7-16 #UselessIdiot : The EU Council has adopted a new regulation that “strengthens sustainability rules for batteries”; China has announced export restrictions on two metals, gallium and germanium; Huawei’s licensing fee caps for 4G and 5G mobile phones are USD1.5 and USD2.5 per unit, respectively; etc.

Intel Foundry Services has introduced a broad range of tools for customers of its new 16nm-class process technology called Intel 16 that addresses mobile, RF, IoT, consumer, storage, military, aerospace, and government applications. The new technology complements Intel’s 22nm FFL process and is said to be an inexpensive FinFET-based node. The 16nm-class technology promises to offer higher transistor density, higher performance, lower power, fewer masks, and simpler back-end design rules compared to planar production nodes used for these applications today. Synopsys, Cadence Digital, Siemens, and Ansys, have announced that the companies now have a range of tools for IFS’s Intel 16, which is specifically designed to address a wide variety of customers’ applications RF and analog capability (Wi-Fi, Bluetooth), mmWave, consumer electronics, storage, military, aerospace, and government applications.(My Drivers, Tom’s Hardware, Extreme Tech, PR NEwswire, Business Wire, Siemens)

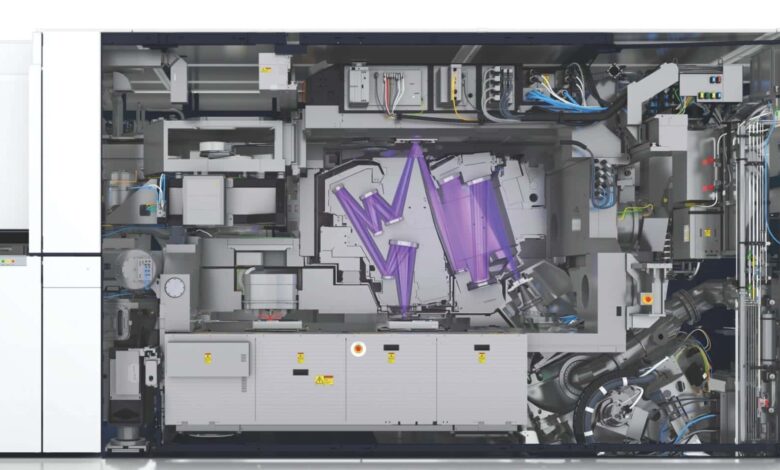

ASML’s new EUV lithography machine NXE:3800E will be shipped, and the 2nm process depends on it. The exposure capability of NXE:3800E lithography machine will reach 30mJ/cm2,The production capacity of WPH is about 195 wafers per hour, and it will be increased to 220 wafers per hour in the future, which is more than 30% higher than the current model. As for the price, there is no authoritative statement on the price of NXE:3800E, but the EUV lithography machine has been sold for more than USD150M before. In the past two years, there are factors such as inflation, and the starting price of CNY1B is indispensable. Future high-NA aperture EUV lithography opportunities will be more expensive, and the price will easily exceed CNY2.5-3B.(CN Beta, MacRumors)

