8-3 #NoFear : Huawei is not launching a 5G smartphone in Oct; Apple and Google are both reportedly considering entering the foldable tablet market; vivo has partner with Sony’s Lytia for a customized of CIS; etc.

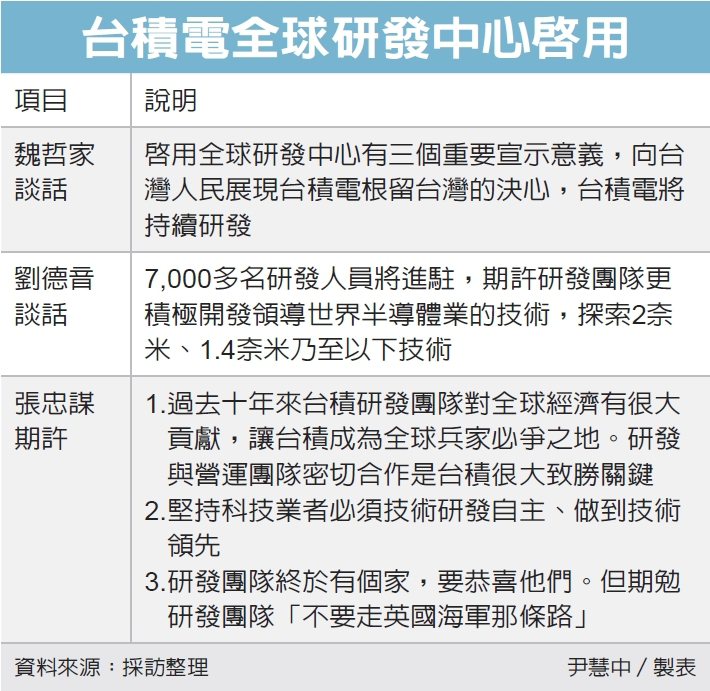

TSMC Chairman Mark Liu has announced that the new global R&D center in Hsinchu, Taiwan, aims to explore cutting-edge chip technologies below 2nm or even 1.4nm process in the next 20 years. TSMC CEO CC Wei also attended the inauguration ceremony, declaring TSMC’s determination to keep developing its major products and advanced technologies in Taiwan, even as the company expands its business overseas in recent years. The cost to the company for the stunning facility is USD3.3B to build and equip. However, TSMC believes that this investment will pay off in the long run. (Gizmo China, UDN, TechNode)

Stellantis, the automotive company formed by the merger of Fiat, Chrysler Automobiles and PSA Group has said it has engaged chip companies such as Infineon, NXP Semiconductors, Onsemi, and Qualcomm to further improve its battery electric vehicle platform known as STLA – pronounced stella. The purchasing agreement run through to 2030. In addition, Stellantis is working with aiMotive and SiliconAuto to develop its own differentiating semiconductors. Stellantis has signed contracts worth EUR10B (USD11.2B) through 2030 with semiconductor makers to guarantee the flow of vital chips for electric vehicles and high-performance computing functions. (Laoyaoba, Reuters, Stellantis, Auto News, Bloomberg, eeNews)

Intel has said that it will work with Swedish telecommunications gear maker Ericsson to make a custom chip for Ericsson’s 5G networking gear, using the most advanced manufacturing technology Intel has disclosed. Intel said that the new Ericsson chip will use Intel’s “18A” (1.8nm) manufacturing technology and is among the first chips from outside customers that Intel has will use the technology. The chips will offer up to a 10% improvement in performance per watt compared to current production processes.(Gizmo China, Reuters, Telecoms)

Shanghai Micro Electronics Equipment Group (SMEE) has been committed to developing a 28nm immersion lithography machine, and it’s expected the first domestically produced SSA/800-10W lithography machine will be delivered to the market by the end of 2023. Lithography machine is a general concept, including three different types: front-end lithography machine, back-end lithography machine, and panel lithography machine. The front lithography machine is what we most often call the lithography machine. It is mainly used for wafer manufacturing and can be divided into two categories: DUV and EUV. At present, ASML of the Netherlands occupies an absolute monopoly position. Canon also has a strong strength. In addition, SMEE also has a 2.5D/3D packaging lithography machine, with an accuracy of about 0.6 microns, which is far behind the previous lithography machine, but still belongs to the world’s leading level.(CN Beta, My Drivers, EEWorld, People.cn, Global Times)

