8-13 #LegoFun : Arm allegedly plans to float its shares in an IPO on the Nasdaq in Sept; Google will soon require specific hardware quality standards for foldable phones; OnePlus new smartphone to feature new self-developed “Rainwater Touch Control”; etc.

SoftBank Group’s British chip design unit, Arm, allegedly plans to float its shares in an initial public offering on the Nasdaq in Sept 2023. The unit’s market capitalization by that time is expected to be more than USD60B, which would make the deal the world’s biggest initial public offering so far in 2023. At present, 75% of Arm’s shares are owned by SoftBank Group, while the remaining 25% stake is held by the SoftBank Vision Fund, a unit that invests in tech companies around the world. The Vision Fund will sell 10% to 15% of its Arm shares on the open market. Leading global chipmakers, including Apple, Samsung Electronics, Nvidia and Intel, will invest in Arm as soon as the company is listed on the market. (Android Headlines, Asia Nikkei)

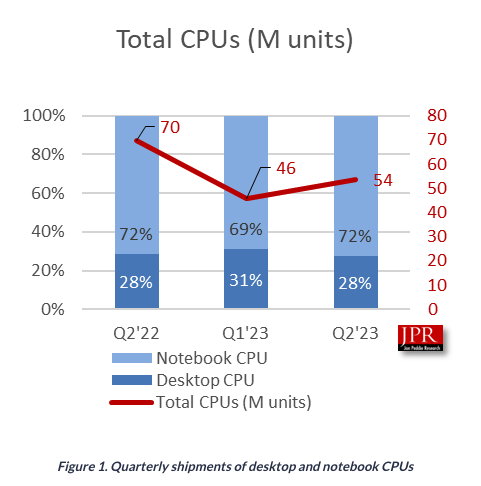

Jon Peddie Research reports the growth of the global PC client-based CPU units market reached 53.6M units in 2Q23, up 17%, and iGPU shipments increased by 14% to 49M units. Integrated GPUs will have a compound annual growth rate of 2.5% during 2022–2026 and reach an installed base of 4.8B units at the end of the forecast period. Over the next 5 years, the penetration of iGPUs in the PC will grow to reach a level of 98%. Year to year, total CPU shipments, which include all platforms and all types of CPUs (with and without graphics), decreased by -23%, desktop CPUs decreased by -25%, and notebooks decreased by -22%. AMD’s overall client CPU market share percentage from last quarter decreased -5.3%, while Intel’s market share increased by 23%. (Jon Peddie Research, Techpowerup, CN Beta)

According to Commerce Sec. Gina Raimondo, the U.S. Department of Commerce’s CHIPS Program Office has received over 460 applications for domestic semiconductor manufacturing and related projects. The applications are for the first round of federal funding from the USD39B pot provided by the CHIPS and Science Act, meant to incentivize semiconductor manufacturers to produce in the U.S. The federal agency initially announced the program in Feb 2023 for manufacturing facilities and expanded it months later to include investments in semiconductor materials and manufacturing equipment projects valued at or above USD300M. Two additional funding opportunities — one for materials and manufacturing equipment factories with investments below USD300M and another for R&D facilities — will be announced later in 2023, according to the National Institute of Standards and Technology. The White House is marking the one-year anniversary on 9 Aug 2023 of President Joe Biden’s signing of the landmark “Chips for America” legislation providing USD52.7B in subsidies for U.S. semiconductor production, research and workforce development. (CN Beta, Reuters, Construction Dive, Telecomlead, White House)

