2-24 #EmbraceOld : OPPO’s self-developed AP is allegedly already in taped-out; Microsoft and Nvidia has agreed to a 10-year partnership; Meta will be collaborating with SK Hynix and LG Display to develop MicroOLED; etc.

Samsung Electronics plans to borrow KRW20T (USD15.78B) from its display unit to secure working capital as the company seeks to maintain a similar level of investment as 2022, despite the sharp industry downturn to continue into the year. In a regulatory filing, Samsung said it will be borrowing funds from Samsung Display at an interest rate of 4.6%, with the loan to mature on 17 Aug 2025. Samsung Display, an affiliate in which Samsung Electronics holds 85% of the stake, reportedly has some KRW20T in reserve funds.(Android Headlines, Korea Herald)

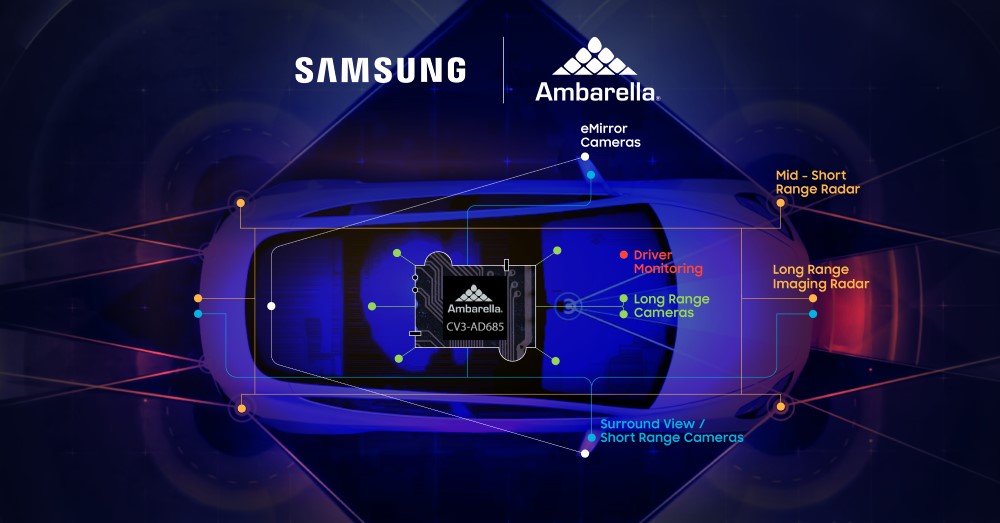

Samsung Electronics and Ambarella, an edge AI semiconductor company, today announced that Samsung’s Foundry business is providing its 5nm process technology to Ambarella for its newly announced CV3-AD685 automotive AI central domain controller. The CV3-AD685 is the first production version of Ambarella’s CV3-AD family of automotive AI central domain controllers with Tier-1 automotive suppliers announcing they will offer solutions using the CV3-AD system-on-chip (SoC) product family. Samsung’s 5nm process technology is optimized for automotive-grade semiconductors with extremely tight process controls and advanced IP for exceptional reliability and outstanding traceability.(Android Headlines, Samsung, Samsung, China Flash Market)

State-backed chipmaker Rapidus is considering building a factory on the northern main island of Hokkaido, as the new company aims to revive Japan’s semiconductor industry through homemade next-generation chip production. Created by Toyota Motor, Sony Group and 6 other major Japanese companies with a total investment of JPY7.3B (USD55M), Rapidus plans to mass-produce chips with state-of-the-art 2-nanometer technology in Japan in 2027. The chip-manufacturing company is also set to receive state subsidies of JPY70B as part of the Japanese government’s semiconductor strategy. Rapidus has recently partnered with U.S. tech giant IBM Corp. to manufacture advanced semiconductors.(Laoyaoba, Reuters, Japan Times, Kyodo News)

According to Digitimes, under the pressure of cutting orders, foundry manufacturers have to accept the price reduction requirements of IC design customers, and the foundry quotations that have been rising for 2 consecutive years have been fully loosened. Some wafer foundry manufacturers have confirmed that the capacity utilization rate has dropped sharply due to customers cutting orders recently, but the corresponding pricing strategies are also quite different. Among them, Samsung, PSMC, and GlobalFoundries have directly reduced their prices. It is reported that Samsung launched a wafer foundry price war to grab orders and targeted customers with mature 7/6nm processes. In recent months, it has continuously proposed preferential terms to Qualcomm, with a price cut of about 10%. Many other second- and third-tier fabs also chose to cut prices directly. Although the nominal foundry prices of TSMC, UMC, and World Advanced have not changed, they privately give different forms of discounts according to different customers and order sizes. Among them, UMC has provided 10% to customers who are willing to increase wafer production in 2Q23. %-15% price discount, the world’s advanced adopts the method of increasing free wafers to benefit customers. (CN Beta, Huxiu, Digitimes)