There were multiple reports that Huawei is working on launching 5G smartphones. In response to recent rumors about the launch of Huawei’s high-end 5G phones after Oct 2023, He Gang, the Chief Operating Officer of the Consumer Business Group, has denied the claims. Qualcomm says they have a license to ship 4G to Huawei, but not 5G, and they do not assume it will generate any substantial revenue in the future. (Gizmo China, CNMO, My Drivers)

Apple and Google are both reportedly considering entering the foldable tablet market, which could happen as soon as 2024, according to Digitimes. Apple is keen to extend the work it’s put into making a foldable iPhone “to the tablet sector”. If Google does indeed push ahead with its foldable tablet plans, “it will be a key product for Google I/O 2024”. (Gizmo China, Digitimes, TechRadar, 9to5Google)

According to Bloomberg’s Mark Gurman, Apple is using low-injection pressure over-molding (LIPO) to shrink the display border size on the iPhone 15 Pro and iPhone 15 Pro Max to 1.5mm (versus around 2.2mm on current iPhones). Apple first used LIPO on the Apple Watch Series 7 to make the device’s borders thinner and increase the size of the display. LIPO is set to follow the same product trajectory as OLED display technology, which went from Apple Watch to iPhone, with OLED iPads expected to launch in 2024. (MacRumors, Phone Arena, Bloomberg, Sohu, IT Home)

Tianma has unveiled a cutting-edge car OLED display features a revolutionary 9.94” tri-fold display design, ingeniously integrating a camera within the display itself. Tianma’s proprietary SOC chip and algorithms can be built into the display, synchronized with DMS technology (Driver Monitoring System). Tianma has incorporated its CFOT (Color Filter On Touch) technology into the screen, a game-changer that significantly reduces power consumption by over 20% by improving light transmission rates. At the same time, CFOT technology expands the screen’s color gamut, resulting in vivid and lifelike visuals. The CFOT technology expands the screen’s color gamut, resulting in vivid and lifelike visuals.(CN Beta, My Drivers, Sparrows News)

Apple is partnering with Adobe, Autodesk, the Linux Foundation, and Nvidia to promote and advance the 3D image ecosystem with Pixar’s Universal Scene Description technology. The Alliance for OpenUSD (AOUSD) “seeks to standardize the 3D ecosystem by advancing the capabilities of Open Universal Scene Description (OpenUSD)”. The companies believe that if there is greater interoperability of 3D tools and data, developers and content creators will have an easier time to “build an ever-widening range of 3D-enabled products and services”.(CN Beta, Apple Insider, AOUSD, Apple)