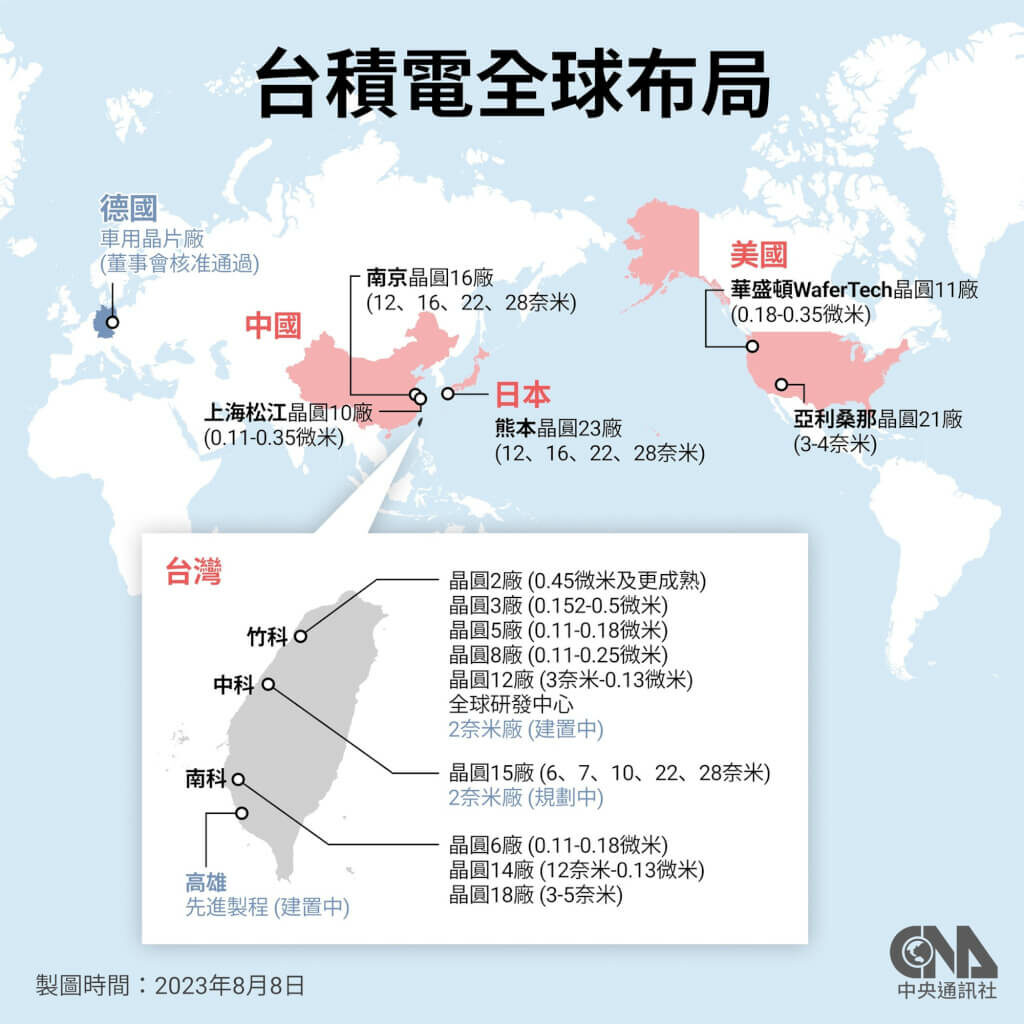

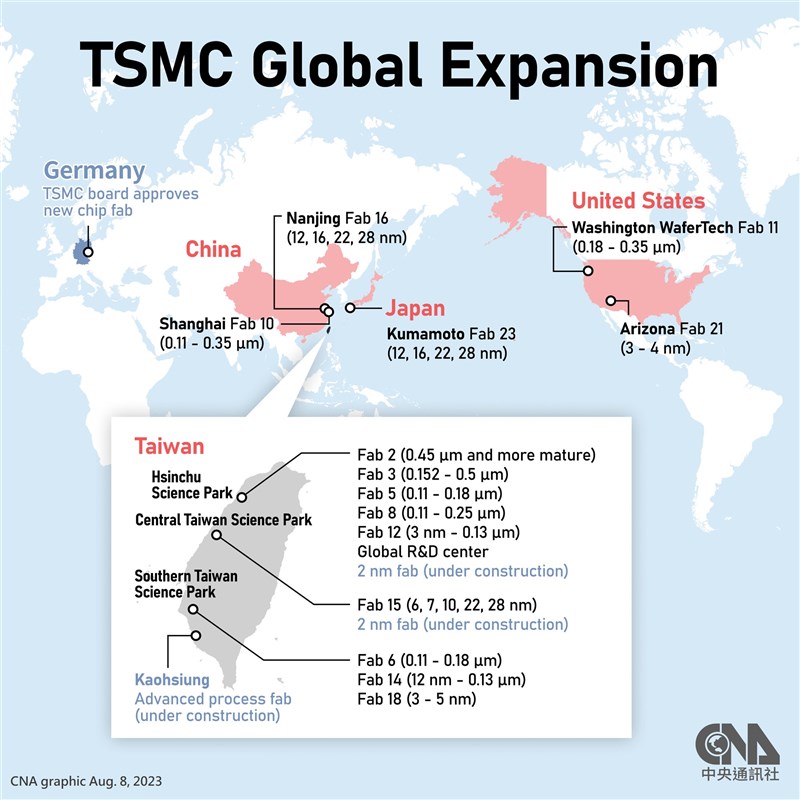

Taiwan Semiconductor Manufacturing Company (TSMC) has committed EUR3.5B (USD3.8B) to a factory in Germany, its first in Europe, taking advantage of huge state support for the USD11B plant as the continent seeks to bring supply chains closer to home. The plant, which will be TSMC’s third outside of traditional manufacturing bases Taiwan and China, is central to Berlin’s ambition to foster the domestic semiconductor industry its car industry will need to remain globally competitive. The European Union has approved the European Chips Act, a EUR43B subsidy plan to double its chipmaking capacity by 2030, in a bid to catch up with Asia and the United States after shortages and high prices during the COVID-19 pandemic created havoc for the continent’s carmakers and machine builders.(Apple Insider, Reuters, CNA, UDN, Yahoo)

