6-18 #Appreciation : Intel plans to invest up to USD4.6B in Poland; Huawei could launch a more affordable foldable phone in the near future; Micron plans to invest over CNY4.3B in its packaging and testing factory located in Xi’an city; etc.

SoftBank’s Arm is allegedly in talks with some of its biggest customers and end users about bringing on one or more anchor investors in the chip designer’s initial public offering (IPO). Arm is talking to at least 10 companies, including Intel, Alphabet, Apple, Microsoft, TSMC, and Samsung Electronics, about their potential participation in the IPO. Arm plans to sell its shares on Nasdaq later 2023, seeking to raise USD8B-10B. The chip designer had filed with regulators confidentially for a U.S. stock market listing in Apr 2023, setting the stage for largest IPO in 2023. (Android Headlines, Reuters)

In its biggest brand update in 15 years, Intel said it will focus on its Intel Core Ultra and Intel Core processor brands for its upcoming processors code-named Meteor Lake. The big chipmaker is updating the branding for its Intel Core, Intel Evo and Intel vPro client-computing processor brands. Intel will now focus on its Intel Core Ultra and Intel Core processor brands. The new client branding begins with Intel’s upcoming Meteor Lake processors. The company is moving from its traditional “i3/i5/i7/i9” branding to a simpler “Core 3/5/7/9” concept. Intel’s higher-end processors will include “Ultra” in their branding before the number — in practice that would look like “Intel Core Ultra 9”. (CN Beta, Engadget, VentureBeat)

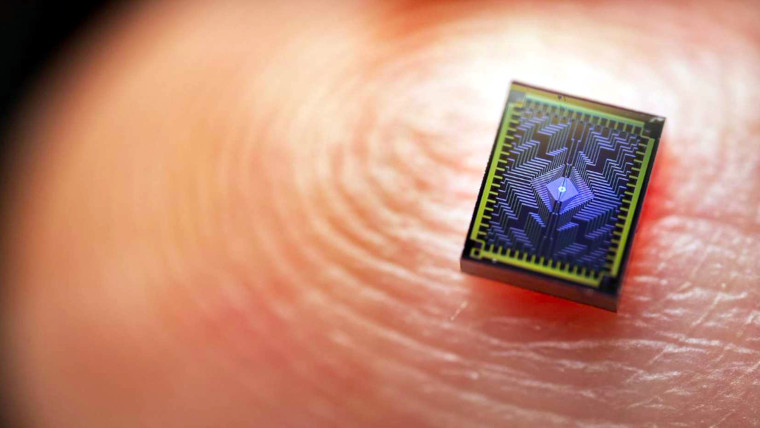

Intel has announced the release of its latest quantum chip, a 12-qubit chip called “Tunnel Falls”. Aside from launching this new chip, the company is partnering with the Laboratory for Physical Sciences (LPS) at the University of Maryland, College Park’s Qubit Collaboratory (LQC) to advance research in the area of quantum computing. The chip is fabricated on 300mm wafers and leverages advanced capabilities such as extreme ultraviolet lithography (EUV) and gate and contact processing techniques.(Neowin, Intel)

Intel plans to invest up to USD4.6B in a new semiconductor assembly and test facility near Wrocław, Poland. Facilities will be constructed according to green building principles and will operate with high environmental standards to minimize carbon footprint and environmental impact. This facility will help meet critical demand for assembly and test capacity that Intel anticipates by 2027.(CN Beta, Intel, Reuters)

Intel is allegedly set to receive almost EUR10B (USD11B) in subsidies from the German government for a chip manufacturing complex in the eastern part of the country. The company postponed the start of construction at the plant – which it had previously agreed to build in Magdeburg with EUR6.8B (USD7.2B) in government aid – at the end of 2022 because of economic headwinds and had been asking for more funds. Germany has now expressed a willingness to grant roughly EUR10B as part of negotiations. (CN Beta, Financial Times, SCMP, Yahoo)

According to Nvidia CEO Jensen Huang, the company is working to diversify its chip manufacturing and has recently received good test results for an Intel test chip based on the company’s next-gen process node. Huang’s remarks come nearly a year after he first signaled that Nvidia was in talks with Intel’s Foundry Services (IFS) to manufacture some of its chips, which is made possible by Intel’s recent shift to an IDM 2.0 model that will see it making chips for other companies with its latest process nodes. Intel has originally stated that its first IFS chips would be based on its 20A, 18A, and ‘Intel 16’ nodes. Beyond the Intel 3 node that will come into production in 2023, Intel also has its 20A node that remains on track for production in early 2024, providing Nvidia with a few options. (CN Beta, Network World, Korea Postsen, Tom’s Hardware)