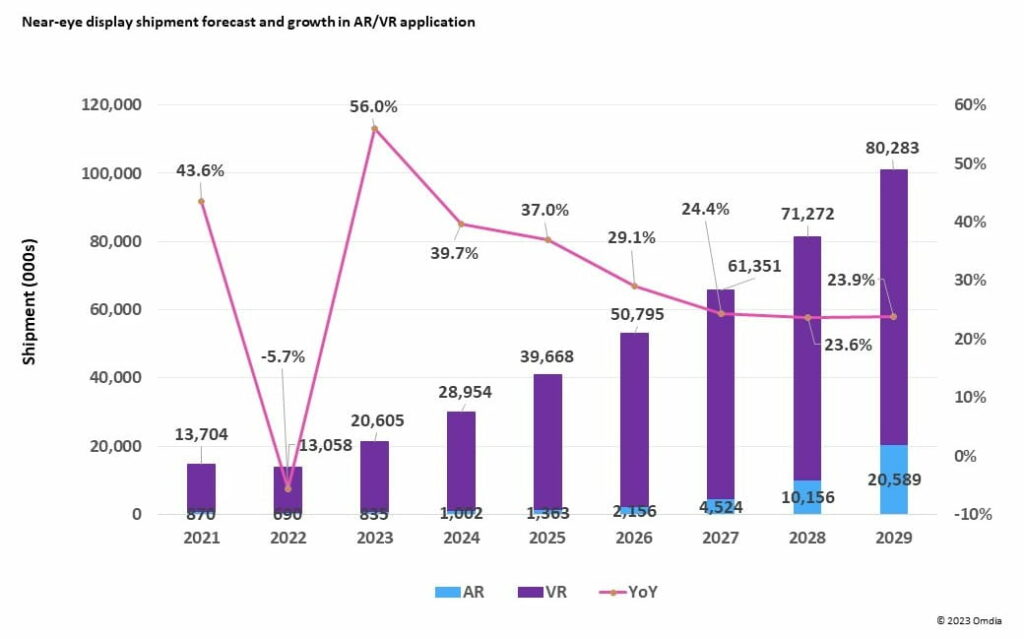

Near-eye display shipments for XR (Extended Reality) applications, including AR (Augmented Reality), VR (Virtual Reality), and MR (Mixed Reality) will grow 56% YoY to 21.4M units in 2023 according to Omdia. Conventionally, wearable XR devices are designed as the form factors of head-mounting and smart glasses. Near-eye display shipments declined by 5.7% in 2022 due to weak demand, inflation for budgets, and uncertainty due to the geopolitical conflict. As for display revenues, Omdia estimates the revenue growth (up 59% YoY) is better than that of the shipments in 2023. This is primarily because brands adopt AMOLED or OLEDoS (OLED on Silicon) in these new products. The higher-priced displays are helpful to drive higher revenue growth. (Omdia)

