2-17 #Celebrate : Arm China joint venture has laid off 90-95 employees; Samsung reportedly launches a price war for wafer foundry to grab; Micron Technology is cutting executives salaries; etc.

SoftBank Group’s chip technology firm Arm China joint venture has laid off 90-95 employees to cope with a challenging business outlook in 2023. Before the layoffs, Arm China had about 700 employees; there were no layoffs last year when parent Arm had global layoffs affecting up to 15% of its workforce. (CN Beta, Market Screener, Reuters)

MediaTek has announced a new entry-level chipset. The MediaTek Helio G36 is based on TSMC’s 12nm process. It has eight Cortex-A53 cores clocked at 2.2GHz. There is an IMG PowerVR GE8320 GPU onboard. The chipset has MediaTek HyperEngine 2.0 Lite gaming technologies. The Resource Management Engine 2.0 ensures sustained performance with dynamic management of GPU, CPU, and memory whereas the Networking Engine 2.0 enables faster response and better connectivity for uninterrupted services.(GizChina, Gizmo China, GSM Arena, MediaTek)

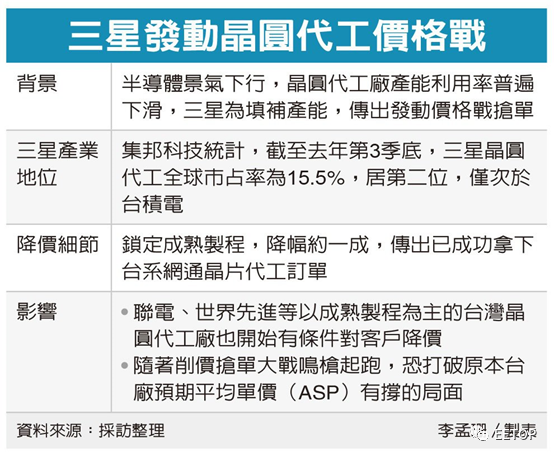

Samsung reportedly launches a price war for wafer foundry to grab orders, locked in mature manufacturing processes, and cut prices by as much as 10%. UMC and VIS has also begun to lower prices for customers. With the start of the price-cutting competition, the expected stable average unit price (ASP) may be disrupted. UMC and VIS have begun to have the conditions to carry out price adjustment strategies with customers. In this regard, UMC has responded that it would not comment on market rumors. At present, the quotations are stable. (Laoyaoba, C114, Wallstreet CN, Bnext, UDN)

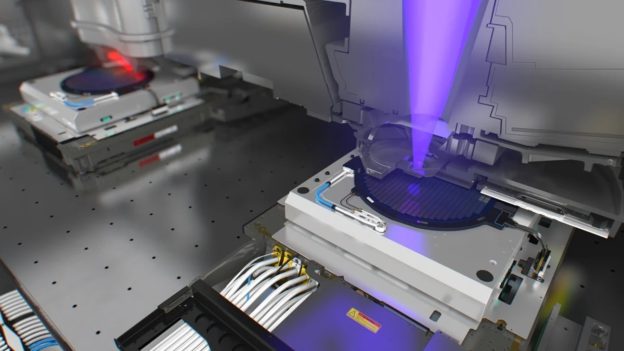

Samsung Electronics has begun developing an advanced extreme ultraviolet (EUV) pellicle to narrow its market share gap with foundry rival TSMC. The company’s Semiconductor Research Institute recently put out a recruitment notice to develop a pellicle that satisfies an EUV transmittance of 92%. Currently, Samsung Electronics is known to have developed a pellicle with a 88% transmittance. EUV pellicles are a material necessary for the exposure process where a circuit shape is printed on a semiconductor wafer using light. They serve as a cover to block foreign substances from being attached to a mask. Pellicles help cut costs by minimizing defects during the process and extending the lifespan of expensive masks. At present, the photomask film suppliers are mainly Dutch ASML, Japanese Mitsui Chemical and Korean S&S Tech, and Korean EUV film has been monopolized by external manufacturers. (CN Beta, Digitimes, Techgoing, Business Korea, TechNews)