According to ASML’s Chief Financial Officer Roger Dassen, Samsung Electronics is a “demanding customer” for the ASML as it is increasing orders for ASML’s extreme ultraviolet (EUV) lithography systems. Samsung is is among the company’s 5 customers for EUV scanners. In 2023, it plans to ship around 60 EUV systems. Previously, it had produced about 40 units per year. It takes about 2 years to produce one EUV scanner, while costing USD150M-200M per unit. Other customers may include TSMC, Intel, SK Hynix and Micron. ASML has confirmed our capacity plans of 600 DUV (deep ultraviolet), 90 EUV systems by 2025-2026 and 20 EUV High-NA systems by 2027-2028. (CN Beta, KED Global, EE Times)

ASML, one of the largest suppliers to the global semiconductor industry and the only supplier of extreme ultraviolet (EUV) lithography photolithography machines, has revealed that a former employee in China stole information pertaining to its proprietary technology in a data breach.(Android Headlines, The Verge, ASML, Twitter)

Canon has launched the “MS-001”, a wafer measuring machine for semiconductor manufacturing, that enables high-precision alignment measurement of wafers. The alignment oscilloscope equipped with “MS-001” is equipped with an area sensor, which can perform the multi-pixel measurements and reduce noise during measurement. In addition, “MS-001” can also measure various types of alignment marks. By employing a newly developed oscilloscope light source for alignment, the new product offers a wavelength range 1.5 times larger than that measured in semiconductor lithography equipment, enabling alignment measurement at any wavelength desired by the user. Therefore, “MS-001” can achieve higher alignment measurement accuracy than measurements performed in semiconductor lithography equipment.(My Drivers, Canon, SPIE)

OPPO’s first-ever self-developed application processor (AP) is allegedly already in taped-out. It would be built using a 4nm manufacturing process, and the foundry manufacturer might be TSMC. Furthermore, this Chipset will also support 5G network connectivity. OPPO has reportedly invested over USD1.4B (CNY10B) in research and development to create its own SoC. The company’s first custom-designed processor, MariSilicon X, was released in 2021. The MariSilicon X was a specialized 6nm imaging chip that showed that the company was not planning to rely on processors and parts made by current partners like MediaTek and Qualcomm. OPPO also has a connectivity chip called MariSilicon Y. OPPO established a chip R&D subsidiary Zeku Technology in 2019, and formed a chip R&D team of up to 2,000 people. (My Drivers, EET China, Gizmo China, MyFixGuide)

According to Digitimes, Apple has procured 100% of TSMC’s initial N3 supply, which is said to have a high yield, despite the higher costs involved and the decline in the foundry’s utilization rate in 1H23. Mass production of TSMC’s 3nm process began in late Dec 2022, and the foundry has scaled up process capacity at a gradual pace with monthly output set to reach 45,000 wafers in Mar 2023. Apple is widely expected to adopt TSMC’s 3nm technology in 2023 for the A17 Bionic chip likely to power the iPhone 15 Pro and iPhone 15 Pro Max models. The 3nm technology is said to deliver a 35% power efficiency improvement over 4nm, which was used to make the A16 Bionic chip for the iPhone 14 Pro and Pro Max. (GizChina, Digitimes, MacRumors, Weibo)

Apple will be the only major customer of TSMC’s 3nm process in 2023. Nevertheless, it now seems like Apple is also feeling the heat, its orders with TSMC appear to have been reduced. Apple has allegedly once again reduced the number of wafers put into production. The decline this time is very large. It is as high as 120,000 pieces of N7, N5, N4 plus some N3 production lines. Apple’s A17 for the iPhone 15 Pro / Pro Max in 2023 will use TSMC’s N3 process. Also, the M2 Ultra / M3 may also use it.(GizChina, IT Home, CTEE)