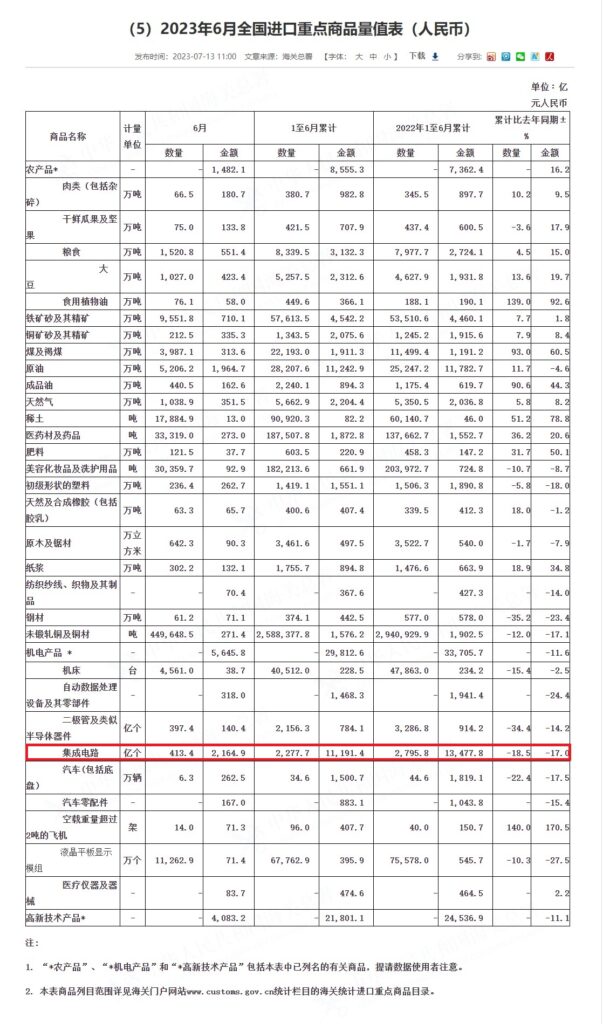

China’s imports of integrated circuits (ICs) slumped 18.5% in the first 6 months of 2023 from a year earlier by volume, according to newly released customs data, at a time when the US and its allies are continuing to restrict China’s access to advanced chips and technologies. China’s imports of integrated circuits dropped to 227.7B units in the first 6 months of 2023, compared with 279.6B units in the same period in 2022, according to data published by the General Administration of Customs. It slightly narrowed the 19.6 per cent drop in the first 5 months of 2023. The total value of chip imports fell 22.4% to USD162.6B in the first half year of 2023. The drop was much deeper than the decline in China’s overall imports, which shrank 0.1% from a year earlier for the same period. (Gizmo China, SCMP, Yahoo, Sina, 199IT, Laoyaoba)

Foxconn has told the Indian government that it wants to establish at least 4-5 semiconductor fabrication lines in India. The move comes after the firm announced its decision to withdraw from a USD19.5B semiconductor joint venture with Indian metals-to-oil conglomerate Vedanta. Since Foxconn is aware of the procedures, they should be able to submit their final application and make the announcement within the next 45-60 days. Foxconn is working towards applying under India’s Modified Programme for Semiconductors and Display Fab Ecosystem, a USD10B plan offering incentives of up to 50% of capital costs for semiconductor and display manufacturing projects.(CN Beta, Economic Times, Business Today)