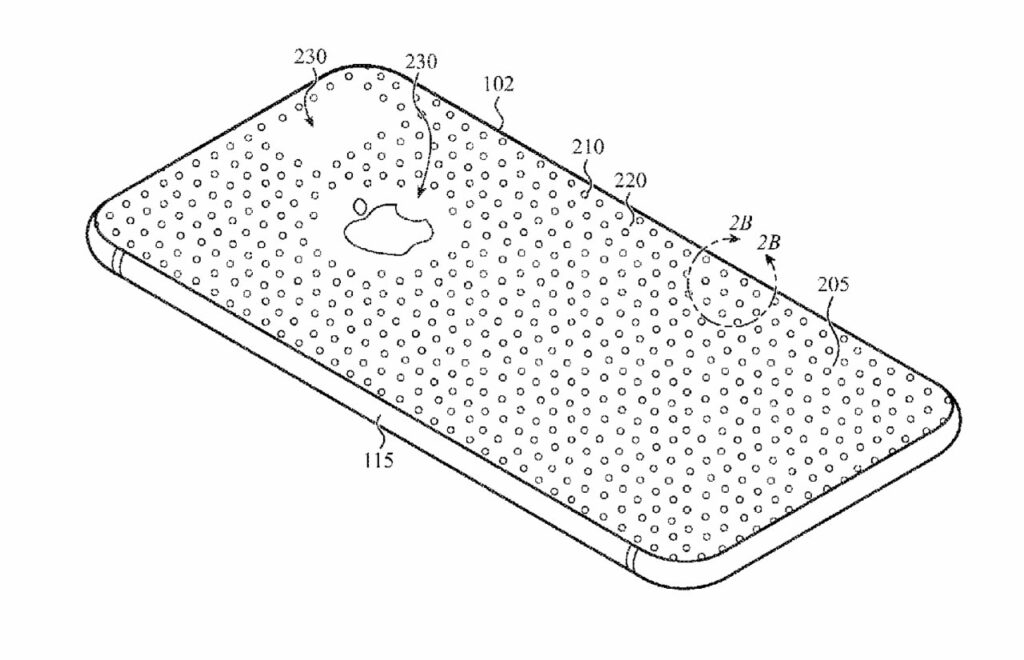

Apple has been granted a patent “Spatial Composites”, which means embedding metal or ceramic with a chassis for scratch resistance. it describes a method for producing an abrasion-resistant housing for electronic devices. The spatial composite method involves disposing abrasion-resistant components with interlocking structures in a mould cavity. ‘Abrasion-resistant members’ made from metal or ceramic would be harder than a moldable matrix substrate. Spaced between about 10 and 100 microns apart, these may have faceted surfaces and may be configured to reflect light at an angle. It’s not clear what kind of texture feel they would give to the device.(Apple Insider, USPTO, Yahoo)

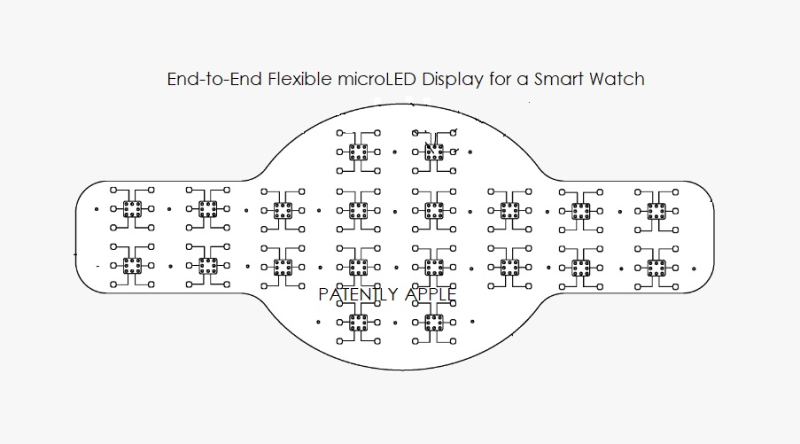

Apple has filed a patent titled “Display Module And System Application”. The patent describes the Apple Watch with a flexible wraparound display that can be worn on the wrist. The giant screen could be used to display additional information, and it could house other uses as well. According to the information listed in the patent, Apple wants the wearable to become a single unit – the watch itself and the watch band. However, the wraparound display could pose a durability threat since the flexible screen has more surface area. The patent also mentions that the approach would require the flexible Apple Watch to match the shape of the user’s wrist.(Apple Insider, WCCFTech, Patently Apple)

Huawei could launch a more affordable foldable phone in the near future, under the “nova” brand. In any case, this foldable smartphone is tipped to cost CNY4,000-5,000 (USD558-697). This phone could feature Qualcomm Snapdragon 778G SoC, and support 4G connectivity only.(Android Headlines, Weibo, Sina)