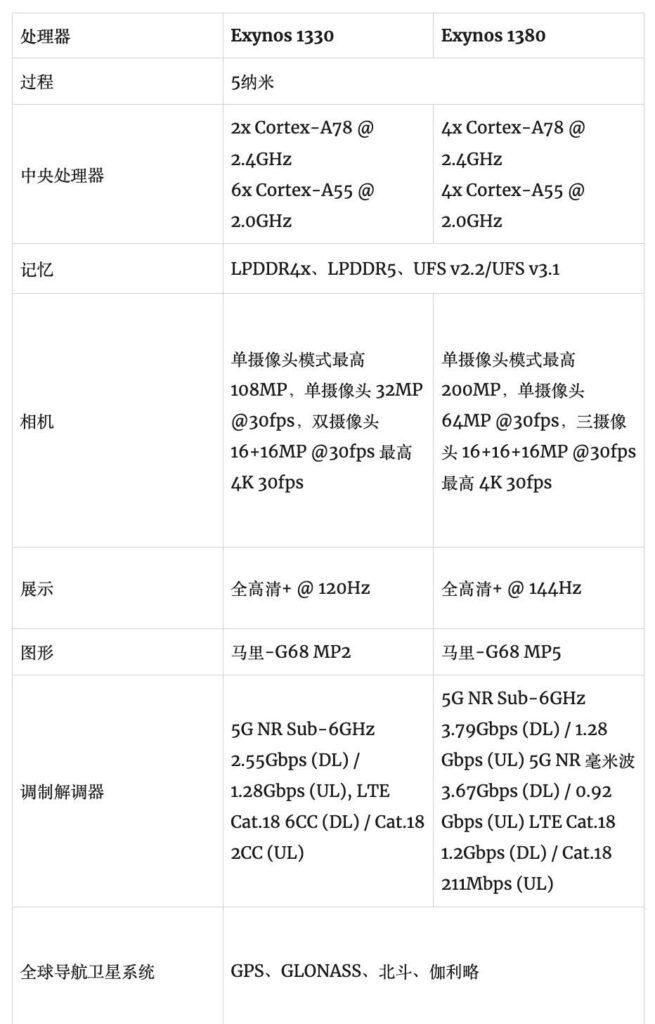

Samsung launches Exynos 1330 and 1380 mid-range 5G chipsets. The Exynos 1330 is an entry-level smartphone chipset based on Samsung’s 5nm EUV (Extreme ultraviolet) process. In fact, it is the company’s first 5nm entry-level processor. The chipset boasts two ARM Cortex-A78 CPU cores clocked at 2.4GHz and six Cortex-A55 cores clocked at 2GHz. Samsung has paired the CPU with ARM’s Mali-G68 MP2 GPU. It supports LPDDR4x and LPDDR5 RAM chips and UFS 2.2 and UFS 3.1 storage chips. The Exynos 1330 comes with an integrated 5G modem that supports Sub-6GHz 5G networks. Samsung touts peak download speeds of 2.55Gbps and upload speeds of 1.28Gbps. The company also mentions support for LTE Cat.18 6CC (download) and Cat.18 2CC (upload).(Android Headlines, Samsung)

Microsoft and Nvidia have announced the companies have agreed to a 10-year partnership to bring Xbox PC games to the NVIDIA GeForce NOW cloud gaming service, which has more than 25M members in over 100 countries. The agreement will enable gamers to stream Xbox PC titles from GeForce NOW to PCs, macOS, Chromebooks, smartphones and other devices. It will also enable Activision Blizzard PC titles, such as Call of Duty, to be streamed on GeForce NOW after Microsoft’s acquisition of Activision closes.(GizChina, Engadget, The Verge, Nvidia, Reuters)

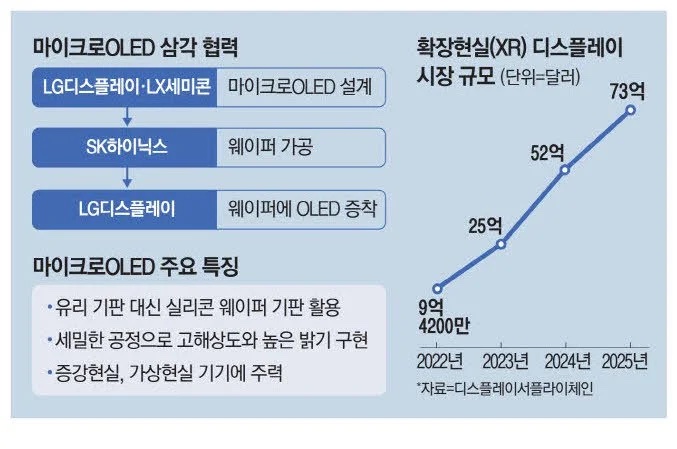

Meta will be collaborating with SK Hynix and LG Display to develop MicroOLED. LG Display. It has recently signed a collaboration agreement with SK Hynix for the development and production of MicroOLED. SK Hynix is also close to signing an agreement with Meta. LG Display already has such an agreement signed with Meta. Their alliance will see Meta design the needed chip; SK Hynix will produce the wafer for the chips; and LG Display will handle the final step where the OLED is deposited on the wafer and then cut to be a MicroOLED panel. SK Hynix is planning to use its M10 wafer line in South Korea to manufacture the wafers for MicroOLED. M10 originally only made DRAM but also manufactures CMOS image sensors now. SK Hynix also has M14 and M16 fabs at Icheon that manufacture DRAM. M10 has a capacity of 100,000 12” wafers per month. Sources said SK Hynix is planning to dedicate 30,000 wafers per month capacity between 2025 to 2026 for the production of MicroOLED wafers using its 28nm or 45nm legacy nodes. (Laoyaoba, The Elec)

