7-18 #OffTheGrid : ASML is facing tighter restrictions on its ability to work with Chinese customers; TSMC has changed its Kaohsiung plant construction plan to 2nm process; Xiaomi is to boosting sales through official retail stores in India; etc.

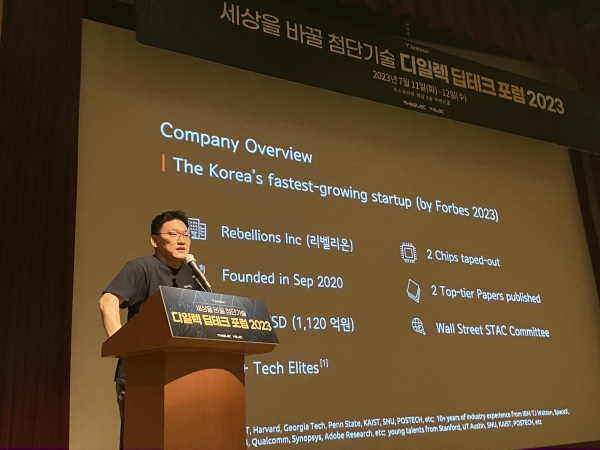

South Korean AI startup Rebellions wants to launch alternatives to AI chips offered by market leader Nvidia. Rebellions CEO Park Sunghyun said the startup’s goal is to, within 1-2 years, find specific applications that it can offer AI chips that be used instead of those by Nvidia. Specifically, Rebellions wants to take away Nvidia A100 and L40 chips’ market shares in the area of inference, Park said. Its first AI chip to be produced in 2024 is called Atom is aimed at data centers and will be supplied to South Korean carrier KT. (The Elec, Industry Wired)

ASML Holding NV, the leading provider of chipmaking equipment, is facing tighter restrictions on its ability to work with Chinese customers, a further escalation in the technology clash between Washington and Beijing. Dutch export control rules will forbid ASML from maintaining, repairing and providing spare parts for controlled equipment without government approval. In addition to the Dutch controls, the US is expected to bar ASML from selling even older DUV lithography gear to about half a dozen of Chinese plants without approval from Washington. (Laoyaoba, Caixing Global, Bloomberg)

Samsung Electronics, which has been focusing on the automotive semiconductor market, has announced its entry into the next-generation power semiconductor market. Samsung has announced that it will start an 8” gallium nitride (GaN) power semiconductor foundry service for consumers, data centers and automotive applications in 2025. Power semiconductors are used to convert power and control current in various electronic devices such as smartphones and home appliances. SK Group is building a next-generation power semiconductor value chain for each of its affiliates, from SiC wafer production at SK siltron to SiC power semiconductor design and manufacturing at SK powertech. Key Foundry, a foundry company acquired by SK hynix, is also developing a GaN foundry process. DB Hi-Tech, a Korean 8” foundry company, also started developing SiC and GaN processes in 2022. It aims to complete the development of the GaN process in 2024 and commercialize it beginning from 2025.(Laoyaoba, Business Korea)

Samsung Electronics’ Device Solutions (DS) Division in charge of the semiconductor business is expected to post an annual loss of more than KRW10T in 2023 due to a recession in the semiconductor industry. According to securities firms, current estimates of Samsung Electronics’ annual operating losses in the DS Division run from KRW10.3T by Kiwoom Securities and KB Securities to KRW14.7T by NH Securities. The DS Division’s losses will continue in 3Q23 but stay in the range of KRW2T-3T less than those in the 1Q / 2Q23, stock market experts forecast. (Laoyaoba, Business Korea)

Intel has started to notify its ecosystem saying that it will stop direct investment in the Next Unit of Compute (NUC) business. Intel’s EMEA comms manager of client computing and graphics, Mark Walton, has confirmed the news. (Laoyaoba, The Verge, STH)