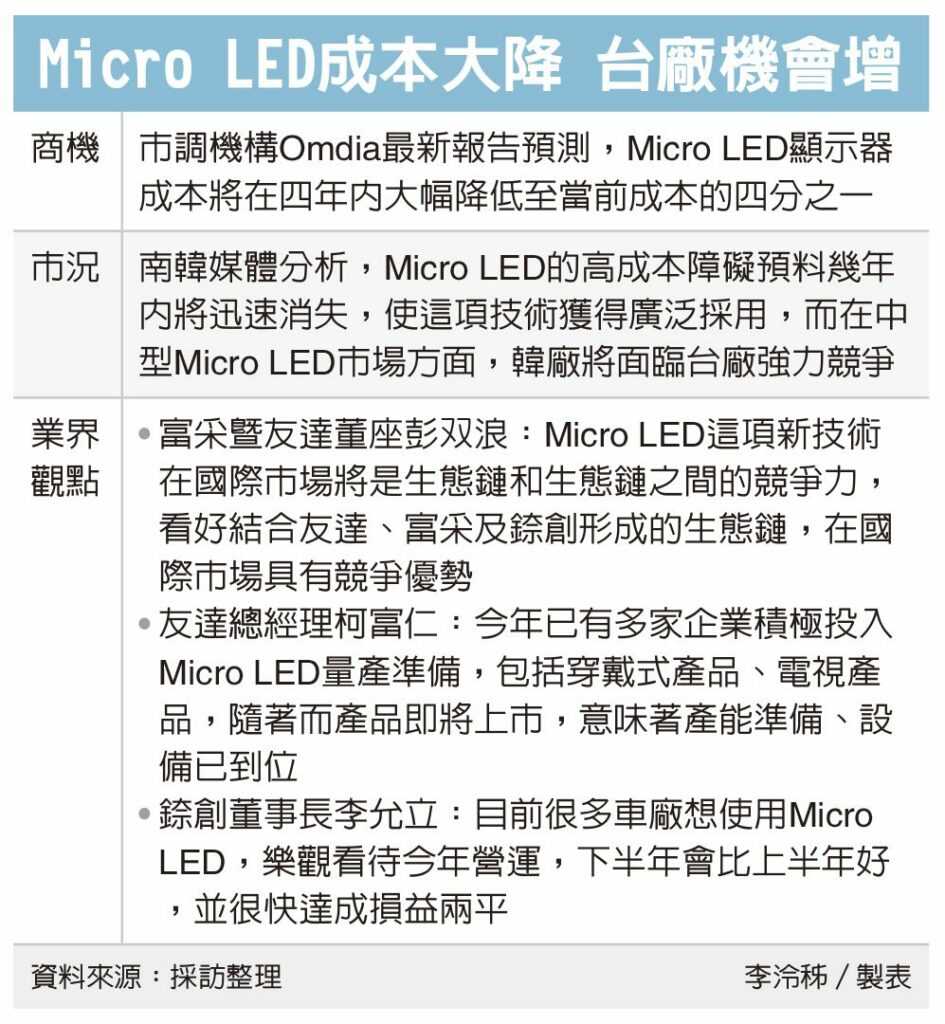

Omdia says that the price of microLED display panels is set to drop 75% by 2027. Omdia is referring to small 10-14” displays, which currently cost around USD5,800 for a 10″ panel, or USD100,000 for a 14.6″ one. Omdia expects the price of a 10″ panel to drop to USD1,277 in 2027, and a 14.6″ panel to USD2,400. That is an impressive price reduction in 4 years, but the prices of such panels will still be very high – much higher than comparable LCD or OLED displays today. Omdia thinks that at such price levels, some niche applications like high-performance laptops or automotive displays may fuel demand for MicroLED displays. (Business Korea, UDN, Microled-Info)

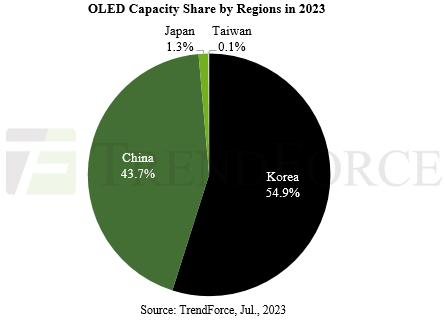

According to TrendForce, OLED panels will secure more than 50% market share in the smartphone industry by 2023, thanks to a continuous decrease in costs. However, the OLED penetration rate in other applications like TV, laptop, and tablets is considerably less, standing at under 3%. To boost the market penetration of OLEDs, panel manufacturers must tackle more demanding technical challenges, including improved specifications and the need for effective cost reductions to meet market expectations. The report highlights the introduction of eLEAP technology by Japan Display Inc. (JDI). Currently, China’s AMOLED production capacity accounts for 43.7% of the global market, slightly less than the capacity share held by South Korean panel manufacturers. (Laoyaoba, TrendForce, TrendForce)

Samsung Display is expected to see its supply of OLED panels for Apple iPhones grow again in 2023. Samsung Display has received Apple’s approval for all models of OLED panels it will supply to the four models on the iPhone 15 Series and has begun delivery. In contrast, LG Display received conditional approval from Apple for the OLED panels for iPhone Pro, but not the approval for iPhone Pro Max. Meanwhile, BOE has yet to receive such approval for the OLED panels it was aiming to supply to the two lower-tier models of the Series. It has lost the initial order it could have won from Apple to Samsung Display. (MacRumors, The Elec, The Elec, CN Beta)

vivo has revealed that it has partnered with Sony’s Lytia division to create a customized version of the LYT800 sensor for the vivo X100 series. The LYT800 makes use of Sony’s stacked design, which separates the photodiodes and the transistors that read them into two layers (normally they are side by side). This opens up more room so the 1/1.43” Lytia LYT800 sensor is expected to have a low-light performance similar to 1” sensors. The LYT800 will have a 53MP resolution. vivo has tapped its partner Zeiss to create the Vario-Apo-Sonner telephoto lens for the X100 series. This will have a floating lens design, which will allow it to focus at closer distances.(GSM Arena, Sparrow News, Weibo, TS2)

vivo has announced its V3 imaging chip, which is made by 6nm process. The V3 ISP chipset is a comprehensive masterpiece that boasts remarkable improvements in algorithm effectiveness while optimizing power consumption. A standout feature of the V3 chip is its capability to capture 4K Cinematic Portrait videos directly on a smartphone.(GSM Arena, Weibo, Sparrow News, My Drivers)