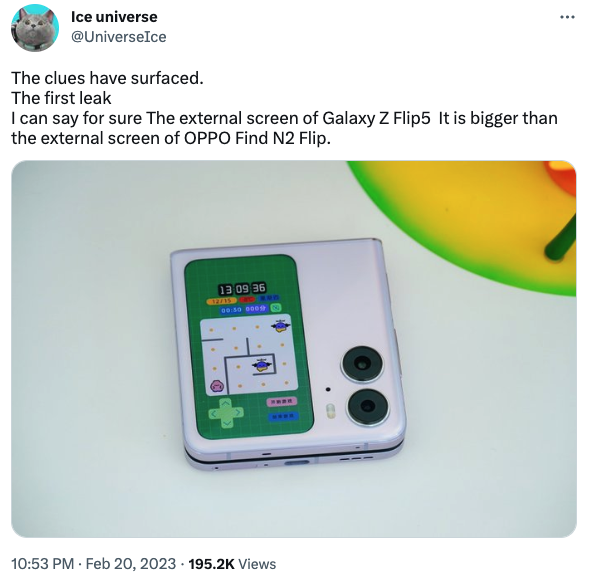

The cover display on the Samsung Galaxy Z Flip5 culd be much larger than the current generation. The Z Flip5 is believed to be launched in summer 2023 along with Z Fold5.(Android Authority, Twitter)

According to Tianyancha, due to other circumvention behaviors, Shenzhen-based Royole Technology is listed as dishonest executor by Shenzhen Intermediate People’s Court, and restricted high consumption. The obligations established by effective legal documents show that,Royole Technology has reached a settlement agreement with Heli Advertising Company, agreeing to pay the latter more than CNY1.1M in contract arrears in two installments.The latter has the right to immediately apply to the courts for enforcement in the event of failure to meet any installment payment obligations. The case process shows that in September last year, Royole Technology was executed for the first time, with an execution target of more than CNY1.21M. (CN Beta, My Drivers)

Samsung Display, LG Display and BOE are competing for a bigger share of Apple’s order for organic light-emitting diode (OLED) displays for tablets and laptops. Apple has reportedly placed orders for the development of 10.9” and 12.9” panels for the iPad with Samsung Display and LG Display. BOE was excluded. Korean display makers are planning to produce OLED panels for the iPad at their current Gen-6 (1500mm x 1850mm) line. LG Display invested KRW3.3T in 2021 to secure a sufficient supply capacity. In 1Q23, it will secure a production capacity of 60,000 sheets per month, which is double the current level.(Business Korea, CN Beta)

Samsung removed the Chinese display maker BOE from its supply chain after a dispute over royalty payments in Dec 2022. It seems the two firms have made amends. Samsung is reportedly considering buying smartphone displays from BOE again. It wants to source a portion of flexible OLED panels for its next-gen foldables from the Chinese company. The talks are for flexible OLED displays for the Galaxy Z Fold 5 and Galaxy Z Flip 5, both of which will arrive in 2H23. Samsung and BOE are reportedly discussing the process method, panel thickness, and the delivery timeline of the finished panels.(Android Headlines, SBS Biz)

