9-20 #Fatigue : Huawei is rumored developing a tri-fold display phone; Samsung is hinting at 200Mp telephoto cameras coming to phones; Tesla has announced that it has produced its 5M-th electric car; etc.

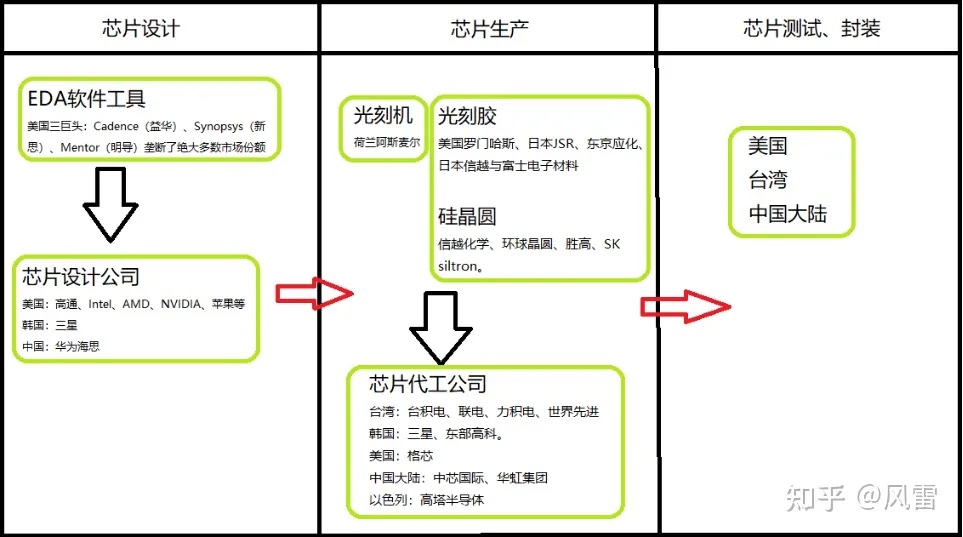

TSMC is said to be cautious about the outlook for customer demand and has notified major suppliers, including Dutch chip production equipment giant ASML, to postpone the delivery of high-end chip manufacturing equipment to TSMC, but the delay is expected to be only a short-term delay. TSMC’s move is to control costs and reflects the company’s increasing caution about the outlook for chip demand. ASML CEO Peter Wennink has mentioned that some of the company’s high-end equipment orders have been delayed, but he did not disclose the name of the customer and expected it to be only a short-term phenomenon. (CN Beta, Yahoo, Investing, Wealth)

Japan’s Rapidus has broken ground on its IIM-1 plant in Hokkaido, kicking off a flurry of hiring as the foundry upstart races to bring its 2nm wafer fab online by 2025. The government-backed foundry got its start a little over a year ago in a bid to compete with TSMC, Samsung Electronics, and Intel. It aims to roll out with mass-produced chips based on 2nm process technology by 2027, with pilot production slated for early 2025. Rapidus has reportedly received JPY370B (USD2.B) in government subsidies, and has solicited the help of IBM to produce chips on its 2nm gate-all-around transistor tech, which it demoed in early 2021. (CN Beta, AnandTech, The Register, Digitimes)

Qualcomm has launched Snapdragon 7s Gen 2, which is a mid-range solution seemingly positioned as an entry-level offering in the 2023 7-series lineup. The new chip features an octa-core CPU setup with four Cortex-A78-based Kyro Gold cores clocked at 24GHz and four Cortex-A55-based Kyro Silver cores clocked at 1.95GHz. Qualcomm has paired the CPU with the Adreno 710 GPU, and it can handle up to FHD+ resolution on-device displays at a 144Hz maximum refresh rate. Manufactured using Samsung’s 4LPE 4nm process, the Snapdragon 7s Gen 2 boasts the FastConnect 6700 connectivity platform and the Snapdragon X62 5G Modem-RF System capable of delivering up to 2.9 Gbps of download speeds. (Android Central, Qualcomm, Android Headlines)