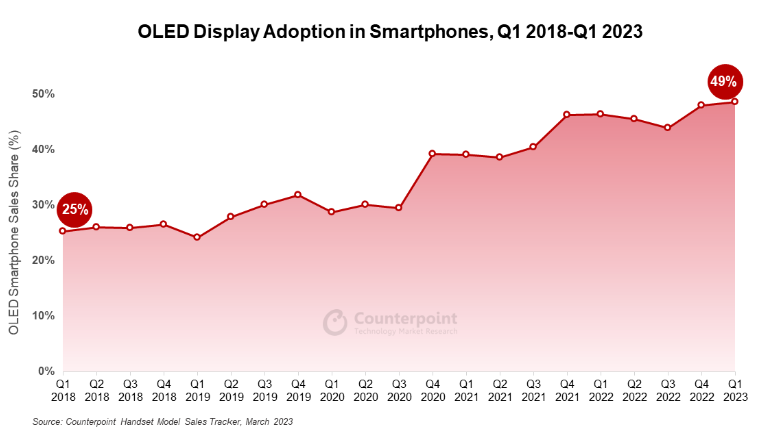

The share of OLED display smartphones in global smartphone sales reached a record high of 49% in 1Q23, up from 29% in 1Q20, according to Counterpoint Research. The screen or display has been one of the main factors influencing consumers to purchase a smartphone. OLED display provides a better viewing experience than LCD in several aspects by offering better viewing angles, deeper blacks and increased battery life along with other features. Brands also pushed OLED displays as a differentiating factor due to the leaner and more flexible panels that allow slimmer phones with curved displays in mid-priced and premium segments. Notably, the share of OLED displays in the above USD250 wholesale price band reached 94% in 1Q23. (Counterpoint Research, Laoyaoba)

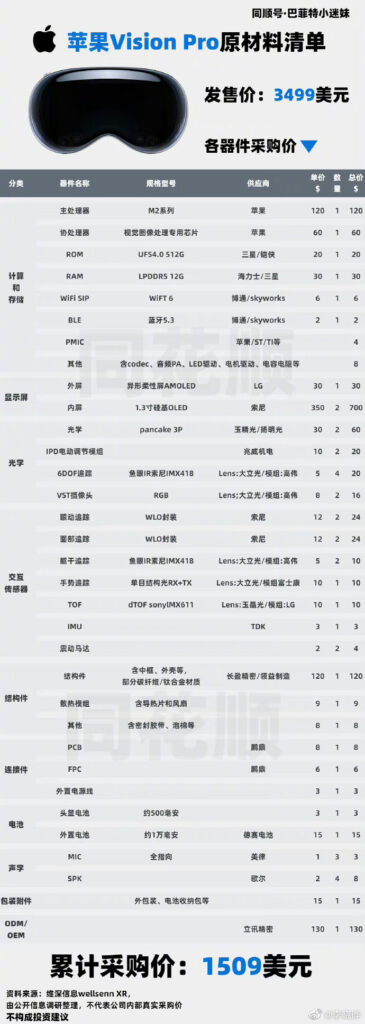

The production cost of Apple’s Vision Pro is about USD1,519 while its retail price is USD3,499. The Vision Pro’s most expensive components are its displays, which account for 48.1% of the retail price. The displays are comprised of micro-OLED panels for the inside and regular OLED panels for the outside. Sony is reportedly supplying the internal micro-OLED panels, which have the highest unit cost of any component in the device. The micro-OLED panels are about USD350 per piece, and each device requires two. The external OLED displays will be supplied by LG Display, regular OLED panels that are USD30 per piece.(Business Korea, Laoyaoba)

LG Display (LGD) is going to be shipping hybrid OLED panels to its automobile OEMs. Hybrid OLED effectively combines glass substrates with thin-film encapsulation (TFE) technologies – elements that have traditionally been used independently in rigid and flexible OLED panels. The hybrid OLED panels merge the advantages of flexible OLED panels, which usually use polyimide substrates, with the reliability of glass-based rigid OLED panels. The new panels incorporate a two-stack tandem structure, with two emission layers, enhancing their longevity. They can be produced at a lower cost than fully flexible OLED panels, which are generally utilized in high-end smartphones.(The Elec, Display Daily)