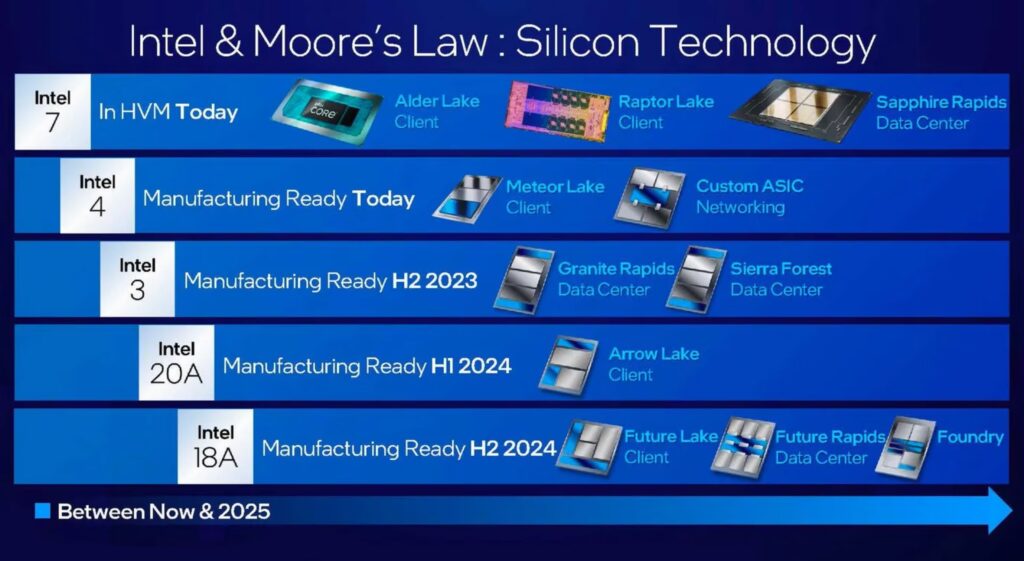

TF Securities analyst Ming-Chi Kuo claims that Intel Foundry Services (IFS) is ceasing to produce Qualcomm SoCs using the 20A fabrication process. Qualcomm will most likely go with TSMC and Samsung Foundry instead. He indicates that Qualcomm has stopped developing Intel 20A chips. The lack of cooperation with a first-tier IC design vendor such as Qualcomm will negatively affect the learning curve of RibbonFET and PowerVia technologies, which in turn puts the highly anticipated Intel 18A R&D and mass production at a higher level of uncertainty and risk. After the advanced node enters 7nm, high-end orders from first-tier IC design vendors are more important for foundries. The design capability, order specification (especially the highest end), and order scale of the first-tier IC design vendor can significantly improve the learning curve of the advanced node for foundries compared to general orders. This has been the key to TSMC’s lead over its competitors to date, and it is also the biggest negative impact that Qualcomm’s discontinuation of Intel 20A development has had on Intel. (Gizmo China, Medium, Notebook Check)

Intel has struck a deal with the US Department of Defense to develop and manufacture chips with its 18A (18-angstrom or 1.8nm) process technology under the DoD’s Rapid Assured Microelectronics Prototypes-Commercial (RAMP-C) program. In 2011, the U.S. Department of Defense proposed the “RAMP-C” plan. It signed a foundry agreement with Intel at the beginning, and will use Intel 18A technology to develop and produce chips. On the other hand, the number of RAMP-C partners continues to increase. In addition to IBM, Microsoft, and Nvidia, Boeing, Northrop Grumman, and other major aerospace and defense technology companies, including MediaTek, ARM, etc., also joined through cooperation with Intel. plan. With the support of the U.S. government’s strategic goal of “Made in America”, Intel’s foundry business has finally made progress. If the blueprint for advanced manufacturing and packaging technology released by Intel is on schedule, it will not only exceed the soft target of Samsung Electronics in 2024 TSMC’s new U.S. factory that will delay mass production until 2025 will also face pressure from the U.S. government’s order sharing.(CN Beta, Digitimes, Digitimes, ICSPEC)

Taiwan Semiconductor Manufacturing Company (TSMC) board of directors has approved the investment of up to EUR3.499B (USD3.83B) as part of a joint venture to build a semiconductor fab in Dresden, Germany. The project, called the European Semiconductor Manufacturing Co, will be 70% owned by TSMC, while investment partners Bosch, Infineon Technologies and NXP Semiconductors will each have a 10% stake. TSMC said only that it expected total investments in the project to exceed EUR10B, consisting of equity injection, debt financing and “strong” support from the European Union and German government. The planned Dresden plant will be operated by TSMC and will have a monthly production capacity of 40,000 300mm (12”) wafers, produced on the company’s 28 / 22nm planar CMOS and 16 / 12nm FinFET process technology.(Apple Insider, Digitimes, Focus Taiwan)

TSMC Arizona plant is a semiconductor manufacturing facility under construction in Phoenix, Arizona, United States. The plant is expected to cost USD40B. The plant is scheduled to begin production in 2024 and will initially produce 5-nanometer chips. A second phase of the project, which is expected to be completed in 2026, will add a second factory to the site and produce 3nm chips. TSMC wants to bring in 500 workers from Taiwan to help. They say these workers know how to set up plants like this. But this has caused more issues. Many thought that the plant would give jobs to local American workers right away. To work in the US, these Taiwanese workers need special permission, called an EB-2 visa. This visa is for very skilled people. Some are asking if the construction work really needs such skilled people. A group of workers in Arizona has even started a petition.(Gizmo China, 9to5Mac)