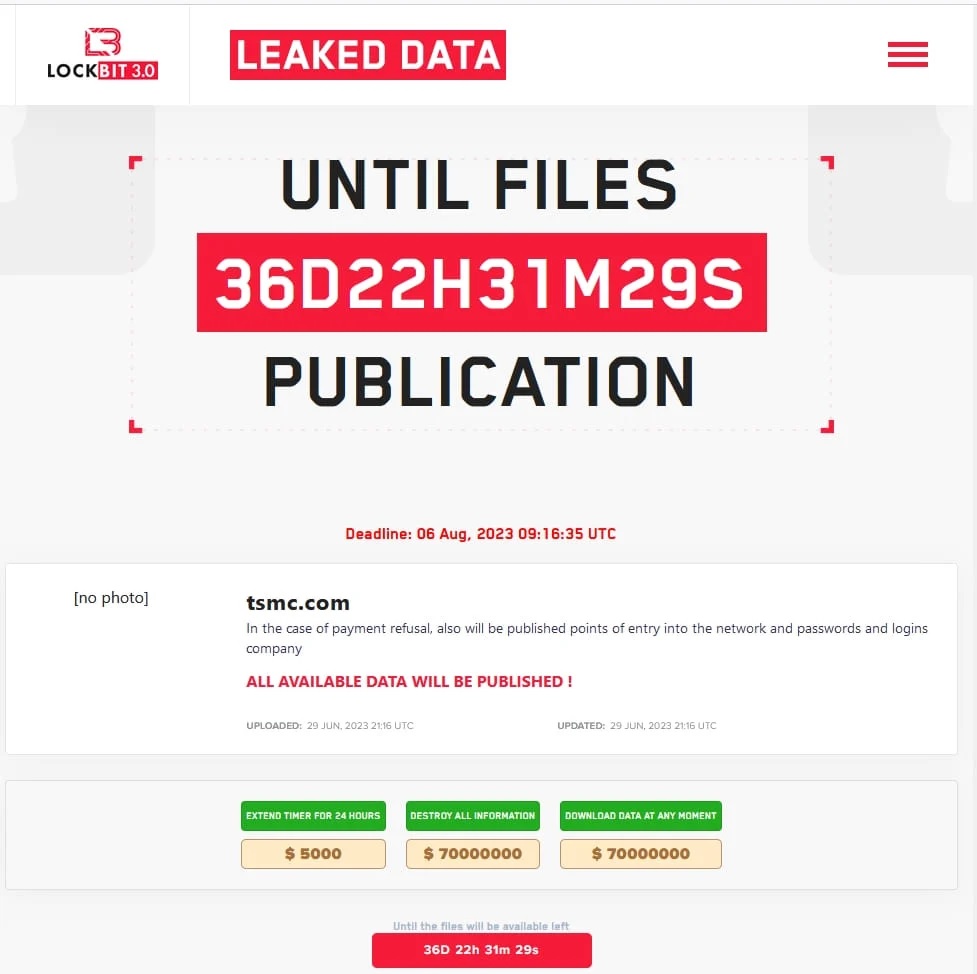

Taiwan Semiconductor Manufacturing Company (TSMC) has confirmed it’s experienced a data breach after being listed as a victim by the LockBit ransomware gang. The Russia-linked LockBit ransomware gang listed TSMC on its dark web leak site. The gang is threatening to publish data stolen from the company, which commands 60% of the global foundry market, unless the company pays a USD70M ransom demand. TSMC has confirmed that a “cybersecurity incident” at one of the company’s IT hardware suppliers, named as Kinmax Technology, led to the leak of “information pertinent to server initial setup and configuration”.(MacRumors, TechCrunch)

Taiwan Semiconductor Manufacturing Compay (TSMC) is straining to meet demand from top customer Apple for 3nm chips. The company’s tool and yield struggles have impeded the ramp to volume production with world-leading technology. Apple is rumored to have secured 90% of TSMC’s 3nm chipsets for the A17 Bionic and M3, the yield rate still has a long way to go up from that 55% figure. Brett Simpson, senior analyst at Arete Research, believes that both parties were able to circumvent around this pricing obstacle, with Apple only paying for the good wafer batches instead of paying standard pricing. According to Mehdi Hosseini, senior equity research analyst with Susquehanna International Group, in 2H23, TSMC will ramp Apple’s A17 and M3 processors at the N3 node, as well as ASIC-based server CPUs at N4 and N3. TSMC will also fabricate Intel’s Meteor Lake graphic chiplets at N5, AMD’s Genoa and Nvidia’s Grace processors at N5 and N4, as well as Nvidia’s H100 GPU at N5. (CN Beta, My Drivers, WCCFtech, ExtremeTech, EE Times)

LG Display is expected to start manufacturing Gen 8 OLED panels aimed at IT devices a year later than rival Samsung Display. Despite this, LG Display is expected to certainly win orders for its panels from Apple and begin supplying no later than 2026, according to Choong Hoon Yi, CEO of analyst firm UBI Research. Samsung Display is the only display panel maker that started spending on Gen 8 OLED production. LG Display and BOE are yet to follow as of yet. In Apr 2023, Samsung Display said it expected to start production of Gen 8 OLED 2-3 years from now, so it will begin in 2025 at the latest. BOE built three Gen 6 OLED factories to supply OLED panels for iPhones but only one of them is properly operating.(The Elec, CN Beta)