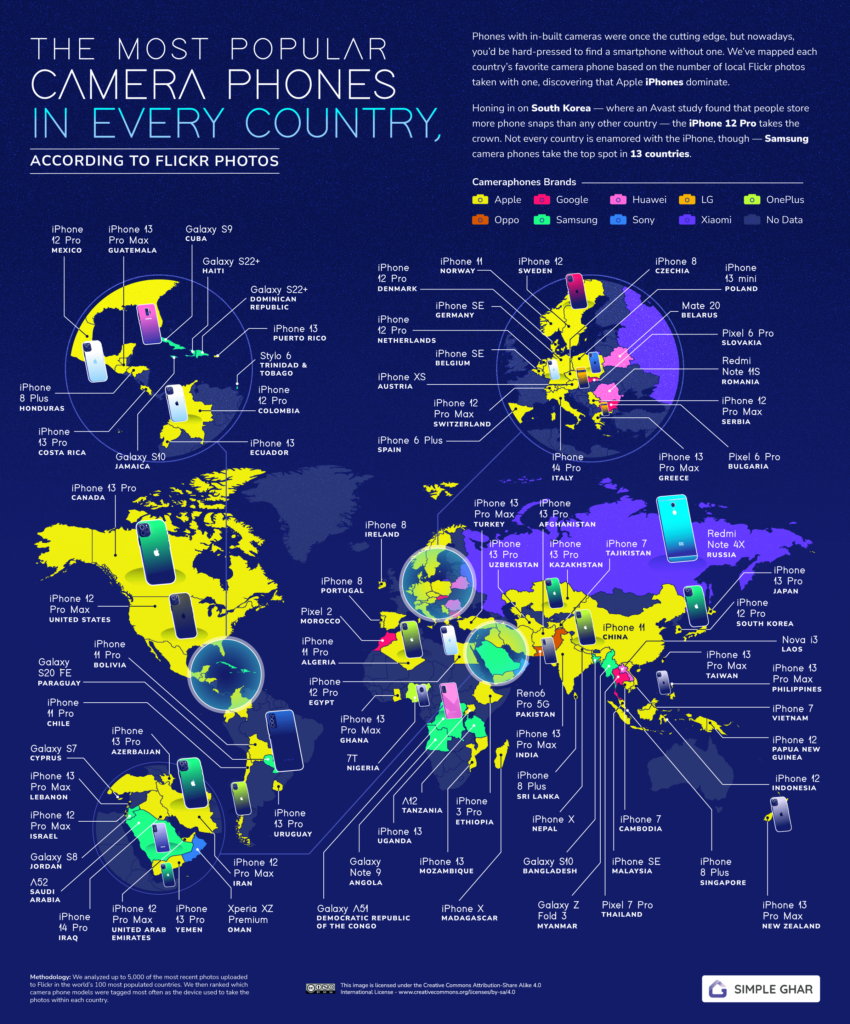

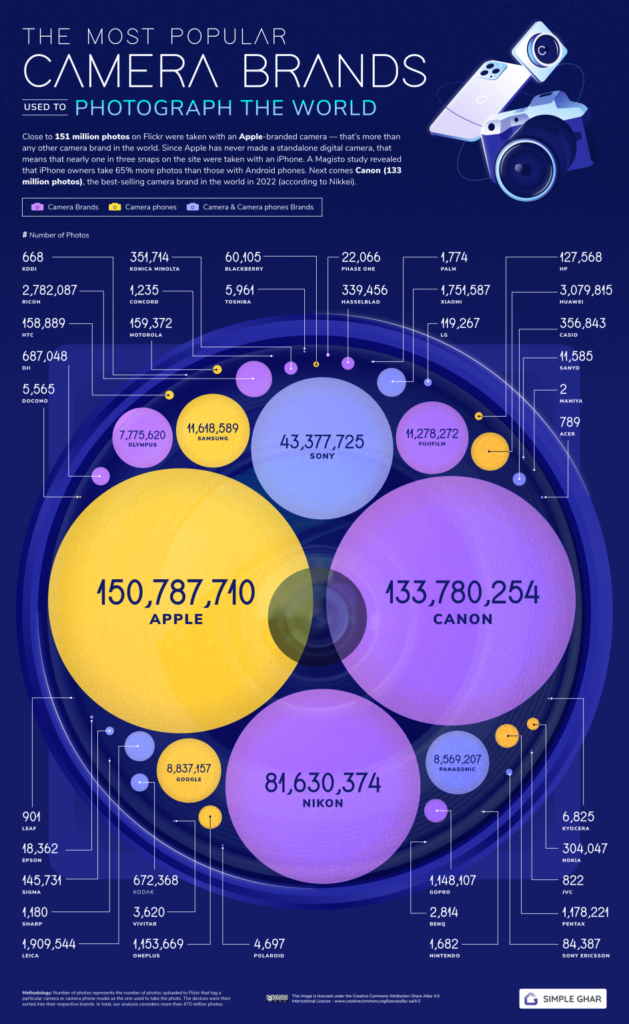

According to a recent study by SimpleGhar, the most popular camera phone brand is Apple. The study has also found that Apple is the most popular photography device brand. To discover the most popular photography brands, camera devices, and camera phones, SimpleGhar has analyzed the tags assigned to more than 470M photos uploaded to Flickr. Apple and Google, Samsung and Huawei are among the top 10 brands of photography devices used on the site — although the remainder of the top 10 are all Japanese camera brands. Together, Apple and Canon are behind more than half of all the photos on Flickr. It is Apple, and particularly iPhones 11 through 13, that is responsible for the lion’s share. (GizChina, Simple Ghar)

According to Hanwang University Professor Park Young-wook, ChangXin Memory Technologies (CXMT) will be substantial enough to threaten the three-way dominance of the DRAM industry by Samsung, SK Hynix and Micron. CXMT was founded in 2016 and has since then grown to be China’s largest DRAM manufacturer. Taiwanese chip maker Nanya was founded in 1995 and was a major player up to the early 2000s but lost out to rivals in the late 2000s when companies were attempting to kill the competition by outspending them. As of 1Q23, in the DRAM market, Samsung held a market share of 43.2%, while Micron and SK Hynix held 28.2% and 23.9%, respectively, Park said. Nanya was ranked fourth with a 2.2% market share while CXMT only had 0.1%. Nanya’s strategy is that of a fast follower, Park claimed, and it has relatively less chance to threaten the major players. But CXMT is aggressively hiring engineers from Micron and is attempting to expand its footprint in the DRAM sector, the professor said. (The Elec)