Qualcomm has been rumored to be working on new Oryon-based chipsets for Windows devices since late 2022. The company even teased the name of the chipset codenamed, “Hamoa”. It was previously thought that Hamoa would only have a 12-core CPU, but a new report claims that there will be other variants with 8 and 10 cores as well. Qualcomm’s upcoming Snapdragon “Hamoa” chip will not only be available in a 12-core version. The company has also been developing two other variations with 10 and 8 cores, known internally as SC8370, SC8370XP, SC8350, and SC8350X. The main difference between the versions is the number of cores. In the SC8370 and SC8350 variants, Qualcomm might scale down the count of high-end cores. (Winfuture, Gizmo China, GSM Arena)

Qualcomm announced the Snapdragon X75 5G Modem-RF System in Feb 2023. The X75 is the successor to the Snapdragon X70. The modem achieved an impressive 7.5 Gbps downlink speed. The Snapdragon X75 was able to achieve this speed by leveraging 300 MHz of spectrum. The modem also utilized 4x carrier aggregation (4xCA) across 4 Time Division Duplexing (TDD) channels in a single downlink connection, along with the use of 1024 quadrature amplitude modulation (QAM). These techniques were tested in a 5G standalone (SA) network configuration to achieve a whooping speed of 7.5 Gbps. Qualcomm has confirmed that phones with the Snapdragon X75 5G Modem will be available in 2H23.(Gizmo China, Qualcomm)

China imported a total of 270.2B units of integrated circuits (IC) in the first 7 months of 2023, down 16.8% from the same period last year and showing a modest improving trend despite tougher trade restrictions imposed by the US and its allies. The fall in IC import volume compared with an 18.5 per cent year-on-year drop in import volume in the first half, and a 22.9% decline in the first 3 months. China imported 42.4B units of IC in Jul 2023 alone, up 2.6% from a month earlier, according to data published by the General Administration of Customs. China’s domestic chip production is also picking up. In Jun 2023, the country churned out 32.2B units of IC, up 5.7% from a year earlier after seeing the first monthly uptick in 16 months in April, according to data from the National Bureau of Statistics. (Gizmo China, SCMP, EE World, EET China)

Samsung placed an order to LG Display to procure white-OLED panels earlier Jun 2023. The order is small and Samsung is planning to use the panels for the development of a W-OLED TV it will unveil later in 2023. LG Display will deliver the panels to Samsung within Jun 2023. The order is more of a trial and the pair are yet to sign a comprehensive contract that covers unit numbers and duration, whether it will be up to 2024. Samsung has also requested that LG Display develop a W-OLED TV panel under the specification it wants. Samsung has also demanded that LG Display manufacture the panels at their facility in Paju, South Korea, not Guangzhou, China. Samsung is expected to ship at most 300,000 units of W-OLED TVs if it launches them in 2023. (The Elec, Yahoo)

Android expert Mishaal Rahman has revealed that Google will soon require specific hardware quality standards for foldable phones. It is believed Android OEMs will need to complete a Google questionnaire and send sample devices to the platform holder for closer scrutiny. For starters, Google will require all foldable phones to last for at least 200,000 folds and unfolds. The 200,000 folds and unfolds still makes for 5 years of usage if the device is folded 100 times a day, or just over 10 years of usage if the device is folded 50 times a day. Rahman adds that devices with a “torque hinge” need to have friction torque equal to at least 80% of the original torque after 200,000 folds / unfolds. In other words, it sounds like Google wants free-stop hinges to still maintain their rigidity rather than becoming loose over time. Moreover, Google is demanding that Android manufacturers offer 2 major OS updates and 3 years of security patches for their foldable devices.(Android Authority, Patreon, Gear Rice)

Apple has reportedly lined up its major display provider for the iPhone SE 4, and now smaller companies are trying to pick up some orders. Tianma and other domestic OLED panel manufacturers are fighting for Apple’s iPhone SE 4 AMOLED panel orders, and Tianma has the opportunity to become the second-level supply. According to TF Securities analyst Ming-Chi Kuo, the fourth-generation iPhone SE will feature a 6.1” OLED display with a design similar to the iPhone 14. (Apple Insider, Techgoing, MacRumors, IT Home)

OnePlus will soon launch OnePlus Ace 2 Pro, which features new self-developed “Rainwater Touch Control”. The phone that has water droplets on their displays due to rain may impact the touch input, which is not registered properly. OnePlus claims that their “Rainwater Touch Control” is effective in wet conditions. OnePlus says a custom screen chip and three new core touch algorithms were developed specifically for this technology. These algorithms overcome the challenges of touch input in wet conditions.(Android Headlines, Android Police, Gizmo China, IT Home)

Samsung Galaxy S24 Ultra will allegedly feature a 50MP 3x telephoto camera. The Galaxy S23 Ultra has a 10MP telephoto camera with 3x optical zoom. In comparison, competitors like the Xiaomi 13 Pro have a 50MP telephoto camera for a 3.2x optical zoom. Even the OnePlus 11 has a 32MP 2x optical zoom telephoto camera. (Android Authority, Twitter)

