6-3 #MorePraises : Qualcomm may exclusively use TSMC’s N3E for 8 Gen 4; Qualcomm reportedly discusses with Nintendo and Sony to develop hardware; Dixon Technologies is partnering with Xiaomi’s Indian; etc.

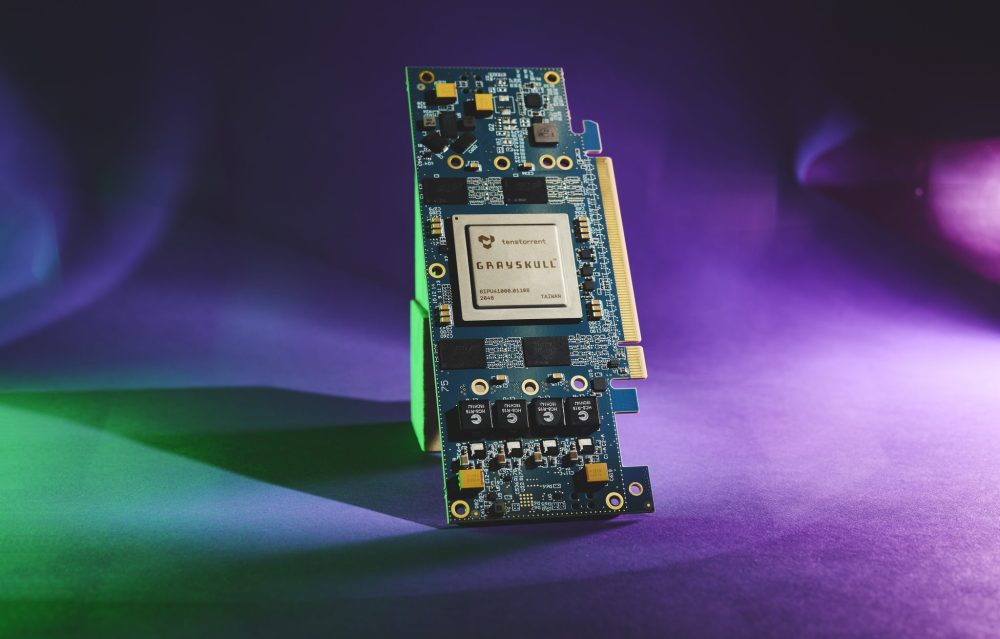

Tenstorrent and LG Electronics have announced that they are collaborating to build a new generation of RISC-V, AI, and video codec chiplets to potentially power LG’s premium TV and automotive products of the future and Tenstorrent’s data center products. Through this collaboration, LG will receive from Tenstorrent artificial intelligence (AI) and RISC-V CPU technology that is ideally suited to drive AI-enhanced features and high-performance computing in LG’s future premium TV’s, high-performance automotive chips and other smart products. (Live Mint, Laoyaoba, Reuters, Forbes, PR Newswire)

Qualcomm may exclusively use TSMC’s N3E process to manufacture its Snapdragon 8 Gen 4. Qualcomm was previously rumored to be exploring a dual-sourcing option where it would enlist the help of TSMC’s and Samsung’s foundries to mass produce future chipsets, including the Snapdragon 8 Gen 4. The Snapdragon 8 Gen 4 for Galaxy would have taken advantage of Samsung’s 3GAP process, which is also known as 3nm GAA+, while the regular version found in devices not made by Samsung’s facilities would be mass produced on TSMC’s N3E technology. Due to undisclosed reasons, Qualcomm may exclusively give TSMC orders in 2024, which can raise the wafer price substantially, with Qualcomm’s smartphone partners being forced to pay the balance.(Laoyaoba, TechNews, WCCFtech, Twitter)

Qualcomm SVP, Alex Katouzian, is reportedly in discussions with Nintendo and Sony to develop hardware that might be similar to the competition. Qualcomm may require some assistance from Nintendo regarding the design and functionality of the handheld gaming console. Qualcomm may partner with Sony in an effort to develop and launch exclusive mobile games that are optimized for the Snapdragon platform.(GizChina, WCCFtech, Twitter)