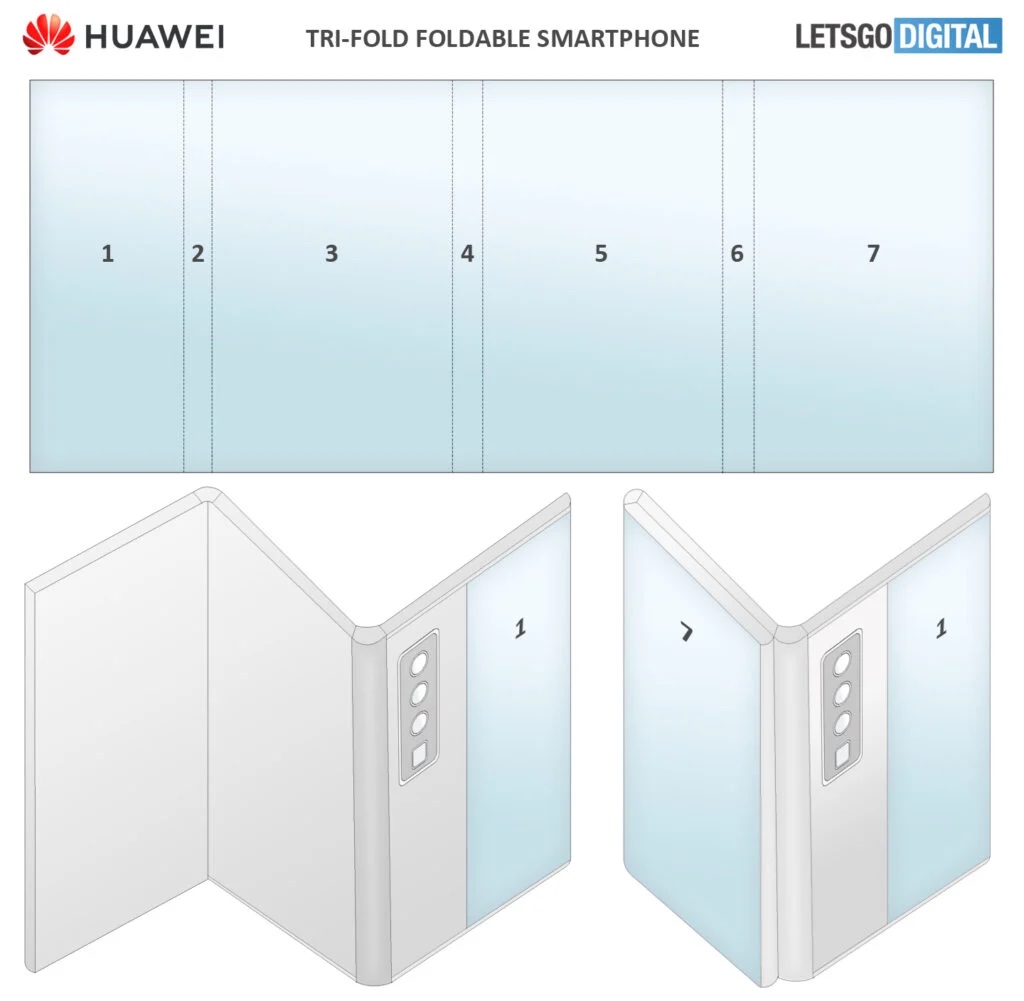

Huawei is rumored working with supply chain manufacturers to develop a tri-fold display phone, planning to lead the next-generation folding screen terminal market and seize Apple’s iPhone and iPad market share in China. Similarly, Samsung Electronics also plans to use its tri-fold phone to compete differentiatedly with Apple’s iPhone and iPad in the global market. Like the early dual-fold phones, the tri-fold phones will face challenges such as being too thick, high cost, obvious creases, short battery life, low hinge yield, poor software experience, and insufficient reliability. (Laoyaoba, UDN)