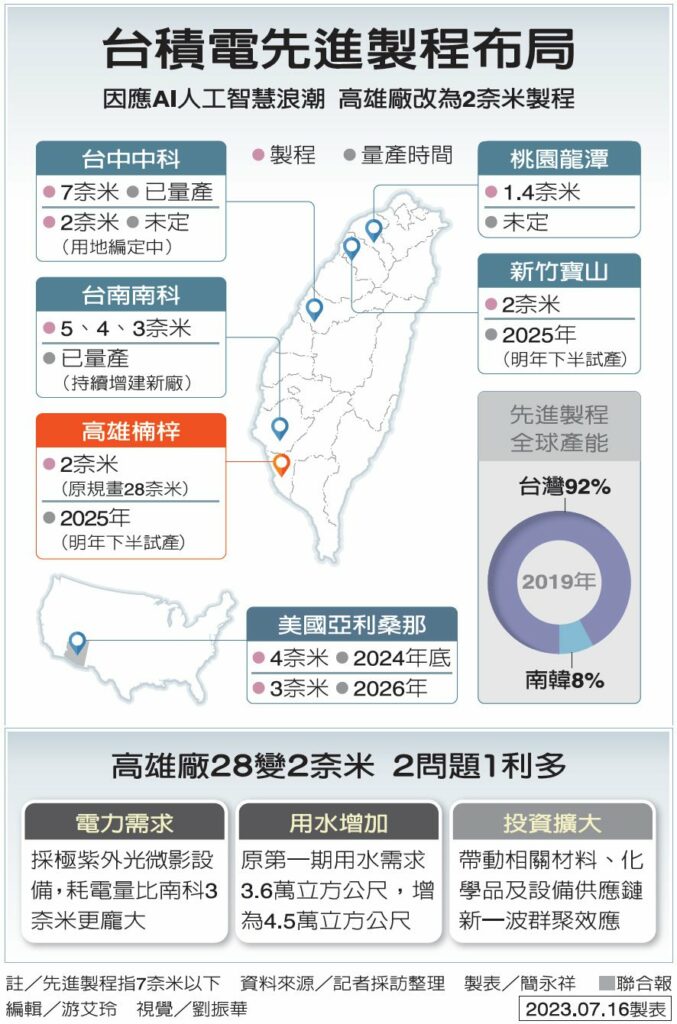

In order to cope with the wave of artificial intelligence (AI), TSMC has changed its Kaohsiung plant construction plan from the original mature process to a more advanced 2nm process. Mass production is expected in 2H25. The relevant plant construction plan will be announced in the near future. According to TSMC’s supply chain, TSMC has notified equipment manufacturers to start delivering 2nm-related machines in 3Q24, and the Kaohsiung plant’s 2nm installation is estimated to be only one month behind the Hsinchu Baoshan plant. Under the same power consumption, TSMC’s 2nm technology is 10~15% faster than the 3nm process; at the same speed, the power consumption is reduced by 25~30%. The main production center of the 2nm process will be first placed in Baoshan, Hsinchu. TSMC is internally designated as 20 factories (Fab 20), and plans to build four factories (P1 to P4). Currently, it is rushing to build the first factory (P1), which is expected to be completed in 2024 Annual risk trial production, mass production in 2H25. (Laoyaoba, TechNews, LTN, UDN)