A planned USD3B semiconductor facility in India by chip consortium ISMC that counted Israeli chipmaker Tower as a tech partner has been stalled due to the company’s ongoing takeover by Intel. A second mega USD19.5B plan to build chips locally by a joint venture between India’s Vedanta and Taiwan’s Foxconn is also proceeding slowly as their talks to rope in European chipmaker STMicroelectronics as a partner are deadlocked. The challenges faced by the companies deal a major setback to Prime Minister Narendra Modi, who has made chipmaking a top priority as he wants to “usher in a new era in electronics manufacturing” by luring global companies. India, which expects its semiconductor market to be worth USD63B by 2026, last year received three applications to set up plants under a USD10B incentive scheme. They were from the Vedanta-Foxconn JV; a global consortium ISMC which counts Tower Semiconductor as a tech partner; and from Singapore-based IGSS Ventures. (Reuters, Economic Times, SCMP, IT Home)

A TWD950M (USD31M) investment plan by Dutch chipmaking equipment supplier ASML to build a facility in Taiwan that will manufacture the necessary equipment to make 2nm chips, has been approved by the Ministry of Economic Affairs (MOEA). The 2-year research and development program will be the first of its kind by ASML, with products set to be rolled out in the company’s compound in New Taipei’s Linkou District, according to the MOEA. The ministry added that it will subsidize 30%, or TWD285M of the project, as part of the government’s drive to attract foreign investment in the sector. (Laoyaoba, Focus Taiwan, Taipei Times, Taiwan News, CNA)

Paul Rosen, the US Treasury official responsible for investment security, has announced that there are discussions to implement new regulations to limit the transfer of U.S. investments and expertise to Chinese companies involved in cutting-edge sectors such as advanced semiconductors, artificial intelligence, and quantum computing. These new rules aim to exert greater control over the flow of critical technologies and knowledge to China. Rosen emphasized that officials are actively working on implementing measures to curb investment from the United States in order to safeguard sensitive knowledge and expertise. (Gizmo China, Reuters, Nasdaq, CNA)

Dutch semiconductor giant NXP has announced its i.MX 91, the latest processor from its i.MX 9 series of applications processors for industrial, medical, consumer and IoT use cases. Features include an 800MHz Cortex-M7 chip for real-time control, and a Cortex-M33 for network management, along with integrated Gbps with support for time-sensitive networking and industrial protocols. It is secured by NPX’s EdgeLock Secure Enclave and has functional safety software libraries. The i.MX 91 family is part of NXP’s product longevity program, which ensures that qualified products are available for at least 10 years, with designated participating products developed for automotive, telecom and medical segments available for a minimum of 15 years. (TechCrunch, NXP)

Samsung Electronics will join Intel, Nvidia and Google in developing an open-source semiconductor software system in an effort to reduce reliance on British chip designer Arm. Under a project titled RISC-V Software Ecosystem (RISE), the tech giants will work together to create royalty-free, open-source licenses essential to developing semiconductor architecture. The Linux Foundation is a non-profit technology consortium that supports open-source systems like RISC-V. (Laoyaoba, Korea JoongAng Daily, Business Korea)

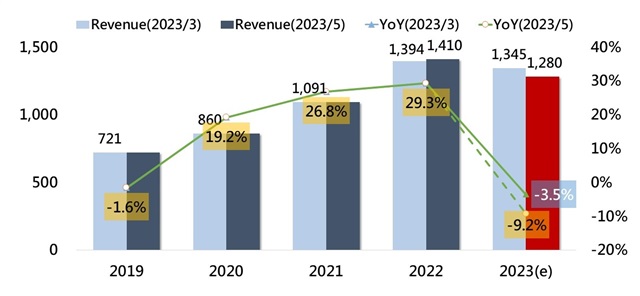

With the Ukraine war, global inflation, and geopolitical tensions, consumer electronics sales plunged, which further caused a decrease in semiconductor sales. Given the weakened demand for chips, DIGITIMES Research projects a 9.2% decline in global foundry industry revenue for 2023. Inventory adjustment in the first half of 2023 is taking longer than anticipated. Weak chip demand poses challenges for the global fabs revenue outlook. Analyst Eric Chen from DIGITIMES Research highlights that although the AI frenzy is bolstering the High-Performance Computing (HPC) market, the overall demand for foundries remains sluggish from the slowing global economy. While the electronics supply chain is expected to return to balance in the second half of 2023, significant activation in terms of materials preparation for typical peak seasons is yet to be seen so far. (Digitimes, Laoyaoba)