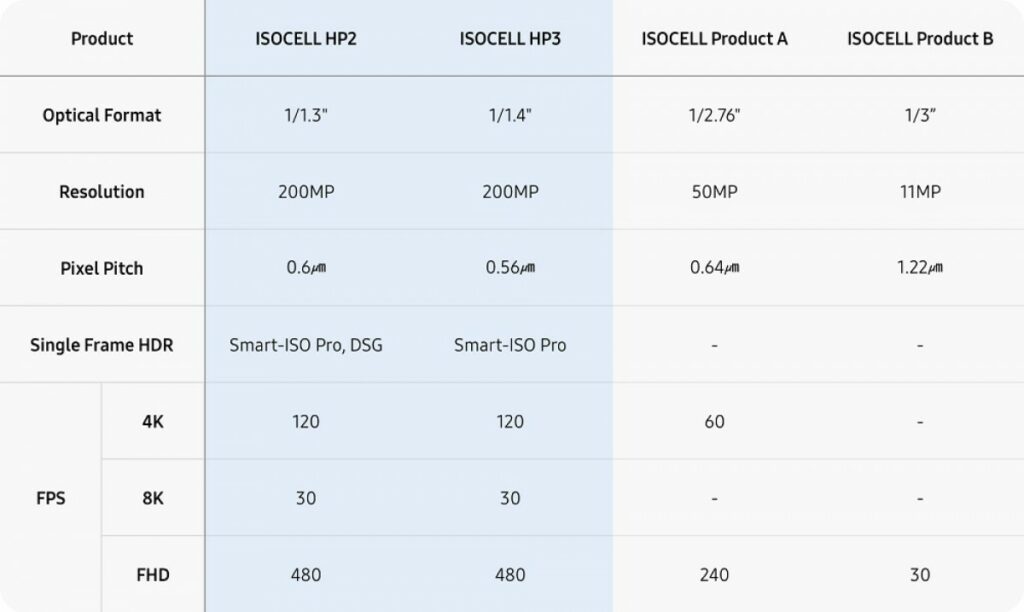

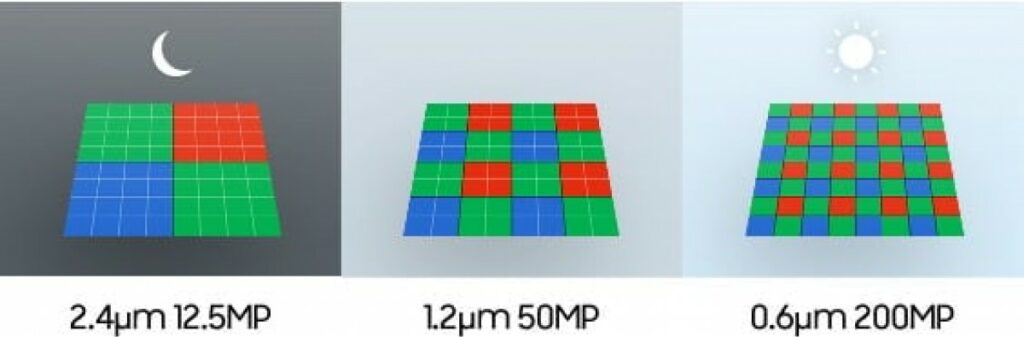

Samsung Semiconductor is hinting at 200Mp telephoto cameras coming to phones. The company notes that a telephoto camera is preferable for portrait shots due to reduced distortion compared to shooting with a main camera sensor. However, the company explains that telephoto camera sensors tend to be much smaller than primary camera sensors. Samsung points out that super high-resolution sensors like 200Mp cameras are able to deliver lossless cropped zoom thanks to all those megapixels. For the future, Samsung’s 200Mp sensors might find themselves behind a 3x tele lens – then they will offer 3x, 6x and 12x zoom. The ISOCELL HP2 and HP3 are 1/1.3” and 1/1.4” sensors, respectively, and they have a lot in common. They use a 4×4 deep-learning remosaic algorithm, which is what takes the sensors’ 4×4 Tetra²Pixel arrangement and reshuffles it into RGB.(Android Headlines, GSM Arena, Android Authority, Samsung)

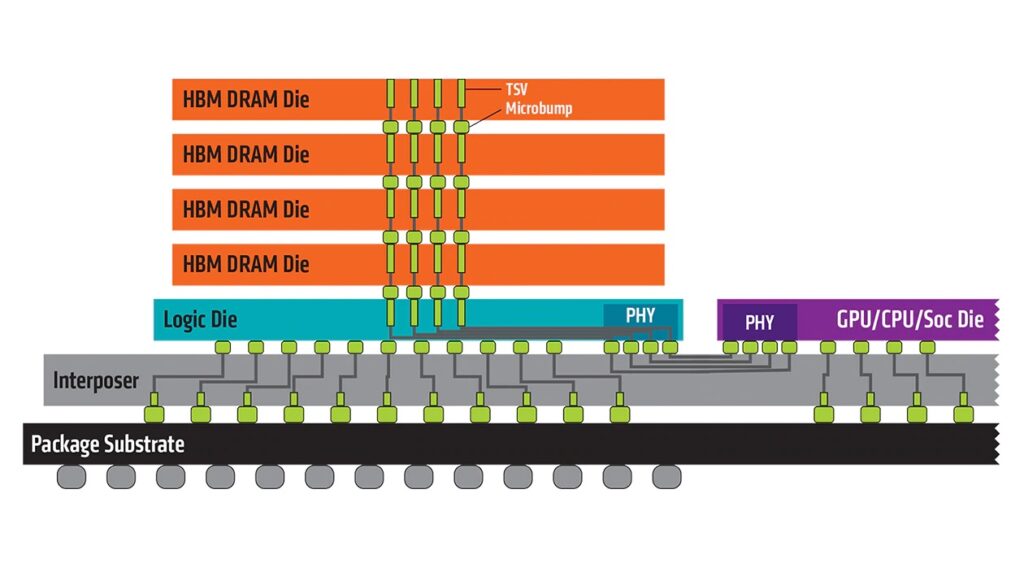

Samsung Electronics and SK Hynix are trying to dominate the rapidly growing high-bandwidth memory (HBM) market both through expanding capacities and revolutionizing the next-generation processing technology. There is another major change incoming and this one is going to be drastic: next generation HBM4 memory stacks will feature a 2048-bit memory interface, according to a Digitimes. Increasing interface width from 1024-bit per stack to 2048-bit per stack will be the biggest change HBM memory technology has ever seen. Samsung and SK Hynix are moving towards integrating “2000 I/O” ports on their next-gen HBM4 memory standard. (CN Beta, Tom’s Hardware, WCCFtech, Digitimes)