Samsung Electronics has retained its top spot in the global memory chip market in 1Q23 despite lackluster earnings amid the chip glut. SK hynic, on the other hand, was pushed back to 3rd place from 2nd rank compared with a year earlier, due largely to the output cut that came before Samsung, according to Omdia. Samsung Electronics kept the largest share of 42.8% in the DRAM market, unchanged from the previous quarter. SK hynix was dragged down by one spot to 3rd place, and Micron Technology took over the second spot with 27.2%. Samsung Electronics also maintained the top place in the NAND flash market, with the percentage inching up 0.4 percentage point to 34.3% despite the sharp fall in the quarterly revenue in the segment. SK hynix placed fourth with 16.8% in 1Q23 NAND flash market, down from the third spot from three months earlier. (Android Headlines, YNA)

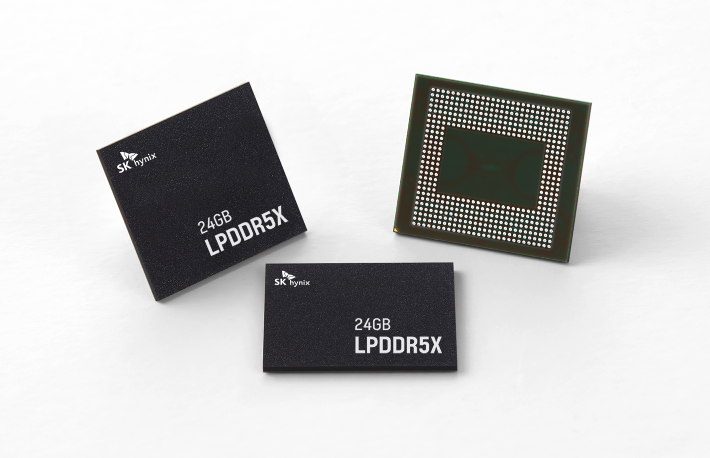

SK Hynix has announced that it has begun supplying the industry’s first 24-gigabyte (GB) Low Power Double Data Rate 5X (LPDDR5X1) mobile DRAM package to its customers, following the mass production of LPDDR5X in Nov 2022. The 24GB LPDDR5X package operates in the ultra-low voltage range of 1.01 to 1.12V set by the Joint Electron Device Engineering Council (JEDEC), and can process 68GB of data per second, which is equivalent to transferring 13 FHD (Full-HD) movies in one second. SK Hynix has begun supplying its new product to smartphone manufacturer OPPO since last month. OPPO’s latest flagship smartphone ‘Oneplus Ace 2 Pro’, which features SK hynix’s 24GB LPDDR5X package. (GSM Arena, GizChina, SK Hynix, Weibo)

Huawei has officially launched a new generation of short-range wireless connection technology – NearLink. This technology brings together the collective collaboration of more than 300 leading enterprises and institutions at home and abroad. It also uses a set of standards to integrate the advantages of traditional wireless technologies such as Bluetooth and WIFI, and its performance is significantly stronger. Compared with traditional wireless connections, Huawei Nearlink has the advantages of 60% lower power consumption, 6 times higher speed, 1/30 delay, and 10 times higher number of network connections. (Android Headlines, Huawei Central, My Drivers, IT Home)

Remote-sensing satellite operator HawkEye 360 is the latest to experience problems in orbit, due to an “irreparable” failure of propulsion systems made by Austria-based Enpulsion, compounded by high solar activity. While HawkEye declined to name its propulsion provider, an Apr 2022 letter from HawkEye to the FCC states that the affected satellites are equipped with Enpulsion’s IFM Nano Thruster propulsion system. HawkEye requested temporary permission from the U.S. Federal Communications Commission to operate three of its satellites, called Cluster 4, at a lower altitude on July 24. In a separate filing, the company requested permanent authority to operate its constellation at orbital altitudes of 400-615km, given the propulsion failures. (CN Beta, TechCrunch, TS2)

Panasonic filed the claims at the end of Jul 2023. A UPC search website run by patent attorney Joeri Beetz shows seven claims are now pending at the court of first instance. According to JUVE Patent information, Panasonic has filed the cases at the local divisions in Mannheim and Munich. However, JUVE Patent does not know which lawsuit was filed at which local division. The claims relate to 4 patents that Panasonic says are essential to the 4G and 5G mobile communication standards. Panasonic is alleging that OPPO and Xiaomi are infringing these patents by selling mobile phones that do not comply with the standards. Panasonic and Kather Augenstein, its a German law firm, are seeking damages and an injunction against OPPO and Xiaomi.(Gizmo China, Juve Patent, Kyodo News, Nikkei CN, Yahoo)

Saudi Arabia announced a law to standardize charging ports for all electronic devices – all devices must have USB-C, with the first stage set to begin on 1 Jan 2025. Government said this aims to improve user experience, reduce costs and e-waste, and also allow high-quality data transfers. The decision comes from the Saudi Standards, Metrology, and Quality Organization and the Communications, Space, and Technology Commission. The first stage (1 Jan 2025) will cover mobile phones and other electronic devices such as headphones, keyboards, speakers, routers, etc. The second stage, (1 Apr 2026) will apply to laptops and portable computers. (Khaleej Times, GSM Arena)