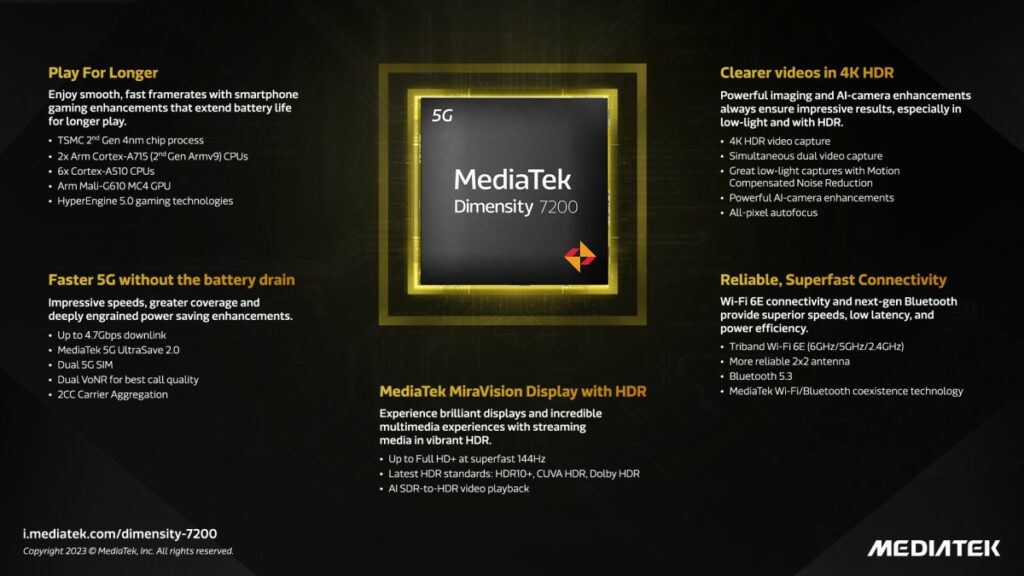

MediaTek has announced the latest addition to its chipset lineup dubbed Dimensity 7200. The MediaTek Dimensity 7200 is built on TSMC’s N4P process, the same used in the Dimensity 9200 series and an improvement over the Dimensity 9000. It packs two Cortex-A715 cores with a peak frequency of 2.8GHz and six Cortex-A510 cores. The graphics unit is a quad-core ARM Mali G610 that scores between 100-120fps on the Manhattan GFX benchmark. The Dimensity 7200 is outfitted with MediaTek’s Imagiq 765 and a 14-bit HDR-ISP that can support main cameras of up to 200MP.(CN Beta, GSM Arena, XDA-Developers, MediaTek)

Qualcomm has announced its latest Snapdragon X75 modem for vehicles, PCs, Industrial IoT, and Snapdragon X72 modem for mobile devices. Both are ready to support 5G Advanced, called by Qualcomm “the next phase of 5G”. The modems have 10-carrier aggregation and support 10 Gbps downlink in both Wi-Fi 7 and 5G. Qualcomm’s 6th-gen modem-to-antenna solution uses a new architecture and brings a new QTM565 mmWave antenna module that reduces cost, board complexity, hardware footprint, and energy consumption. Commercial devices with the new Snapdragon modems are expected to launch by the end of 2023.(Gizmo China, GSM Arena, Qualcomm)

LG has announced a new range of displays designed to help eliminate the need for projection rooms at cinemas. The LG Mirraclass (a combination of Miracle and Class) LED displays can offer viewing experiences of between 14 and 101 square metres squared and in resolutions of 2K and 4K. The LED pixels deliver 24-bit colour processing and are capable of delivering 68.7M different colour combinations. The Mirraclass brightness can also be adjusted across 5 different stages ranging from 48 to 300 nits.(CN Beta, Pocket-Lint, Gizmodo, LG)