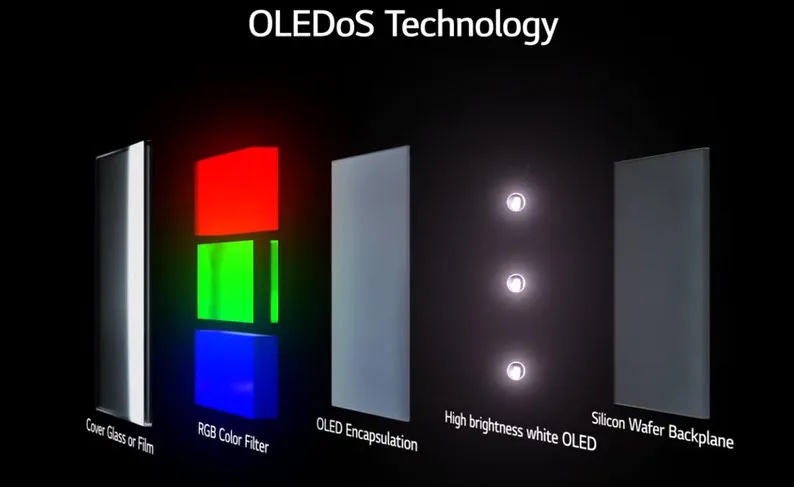

Lee Jung-il, team leader of LG Display’s Best OLEDoS (BO) team, has discussed the future of display technologies for virtual reality (VR) and augmented reality (AR) devices. According to Lee, LG Display believes that OLED on silicon (OLEDoS) technology holds the greatest potential for VR devices, while LED on silicon (LEDoS) technology is expected to become mainstream for AR devices. Lee has outlined 4 key technologies for microdisplays in extended reality (XR) devices: OLEDoS, LEDoS, liquid crystal on silicon (LCoS), and digital light processing (DLP). (The Elec, Display Daily)

LG Innotek will spend KRW1.3T at its facility in Haiphong, Vietnam to build an additional camera module production line. The funds will be spent up to Dec 2025. The City of Haiphong will install additional electrical substations and offer tax benefits to the facility. The new production line is expected to be completed in 2H24 with mass production beginning in 2025. The new line will double LG Innotek’s camera module production capacity at its facility in Vietnam, which currently accounts for 30% of LG Innotek’s total camera module output. Its factories at Gumi and Paju in South Korea account for 70%.(The Elec, Asia Nikkei,KED Global)

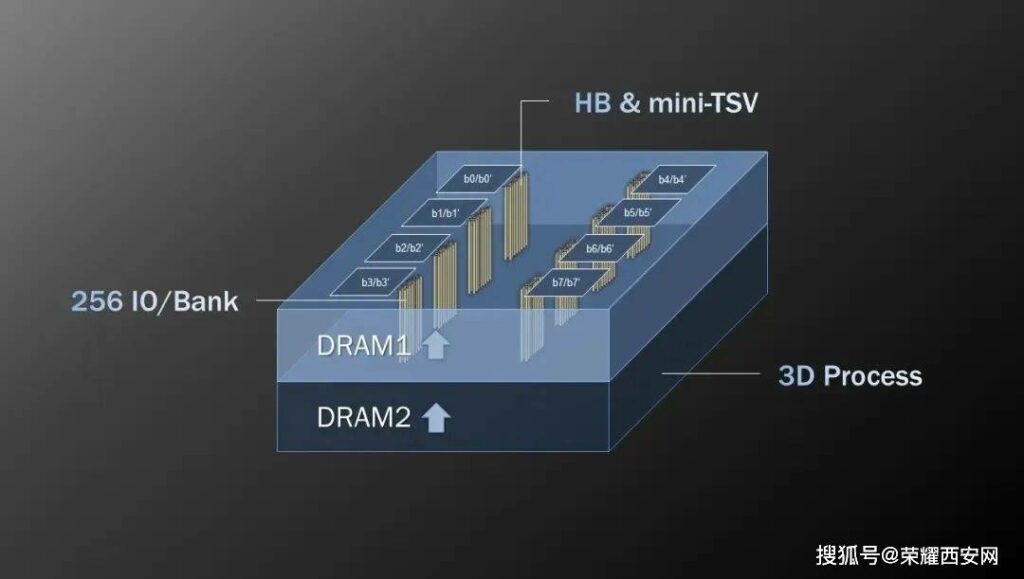

Unigroup Guoxin has demonstrated the latest breakthrough in SeDRAM direction of Xi’an Ziguang Guoxin. Xi’an Ziguang Guoxin’s new generation of multi-layer array SeDRAM, compared with the previous generation of single-layer array structure, mainly uses low-temperature hybrid bonding technology (Hybrid Bonding) and micro through-silicon via (mini-TSV) stacking technology. Each Gbit (billion bits) of this memory is composed of 2048 data interfaces, and the data speed of each interface reaches 541Mbps, finally realizing the industry-leading 135 GBps/Gbit bandwidth and 0.66 pJ/bit energy efficiency. Three-dimensional integration of logic cells and DRAM arrays. (CN Beta, Sohu, China Daily)