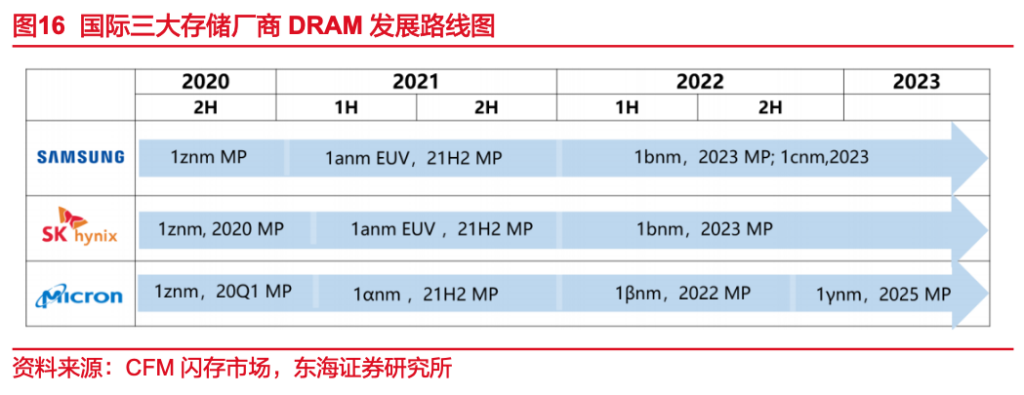

The advanced process technology of DRAM has been reduced to below 15nm, and major manufacturers continue to approach 10nm. Judging from the progress of process technology, the update time of DRAM products in the past was roughly 3-5 years to a new generation. Breakthrough progress within 20nm showed a slowdown trend. The 10-20nm series process includes at least 6 generations, about a breakthrough achieved in 2 years. Since the circuit structure is 3D, linear measurement is not suitable. The storage industry usually uses terms such as 1X, 1Y, 1Z, 1α, 1β, and 1γ to express the process. International storage giants Samsung Electronics, SK Hynix and Micron have successively entered the 1Z nanometer stage after 2020. Micron’s 1βnm DRAM will achieve mass production in Nov 2022, and will be the first to be used in LPDDR5X on smartphones; Samsung will achieve mass production at the end of Dec 2022 launched 12nm DRAM, with power consumption reduced by 23% compared to the previous generation; SK Hynix’s latest generation DRAM is 1anm, and it is expected to achieve mass production of 1bnm (i.e. 12nm) DRAM in 2023. China’s local DRAM manufacturers mainly include CXMT, Unigroup Guoxin, GigaDevice, Dongxin and Fujian Jinhua. GigaDevice relies on Hefei CXMT’s foundry resources to launch its first self-developed Gb DRAM in 2021, using 19nm-process technology is currently about to launch 17nm products; Beijing Ingenic Semiconductor adopts the 25nm process platform of Powerchip and Nanya Technology; the latest process technology of Unigroup Guoxin, Dongxin is 25nm. (Donghai Securities report)