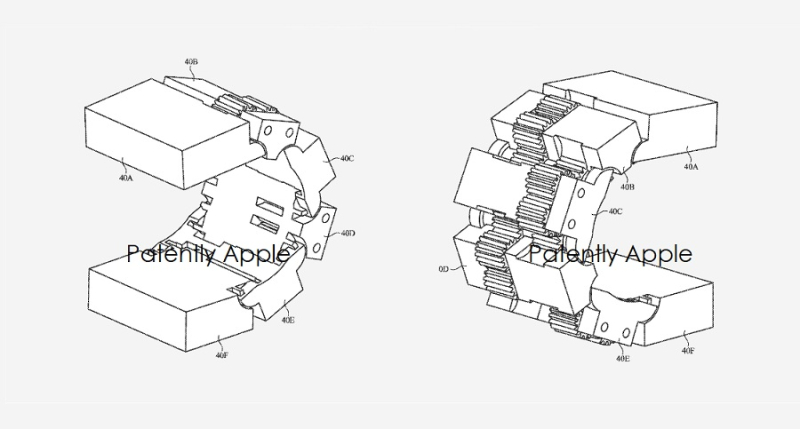

Apple has filed new patent of hinge system relating to future foldable devices. The hinge may have a series of interconnected links. The links may be formed from thin sheets of material that form interdigitated fingers in a friction clutch. The fingers or other portions of the links may be provided with crescent-shaped slots that receive pins. During folding of the device, the pins may slide along the crescent-shaped slots, thereby ensuring that adjacent links rotate relative to each other about a rotation axis that lies outside of the hinge and within the flexible display panel supported over the links.(Apple Insider, Patently Apple)

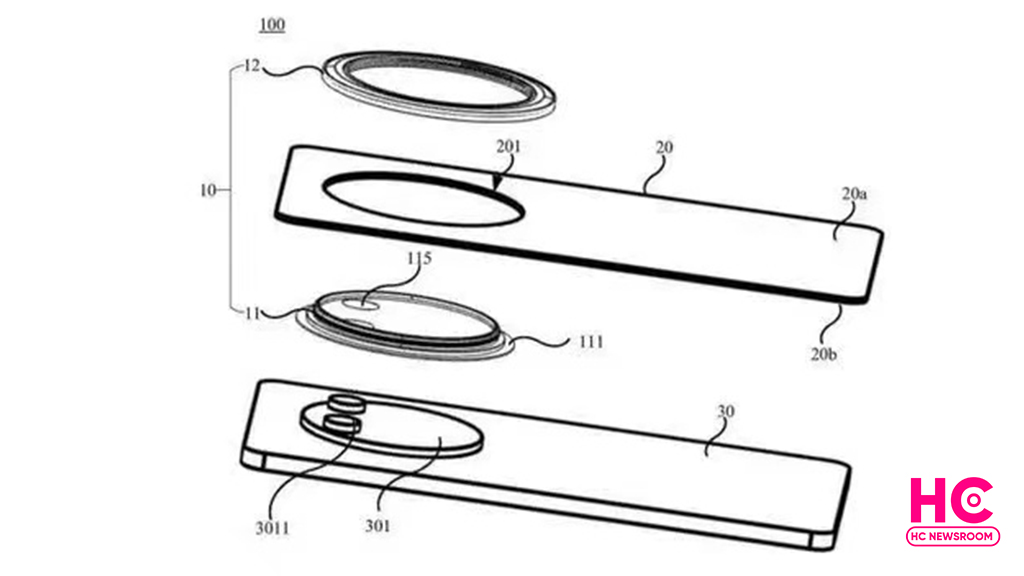

Huawei’s new patent is for the phones’ electronic devices and their casing of decorations. In other words, it is about the camera models and their covers. The main aim of the patent is to customization of the camera models. The patent’s camera replacement technology relates to the field of device technology and discloses an electronic device, a cover decoration, and a rear cover itself.(GizChina, Huawel Central)