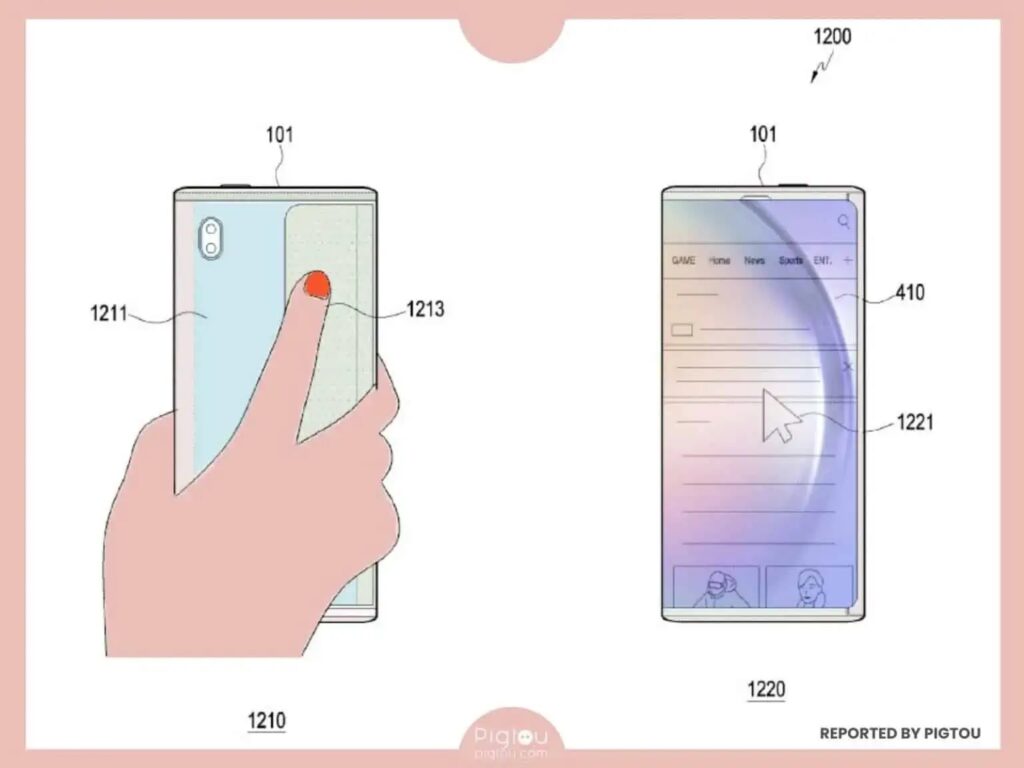

Samsung has unveiled a patent showcasing an electronic device featuring a flexible display that can slide or extend. They have developed a system where the device’s functions can be controlled using inputs on the rear surface of the back panel. In simple terms, by tapping, pressing, and dragging on the back of the phone, users will gain the ability to effortlessly control the extended screen without the need for both hands. This enhancement aims to provide a more comfortable user experience. The patent illustration reveals the presence of a “Rear touch function” that can be enabled or disabled through the device’s settings.(Android Headlines, Pigtou, WIPO)

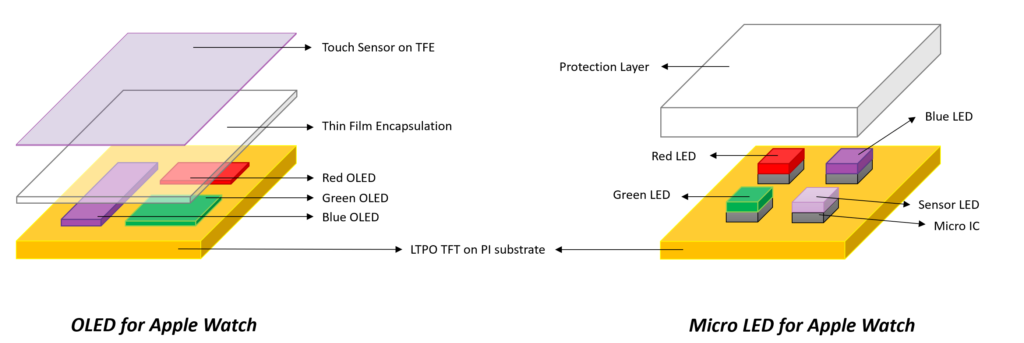

Apple is known to be working on an updated version of the Apple Watch Ultra that uses a next-generation microLED display, but the device has again been postponed due to manufacturing issues, according to market research firm Trendforce. Trendforce believes it has been postponed for a second time and is unlikely to emerge before 1Q26, because of problems relating to high manufacturing costs which need to be solved before Apple can proceed to mass production. (Android Headlines, The Elec, MacRumors, Yahoo, 9to5Mac)

Samsung Display has started the development of LED on silicon (LEDoS) microdisplay technology for applications in augmented reality (AR) devices. OLEDoS had limitations in brightness, form factor, and lifespan for AR applications, according to Samsung Display Vice President and Head of Technology Strategy Team Gong Min Kim. Samsung Display was developing LEDoS with LEDs that were smaller than 10 micrometers and 5 micrometers. Apple is currently using OLEDoS technology its Vision Pro reality device. (The Elec, SamMobile)

Japan Display Inc (JDI) has agreed with TCL China Star Optoelectronics Technology (TCL CSOT) have agreed to enter into a patent cross-license agreement for liquid crystal displays (LCDs), pursuant to which JDI will receive license fees from TCL CSOT. JDI’s advanced technologies and intellectual property (IP) assets are deeply important strategic resources rooted in JDI core capabilities built over many years. JDI will continue to make full use of these strategic resources and core capabilities to drive long-term customer and social value.(Laoyaoba, Display Daily, Market Screener, CN Nikkei)