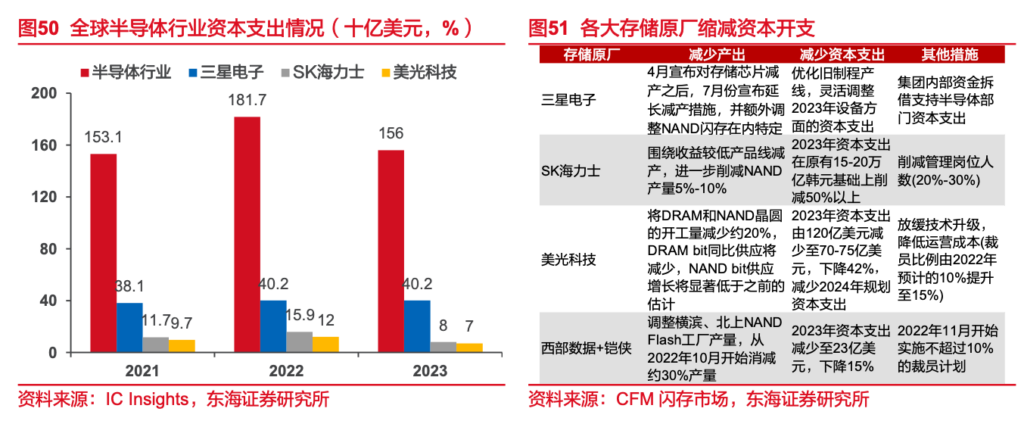

According to IC Insights, global semiconductor capital expenditures will increase by 35% in 2021 and 19% in 2022. They are expected to decline by 14% in 2023, reaching USD156B. Broken down, in the storage field, memory chip manufacturers led by SK Hynix and Micron Technology have seen a significant decline in semiconductor investment expenditures. Among them, SK Hynix will reduce capital expenditures by 50% in 2023, and Micron will reduce capital expenditures by 42% in 2023. Samsung Electronics, the leading storage manufacturer, will only increase capital expenditure by 5% in 2022 and maintain the same level as the previous year in 2023. Currently, the storage market is in a downward cycle. Global storage manufacturers are facing price declines, the cyclical nature of the industry itself, and the downward factors of the external economic environment. In response to the continued downturn in the memory chip market, Samsung Electronics, Micron Technology, SK Hynix, Western Digital and other storage companies Major chip manufacturers have announced that they will significantly reduce production and capital expenditures in 2023 to improve the supply and demand structure. (Donghai Securities report)

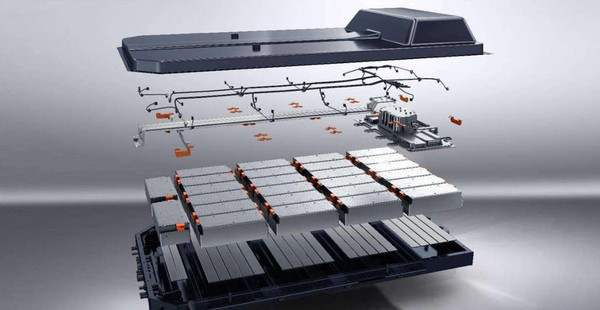

Two major Chinese battery companies, Guoxuan High-Tech and EVE Energy, are reportedly planning significant investments in the United States by establishing battery manufacturing facilities. The Guoxuan Illinois facility will focus on lithium-ion cell and battery pack production and energy storage system integration. After completion, it will have an annual Pack production capacity of 10GWh and an annual battery cell production capacity of 40GWh. The factory will be completed in two phases based on an existing local factory and is expected to cover an area of approximately 150 acres (approximately 910 acres). After the first phase of the factory renovation is completed, it is expected to be put into production in 2024. Previously, EVE Energy also announced that it would invest USD2.64B in a joint venture with Electrified Power, Daimler Truck and PACCAR to build battery production capacity. The batteries produced by the joint venture are mainly used in designated North American commercial vehicle fields. (Gizmo China, CNMO, Sohu, Sina, iFeng)

The European Union (EU) is providing EUR352M (USD378M) in funding to support green transport infrastructure, and Tesla will get about USD160M out of it. The company’s Polish and Italian divisions will receive a total of EUR148.72M (USD159.64M) to install or upgrade 7,198 Superchargers across 22 countries, according to the EU’s list of projects. The project aims at deploying 6,458 recharging points (250 kW) for LDV in 613 locations in 16 countries (AT, BE, BG, DE, ES, FI, FR, IE, IT, LV, LT, LU, NL, RO, SK, SE) along the Core and Comprehensive Network. (Engadget, Europa)

German operators can still install technology components from China in their 5G networks, despite concerns raised by politicians and experts. The information is based on a previously undisclosed response from State Secretary Daniela Kluckert at the Federal Ministry of Digital Affairs and Transport regarding the “status of the gigabit strategy implementation”. Three of the 11 notifications involved components from Chinese manufacturers, and Section 9b of the Act on the Federal Office for Information Security currently does not prohibit the use of such components. Concerning whether Huawei is among those Chinese suppliers, the Federal Ministry of the Interior and Community of Germany said it cannot provide any information in relation to that question, as it involves confidential trade information of enterprises. (CN Beta, Welt.de, AAStock, Technode)