Micron Technology is cutting executives salaries by as much as 20% and suspending bonuses as the chipmaker copes with an industrywide slump. Chief Executive Officer Sanjay Mehrotra will see his salary reduced by a fifth, with executive vice presidents getting a 15% cut. Senior vice presidents will have their salaries reduced 10%, and bonuses will be suspended for all named executive officers. The move follows a plan to cut jobs at Micron by 10%. The Boise, Idaho-based company is contending with sluggish demand for memory chips as part of slowdown for sales of personal computers and other devices. (CN Beta, Bloomberg, Barron’s, MSN)

Micron Taiwan has confirmed rumors of work force streamlining at its Taoyuan main office. The company employs approximately 10,000 people in Taiwan, though cost-cutting plans have been implemented since late Dec 2022 to cope with an expected sales slump for 2023. The measures include slashing operational expenditure and suspending stock buybacks. (Epoch Times, CN Beta, Bnext, ETtoday, UDN, Taiwan News)

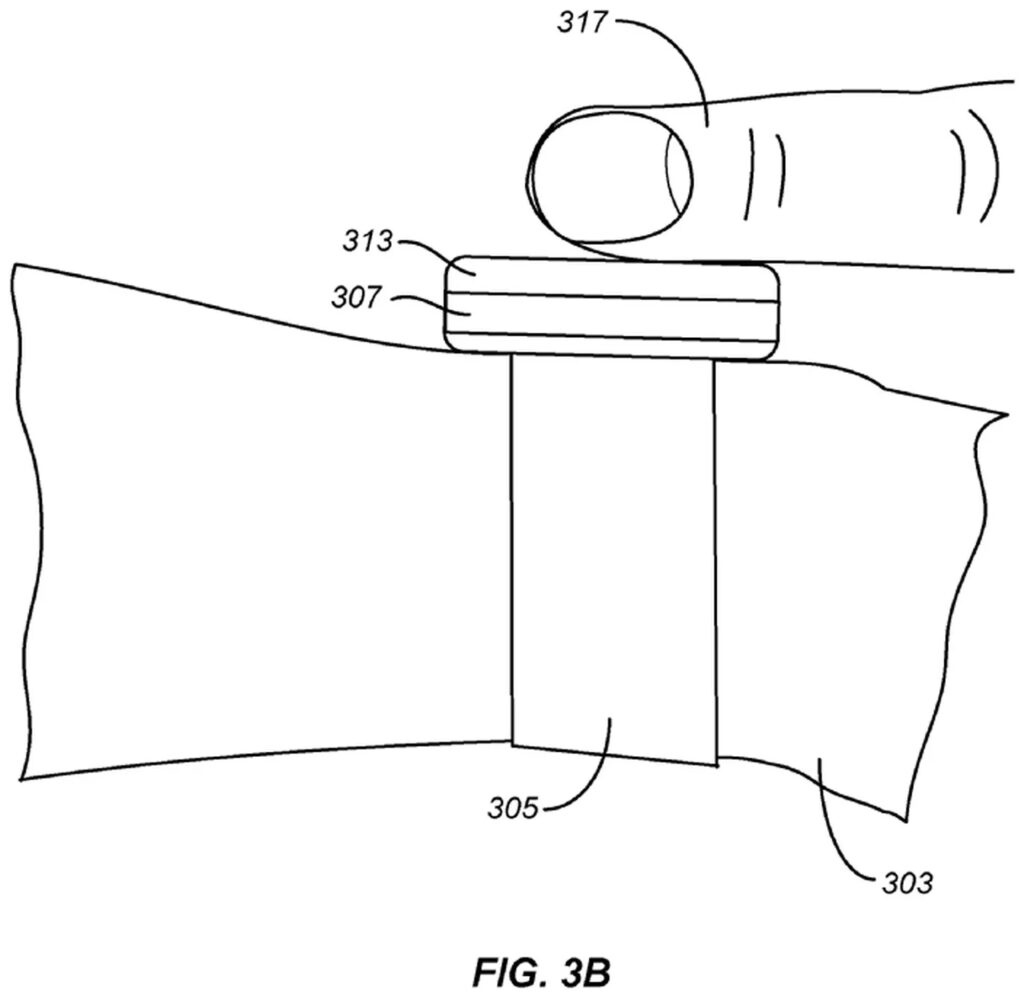

Fitbit has filed a patent application for a force-sensitive display that would enable blood pressure readings on wearables. As per the filing details, the technology includes a force-sensitive screen and a photoplethysmography (PPG) sensor to measure blood pressure. Those work by cutting off blood flow in an artery. That pressure is then slowly relieved, which helps doctors figure out when blood flow starts up again (systolic reading) and when user’s heart relaxes again (diastolic reading). High numbers can be a sign user’s heart is working too hard to pump blood through body. (Android Headlines, The Verge, USPTO)