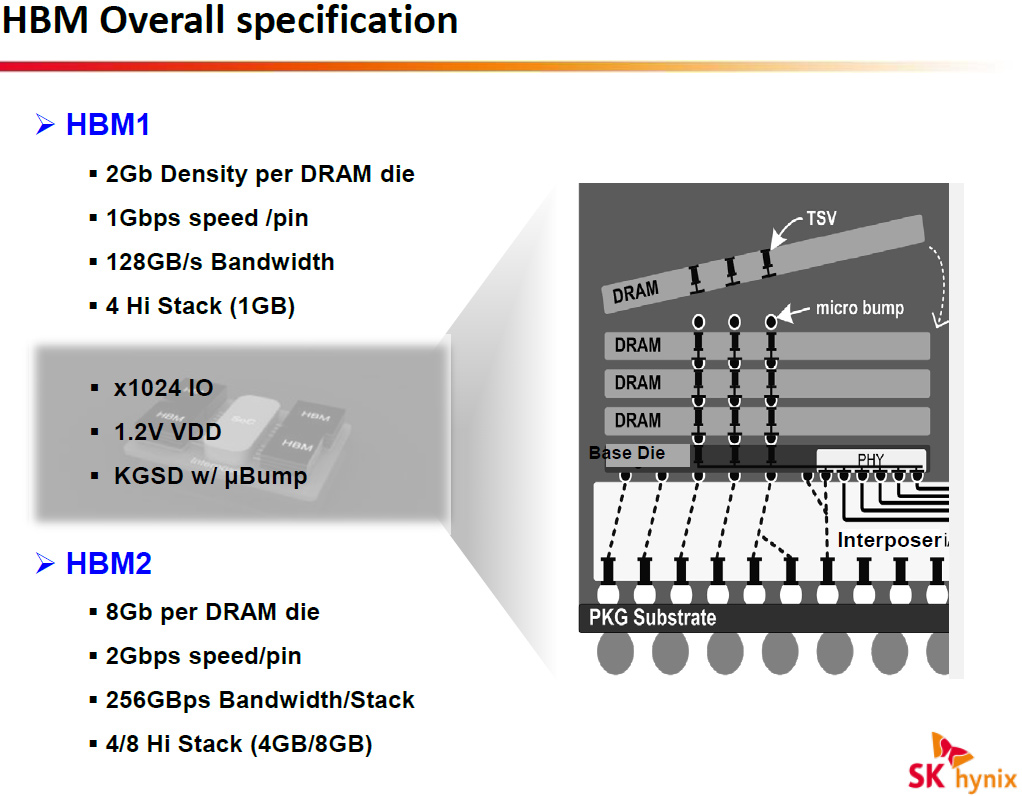

DRAM data processing speed has become important for better and faster ChatGTP services. Korean companies are producing all of high-performance DRAMs essential for this. Since the beginning of 2023, Samsung Electronics and SK Hynix have been receiving a surge in orders for high bandwidth memories (HBMs). HBMs significantly increase data processing speeds compared to other DRAMs by vertically connecting several DRAMs. They work together with central processing units (CPUs) and graphics processing units (GPUs) and can greatly improve the learning and calculation performances of servers. HBMs’ average selling price (ASP) is at least 3 times that of DRAM. (Laoyaoba, Business Korea, WCCFTech)

SK Hynix faced problems in Feb 2023 during DRAM production due to the high-k material having a quality issue. The zirconium (Zr) high-k material that was supplied by SK Trichem had impurities in them. This caused some of SK Hynix’s production equipment at its DRAM fab to halt operation. SK Hynix said it immediately conducted a cleaning process so there was no damage to its production output. However, SK Hynix is reviewing and asking for damages from SK Trichem from the halt in equipment and the need to swap out of components.SK Hynix is also stopping procuring the material from SK Trichem until the issue is resolved. SK Trichem said it plans to supply products with improved quality to SK Hynix near the end of the month.(CN Beta, TechPowerUp, The Elec)

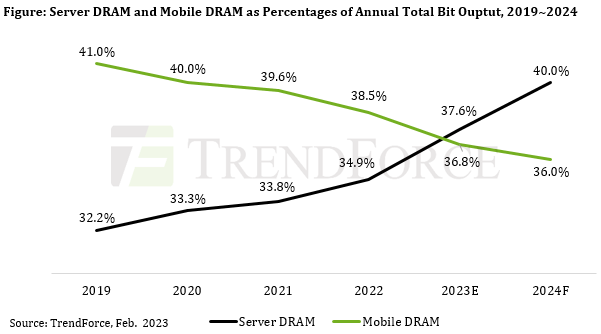

Since 2022, DRAM suppliers have been adjusting their product mixes so as to assign more wafer input to server DRAM products while scaling back the wafer input for mobile DRAM products. This trend is driven by 2 reasons. First, the demand outlook is bright for the server DRAM segment. Second, the mobile DRAM segment was in significant oversupply during 2022. Moving into 2023, the projections on the growth of smartphone shipments and the increase in the average DRAM content of smartphones remain quite conservative. Therefore, DRAM suppliers intend to keep expanding the share of server DRAM in their product mixes. According to TrendForce’s analysis on the distribution of the DRAM industry’s total bit output for 2023, server DRAM is estimated to comprise around 37.6%, whereas mobile DRAM is estimated to comprise around 36.8%. Hence, server DRAM will formally surpass mobile DRAM in terms of the portion of the overall supply within 2023. (TrendForce, TrendForce, My Drivers)