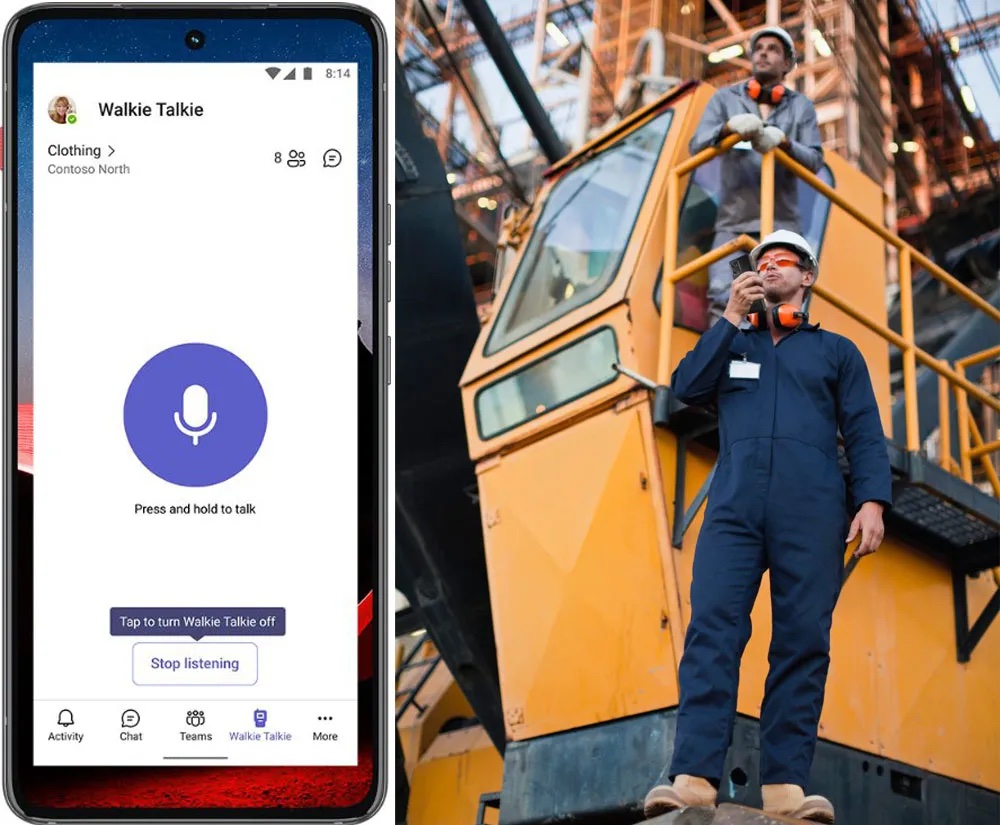

Microsoft and Motorola have partnered to bring new productivity features to the ThinkPhone, including enhanced mobile access for Windows 365 and push-to-talk integration with the Walkie Talkie app in Microsoft Teams. These features will be rolled out and are aimed at business users, requiring relevant licenses for access. Windows 365 is a cloud-based version of Windows that allows users to access their work files and applications from anywhere. With Windows 365 now available on ThinkPhone, users access a full-fledged Windows Cloud PC directly on their phone. Users can also stream the Cloud PC experience to a larger display, keyboard, and mouse using Moto Connect. Motorola has expanded the functionality of the ThinkPhone’s Red Key button to include integration with the Walkie Talkie app in Microsoft Teams. (Gizmo China, Motorola, XDA-Developers, Phone Arena)

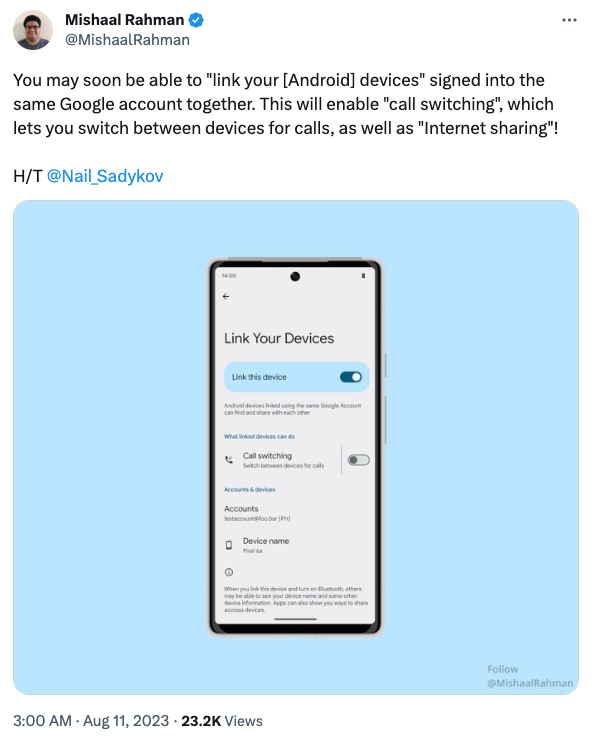

Google is reportedly working on a “Link Your Devices” feature so users can connect devices using the same account together. The discovery details “Call Switching” should be possible so users can swap a call from their phone to another device without dropping it. “Internet Sharing” was also discovered, though not listed, and it may function similarly to Android’s hotspot. The menu offers further information for users such as the Google account‘s email to ensure they have got the right one, as well as a list containing the linked devices. (Twitter, Android Central, Android Authority)