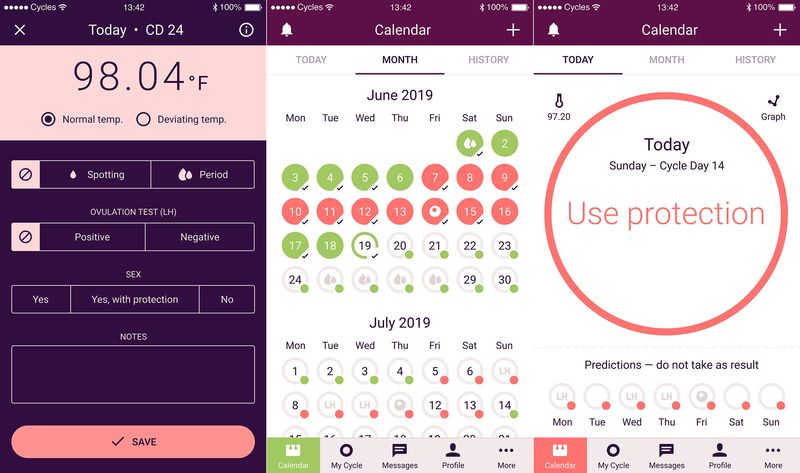

Samsung Electronics and Natural Cycles have announced a partnership to bring advanced temperature-based menstrual cycle tracking capabilities to the Galaxy Watch5 series — the first time Natural Cycles’ algorithm has been adapted for a smartwatch. This latest partnership combines Samsung’s superior sensor technology with Natural Cycles’ innovative fertility technology to give users more detailed insight into their menstrual cycle. Galaxy Watch5 users will be able to access advanced cycle tracking through the Cycle Tracking feature, which was recently approved by the Ministry of Food and Drug Safety (MFDS) of the Republic of Korea. The Cycle Tracking feature has also been registered with the Food and Drug Administration (FDA) and complies with CE Marking requirements.(Forbes, CNET, Samsung, The Verge)

Finland’s Salcomp, a supplier to Apple, plans to double its workforce in India to 25,000 over the next 3 years, targeting annual revenue in the country of at least USD2B-3B by 2025. Salcomp is a supplier of smartphone parts and manufacturer of chargers, with its workforce in its Chennai plant currently sitting at 12,000 people. (CN Beta, Reuters, Apple Insider)

Ford Motor is set to announce it plans to build a USD3.5B lithium iron phosphate battery plant in Michigan. Ford is expected to own and operate the plant with Chinese battery company China’s Contemporary Amperex Technology Co Ltd (CATL) as a technology partner to help develop the batteries. The plant is expected to be located in the Marshall, Michigan area.(CN Beta, Reuters, Yahoo, Detroit News)