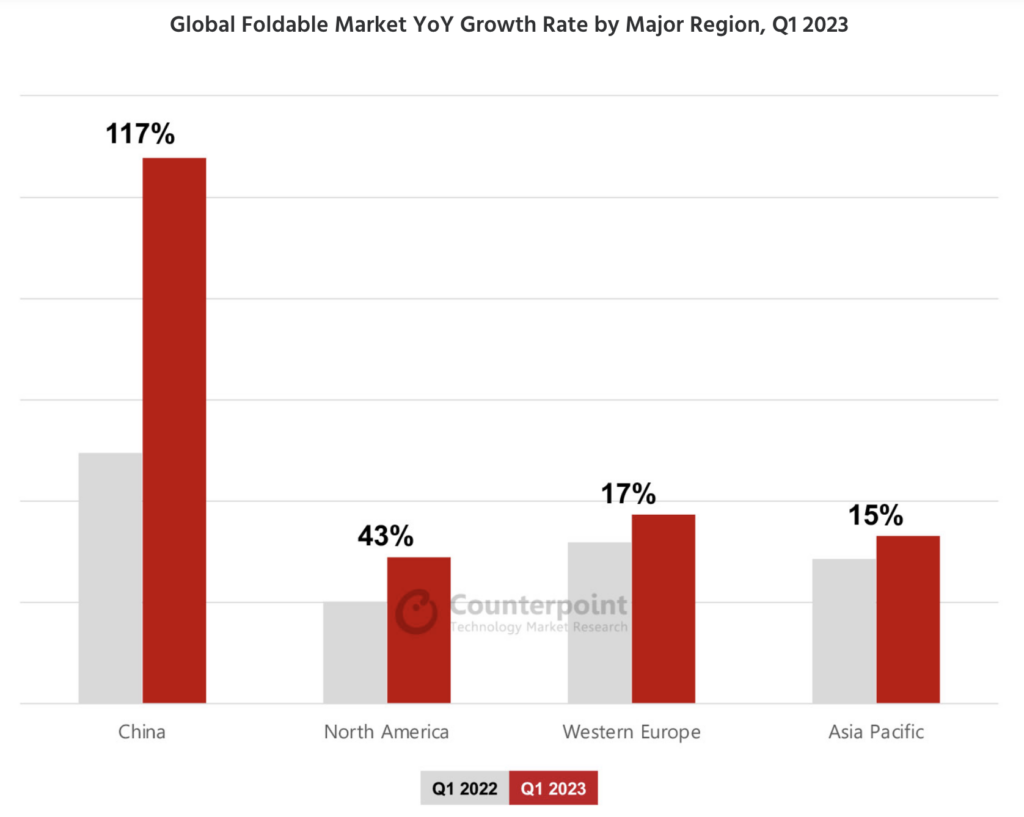

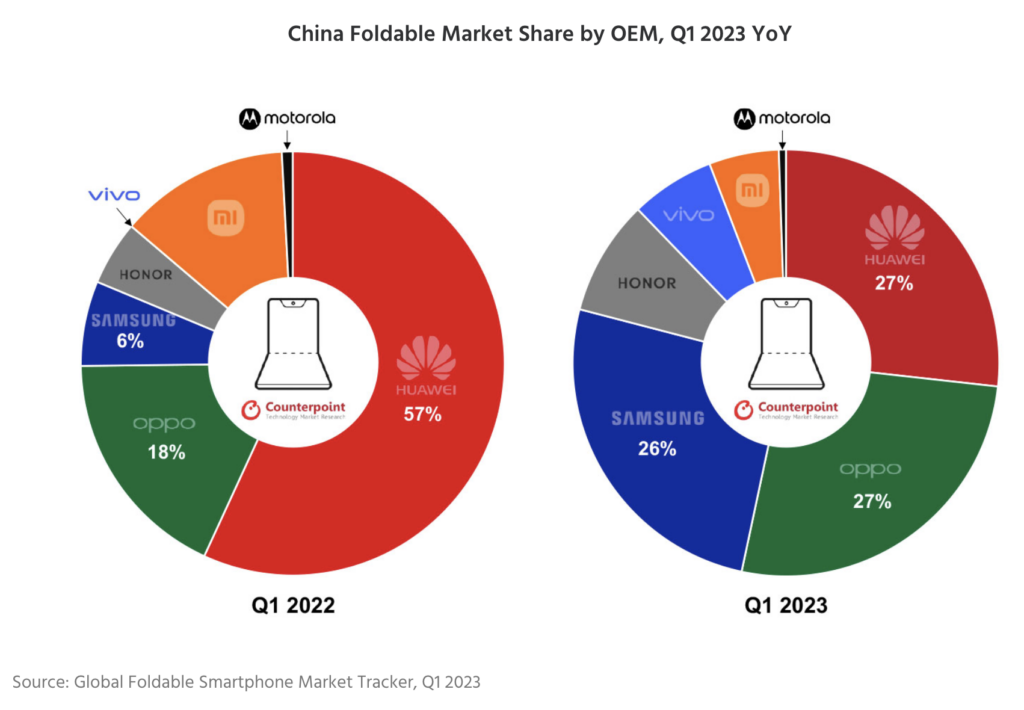

According to the Counterpoint Research, the global foldable smartphone market increased 64% YoY in 1Q23, based on sell-in volume, to reach 2.5M units. This is quite significant because the foldable market rose amid a 14.2% YoY decline in the overall global smartphone market during the same period. Foldable smartphone markets in almost all major regions, including China, North America and Western Europe, displayed strong growth in 1Q23. OPPO’s strong 1Q23 performance is noteworthy as it reflects the brand’s success in the Chinese foldable market, which is emerging as the world’s largest foldable smartphone market. OPPO ranked second in the Chinese foldable market with a slight gap with leader Huawei, helped by the N2 Flip and N2 which were released at the end of 2022. (Counterpoint Research, Laoyaoba)