Samsung Galaxy S23 FE will reportedly feature a 10MP selfie shooter instead of the 32MP sensor that Samsung used on the Galaxy S20 FE and Galaxy S21 FE. The 10MP camera has been used on the base and Plus models in the Galaxy S20, S21, and S21 lineups, with features such as Dual Pixel autofocus for superquick and accurate focusing in all lighting conditions. Samsung Galaxy S23 FE will also feature 8MP telephoto sensor, which has been used by S20 FE and S21 FE. (Android Headlines, Galaxy Club, SamMobile)

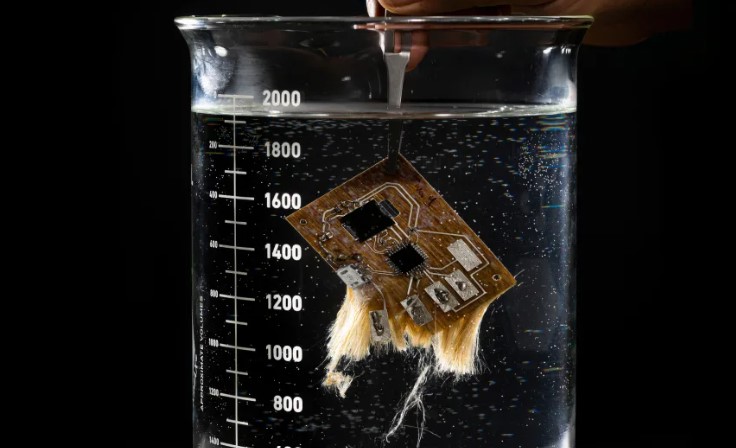

German semiconductor maker Infineon Technologies AG has announced that it’s producing a printed circuit board (PCB) that dissolves in water. Sourced from UK startup Jiva Materials, the plant-based Soluboard could provide a new avenue for the tech industry to reduce e-waste as companies scramble to meet climate goals by 2030. Jiva’s biodegradable PCB is made from natural fibers and a halogen-free polymer with a much lower carbon footprint than traditional boards made with fiberglass composites. (Engadget, Infineon)

Airalo, which uses software-based eSIM connectivity to provide a wide range of lower-cost mobile data packages, nearly 700 in all, for international travelers, has raised USD60M in a Series B round that it will be using to expand its business. The all-equity round, which values Airalo, founded in Singapore, officially headquarterd in Delaware with offices in many other places, including Toronto , USD280M post-money, includes a long list of financial and strategic backers, a mix that speaks to who works with the startup as a business partner as a complement to their own direct operations.(TechCrunch)

China’s smartphone sales fell 4% YoY 2Q23, reaching the lowest Q2 sales figure since 2014, according to Counterpoint Research. Among OEMs, vivo reclaimed its leadership position with a 17.7% market share. OPPO (including OnePlus) and Apple were in a tie in 2Q23, each capturing 17.2%. Apple, Huawei and realme managed to achieve positive YoY growth. Huawei’s smartphone sales grew 58% YoY driven by a bigger product portfolio. Apple’s sales increased 7% YoY as its position in the premium segment remained unchallenged. (CN Beta, Counterpoint Research)