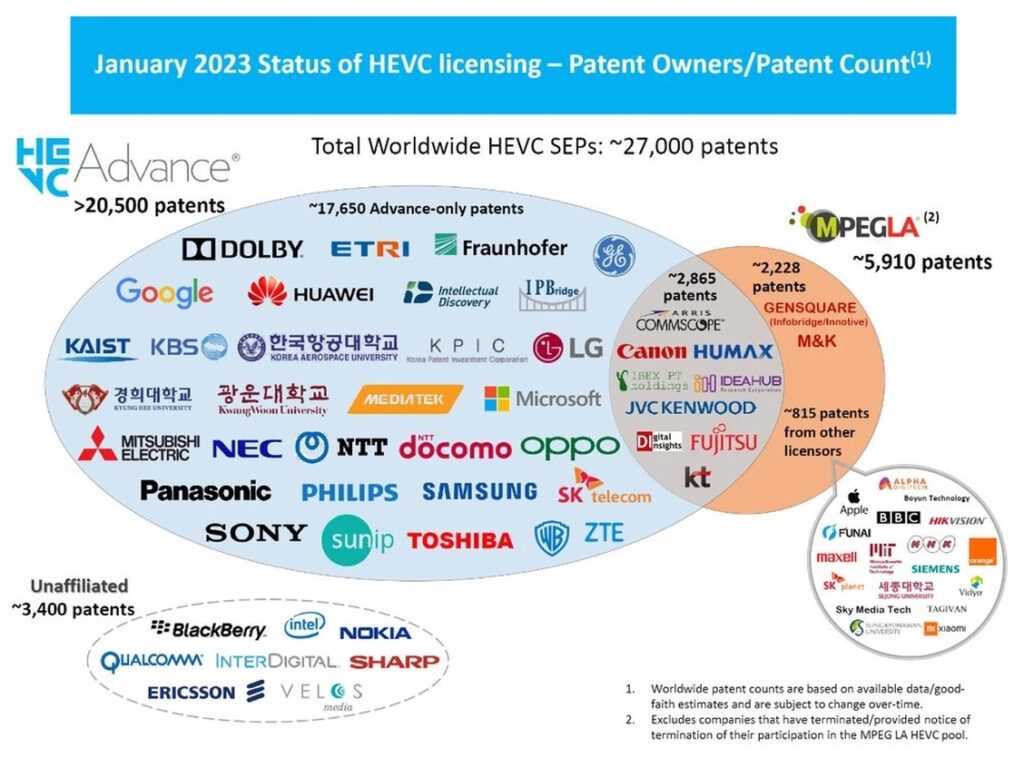

Sharp, Motorola Mobility, and Kyocera, among other recent additions, have become Licensees of the HEVC Advance Patent Pool. The HEVC Advance Patent Pool license now includes over 20,500 HEVC / H.265 essential patents issued in 116 countries, of which over 17,650 are exclusively available for a pool license through HEVC Advance. Access Advance is an independent licensing administrator company formed to lead the development, administration, and management of patent pools for licensing essential patents of the most important standards-based video codec technologies.(Laoyaoba, Business Wire, Financial Post)