Samsung plans to use 100% recycled plastic parts in all of its smartphones by 2050. The company aims to achieve a net-zero plastic footprint in new flagship models by as early as 2025, using recycled plastic materials in all devices. It will also entirely stop using plastic in smartphone packaging over the next couple of years. The new Galaxy flagships use recycled plastic from discarded PET (Polyethylene terephthalate) bottles in the back glass and front case, and recycled aluminum in the power key, volume key, and SIM tray. The Galaxy S23 Ultra contains about 22% recycled content on the front and back glass.(Android Headlines, YNA, SamMobile)

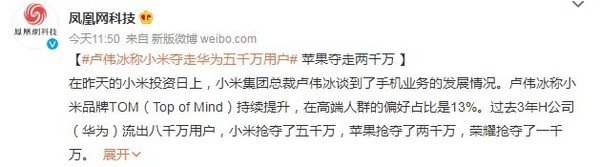

Lu Weibing, President of Xiaomi Group said that Huawei has lost over 80M smartphone users, of which, Xiaomi took over 50M. From the rest, Apple took over 20M users and Honor grabbed 10M. (GizChina, Huawei Central, CNMO)

Xiaomi India is teaming up with Sourav Ganguly Foundation and CRY, the leading smartphone and smart TV brand is launching its #BackToSchool initiative to give a helping hand to 1600 underprivileged children in India. The goal is to provide these young students with academic support, life skills, and self-confidence, all with the aim of reducing dropout rates and encouraging education.(Gizmo China, Twitter)

According to TF Securities analyst Ming-chi Kuo, Xiaomi’s component inventory, equivalent to roughly 20–30M smartphones, is showing the most severe signs of excess in terms of processors, with MediaTek and Qualcomm as the suppliers. Xiaomi and most Android brands are at risk of high inventory levels due to weak demand. For example, Samsung’s global mobile phone inventory, which combines end products and components, may not drop to a reasonable level until Jun 2023. (Laoyaoba, Twitter, Medium)

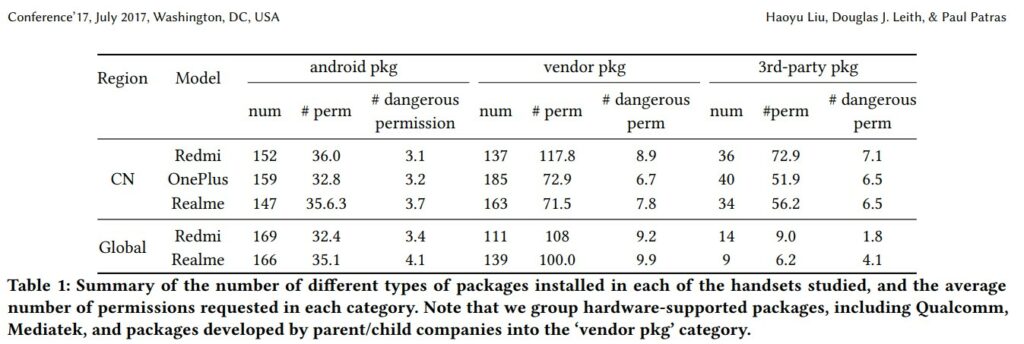

A study published by computer scientists at several different universities reveals that phone makers like Xiaomi, OnePlus, and OPPO realme, are all collecting massive amounts of sensitive user data via their respective operating systems, as are a variety of apps that come pre-installed on the phones. The data is also getting hoovered up by an assortment of other private actors. Researchers worry that the devices in question “send a worrying amount of Personally Identifiable Information (PII) not only to the device vendor but also to service providers like Baidu and to Chinese mobile network operators. (Gizmo China, Phone Arena, Gizmodo, ARXIV)