Liu Qidong, CFO of United Microelectronics Corp (UMC), has said that UMC’s current 28nm OLED DDI (driver chip) is still tight, and the utilization rate of 28nm production capacity can reach more than 90% in 2H23. In contrast, 8” wafers are not as effective as 12”wafers due to the special process, and the capacity utilization rate is relatively poor. From the perspective of application categories, the demand for mobile phones and PCs is not good, while the demand for automobiles and industrial categories is good in 1Q23, and there are signs of peaking at present, because the inventory of customers has reached a certain level. He said that UMC currently has a leading position in the field of 28nm process OLED driver chips, with a market share of 70%-80%, and hopes to continue to maintain it. UMC’s product portfolio will be dominated by special processes, and other areas are also planned, including RFSOI, embedded memory chips, MCU, etc. In terms of price, he said that the company will stick to the price and will not use low prices to win orders, hoping to reduce prices as a last resort. (Laoyaoba, UDN, Yahoo, LTN)

Samsung Display has started placing orders for equipment it wants to install on its first Gen 8 OLED production line. This was confirmed by its equipment suppliers Philoptics, FNS Tech, KCTech and HIMS. Philoptics said it signed a deal worth KRW63B; FNS Tech KRW36B; KCTech KRW35.7B; and HIMS KRW21.8B. However, somewhat surprisingly, suppliers for deposition and lithography machines were absent in the initial orders placed by Samsung Display. The two equipment takes the longest to manufacture and prepare. The delay comes from Samsung Display yet to fix terms with deposition machine supplier Canon Tokki.(The Elec, Laoyaoba)

LG Display (LGD) will increase its LTPO OLED panel supply share for the iPhone 15 Pro series. LG has reportedly expanded its LTPO OLED production capacity to accommodate the large demand for 2023 iPhone 15 Pro and 15 Pro Max. This development could spell bad news for Samsung, which reportedly supplied up to 70% of all OLED panels for 2022 iPhone 14 Pro series. As a reminder, LG suffered low LTPO OLED yield rates in2022, which limited the supply to Apple and in turn led to some shipment delays for the iPhone 14 Pro Max. This allowed Samsung to come in and take up additional display panel orders in place of LG but at a higher cost to Apple due to the short notice and extremity of the situation.(Android Headlines, GSM Arena, The Elec)

TCL CSOT has announced an upgraded strategic partnership with Intel. The two companies will jointly promote the formulation of the next-generation LPDT (Low Power Display Technology) standard based on TCL CSOT’s unique LTPS solutions. The two parties will work on green display projects in MNT display, and build full-chain management for product environmental protection and energy-saving, as well as tracking carbon footprints. They will collaborate on a joint platform to enhance the AI models used for product inspection in the field of intelligent manufacturing. This has leveraged Intel’s advanced technologies, including stable 5G transmission, NAS storage, and CPU computing power.(Laoyaoba, Laoyaoba, TCL CSOT)

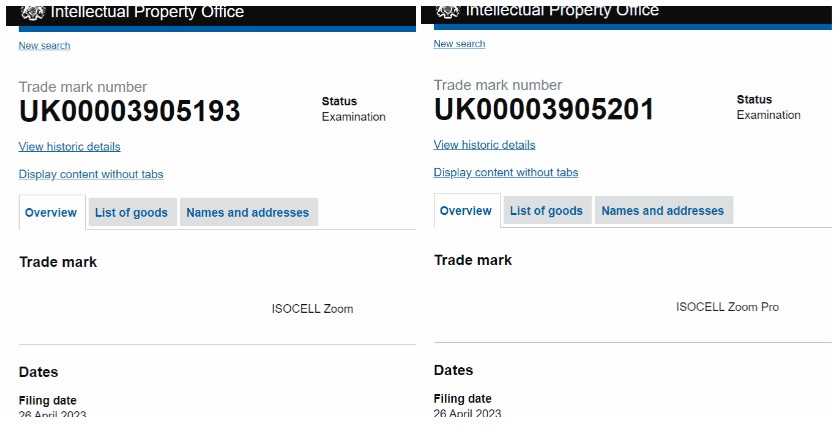

Samsung may upgrade its 3x optical zoom telephoto lens to 5x strength. This would mean the S24 Ultra would be the first device to drop this pairing of a 3x and 10x telephoto lens since the Note 20 Ultra. However, most reports have suggested that the Ultra model will upgrade to a variable zoom lens that offers continuous optical zoom between 3x and 10x magnification levels. Samsung has recently filed trademark applications for a couple of new camera sensors: ISOCELL Zoom and ISOCELL Zoom Pro.(Android Central, Galaxy Club, Galaxy Club, Android Headlines)