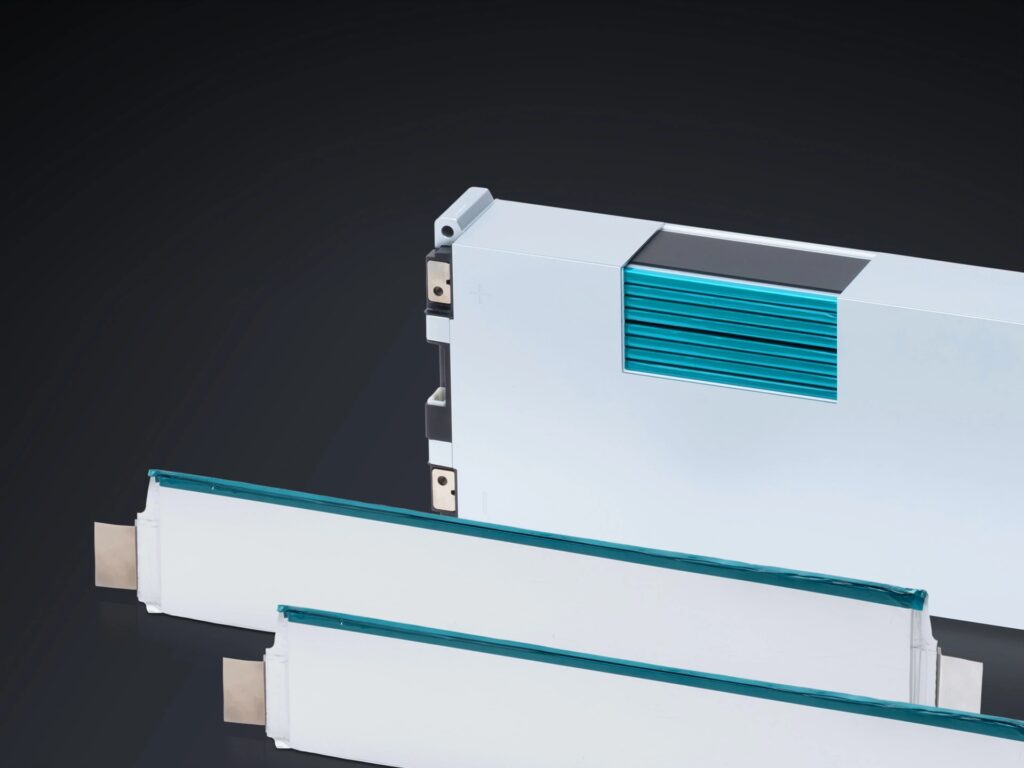

LG Energy Solution has set a goal to develop lithium-sulfur battery within the next 3 years. This means the company is aiming to commercialize the battery sometime in 2027. Lithium-sulfur battery is one of many battery technologies that could possibly replace lithium-ion batteries in the future. It has superior energy density of around 2x. This means electric vehicles with lithium-sulfur batteries will be able to double their driving distance while carrying the same weight of batteries. However, LG Energy Solution is planning to apply the new battery in the aerospace sector first. (CN Beta, The Elec)

Contemporary Amperex Technology Co Ltd (CATL) is in talks to offer automakers steeply discounted prices in exchange for sourcing the vast bulk of their power cells from the company in a bid to stave off growing competition from smaller rivals. If the plan goes ahead, CATL will sell the strategic clients EV batteries made from self-manufactured lithium carbonate at a low price. In return, they will be required to sign a contract committing them to buy 80% of their EV batteries from CATL over the next 3 years. The price will be set based on the production cost of CATL’s self-made lithium carbonate that is estimated to be up to CNY200,000 (USD29,100) a ton, far below market prices.(CN Beta, Sina, WallStreet CN, Asia Nikkei)

Samsung Electronics has announced that it has secured standardized 5G non-terrestrial networks (NTN) modem technology for direct communication between smartphones and satellites, especially in remote areas. Samsung plans to integrate this technology into the company’s Exynos modem solutions, accelerating the commercialization of 5G satellite communications and paving the way for the 6G-driven Internet of Everything (IoE) era. NTN is a communications technology that uses satellites and other non-terrestrial vehicles to bring connectivity to regions that were previously unreachable by terrestrial networks, whether over mountains, across deserts or in the middle of the ocean.(Android Authority, Samsung)

Samsung has reportedly considered adding a dedicated S Pen slot to the Galaxy Z Fold5. However, it would have made the foldable smartphone thicker. As Samsung is pushing to make foldable smartphones thinner so that they can easily fit in pockets, it has decided not to include a built-in home for the accessory in Fold4. Making foldable slimmer is the company’s priority. It has even developed a new type of hinge to reduce the overall thickness of the phone, while simultaneously reducing the crease along the fold line on the inner folding display. Samsung is not entirely giving up on the idea. Samsung will try to make the S Pen thinner. The Z Fold6 may debut this new S Pen in 2024. (Android Headlines, ET News)

Apple has reportedly started to cut ties with hundreds of contractors — workers technically employed by outside agencies who work alongside Apple employees on projects – in what looks like a stealthy move to cut costs. (Apple Insider, New York Post, Sina, My Drivers)