Samsung has announced that it has initiated mass production of its new automotive Universal Flash Storage (UFS) 3.1 memory solution optimized for in-vehicle infotainment (IVI) systems. The UFS 3.1 lineup will come in 128, 256 and 512-gigabyte (GB) variants to meet different needs of customers. The enhanced lineup allows more efficient battery life management to future automotive applications such as electric or autonomous vehicles. The 256GB model, for instance, has reduced its energy consumption by about 33% compared to the previous generation product. The 256GB model also provides a sequential write speed of 700-megabytes-per-second (MB/s) and a sequential read speed of 2,000MB/s.(Gizmo China, Samsung, SamMobile, GSM Arena)

China’s Contemporary Amperex Technology Co Limited (CATL) in Debrecen, eastern Hungary, is applying for permission to scale back its original plan, at least in terms of the size of the factory. In Aug 2022, CATL announced that it will invest HUF3,000B (EUR 7.9B) to build a new 100GWh battery factory in Debrecen. After completion, it will become the battery factory with the largest production capacity in Europe. The factory will produce battery cells and modules and become a service center for Eropean auto factories, supplying about 30 electric vehicle brands including BMW, Mercedes-Benz and Volkswagen. On 13 Feb 2023, the Debrecen Municipal Government issued CATL an environmental license for its Hungarian factory. It is understood that since the license was issued, the construction of the factory has made significant progress. According to the established plan, the factory will be put into trial operation in 2024 and put into production in 2025. (CN Beta, Hungary Today, Daily News Hungary, Quartz, Asia Nikkei)

The EU Council has adopted a new regulation that “strengthens sustainability rules for batteries”. The EU regulation concerns the entire life cycle of batteries to ensure they are “safe, sustainable, and competitive”. The regulation claims that “portable batteries incorporated into appliances should be removable and replaceable by the end-user” by 2027. The European Commission states that manufacturers, including Samsung, Apple, and others, should have ample time to adapt their hardware and design to meet the new EU regulations by 2027. The European Commission is trying to make batteries easier to replace. Aside from replaceability, the EU Commission has set new waste collection targets for battery manufacturers (63% by the end of 2027 and 73% by the end of 2030). The EU also set a target of lithium recovery of 50% and a recycling efficiency target of 80% for nickel-cadmium batteries by 2027. (GizChina, Europa, SamMobile, Android Authority)

BYD plans to establish a battery assembly plant in Hungary with an investment of over CNY200M (about USD28M). This is BYD’s second factory in the country following the electric bus and truck factory in Hungary. It is reported that the new factory will supply power batteries for Tesla’s Berlin factory. Peter Szijjarto, the Hungarian Minister of Foreign Affairs and Trade, has stated that the new factory will not produce batteries but only perform assembly operations with an investment amounting to HUF10B. BYD has a power battery supply agreement with Tesla, and the establishment of the battery assembly plant in Hungary will support its overseas business. (CN Beta, CNEVpost, Pandaily, Shanghailist, Hungary Today)

Toyota has unveiled ambitions to halve the size, cost and weight of batteries for its electric vehicles following a breakthrough in its solid-state battery technology. The president of the company’s research and development center, Keiji Kaita, has said that simplifying the production process for battery materials would bring down the cost of its long-awaited next-generation technology. Toyota has initially said it wanted to start selling hybrid but not electric cars with solid-state batteries before 2025. Kaita has said the company discovered ways to address the durability problems from about 3 years ago and now had enough confidence to mass-produce solid-state batteries in EVs by 2027 or 2028. (CN Beta, Quartz, Financial Times)

General Motors (GM) has announced that it has acquired substantially all the assets of Israel-based battery software startup ALGOLiON. The acquisition was led by the newly formed Technology Acceleration and Commercialization (TAC) organization, a group within GM that works to identify emerging technology that can support GM’s leadership position in battery development through investments, acquisitions or partnerships. ALGOLiON has developed sophisticated software that uses data streams from EV battery management systems to help identify anomalies in cell performance to ensure proper vehicle health management and provide early detection of battery hazards including thermal runaway propagation events.(TechCrunch, General Motors, Charged EVs)

Penn State has developed LionGlass, a new type of the material that’s not only 10 times more damage resistant, but requires significantly less energy to manufacture. The family of new glass compositions, which the team calls LionGlass, swaps out the soda ash and limestone for non-carbonate materials – the exact composition of which is still undisclosed, due to the pending patent. Swapping out the carbonates not only cuts their direct emissions during melting, but lowers the required temperatures by up to 400 °C (720 °F). That in turn reduces the energy consumption by about 30% and as such cuts their emissions. (CN Beta, New Atlas, Carbon Credits, Penn State)