U.S.-based memory chipmaker Micron Technology has announced its plans to invest over CNY4.3B (USD603M) in its packaging and testing factory located in Xi’an city, Shaanxi province over the coming years. Micron’s announcement comes as Chinese consumer electronics groups are drawing up plans to replace the group’s memory chips. The chipmaker will also purchase packaging equipment from a Xi’an-based subsidiary of Taiwan’s Powertech Technology that it has been using in the factory since 2016.(CN Beta, Reuters, Financial Times, Gasgoo)

Micron Technology says that half of its China headquarter customer revenue is “now at risk of being impacted” from China’s ban on sale of its memory chips to key domestic industries. The impact to China headquarter revenue equates to a low-double-digit percentage of Micron’s worldwide revenue. The company had previously forecast a hit to total revenue in the low-single to high-single digit percentage.(Laoyaoba, Yahoo, Yahoo, Reuters)

The European Union is moving closer to enacting a law that will not just require smartphones like Apple iPhone to have easier battery repairs, but it will also mandate how much of a battery must be reclaimable after recycling. By a vote of 587 in favor, 0 against, and 20 abstentions, Members of the European Parliament (MEPs) have approved an agreement made with the Council to revamp European Union regulations about batteries and waste. The legislation represents the most recent endeavor within the “Right to Repair” movement, compelling companies to manufacture their products to make it easy for do-it-yourself repairs. Certain provisions will probably become effective later in 2023, while others will be implemented at a later date. For example, it has a goal of 45% of more strict waste collection targets for portable batteries by 2023. (Apple Insider, Europa)

Posco is constructing Korea’s first lithium hydroxide plant to increase the lithium supply for secondary batteries that it will produce enough lithium for approximately 600,000 electric vehicles (EV) annually. The new plant will have an annual capacity of 25,000 tons of lithium hydroxide, which is enough for approximately 600,000 EVs. Posco plans to invest approximately KRW575B and aims to complete the construction by 2025. The construction of the lithium hydroxide plant is part of the second phase of investment in Argentina announced in Oct 2022. (The Elec, KED Global, Korea Times)

Samsung SDI and General Motors (GM) have announced their plans to construct a joint venture electric vehicle battery plant in the state of Indiana in the U.S., with mass production set to begin by 2026. The companies have announced their decision to build the joint venture in New Carlisle, located in the north-central region of St. Joseph County in Indiana. In Apr 2023, both companies announced their plans to invest more than USD3B to establish a battery factory together in Indiana. The joint venture site in New Carlisle will cover an area of approximately 2.65M square meters. The goal is to produce batteries equivalent to 30 gigawatt hours annually. This will be the second time for Samsung SDI to establish a joint venture factory with a local automobile manufacturer in North America. Samsung SDI is also currently constructing a battery factory with Stellantis in Kokomo, Indiana, with an investment of USD2.5B.(Engadget, Business Korea, Electrive, Samsung SDI)

Japan’s industry ministry will provide a roughly JPY120B (USD853M) subsidy to Toyota Motor to expand its production of electric-vehicle batteries, in a bid to boost domestic output and curb supply chain risks. The Ministry of Economy, Trade and Industry has designated storage batteries as crucial to Japan’s economic security and has secured JPY330B in a supplementary fiscal 2022 budget to support the sector. Tokyo sees boosting the domestic battery supply as a key priority amid the auto industry’s shift toward EVs. Around JPY330B in Toyota investments are expected to qualify for the state aid. Toyota will use the subsidy to expand output at Prime Planet Energy & Solutions, a joint battery venture with Panasonic. (Laoyaoba, Reuters, Asia Nikkei)

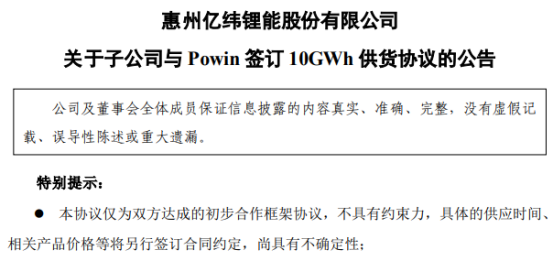

EVE Energy, a leading lithium battery manufacturer in China, announced that its subsidiary, Hubei EVE Power, has signed a Conditional Offtake Agreement for the Purchase of Battery Products with Powin. Under the agreement, Hubei EVE Power will produce and deliver 10GWh of square-shaped lithium iron phosphate batteries to Powin. Powin, a US-based company specializing in energy storage battery integration solutions, is not affiliated with EVE Energy.(Laoyaoba, OfWeek, NBD, STCN)

Stellantis has confirmed that it is “evaluating” Tesla’s North American Charging Standard (NACS) connector after Ford and General Motors (GM) partnered with Tesla’s system. Stellantis said that it is evaluating NACS and that it still plans to work with third-party charging companies. (CN Beta, Investors, Reuters, Electrek, Inside EVs)