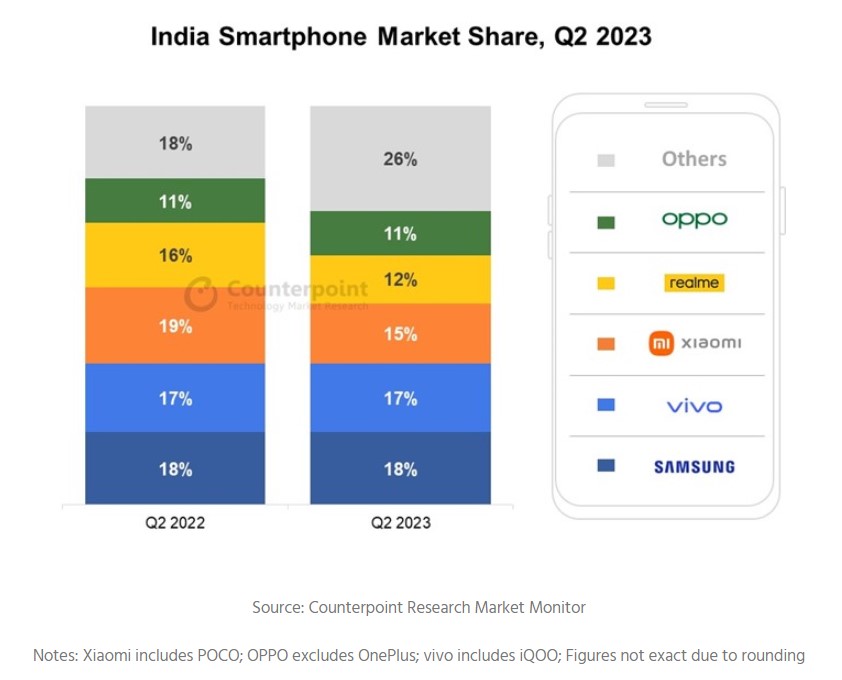

India’s smartphone shipments declined 3% YoY in 2Q23, according to Counterpoint Research. Though this decline was the fourth consecutive quarterly decline, its magnitude reduced significantly, from 19% in 1Q23 to 3% in 2Q23. Base effect, pent-up demand and improving macroeconomic conditions helped the market close at less than the expected decline. However, the premium smartphone segment presented a different picture, growing 112% YoY in 2Q23 to contribute a record 17% to the overall shipments. 5G upgrades played a major role as OEMs kept launching 5G devices in the INR 10,000-INR 15,000 (~USD122-244) segment for a wider reach. (Counterpoint Research, GSM Arena)

Foxconn Technology Group plans to increase its investments to more than USD1.2B in southern India’s Karnataka state and add two component factories there. At least one of the factories that the Taiwanese company plans to construct in Karnataka will produce Apple parts, including for iPhones. The second plant will also be in Karnataka, but their exact location has yet to be decided. Foxconn is spending USD500M on these two complexes on top of a USD700M facility it aims to build on a 300-acre site close to the airport in Bengaluru, the capital of Karnataka. Separately, a Foxconn subsidiary also signed an initial agreement with the southern Tamil Nadu government to set up its own components plant with an investment of INR16B (USD195M). (Bloomberg, Apple Insider, Sina, Yahoo)

According to TF Securities analyst Ming-chi Kuo, 2Q23 is the traditional off-season, and 3Q23 is the transition period between Apple’s legacy and new iPhones, so usually the financial results and guidance at this time are usually not attention-grabbing. The 2H23 shipment forecasts for Apple’s hardware products in 2H23 are almost universally weaker in 2H23 than in 2H22. Therefore, unless Apple clearly indicates that it is positive about market demand in 2H23 or 2024, this financial report is unlikely to be a positive for most suppliers’ stock prices. Unless the demand for the iPhone 15 is better than market expectations after launch, most of the suppliers will face growth pressure in 2H23 as the demand for iPhone 15 is lower than that of iPhone 14. (Apple Insider, Medium, Twitter)