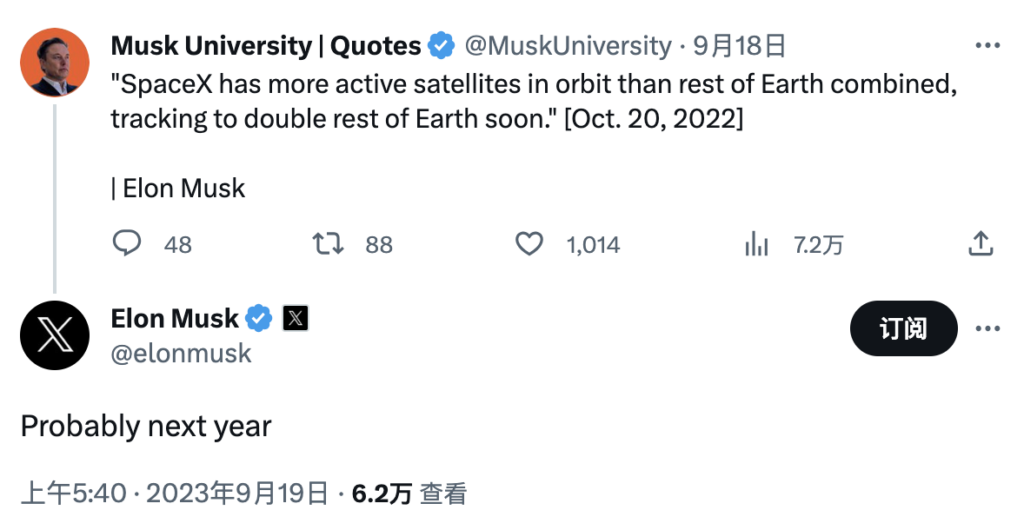

SpaceX CEO Elon Musk has said it is expected that by 2024, Starlink may have twice the number of satellites in orbit as all other satellites combined. In August 2023, Musk said that SpaceX may account for 80% of the world’s payloads launched in 2023. This is consistent with the 80% payload target announced by Musk back in Mar 2023. The company plans more than 90 launches in 2023, up from 61 completed in 2022. (CN Beta, Benzinga, MSN, Twitter)

Samsung is reportedly evaluating making telecom gear in India, as manufacturers see increasing geopolitical risk in China. Samsung may have to wait for more orders in India as well as from overseas before making such a decision. In Feb 2021, India introduced the PLI scheme for manufacturing telecom and networking equipment with an outlay of INR121.95B (USD1.46B). Samsung did not participate in the scheme as Samsung had only an Indian customer, Reliance Jio, which did not make a case for the company to invest in manufacturing, and Reliance Jio has been building its own end-to-end 5G design and manufacturing capabilities. Still, India launched another round of a telecom and networking gear PLI scheme in June 2022, which included a design-led PLI scheme, inviting applicants from design-led manufacturers and others to avail incentives for 5 years. Samsung, among Nokia, Ericsson’s partner Jabgil, Flex, Tejas Networks, VVDN, and HFCL, participated in the 2022 round of the PLI scheme. Besides Reliance Jio, Samsung in earlier 2023 announced it had signed an agreement with India’s second-largest mobile operator, Bharti Airtel, for 5G network deployment. (Live Mint, Digitimes, CN Beta)

For 13 years, the value of the Kantar BrandZ Most Valuable Chinese brands has trended consistently upward. Since 2014, when it first expanded to include China’s Top 100 brands, the total value of the rankings has grown 265%, to reach a total for 2023 of slightly more than USD1T. That figure represents a 19% YoY decline for the China Top 100 – a retreat that is in line with brand value corrections seen elsewhere in world, including a 20% YoY decline for 2023 Kantar BrandZ Global Top 100 ranking. Despite these corrections, the USD1T valuation of 2023 China Top 100 remains 13% higher than the rankings’ total value in 2019 – the valuation conducted before the impact of the COVID-19 pandemic. (Kantar report)