Xiaomi is reportedly researching a 1.33” main camera, and is currently in the state of technical pre-development internally. It is estimated that the outsole sensor of this specification will not be used on ordinary digital series models, but should be used on Xiaomi’s most representative Ultra model. Xiaomi has signed a contract with AAC Technology to manufacture exclusive WLG high-lens lenses. The two parties also jointly established the MI & AAC camera joint laboratory to jointly explore new imaging technologies. (Gizmo China, Weibo, Sina)

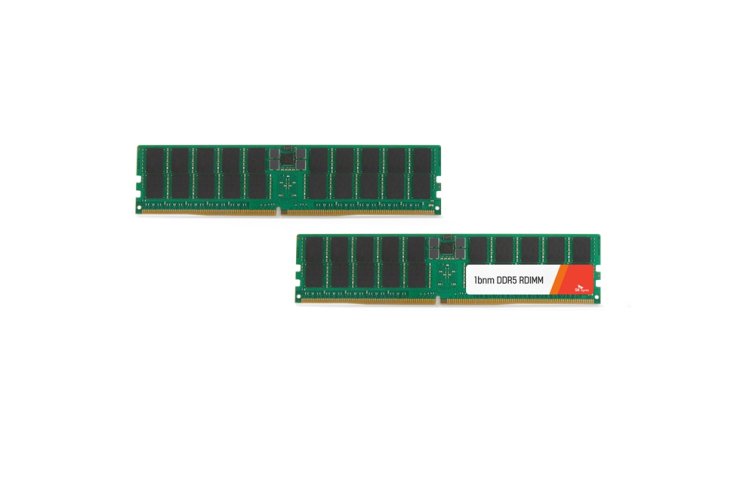

SK hynix has completed the development of the industry-leading 10nm process technology-based fifth-generation DDR5 DRAM and entered a product validation process with Intel. The company said its latest DDR5 DRAM memory chips for servers, also called 1bnm DDR5 DRAM chips, are now in the Intel Data Center Certified memory program for DDR5 products targeted at Intel Xeon Scalable platforms. The DDR5 product SK hynix provided to Intel has an operating speed of 6.4 gigabits per second, making it the fastest DRAM. Compared to the early prototypes of DDR5, the new product processes data 33% faster.(The Elec, Korea Times, Korea Herald, Digitimes)

Kioxia has commenced operation of 2 new R&D facilities — the Flagship Building at the Yokohama Technology Campus and the Shin-Koyasu Technology Front — strengthening the company’s research and development capabilities in flash memory and solid-state drives (SSDs). Going forward, other R&D functions in Kanagawa Prefecture will be relocated to these new R&D hubs to improve research efficiency and promote further advancement in technological innovation.(CN Beta, Kioxia, Yahoo)

Toyota will spend an additional USD2.1B to build a new battery plant in North Carolina, the latest sign that the automaker is attempting to catch up with an industry that has embraced the move to electric vehicles. Toyota has also announced it will build its first U.S.-made electric SUV at its Kentucky factory, starting from 2025. The three-row car will use batteries supplied by Toyota’s North Carolina factory. At the outset, the news suggests that Toyota is strengthening its commitment to EVs. Historically, the company has lagged behind other automakers in announcing new EV models, instead supporting hydrogen-based vehicles. But earlier 2023, Toyota said it plans to introduce 10 new battery-powered vehicles, with a target of 1.5M EVs sold per year by 2026.(CN Beta, Reuters, Yahoo, TechCrunch)

T-Mobile CEO Mike Sievert shared the company’s plans to capitalize on artificial intelligence (AI) for customer retention. T-Mobile sees opportunity in artificial intelligence to analyze why customers leave the company, attempting to retain more of them and improve in an area where it’s already doing better than others in the wireless industry. (Android Headlines, GeekWire)