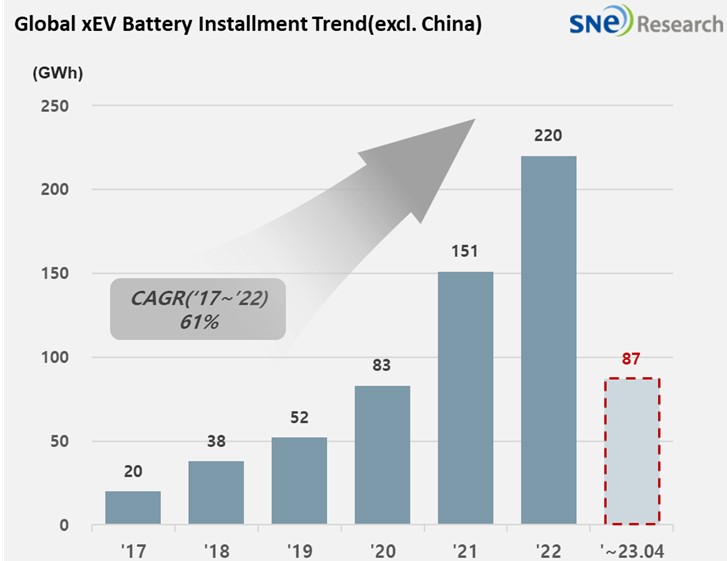

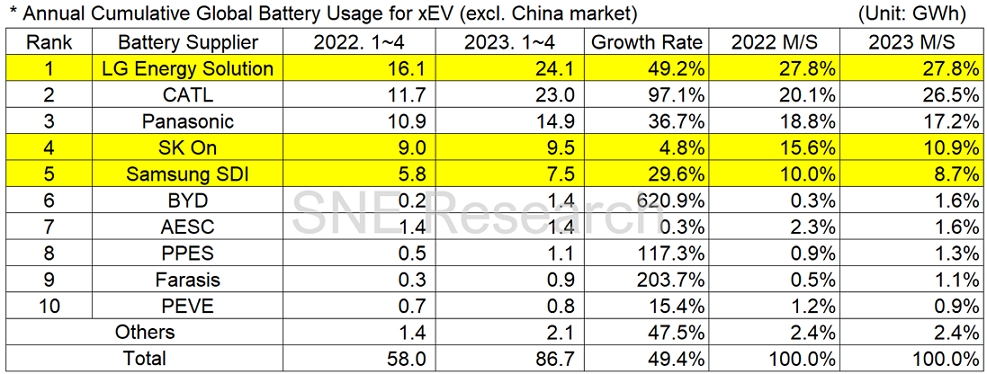

According to energy market research firm SNE Research, the total usage of electric vehicle batteries produced by LG Energy Solution in the global market, excluding China, in the 4 four months of 2023 reached 24.1 gigawatt hours (GWh), up 49.2% from 16.1 GWh in the same period of 2022. LG Energy Solution picked up first place in the world in terms of battery usage. This is due to increased sales of the Tesla Model 3 and the Tesla Model Y, the Volkswagen ID.4, and the Ford Mustang Mach E, all powered by LG Energy Solution batteries. Second place went to China’s CATL. In the global market, CATL battery usage nearly doubled to 23.0 GWh in the first 4 months of 2023, compared to 11.7 GWh in the same period of 2022. CATL is also rapidly expanding its market share. In the global market, excluding China, LG Energy Solution’s share in the first 4 months of 2023 was 27.8%, unchanged from the same period of 2022. However, CATL’s share jumped from 20.1% in the first 4 months of 2022 to 26.5% in 2023. (SNE Research, Laoyaoba, Hani, Business Korea)

The Japanese government plans to implement a new law that regulates smartphone app stores to promote easier market access for third-party developers and spur competition amid the Apple and Google duopoly. The envisaged law would make it mandatory for the dominant smartphone operating system providers to allow the entry of third-party app stores if they are deemed safe. It will require Apple and Google to let users download apps through services other than their app stores. The government aims to stimulate competition and believes it could reduce app prices. The government will compile a list of prohibited actions for OS providers to prevent them from showing bias towards their services and payment platforms. (Apple Insider, Japan Times, Japan Today)