SmartSens Technology has indicated that according to TSR data, the company will rank fourth in the CIS vehicle market shipments ranking in 2021. Currently, the domestic automotive electronics CIS market is a blue ocean market with great development prospects, which brings huge business opportunities and development opportunities for the company. (Laoyaoba, Stock Star)

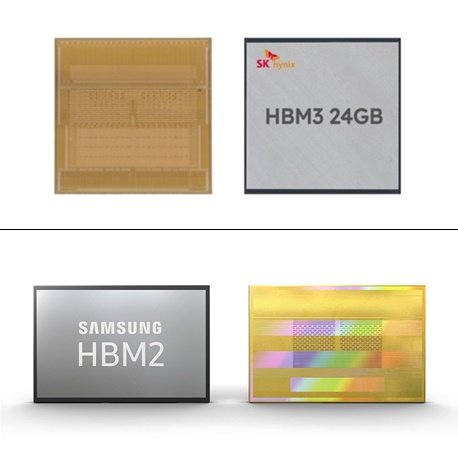

Samsung Electronics will invest KRW1T (about USD766M) to expand its high bandwidth memory (HBM) production capacity to digest demand from Nvidia and AMD. Samsung aims to double HBM production capacity by the end of 2024 and has already placed orders for major equipment. It is reported that suppliers of WSS (wafer carrier system) include Tokyo Electron (TEL) and Suss Microtech. Samsung plans to install the device at the Cheonan factory to increase HBM shipments. The Tianan factory is the production base of Samsung Semiconductor’s back-end process. Considering that HBM is made up of multiple DRAMs connected vertically, Samsung needs to add more back-end process equipment to increase shipments. (KED Global, Digitimes, Laoyaoba)

Samsung SDI is planning to expand its battery factory at its facility in Goed, Hungary, within 2023. Samsung SDI is planning to expand its second factory (the building of which was called stage one internally; the expansion is called stage two) to manufacture batteries with diameters of 46mm. BMW has reportedly requested that Samsung SDI manufacture 46120 batteries (46mm in diameter, 120mm in length). BMW is building an electric vehicle factory at nearby Debrecen, which is around 3 hours’ driving distance from Samsung SDI’s factory. Samsung SDI is expected to spend KRW500B for the expansion to add 2 production lines for an annual capacity of 10GWh. Meanwhile, the battery maker is also expected to manufacture 4680 and 4695 batteries.(Laoyaoba, Business Korea)

TikTok is launching a new subscription-only music streaming service called “TikTok Music” in Brazil and Indonesia. TikTok Music lets users sync the service to their existing TikTok accounts and listen, download and share songs. The service includes the catalogs of major record companies, including Universal Music Group, Warner Music Group and Sony Music. TikTok Music lets users play full versions of viral TikTok songs, discover personalized music recommendations, access lyrics in real time, create collaborative playlists with friends, import their music library and find songs via lyrics search.(Android Headlines, 9to5Mac, TechCrunch)

Xiaomi India’s president, Muralikrishnan B has explained the company’s commitment to boosting sales through official retail stores in India. Xiaomi has retail stores across different regions of India, and customers in India prefers offline shopping rather than the online. Approximately 56% of phone sales in India are conducted through offline channels, and Xiaomi India aims to further increase their product sales in the stores. While the majority of Indians prefer purchasing the smartphones from physical stores, Xiaomi’s position in India has gone a little different. They have achieved around 34% of their sales through retail stores, which is lower than the average of offline sales in India. (Laoyaoba, Reuters, AAStocks, SCMP, Xiaomi UI)

Logitech International has announced that it has acquired Loupedeck, a Helsinki-based creator of custom consoles and software designed to make the creative process faster and more intuitive for streamers, creators and gamers. After launching an advanced editing console in 2019 (the Loupedeck CT), Loupedeck pivoted toward video streaming with the Loupedeck Live and Loupedeck Live S. Acquring Loupedeck gives Logitech the ability to deliver a “premium experience” for content creators including gamers, livestreamers and others. (Engadget, Business Wire)