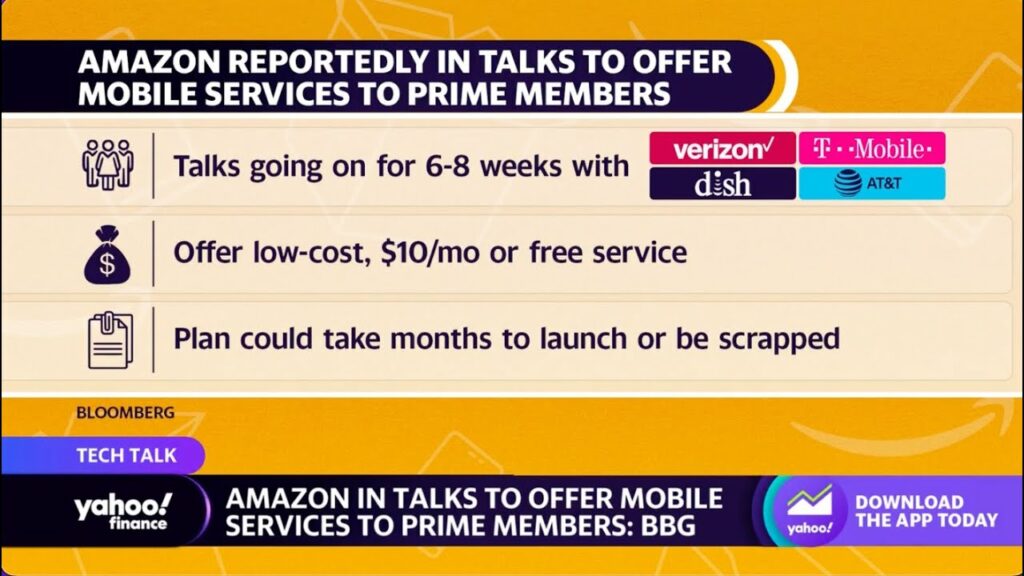

Amazon has allegedly been talking with wireless carriers about offering low-cost or possibly free nationwide mobile phone service to Prime subscribers. The company is negotiating with Verizon Communications, T-Mobile US and Dish Network to get the lowest possible wholesale prices. That would let it offer Prime members wireless plans for USD10 a month or possibly for free and bolster loyalty among its biggest spending customers. (Neowin, Bloomberg, Yahoo, TechCrunch)

Contract manufacturer Dixon Technologies has said it is partnering with Xiaomi’s Indian arm to make and export phones for the Chinese firm. Atul B Lall, the Vice Chairman and Managing Director of Dixon Technologies (India), praised the progress of the Indian Electronic Manufacturing Service (EMS) industry. Lall pointed towards the trend of mobile phone manufacturers increasingly investing in manufacturing and stated that India was well positioned in the industry. (Laoyaoba, Laoyaoba, Business Today, Reuters, Economic Times)