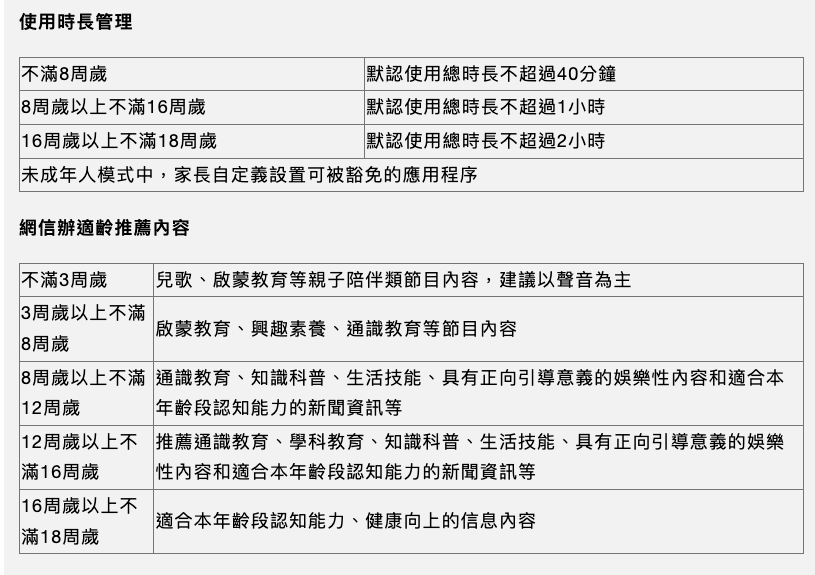

A draft regulation put forth by the Cyberspace Administration of China (CAC) would make a “minor mode” mandatory for smartphones and app stores, imposing sharp limits on how long and when children can use devices, depending on their age. The law would further restrict what apps kids could download, making parental permission mandatory in numerous instances. With minor mode activated by a parent or guardian, children under the age of 8 would only be allowed to use devices for 40 minutes at a stretch without additional permission. Age 8-6 children can use devices for up to 1 hour. Ages 16-18 would be able to use devices for 2 hours if the law is enacted. The law also spells out rules for frequent rest reminders, and forbids kids from using devices in 10PM-6AM. (Android Authority, Engadget, CAC, Apple Insider, CNBC, STCN)

Apple suppliers will likely begin mass production of a second-generation AirTag in 4Q24, according to TF Securities analyst Ming-chi Kuo. Kuo believes the new AirTag will have better integration with Apple’s upcoming Vision Pro headset, as part of a spatial computing ecosystem, but he did not provide any additional details or reveal any other potential new features for the item tracker. The current AirTag is equipped with an Apple-designed U1 chip for Ultra Wideband, enabling a Precision Finding feature that displays the distance and direction to an AirTag. (Twitter, GSM Arena, Gizmo China, MacRumors)

Samsung’s president of mobile experience, TM Roh has indicated that the plan for a new XR headset and ecosystem is on track, and an announcement is coming soon. Roh has also added, predictions on the XR market are polarized, but they do believe it will become a next growth engine much in the vein of smartphones. (Android Headlines, ZDNet, SamMobile)

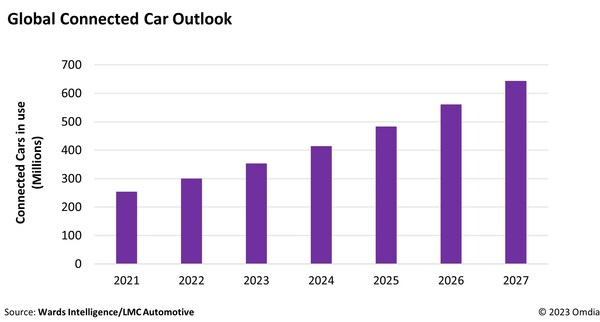

Connected cars on the road are set to grow 18% in 2023 according to Omdia. Companies including the likes of Google and Apple are positioning themselves to capture and develop the potential revenue opportunities from this market over the coming decade. Omdia’s research further reveals that over 900M connected cars will be on the road at the start of the next decade, eclipsing the installed base of popular consumer devices such as pay-TV set top boxes and tablets. These vehicles will include a plethora of screens in the front and rear of the cabin which are growing in size each year to enable video and gaming services. (Korea Herald, PR Newswire)

TF Securities analyst Ming-chi Kuo claims that at present, there is no sign that Apple will integrate AI edge computing and hardware products in 2024. That is in direct contrast to Bloomberg’s Mark Gurman, who claims that unspecified sources say a major Apple AI launch is aimed at some point in 2024. (Apple Insider, CN Beta, Medium)

IBM and open-source AI platform Hugging Face have announced that IBM’s watsonx.ai geospatial foundation model – built from NASA’s satellite data – will now be openly available on Hugging Face. It will be the largest geospatial foundation model on Hugging Face and the first-ever open-source AI foundation model built in collaboration with NASA. Access to the latest data remains a significant challenge in climate science where environmental conditions change almost daily. And, despite growing amounts of data — estimates from NASA suggest that by 2024, scientists will have 250,000 terabytes of data from new missions — scientists and researchers still face obstacles in analyzing these large datasets.(Engadget, NASA, VentureBeat, PR Newswire)