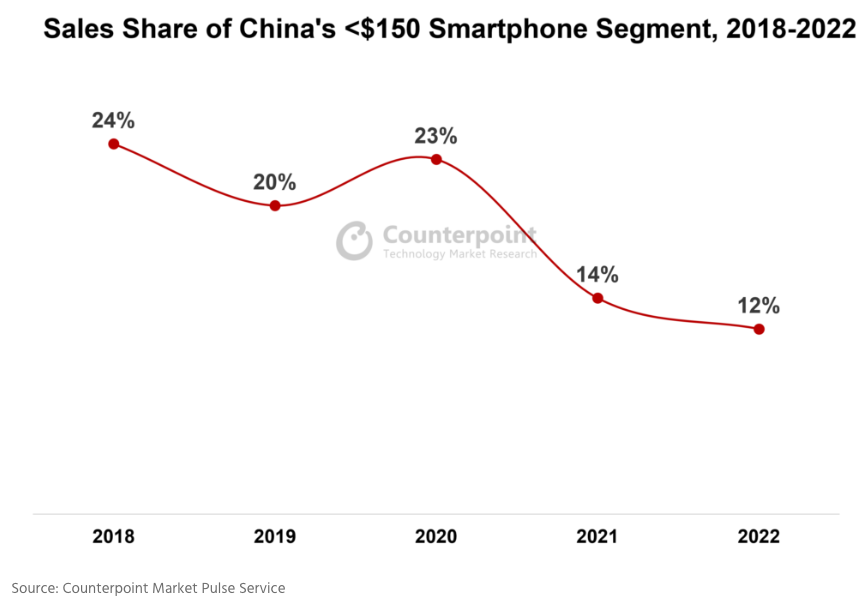

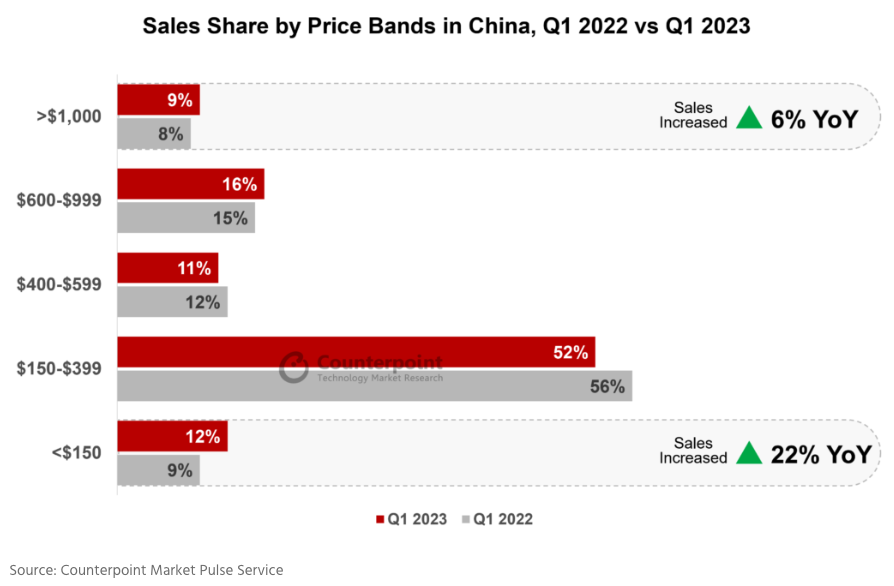

China’s smartphone market is witnessing a surprising shift in the landscape. In 1Q23, China’s overall smartphone market fell 5% YoY. However, going against the grain, the entry-level segment (<USD150 wholesale price) increased significantly by 22% YoY during the quarter, according to Counterpoint Research. Over the years, Chinese OEMs have been mostly targeting the premium segment. Android smartphones have actively pushed the trend of premiumization in China, hoping to capture more market share from established players like Apple in the ultra-premium (>USD800) segment. Nevertheless, Apple’s market share has continued to grow, reaching its highest in recent years. The surprising rise in the entry-level price band in 1Q23 serves as a reminder of the segment’s resilience. (Counterpoint Research)

A team of the biggest global music publishers, including Universal Music Publishing Group, Warner Chappell Music, and Sony Music Publishing, has launched a joint lawsuit against Twitter, alleging “massive copyright infringement” involving their music catalogues. The lawsuit, filed in Tennessee federal court, involves seventeen music publishers seeking over USD250M in damages. This legal action highlights the growing concerns of music publishers and their ask for fair compensation for the use of copyrighted music on social media platforms. (Gizmo China, CNN, The Verge, Forbes)

Samsung Electronics and LG Electronics are going all out in their assault on the In-Vehicle Infotainment (IVI) market. Samsung is leveraging its semiconductor prowess in partnership with Hyundai Motor, while LG is bolstering its technology by investing in research and development (R&D). Samsung Electronics has decided to collaborate with Hyundai Motor for their IVI strategy. Samsung Electronics will supply the Exynos Auto V920 processor for IVI by 2025. LG Electronics has upgraded its R&D center in Vietnam to an official subsidiary. The LG Electronics Vietnam R&D corporation is responsible for IVI software development and verification. LG Electronics plans to strengthen its talent acquisition and management strategy through the establishment of this R&D corporation.(Laoyaoba, Business Korea)