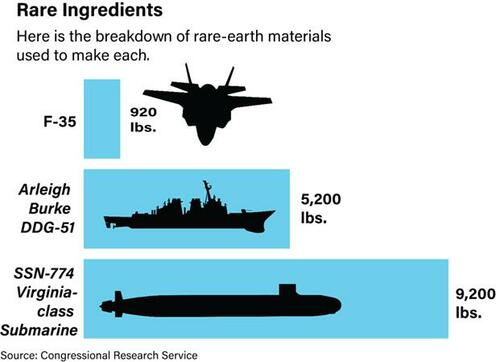

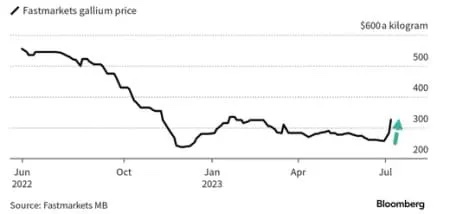

China has announced export restrictions on two metals, gallium and germanium, which are heavily imported by Western countries for semiconductor production from 1 Aug 2023. According to the Ministry of Commerce, the move is to “safeguard national security and interests”. Gallium is most common in semiconductors, transistors, and small electronic devices. It is also used to make LEDs. As for military-grade Gallium Nitride, it is found in cutting-edge weapon technology that US defense companies produce. Three of the most common uses for germanium are rectifiers, transistors, and weapons-sighting systems. Meanwhile, China has already placed Lockheed Martin and a unit of Raytheon Technologies on an “unreliable entities list” over weapon sales to Taiwan. (CNBC, Neowin, HK01, 163.com, Storm, Bloomberg, Yahoo, ZeroHedge)

According to TF Securities analsyt Ming-chi Kuo, Apple is actively adopting 3D printing technology, and it is expected that some of the titanium mechanical parts of the 2H23 new Apple Watch Ultra will be made by 3D printing. Although currently the mechanical parts made by 3D printing still have to go through the Computerized Numerical Control (CNC) process for back-end processes, it can still improve the production time and reduce the production cost. In terms of the supply chain for 3D printers used to produce mechanical parts for the Apple Watch Ultra, IPG Photonics is the exclusive supplier of laser components, and the printer suppliers are Farsoon and BLT. (Phone Arena, Twitter, Medium, Apple Insider)

Nokia has announced it has signed a new patent cross-license agreement with Apple which will replace the current license that is due to expire at the end of 2023. Nokia’s industry-leading patent portfolio is built on more than EUR140B invested in R&D since 2000 and is composed of around 20,000 patent families, including over 5,500 patent families declared essential to 5G.(MacRumors, Nokia)