Struggling electric-truck maker Lordstown Motors has filed for Chapter 11 bankruptcy protection and said that it would put itself up for sale amid an ongoing dispute over investments that had been promised by Taiwanese manufacturer Foxconn. Simultaneously with its bankruptcy filing, Lordstown filed a suit against Foxconn. The company accused Foxconn of fraud and of failing to abide by an agreement that called for the Taiwan-based firm to invest up to USD170M in Lordstown, and for the two to work together on a range of new electric vehicles. (TechCrunch, Reuters, CNBC, Lordstown Motors)

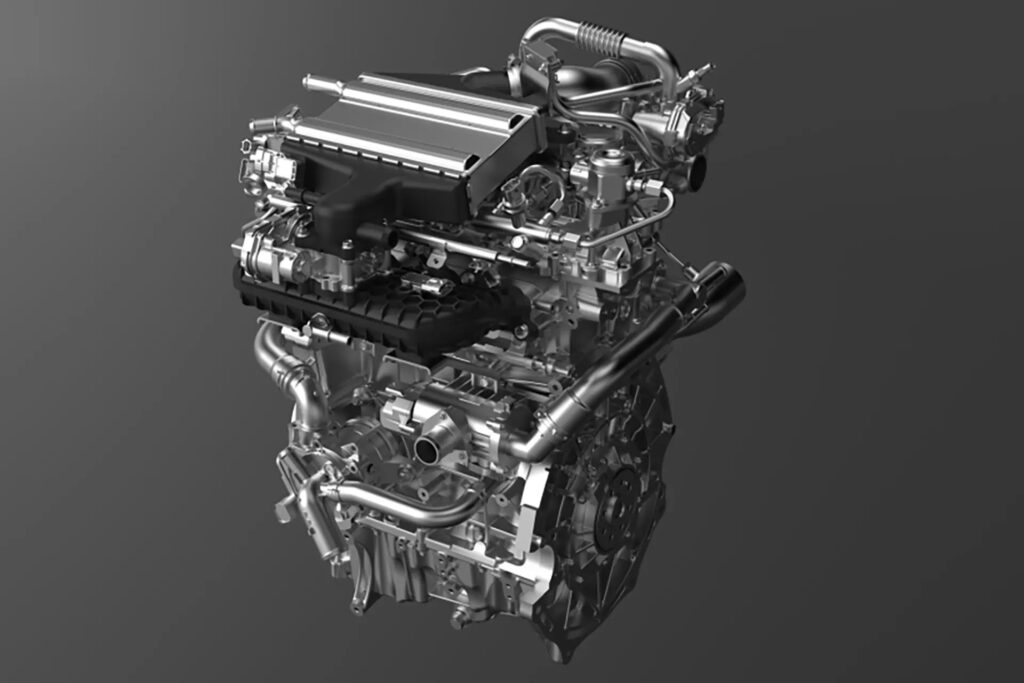

Ammonia has been proposed as a clean fuel for ships, airliners, trucks and trains, but China’s Guangzhou Automobile Group Co (GAC) believes it could also have a future in passenger cars. It has built a combustion engine to test the theory, capable of reducing emissions by around 90%. Ammonia (NH3) carries hydrogen better than hydrogen carries hydrogen, in some regards. It is easier to handle, since it is liquid at ambient temperatures, and it thus does not require energy-hungry compression or cryogenic liquefaction gear. GAC claims a 120 kW (161 hp) peak power output, and a 90% reduction in carbon emissions compared to conventional fuels. The hybrid-hydrogen platform is being promoted by Japanese automaker Toyota. (Gizmo China, Bloomberg, New Atlas, Carscoops)

Chinese automaker Guangzhou Automobile Group (GAC) has unveiled a flying electric vehicle concept which is capable of both ground and air travel. GAC has unveiled the concept vehicle and it consists of a separable flight cabin and a vehicle chassis using the company’s ADiGO Pilot-powered autonomous driving software. The GOVE – short for GAC On-the-Go Vertical EV – is made from 90% lightweight composite materials, a 3DoF flight control system, as well as aerospace-grade high-precision docking technology.(CN Beta, JEC, ChinaPEV, The Driven)

BYD plans to invest BRL3B (USD620M) in a new Brazilian manufacturing hub, as it looks to build a larger presence in South America The industrial complex will be built in the northeastern state of Bahia, in the town of Camaçari, where BYD bought a Ford plant that closed in 2021. BYD plans to build 3 factories at the complex. One will process lithium and iron phosphate mined in Brazil, while the other two will produce hybrid and electric cars, trucks, and buses. (Laoyaoba, Investment Monitor, Quartz)