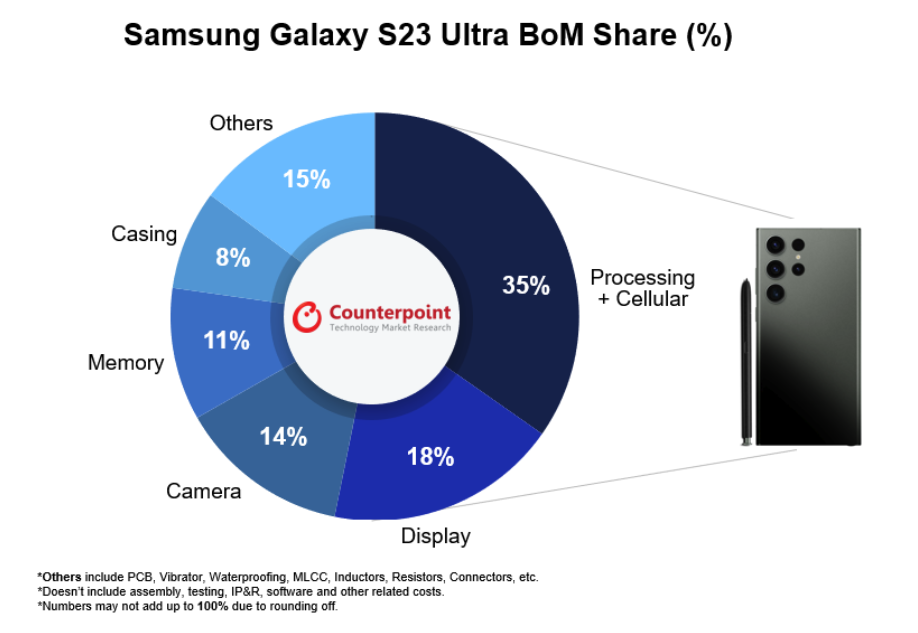

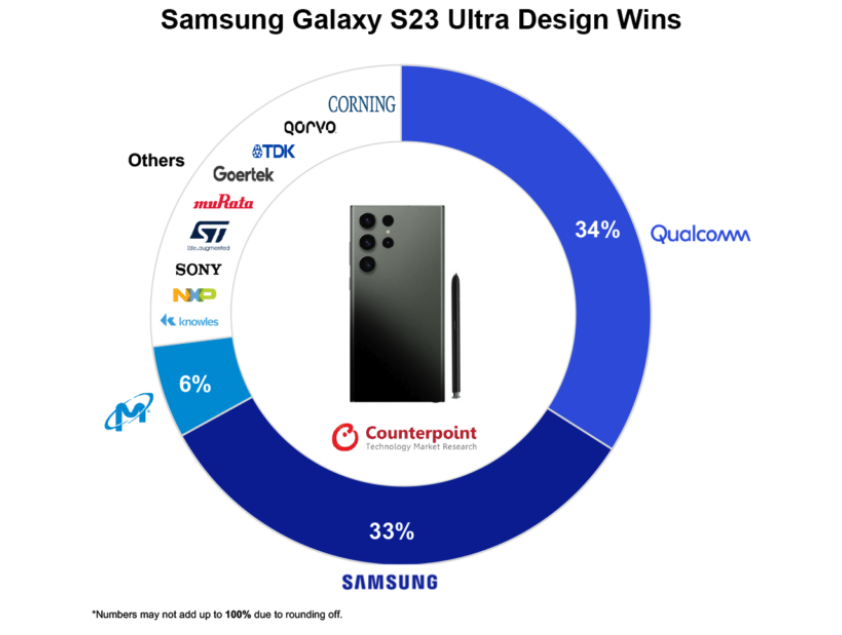

Producing an 8GB+256GB Galaxy S23 Ultra (Sub-6GHz) variant costs Samsung around USD469, according to the latest bill of materials (BoM) analysis by Counterpoint. The major components driving cost in the smartphone are the SoC, display and camera subsystem. Due to excess inventory and supply, components related to the RF sub-system and memory were subjected to a cost decrease. (GSM Arena, Counterpoint Research, Android Authority)

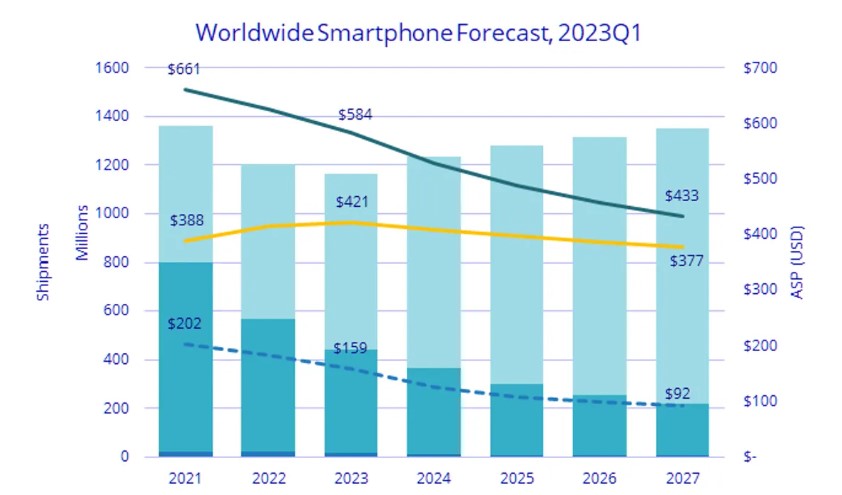

A weaker economic outlook and ongoing inflation mean that global shipments of smartphones are expected to decline by 3.2% in 2023, according to a new forecast from IDC. Smartphone shipments now are expected to total 1.17B units for the year. Despite the lower forecast for 2023, IDC reports that it expects a smartphone market recovery in 2024, with 6% YoY growth. However, consumer demand is recovering much slower than expected in all regions. (Android Headlines, CNET, IDC)