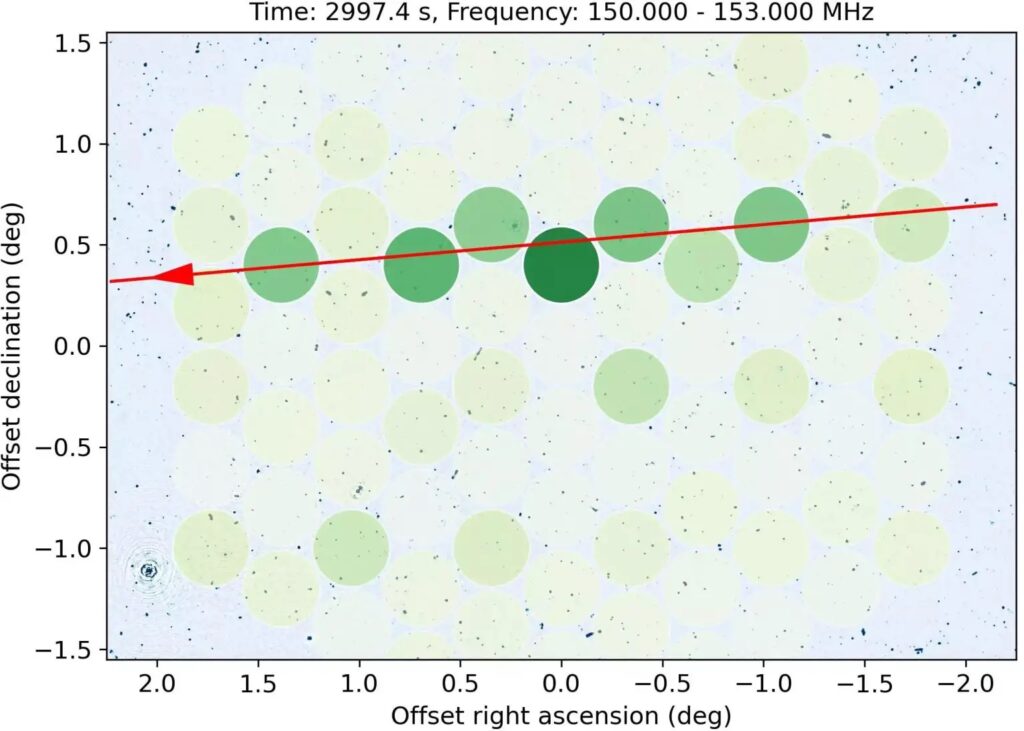

Scientists from a number of leading research institutions including the Max Planck Institute for Radio Astronomy in Bonn, Germany, used the Low Frequency Array (LOFAR) telescope to observe 68 of SpaceX’s satellites. They detected “unintended electromagnetic radiation” emanating from onboard electronics. This is different from communications transmissions, which had been the primary focus for radio astronomers so far. The unintended radiation could impact astronomical research. They encourage satellite operators and regulators to consider this impact on radio astronomy in spacecraft development and regulatory processes alike. (CN Beta, SciTechDaily, New Atlas)

Huawei’s licensing fee caps for 4G and 5G mobile phones are USD1.5 and USD2.5 per unit respectively; the licensing fee for Wi-Fi 6 consumer devices is USD0.5 per unit. For devices with Internet of Things technology as the core, the license rate set by Huawei is 1% of the net selling price, with a maximum rate of no more than USD0.75 per device; for devices that enhance connectivity through the Internet of Things, the license rate is USD0.3–1 per unit. Huawei Supervisor, Chief Legal Officer, and Chief Compliance Officer Song Liuping said at the 2023 Innovation and Intellectual Property Forum that by the end of 2022, Huawei will hold more than 120,000 valid authorized patents worldwide.(My Drivers, CE.cn, Yicai, CN Beta)

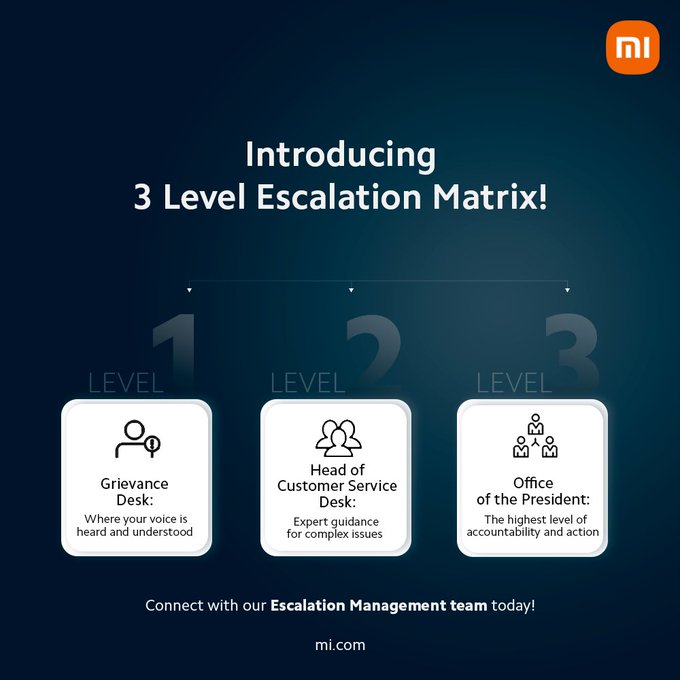

Xiaomi has announced a new escalation system to handle customer queries and complaints in India. It is called the 3-Layer Escalation Matrix. The matrix system is aimed at helping customers with their problems. The company says that it is designed to ensure that concerns are acknowledged, investigated, and resolved promptly. Xiaomi aims to provide seamless and excellent customer service with the escalation system. Xiaomi has a wide service network in India. Customers facing any problems with their devices can visit their nearest service center. Alternatively, they can also register their complaint using Xiaomi’s Greivance Redressal Form via the Mi Store app, mi.com, or the Xiaomi Service+ app.(Gizmo China, Twitter, Xiaomi)

