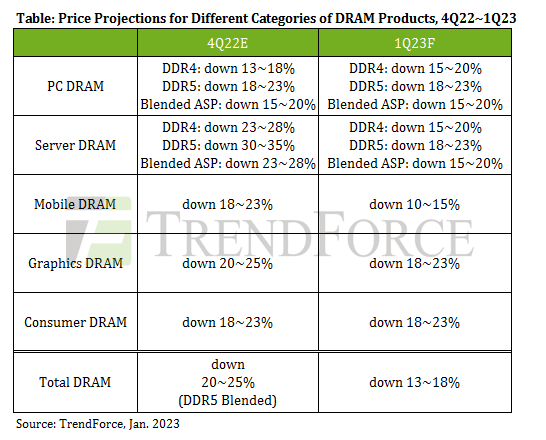

TrendForce’s latest analysis of the DRAM market finds that the inventory pressure on suppliers remain significant due to the persistently weak demand for consumer electronics. Among the top three DRAM suppliers, only Samsung has seen a slight drop in inventory level thanks to its highly competitive pricing strategy. To prevent DRAM prices as a whole from making another sharp dive, a few suppliers such as Micron have been cutting production. Therefore, the QoQ decline in DRAM prices are projected to shrink to around 13~18% for 1Q23. However, the slump will have yet to reach the bottom at that time. Regarding the QoQ changes in the prices of the major categories of DRAM products for 1Q23, PC DRAM and server DRAM are projected to again register a drop that is near 20%. Conversely, mobile DRAM will experience the smallest price decline because its profit margin is ready the thinnest. (TrendForce, TrendForce)

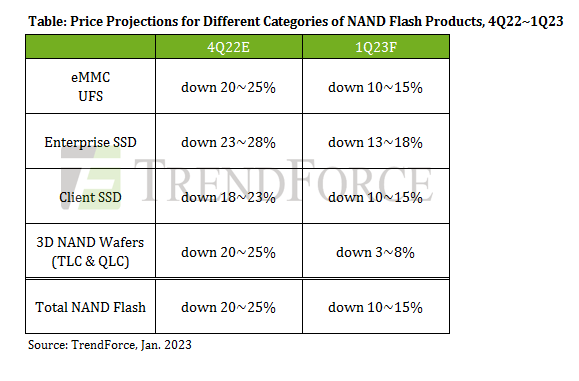

TrendForce’s latest analysis of the NAND Flash market finds that most suppliers have already started to scale back production. Due to this development, the vicious cycle of suppliers undercutting each other has been brought under control to some degree as well. Therefore, the QoQ decline in the overall NAND Flash ASP for 1Q23 is currently projected to reach 10~15%, which is smaller than the QoQ decline for 4Q22. Regarding price trends of different NAND Flash products in 1Q23, prices of NAND Flash wafers are already at the cash cost level, so their decline will moderate sooner compared with other kinds of NAND Flash products. Conversely, prices of enterprise SSDs will suffer the sharpest drop compared with other kinds of NAND Flash products because they represent a major source of inventory consumption and offer a relatively high profit margin. (TrendForce, TrendForce)

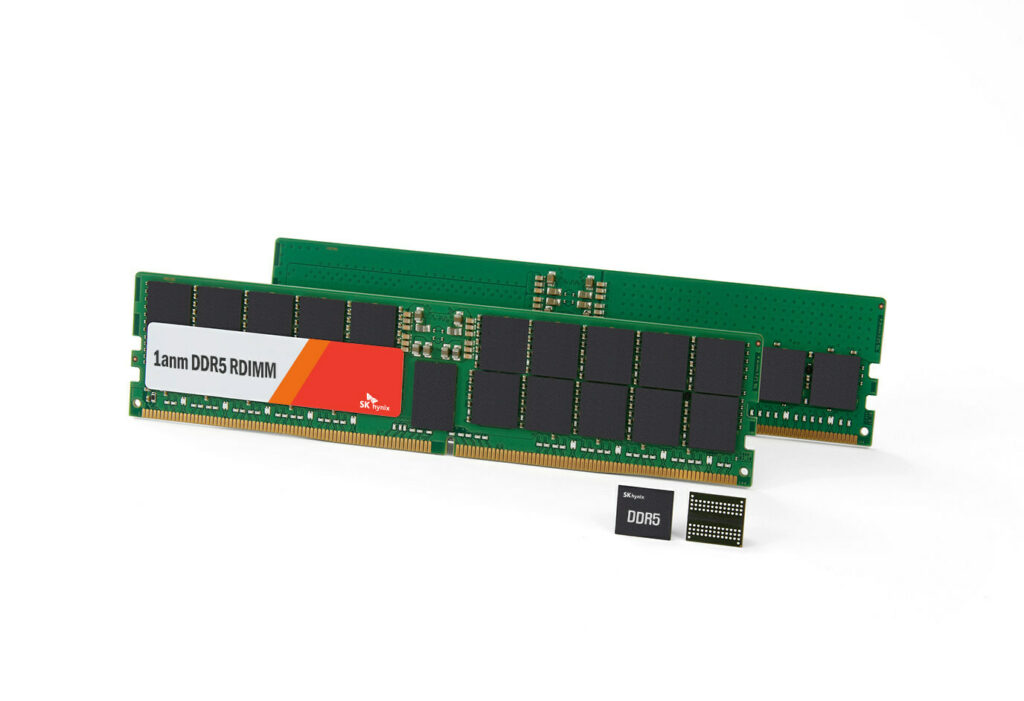

SK hynix has announced that its DDR5 product for servers using 1anm, the fourth generation of the 10nm process technology, has been validated on the 4th Gen Intel Xeon Scalable processor (formerly codenamed Sapphire Rapids) for the first time in the industry. The validation of the company’s 1anm DDR5 product, which adopts 1anm technology using the EUV lithography process, is for 4th Gen Intel Xeon Scalable processors.(CN Beta, WCCFTech, PR Newswire)