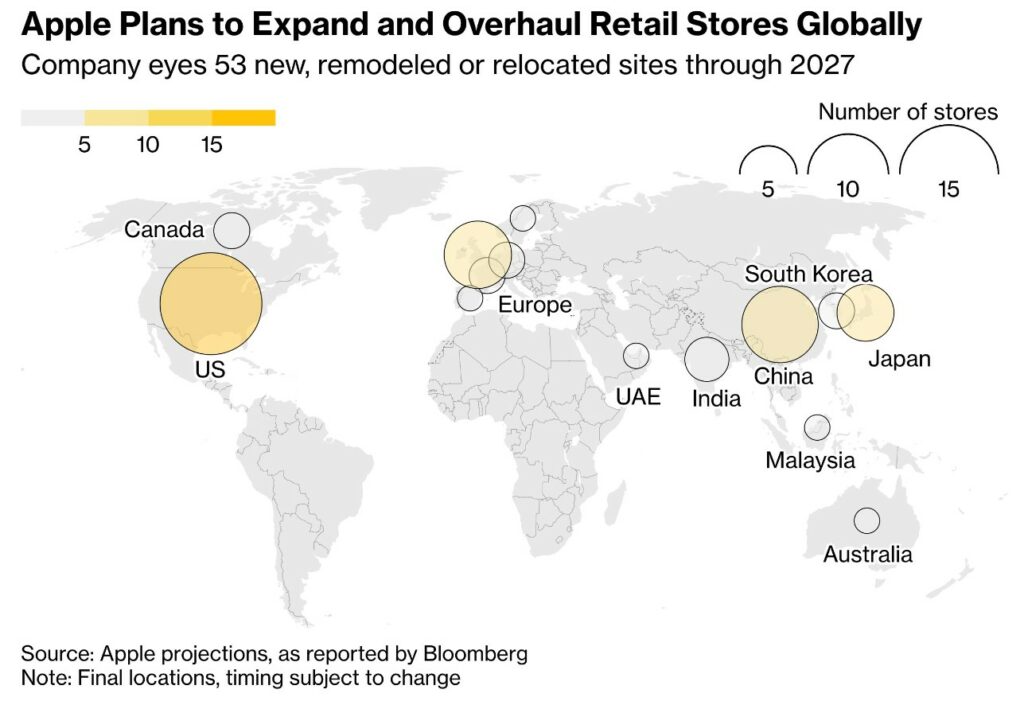

Apple is working on plans to expand and revitalize its retail chain, aiming to push deeper into China and other parts of Asia while overhauling established locations in the US and Europe. Through 2027, Apple is discussing opening 15 new stores across the Asia-Pacific region, 5 locations in Europe and the Middle East, and 4 additional outlets in the US and Canada. The company is also aiming for six revamped or relocated stores in Asia, nine in Europe and 13 in North America. In total, the company is proposing 53 new, relocated or remodeled stores over the next 4 years.(Bloomberg, Twitter, Yahoo, Apple Insider)

Foxconn, a key Apple supplier, will start manufacturing iPhones in Bengaluru by Apr 2024, Minister for Large and Medium Industries MB Patil said. The minister informed that the company has plans to start manufacturing iPhones at its proposed Devanahalli plant and the state government would hand over the required land for the company by Jul 1 to facilitate this. The INR13,600 crore project is expected to create 50,000 jobs. Foxconn has already paid 30% of the cost of the land (INR90 crore) to Karnataka Industrial Areas Development Board. The electronics giant has set the goal to complete the project in three faces and has set a target of manufacturing 20M units (2 crore units) annually from the plant after the completion of 3 phases. (CN Beta, New Indian Express, India Times, Business Today)

Microsoft said it expected to take a charge of about USD425M in 2Q23 for a potential fine from an Irish regulator over alleged privacy violations at its unit LinkedIn. The Irish Data Protection Commission (IDPC) launched an investigation into the professional networking platform in 2018 over whether its targeted advertising practices violated the European data protection law. The regulator’s order is not public and Microsoft said that LinkedIn was informed about the preliminary decision in Apr 2023. Microsoft added it would dispute the proposed fine after receiving a final order.(Neowin, Reuters, Yahoo, Nasdaq)

Noise has announced that it has achieved a new “Make In India” milestone of making over 1M smartwatches locally in the month of May 2023 alone. In line with the ‘Make in India’ mission, the company said that it has achieved and surpassed its initial target of making 1M units every month. Noise said that it has also been the first brand to ship over 3M made-in-India smartwatches. The company hopes to sustain its strong performance in 2H23. It could even achieve new milestones in production going forward.(Gizmo China, Fonearena)

Amazon has reached a settlement with the U.S. Department of Justice (DOJ) regarding allegations brought by the U.S. Federal Trade Commission (FTC) about how Amazon handles Alexa customer data—including children’s data. Amazon has agreed to pay a USD25M settlement over Federal Trade Commission (FTC) allegations it violated child privacy through Alexa. The company allegedly fell afoul of both the FTC Act and the Children’s Online Privacy Protection Act (COPPA) through its handling of kids’ voice data.(Engadget, Amazon, Court Lisetener)