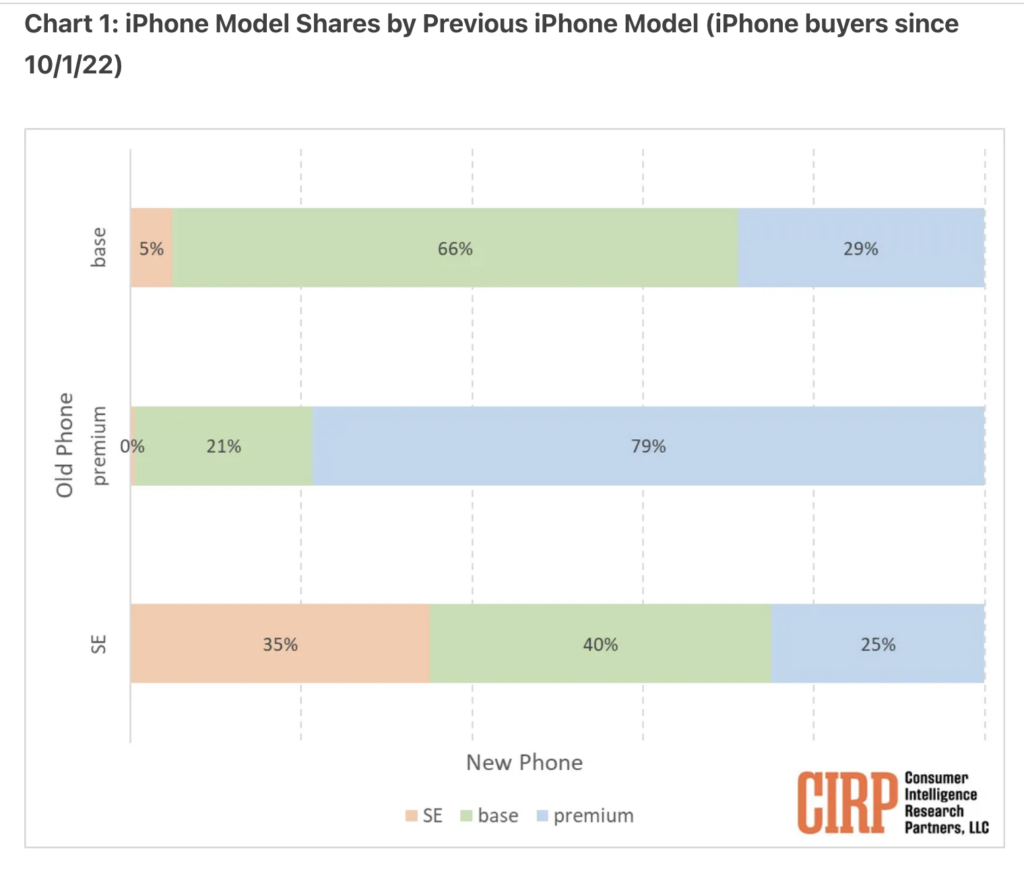

Apple’s iPhones can be divided into three tiers – SE, the value priced; the “standard” number iPhones: 11, 12, 13, 14, XR, and their predecessors, including minis and Pluses; and the premium tier that started with X, then XS, and now includes the numbered Pro models and their Max counterparts. CIRP sees significant loyalty to the model tier that a buyer previously owned. Base model owners are not very likely to upgrade to a premium model. Almost two-thirds purchase another base model, while less than one-third upgrade to a premium model and a small percentage move to the SE tier. Premium model owners also stay in their lane, purchasing another premium model. 79% upgraded to a new Pro model, while 21% dropped down to a base model. Almost no premium iPhone owners shifted all the way to the SE.(Android Headlines, CIRP)

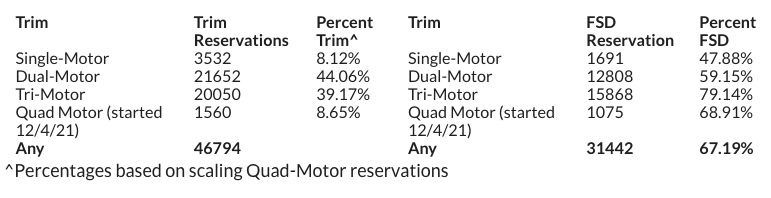

Tesla Cybertruck has reportedly topped 2M reservations ahead of its official launch. Based on the number of reservations, the sheet also estimates a potential revenue of USD152.13B and as much as USD201M in deposits alone. Out of the Cybertruck’s single-motor, dual-motor, tri-motor and quad-motor trims, the dual-motor is the most popular, with the tri-motor trailing behind as the second most popular. (CN Beta, Electrek, Teslarati)