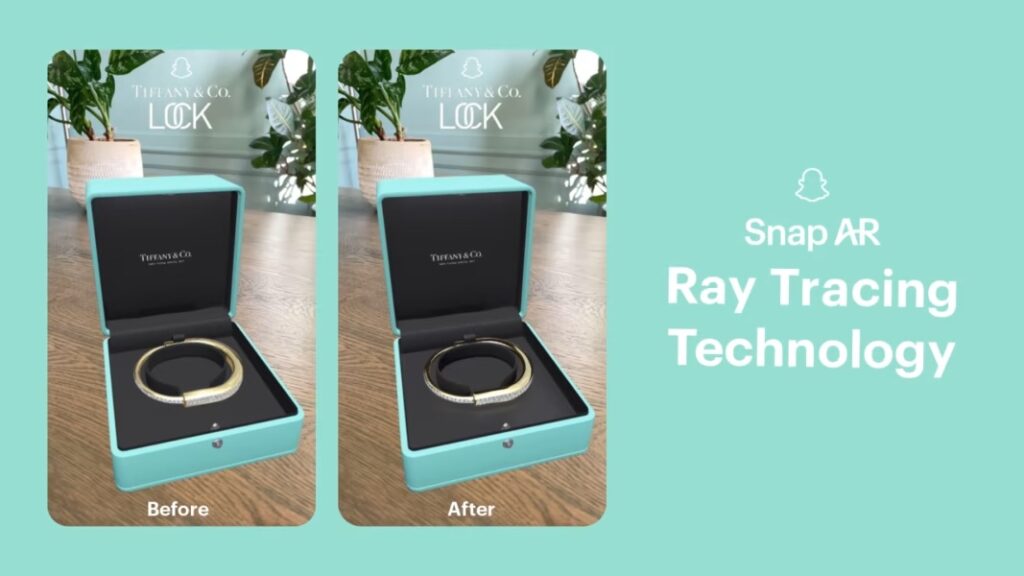

Snap has announced that it’s rolling out ray tracing for the Snap AR platform. The new tech allows developers to incorporate light-reflection effects on objects in their augmented reality Lenses. Ray tracing is available for developers to use in Lens Studio now. The first Lens that uses ray tracing was built in partnership with Tiffany & Co. Users can virtually try on Tiffany bracelets that sparkle realistically. Given that Snap has incorporated shopping into its Lenses, consumers can use this Lens to try this AR jewelry on and then buy it within the app.(VentureBeat, Snap.com)

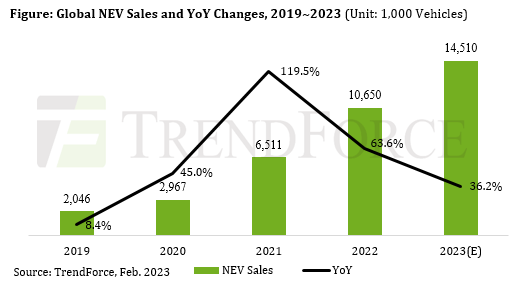

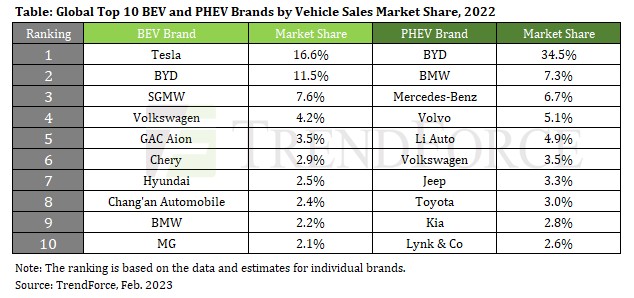

According to TrendForce, global sales of new energy vehicles (NEVs) rose by 63.6% YoY to 10.65M units for 2022. Of this total, sales of battery-electric vehicles (BEVs) comprised 7.89M units and registered a YoY growth rate of 68.7%; and sales of plug-in hybrid electric vehicles (PHEVs) comprised 2.74 million units and registered a YoY growth rate of 50.8%. China and Western Europe remained the two largest regional markets for NEVs by vehicle sales in 2022, but the difference between them in terms of percentage of the annual global sales widened further. China’s share of the global market reached 63%, whereas Western Europe’s share came to 29%. NEV as a category encompasses BEVs, PHEVs, and fuel-cell vehicles (FCVs). (TrendForce, TrendForce)

Huawei Technologies’ executive director Richard Yu has said the company is not working with Anhui Jianghuai Automobile Group, better known as JAC Motors, to make cars after a contractor chosen to build a new energy vehicle industrial park said the pair are linking arms to produce smart electric vehicles. Huawei is not directly involved in car making, but is partnered with JAC Motors as part of its Smart Selection business model. Huawei remains focused on the high-end market and will not engage with loss-making vehicles priced under CNY200,000 (USD29,015), Yu said. The firm is yet to profit or lose from its Smart Selection model, and its automotive segment will be profitable by 2025, he noted. Through Smart Selection is Huawei offers carmakers its self-developed auto software and hardware and deep involvement in the design, manufacturing, marketing, and sales of vehicles. (CN Beta, My Drivers, My Drivers, My Drivers, NBD, Sina, Yicai, TechNode, Pandaily, Yicai Global)