Google has announced that support for Chromecast (1st gen) has ended and that there will be no more updates. On the Chromecast firmware versions and release notes support page (which was last updated on 27 Apr 2023), Google says: Support for Chromecast (1st gen) has ended, which means these devices no longer receive software or security updates, and Google does not provide technical support for them. Users may notice a degradation in performance.(Engadget, 9to5Google, Google)

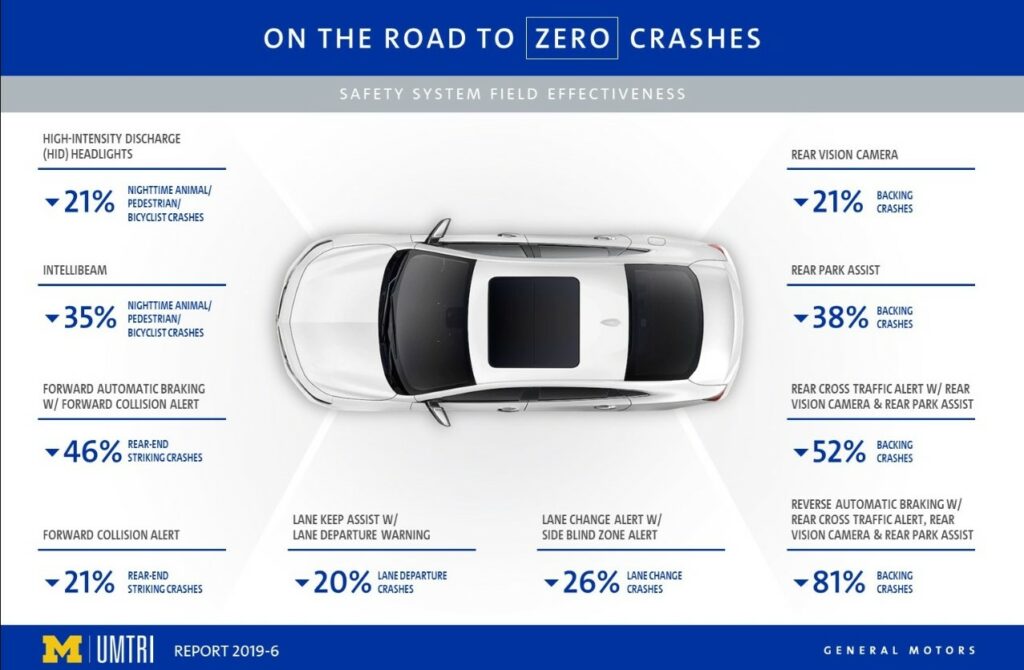

General Motors (GM) will include Automatic Emergency Braking, as well as four additional active safety features proven to reduce crashes, as standard equipment on 98% of its 2023 model year vehicles. This encompasses every new EV launching in 2023, including the family-oriented Chevrolet Blazer EV and Equinox EV. GM is on track to meet a previously signed industry commitment to make Automatic Emergency Braking standard on 95% of all new vehicles sold. Thanks to this advocacy and collaboration among automakers, more new vehicles than ever will now provide this key active safety feature as standard equipment. (Engadget, General Motors)

Microsoft has signed a deal with CoreWeave, a provider of AI computing power, that could be worth billions of dollars over a number of years. the deal was made to ensure that OpenAI’s ChatGPT had enough computing power going forward. Through a partnership with Microsoft, OpenAI currently uses Microsoft Azure infrastructure to run ChatGPT, which is resource intensive. It seems that the agreement was made earlier 2023. CoreWeave, a specialized cloud provider built for large-scale GPU-accelerated workloads, announced an additional USD200M in funding from Magnetar Capital, a leading alternative asset manager.(Neowin, CNBC, Business Wire)

MIT’s Computer Science and Artificial Intelligence Laboratory (CSAIL) has developed a small, self-learning language model that surpasses large scale language models. CSAIL’s algorithm for the model called Simple Pseudo-Label Editing (SimPLE) allows it to learn from its own predictions, eliminating the use of annotated training data. The team claims that the model’s performance across various tasks is better than larger, more notable models like OpenAI’s GPT-4 or Google’s LaMDA. (VentureBeat, MIT, Money Control)