Starting in Jan 2024, smartphones, tablets, and smartwatches will be largely banned from classrooms in the Netherlands. The ban is the result of an agreement between the ministry, schools, and related organizations. Education minister Robbert Dijkgraaf said that the ban is necessary to protect students from distractions and to help them focus on their studies. The ban will only apply to smartphones that are not specifically needed for lessons. Schools will be responsible for enforcing the ban. However, if the ban does not yield enough results by the summer of 2024, legal rules will follow. (Gizmo China, CNN)

LG Electronics plans to spend USD39.5B (KRW50T) in R&D, facility and strategic investment as it aims to reach USD79B (KRW100T) in sales by 2030, up from USD51.4B (KRW65T) in 2022. LG Electronics has rolled out its new strategy, transforming its home appliance and electronics goods maker into a platform-based tech company. LG will bolster service platforms on its home appliances like TV products and white goods, reinforce business-to-business (B2B) units by leveraging its experience in the B2C market and accelerate new growth businesses such as electric vehicle (EV) charging and digital healthcare. (CN Beta, TechCrunch, Benzinga)

LG Electronics has declared its vision to transform from its current position as a top global home appliance brand to a “smart life solution company” that can connect and expand customers’ diverse experiences while driving for global annual revenues of KRW100T by 2030. The company CEO William Cho has outlined the bold vision built on 3 growth engines: pursuing new platform-based service businesses through the advancement of business portfolio, accelerating business-to-business (B2B) and exploring new business areas such as electronics vehicle charging and digital health. The CEO identified electrification, servitization and digitalization as key inflection points LG will focus on to achieve rapid mid- to long-term growth. (Android Authority, The Verge, LG)

Tesla has started discussions with the Indian government for an investment proposal to set up a car factory in the country, with an annual capacity of as many as 500,000 electric vehicles. The prices for the electric vehicles would start from INR2M (USD24,400.66). The company is also allegedly looking at using India as an export base as it plans to ship cars to countries in the Indo-Pacific region. (My Drivers, Economic Times, India Times, NDTV, Reuters)

BYD has submitted a USD1B investment proposal to build electric cars and batteries in India in partnership with a local company. BYD and privately held Hyderabad-based Megha Engineering and Infrastructures have submitted a proposal to Indian regulators to form an EV joint venture, the people said, asking not to be named because the application is private. The longer-term plan is to build a full line-up of BYD-brand electric cars in India from hatchbacks to luxury models. BYD has already invested USD200M in India where it sells the Atto 3 electric SUV and the e6 EV to corporate fleets, and plans to launch its Seal luxury electric sedan in 2023. The company aims to launch its first mass-market electric car in India later 2023. (Gizmo China, Reuters, HK01)

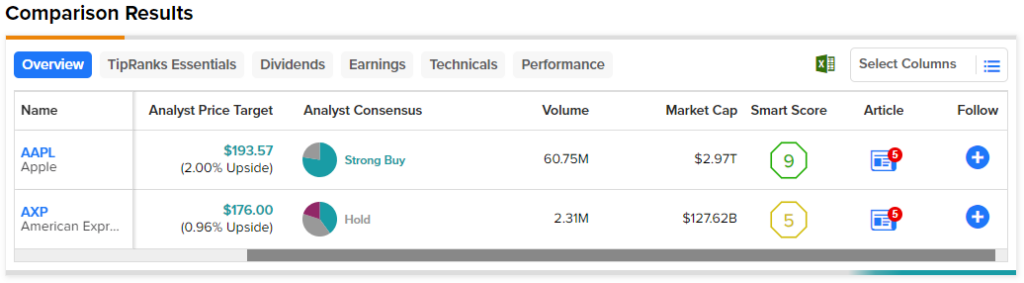

Goldman Sachs, Apple’s partner for the Apple Card and Apple’s Pay Later, has been in talks with American Express “for months” to hand over the partnership. Goldman Sachs has been trying to scale back consumer operations since 2022 and its tie-up with Apple is a part of that. A deal between the two banks is not imminent or assured and even if they do reach an agreement, the switch needs the blessing of Apple which recently extended the partnership with Goldman until the end of the decade. Goldman CEO David Solomon has been internally criticized for focusing on its consumer business so heavily which has generated losses of USD3B since 2020. (Neowin, WSJ)