GAC Toyota, the joint venture of GAC Group and Toyota Motor, has inked a strategic cooperation framework agreement with Chinese Internet giant Tencent for digital ecosystem collaboration. This comprehensive partnership aims to accelerate GAC Toyota’s digital transformation and upgrade by focusing on areas such as automotive cloud platform, internet connectivity and security, V2X, and digital marketing. GAC Toyota, in collaboration with Tencent, will co-create a leading cloud platform and related solutions to expedite the migration of its marketing and service operations to the cloud, ensuring a high-quality digital transformation. (Laoyaoba, Gasgoo, Shanghaiist, Sina, IT Home)

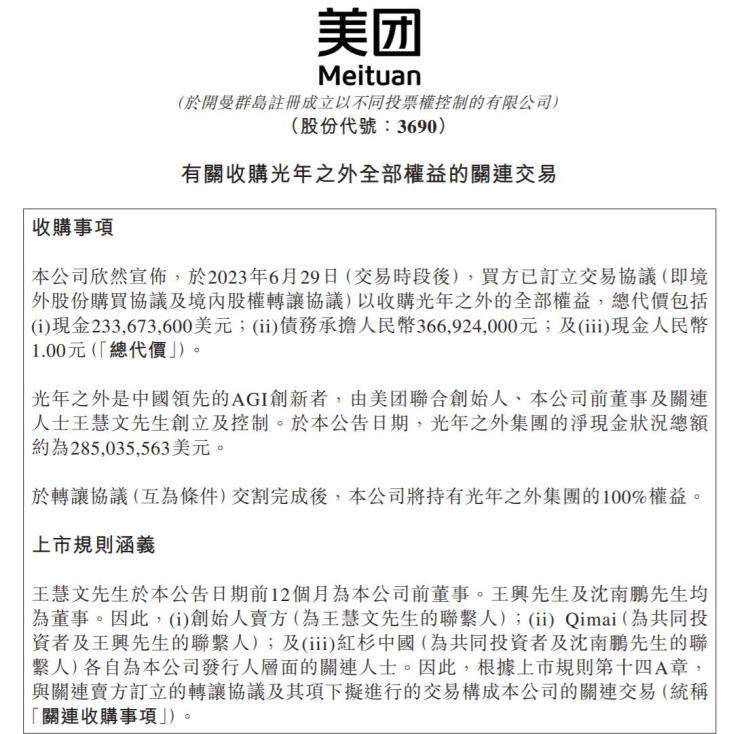

Meituan has announced that it will be fully acquiring Light Years Beyond (“Guangnian Zhi Wai”) for USD233.7M in cash. It is also taking on the startup’s USD50.66M debt. That makes the deal’s total purchase price about USD284M. (TechCrunch, Meituan, Leiphone, Wallstreet CN, Sina)