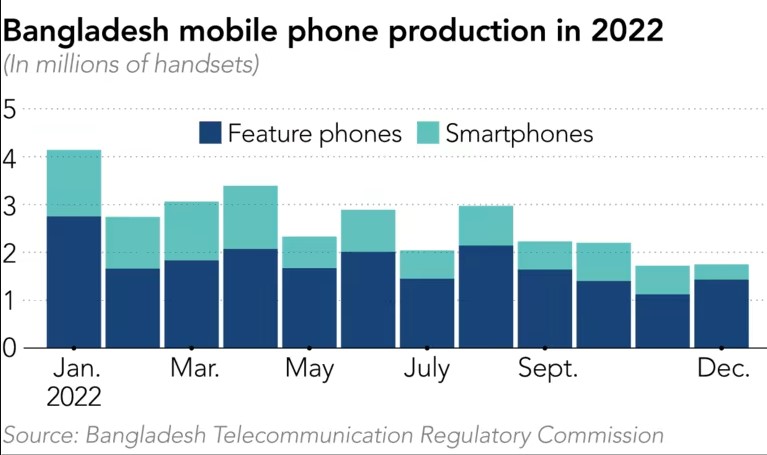

Bangladesh’s once booming mobile phone market has hit the skids as manufacturers including Samsung Electronics, Xiaomi and vivo reduce or calibrate local handset assembly as economic and financial pressures batter the country and force consumers to tighten their belts. Dmand and manufacturing are falling due to myriad issues including inflation, a weak local currency, dwindling foreign currency reserves, more taxes, higher phone costs, and a profusion of illegal handsets. Handset assembly in Bangladesh developed as manufacturers, including other global names such as Nokia, OPPO and realme, set up production to escape high import tariffs. While some phones have been exported, most are sold domestically in a nation with a population approaching 170 million people — the world’s eighth largest. Most manufacturing is done through ventures with local companies. Data from the Bangladesh Telecommunication Regulatory Commission illustrates last year’s deteriorating production. In Jan 2022, a record 4.145M handsets were produced locally, but the figure slumped to 1.753M in Dec 2022. Imported ones declined from 211,033 in 1Q22 to just 3,186 in 4Q22. (Laoyaoba, Asia Nikkei)

Apple’s biggest contractor Foxconn Technology Group said it has secured a new site in Vietnam, as the company pushes ahead with efforts to shift more production away from mainland China following major disruptions at its key manufacturing base late 2022. Foxconn, formally known as Hon Hai Precision Industry, has signed a lease with Saigon-Bac Giang Industrial Park Corp to occupy a plot of 45 hectares (111 acres) for around USD62.5M to meet “operational needs and expand production capacity”. Foxconn signed a USD300M agreement with a Vietnamese developer Aug 2022 to build a new factory in Bac Giang, where it already produces iPads and AirPods.(Apple Insider, SCMP, CN Beta)

Apple is reportedly facing a significant challenge in reducing its dependence on China. In particular, a supplier based in India is producing iPhone casings with a 50% rejection rate, compared to the company’s target of zero defects. At an iPhone casings factory run by Indian conglomerate Tata, only half of the components produced are of acceptable quality to be sent to Foxconn, Apple’s assembly partner for building iPhones. Tech entrepreneur and academic Vivek Wadhwa suggested that it could take up to 3 years for Indian suppliers to be capable of the kind of volume production needed to compete with Chinese production. (9to5Mac, Financial Times, Gizmo China, Twitter)

The EU is set to launch an antitrust case against Amazon over its proposed USD1.7B acquisition of Roomba-maker iRobot, in the latest signal that big tech groups will receive greater scrutiny over dealmaking. Regulators in Brussels have sent the USD1T tech giant a series of detailed questions over the proposed transaction, in a move that indicates that they are gearing up for a formal probe. (CN Beta, Financial Times, Reuters, Engadget)