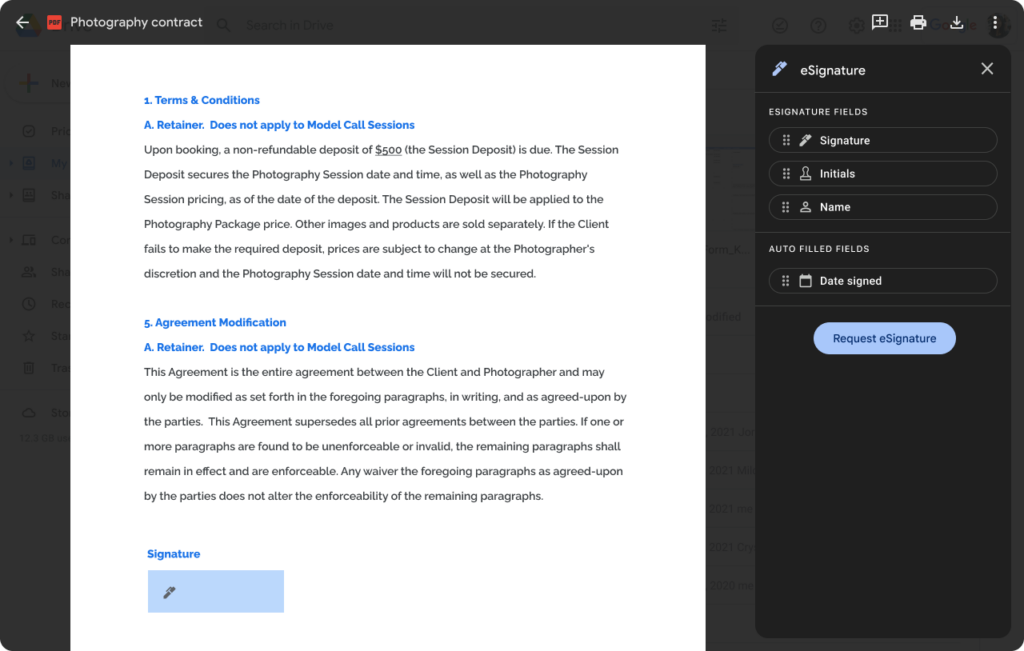

Google is adding native support for electronic signatures in Google Docs and Google Drive. Google has announced an open beta of the new-ish eSignature capability on Google Workspace. The function, which was limited to alpha testing in Jun 2023, has now been released in beta. The company is in the process of rolling out the new capability to individual Workspace users. Google explains that it expects to add other capabilities later in 2023, including an audit trail to track signatures in Google Docs; the ability to handle multiple signers, as well as non-Gmail users; and, finally, the ability to initiate electronic signatures from PDFs stored on Drive. (Android Central, Google)

Micromax is reportedly planning to enter the electric vehicle (EV) space starting with two-wheelers. The firm’s co-founders reportedly filed for a new company named “Micromax Mobility” to start afresh with the new venture. With the new project in tow, the company may shift its focus from smartphones to developing and bringing EVs to the Indian market. The company has allegedly initiated the renovation work at one of its offices in Gurugram to accommodate the new line of work. Micromax may face stiff competition from the likes of Ola, Ather, and Hero Electric, among others. (Gizmo China, TechCrunch, Gadgets360, India Today, 91Mobiles)