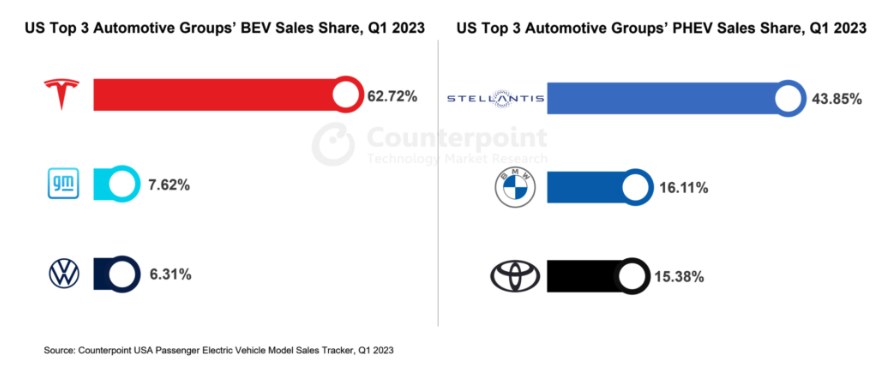

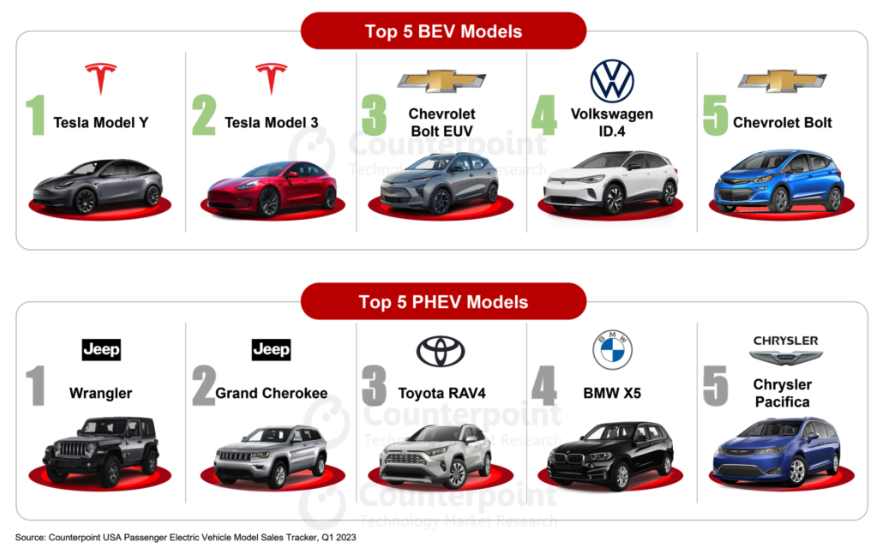

US passenger electric vehicle (EV) sales soared over 79% YoY in 1Q23, according Counterpoint Research. This strong growth helped the US surpass Germany to become the world’s second-largest EV market, the largest being China. Battery EVs (BEV) accounted for 81% of all passenger EV sales in the US while plug-in hybrid EVs (PHEVs) made up the rest. In 1Q23, Tesla’s sales outperformed the combined sales of the next 18 automotive groups, which collectively represent 34 automotive brands. Although EV sales saw strong growth during the quarter, those of conventional passenger vehicles remained flat. One reason was the introduction of an EV tax credit of up to USD7,500, which has played a crucial role in driving up EV sales. Currently, around 20 models in total offered by Tesla, GM, Ford, Stellantis, Rivian and Volkswagen are eligible for the tax credit. However, strict eligibility conditions set by the US government have excluded brands such as Hyundai, Nissan, BMW, Audi and Volvo from benefiting from the EV tax credit scheme in 2023. (Counterpoint Research)

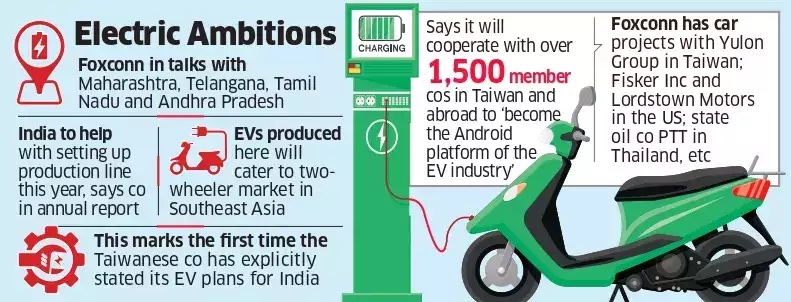

Foxconn is allegedly to enter the electric vehicle (EV) manufacturing space in India, and has been in talks with some state governments to further its plans. Foxconn has said that India will assist with the establishment of a production line this year to provide two-wheeled EV manufacturing services that will cater to the EV two-wheeler market in Southeast Asia. While the manufacturer has a tie-up with electric scooter-maker Ather Energy, it is expected to look for a partner as it enters the space. They could partner with an Indian auto giant too. Foxconn would want to build a vertical platform including manufacturing, hardware, component manufacturing and battery managemen. (Gizmo China, India Times, Laoyaoba, Live Mint, Business Today)

Chinese President Xi Jinping has discussed the global rise of artificial intelligence (AI) with Bill Gates and said he welcomed U.S. firms including Microsoft bringing their AI tech to China. This part of the conversation was left out in the Gates Notes post so the specifics of the discussion are not clear. They have discussed a whole range of matters including climate change, health, development. (Neowin, Reuters)