Amazon-owned Zoox said employees are test-riding its driverless robotaxis on public roads in California. For now, the tests are limited to employees at Zoox’s Foster City, California, headquarters. Amazon acquired the 9-year-old startup in 2020. The tests are currently limited to shuttling Zoox employees on a one-mile public route between two office buildings at the company’s headquarters in Foster City, California, at speeds up to 35 miles an hour. The company hasn’t said how big its test fleet is, but executives have said they have built “dozens” of vehicles, although fewer than 100.(CNN, CN Beta, CNBC, Seattle Times)

Xiaomi’s CEO Lei Jun has indicated that the company’s R&D team behind the project has grown to over 2,300 members, and they plan to launch the vehicle for mass production by 1Q24. He hasstated that autonomous driving is playing a crucial role in the car’s development, and they are investing heavily in becoming a leader in this field by 2024. In order to achieve this goal, the company also plans to test over 140 vehicles during the first phase of testing.(Android Headlines, My Drivers, Laoyaoba)

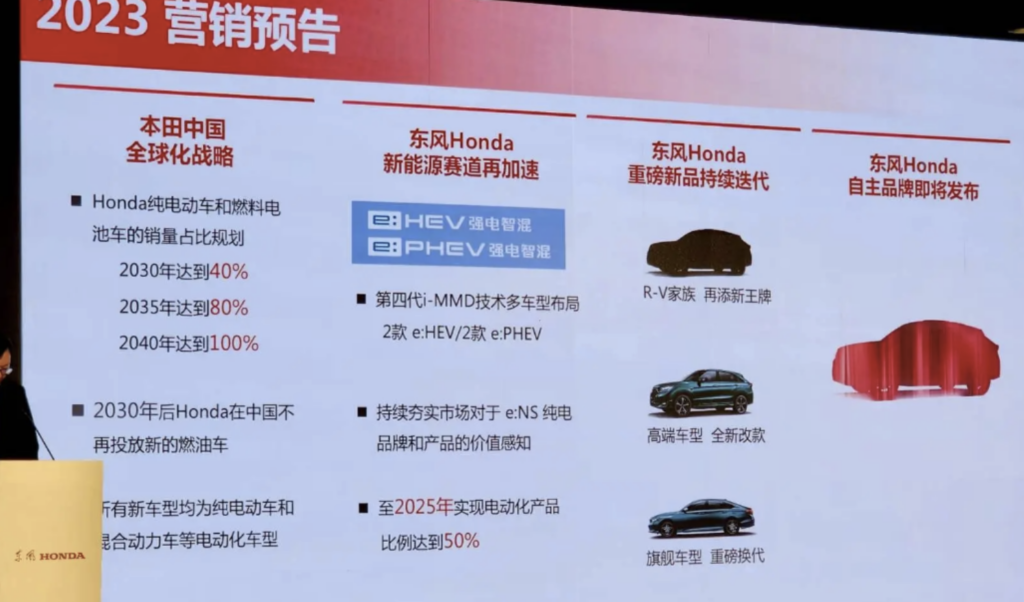

Dongfeng Honda Automobile has recently announced its business plan for the new year. The automaker plans to launch several hybrid and plug-in hybrid EVs in 2023, accelerating the transition to electrified cars. The goal is to increase the proportion of EVs in its portfolio to 50% by 2025. Dongfeng Honda is a 50:50 joint venture between China-based Dongfeng Motor and Japanese Honda Motor. The company, headquartered in Wuhan, has 20 years of history in China. Dongfeng Honda has reiterated the strategy of Honda Automobile (China) to stop introducing new internal combustion engine vehicles to the China market after 2030. Instead, Honda will put effort into raising the percentage of battery and fuel cell EVs to 40% in 2030, 80% in 2025 and 100% in 2040. Dongfeng Honda said it will launch two e:HEV and two e:PHEV-branded models based on the fourth-generation i-MMD hybrid technology in 2023. It also aims to bring the new generation or facelift of the existing SUVs and flagship sedans to the market.(CN Beta, Digitimes)