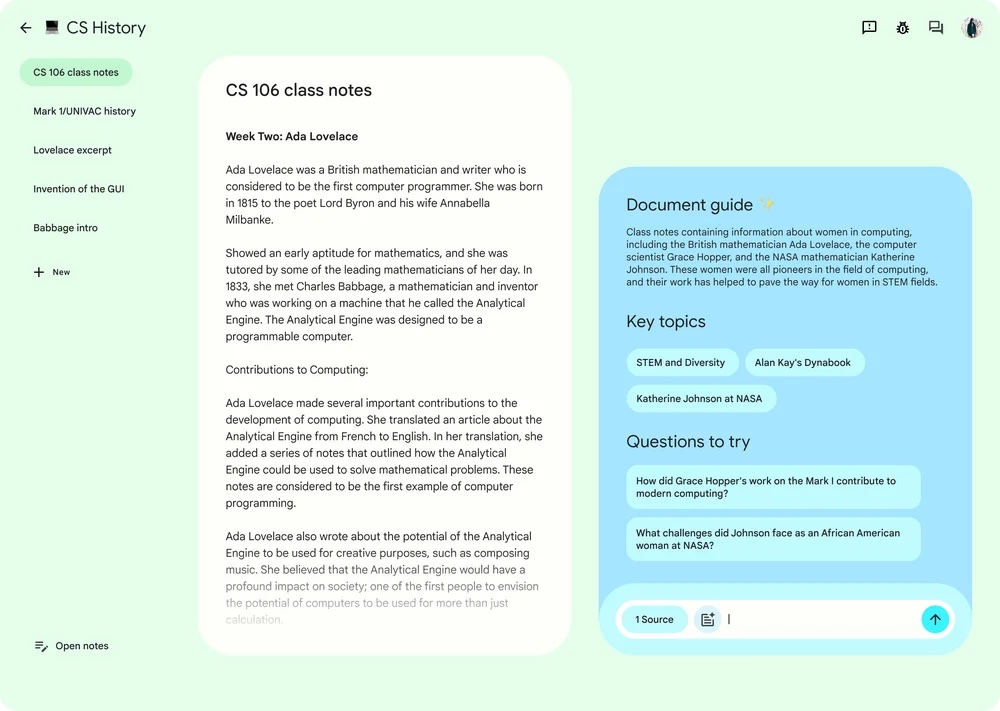

Google has launched its latest experimental project called NotebookLM, an AI-powered note-taking tool designed to assist students and learners in organizing and accessing lecture notes and coursework materials more effectively. NotebookLM aims to simplify the process of understanding and retrieving relevant information from various documents. The tool seamlessly integrates with Google Docs, allowing users to select multiple documents and interact with NotebookLM to ask questions, gain insights, and even generate new content. Additionally, the tool will automatically summarize lengthy documents and transform video outlines into scripts.(Android Headlines, Google)

KPMG and Microsoft have announced an expanded global collaboration aimed at enhancing professional services through workforce modernization, secure development and artificial intelligence (AI) solutions. This new multi-year alliance seeks to streamline KPMG’s client engagement across the audit, tax and advisory sectors. As part of the initiative, KPMG has pledged a USD2B investment in Microsoft Cloud and AI services over the next 5 years. This is anticipated to unlock a potential incremental growth opportunity of over USD12B for KPMG.(Microsoft, Axios, VentureBeat)

Elon Musk, CEO of Tesla and SpaceX, and owner of Twitter, has announced the debut of a new AI company, xAI, with the goal to “understand the true nature of the universe”. Musk seems to be positioning xAI to compete with companies like OpenAI, Google and Anthropic, which are behind leading chatbots like ChatGPT, Bard and Claude. Musk has reportedly secured thousands of GPU processors from Nvidia. Musk has shared details of his plans for a new AI tool called “TruthGPT”. (My Drivers, FT, CNBC, USA Today, x.ai)

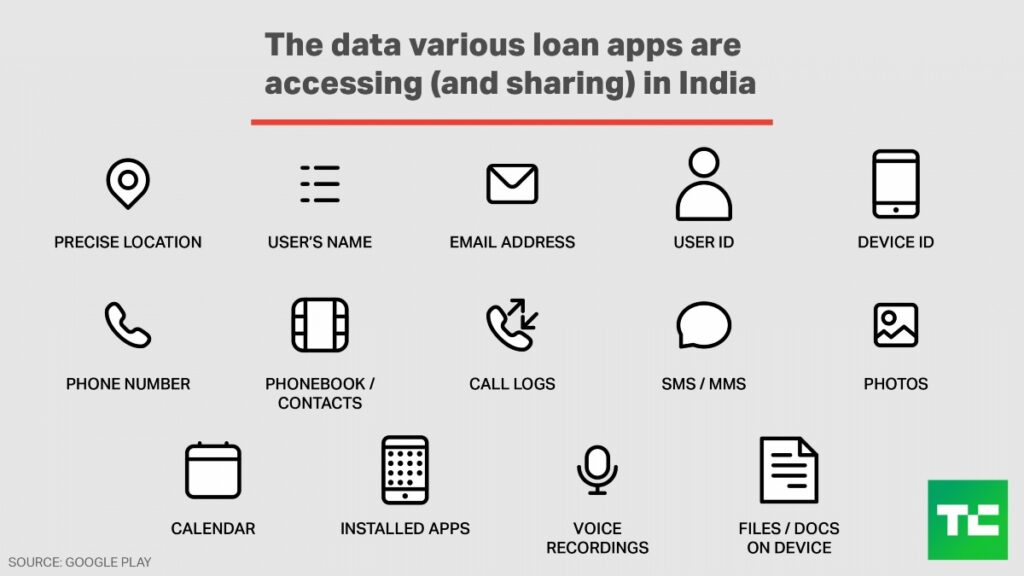

Apple has removed several predatory lending apps from the App Store in India, after users took to social media and complained about them. Pocket Kash, White Kash, Golden Kash and OK Rupee are among the apps that Apple pulled from the store. These apps would demand unnecessary and intrusive permissions like access to the contact list and gallery, and would also harass and threaten users with dire consequences in case of a delay in payment. The apps were also misrepresenting that they were associated with a financial institution. (India Times, Times of India, TechCrunch)