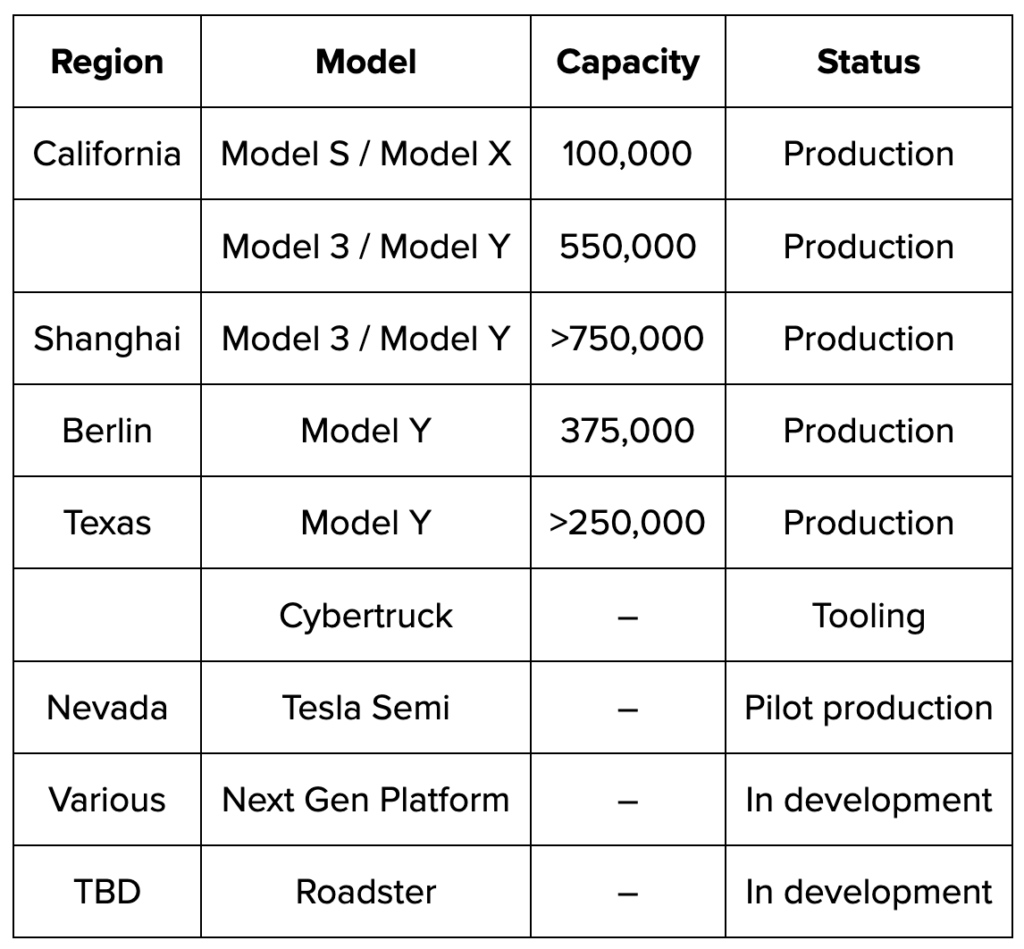

Tesla has announced that it has produced its 5M-th electric car. The milestone comes about 20 years after the company was started in 2003 and 15 years after the first car (the original Roadster) was produced and delivered in 2008. It took Tesla 12 years of operations to build its first 1M vehicles. Tesla made the announcement just 6 months after announcing it built its 4M-th electric car. (GizChina, Inside EVs, Electrek, Twitter)

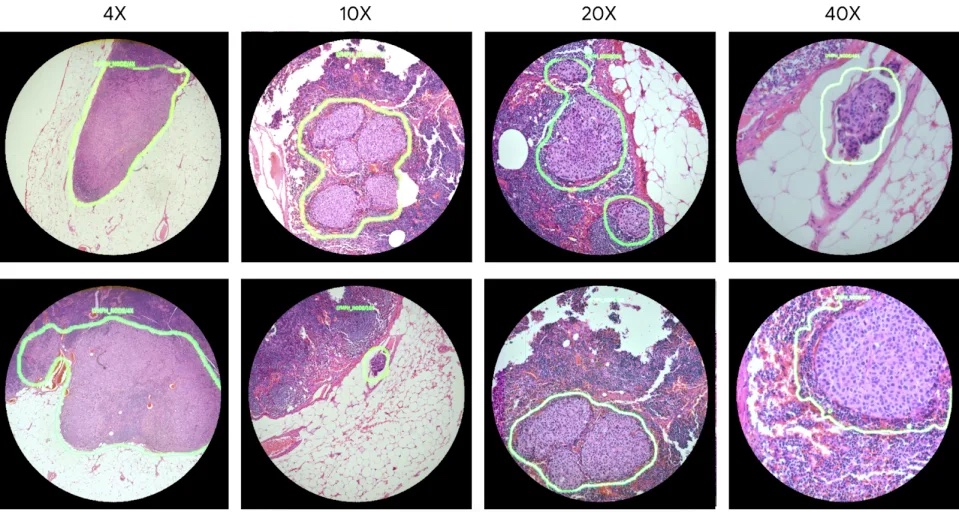

Google has prototyped an “Augmented Reality Microscope” (ARM), in conjunction with the Department of Defense, which incorporates artificial intelligence enhancements to overlay visual indicators, like heatmaps or object boundaries, in real-time. The AI additions allegedly make it easier to classify samples and identify the presence of cancer cells or pathogens. According to Google. ARM-equipped microscopes can then provide a variety of visual feedback, including text, arrows, contours, heat maps, or animations, each tailored to unique assessment goals. The Department of Defense’s Defense Innovation Unit has reportedly negotiated agreements with Google that will enable ARM distribution through the military.(Engadget, Google, CNBC)

Baidu has unveiled a large language model (LLM) with the aim of improving the digitization and intelligence of the healthcare industry. The new industry-grade AI model is called Lingyi (“Spiritual Doctor”) and it is currently available for trial use in both upstream and downstream healthcare sectors. The LLM can generate structured medical records from free-text input and accurately analyze and generate patient complaints, medical histories, and more based on doctor-patient conversations. It can do simultaneous parsing of multiple Chinese and English medical literature articles, enabling intelligent question-answering based on the content of the literature. (Gizmo China, IT Home, Sina)