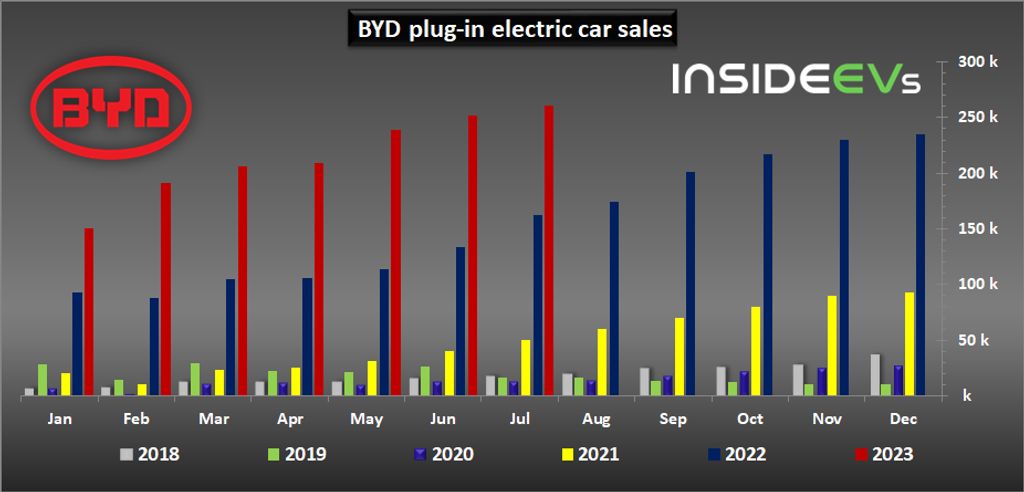

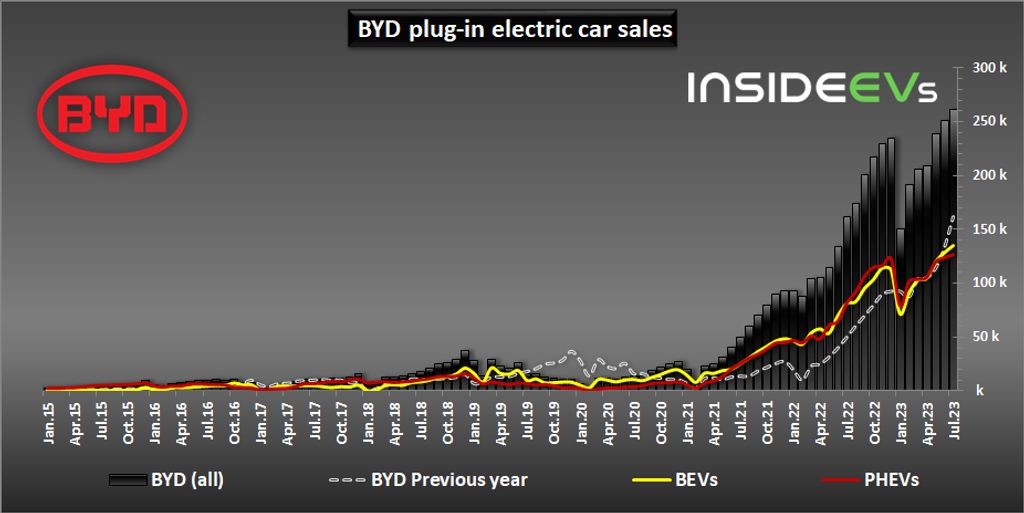

According to the BYD, in Jul 2023, BYD passenger plug-in car sales amounted to 261,105 (including 11,146 Denza premium EVs), which is 61% more than a year ago (the lowest growth rate since late 2020). BYD plug-in car sales results: BEVs: 134,783 (up 66% YoY), PHEVs: 126,322 (up 56% YoY), and total of 261,105 (up 61% YoY). BYD also sold 1,056 commercial electric vehicles for a total of 262,161 plug-in vehicles in Jul 2023. Out of the total number, some 18,169 BYD plug-ins were exported. So far in 2023, BYD sold over 1.5M passenger plug-in electric cars, which is 89% more than a year ago.(Gizmo China, Inside EVs, Twitter)

Walt Disney has allegedly created a task force to study artificial intelligence (AI) and how it can be applied across the entertainment conglomerate, even as Hollywood writers and actors battle to limit the industry’s exploitation of the technology. Launched earlier in 2023, before the Hollywood writers’ strike, the group is looking to develop AI applications in-house as well as form partnerships with startups. (CN Beta, WDW News Today, Reuters)

The United States Department of Defence has launched a new task force to look into how generative artificial intelligence (AI) can be used for the nation’s defense. Task Force Lima will assess, synchronise and employ generative AI capabilities across the Defence Department, ensuring that it remains at the forefront of cutting-edge technologies while safeguarding national security, according to a Pentagon statement. Deputy Defense Secretary Kathleen Hicks said that part of Lima’s mission would also study how the department can defend against and respond to malicious or adversarial uses of AI. The newly formed Chief Digital and Artificial Intelligence Office, which launched in Jun 2022, will lead the new task force, with U.S. Navy Captain Manuel Xavier Lugo named Lima’s mission commander. (CN Beta, SCMP, C114, Coin Telegraph, Pentagon, Twitter)

Payments giant PayPal has launched a U.S. dollar stablecoin, becoming the first major financial technology firm to embrace digital currencies for payments and transfers. PayPal USD (PYUSD) is issued by Paxos Trust Company and is backed by U.S. dollar deposits, short-term U.S Treasuries and similar cash equivalents. PayPal says the stablecoin is rolling out to U.S. customers gradually. Eligible U.S. PayPal customers who purchase PYUSD will be able to transfer PYUSD between PayPal and compatible external wallets, send person-to-person payments using PYUSD, fund purchases with PYUSD by selecting it at checkout and convert any of PayPal’s supported cryptocurrencies to and from PYUSD. (CN Beta, TechCrunch, Reuters, Bloomberg)

Amazon plans to reduce its in-house brands. The retailer will eliminate 27 of its 30 clothing brands and all of its private-label furniture lines. Among the Amazon clothing labels reportedly being phased out are Lark & Ro, Daily Ritual and Goodthreads. Amazon Essentials, Amazon Collection and Amazon Aware will reportedly remain. Meanwhile, the retailer is allegedly dropping its Rivet and Stone & Beam furniture brands once their current stock is depleted.(Live Mint, Gizmo China, Engadget, WSJ)