10-7 #CestLaVie : Intel will begin mass production of 1.8nm chips in 2025; Samsung is reportedly developing two near-1″ high-res CIS; Samsung is reportedy to increase prices of NAND products over 10% during 4Q23; etc.

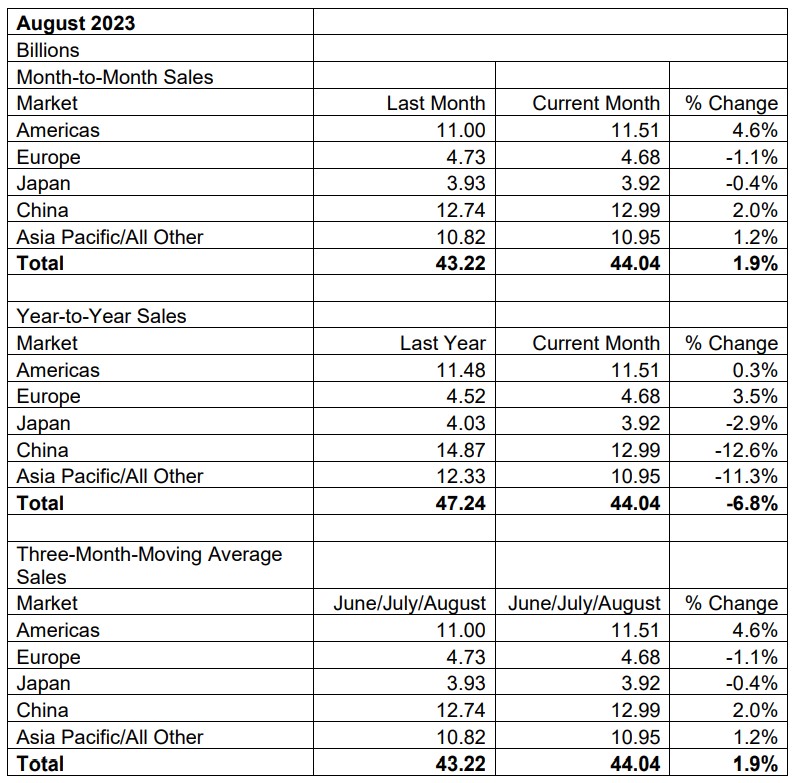

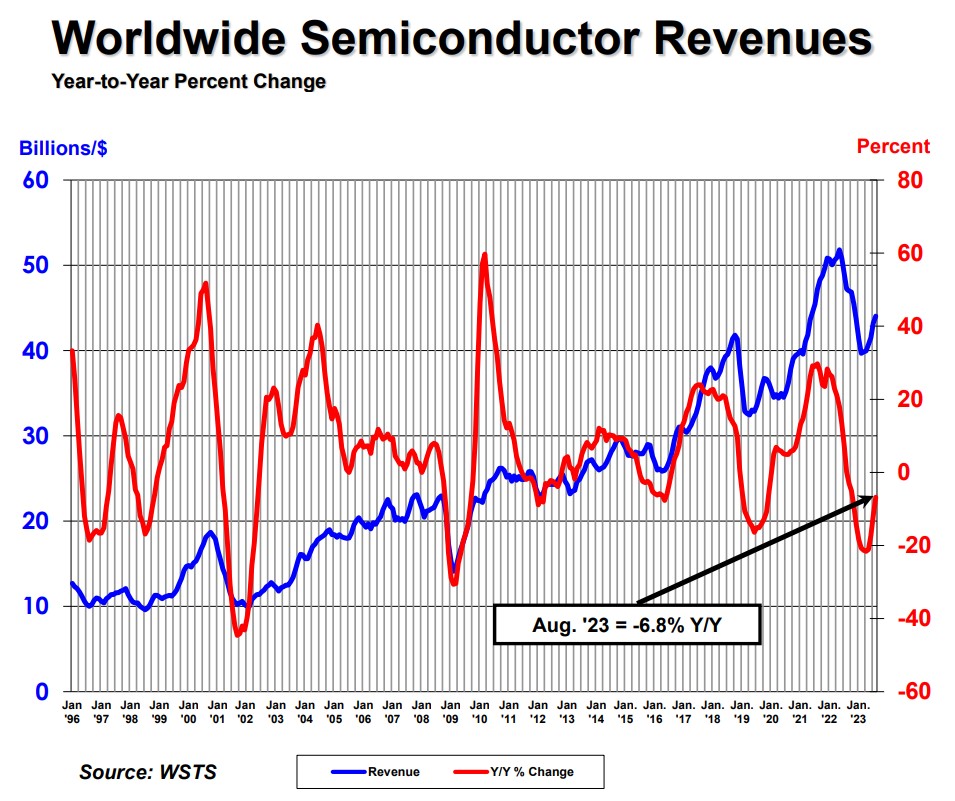

The Semiconductor Industry Association (SIA) has announced global semiconductor industry sales totaled USD44.0B during the month of Aug 2023, an increase of 1.9% compared to the July 2023 total of USD43.2B but 6.8% less than the Aug 2022 total of USD47.2B. Regionally, month-to-month sales increased in the Americas (4.6%), China (2.0%), and Asia Pacific / All Other (1.2%), but decreased slightly in Japan (-0.4%) and Europe (-1.1%). Year-to-year sales were up in Europe (3.5%) and the Americas (0.3%), but down in Japan (-2.9%), Asia Pacific/All Other (-11.3%), and China (-12.6%). (CN Beta, SIA, My Drivers)

Samsung has announced Exynos 2400. Samsung claims the Exynos 2400 offers 70% faster CPU performance and an incredible 14.7x faster AI processing than the Exynos 2200. The new chip also features the Xclipse 940 GPU based on AMD’s latest GPU architecture: RDNA3. This new chip has 6 WGP (Workgroup Processors) in the GPU. Exynos 2400 is equipped with an Xclipse 940 GPU based on the AMD RDNA 3 architecture offering mobile ray tracing which brings a more life-like experience in games with improved shadow rendering, reflections and global illumination.(CN Beta, GSM Arena, SamMobile, Samsung)

Kneron, which is developing AI chips to power self-driving cars, among other autonomous machines, has announced that it raised USD49N in an extension to its Series B round from investors including Foxconn, Alltek, Horizon Ventures, Liteon Technology Corp., Adata and PalPilot. Kneron’s CEO, Albert Liu, says that the new tranche, which brings Kneron’s total raised to USD190M, will be put toward bolstering Kneron’s go-to-market efforts in the automotive industry and expanding the size of its team, with an emphasis on the R&D division. (CN Beta, New Electronics, TechCrunch, Kneron)

Google Tensor G3 features a 9-core CPU and a Mali-G715 GPU. The manufacturing process is allegedly Samsung’s older 4nm LPP (Low Power Plus) instead of the 4nm LPP+. The newer manufacturing process may be dedicated to the Exynos 2400. Where the Snapdragon 8 Gen 2 reportedly costs USD160 to Qualcomm’s smartphone partners and the Snapdragon 8 Gen 3 is said to be costlier than its predecessor, Google can instead invest those funds by focusing more on the features side of the Tensor G3, giving it capabilities in the software department.(CN Beta, WCCFTech, Notebook Check)

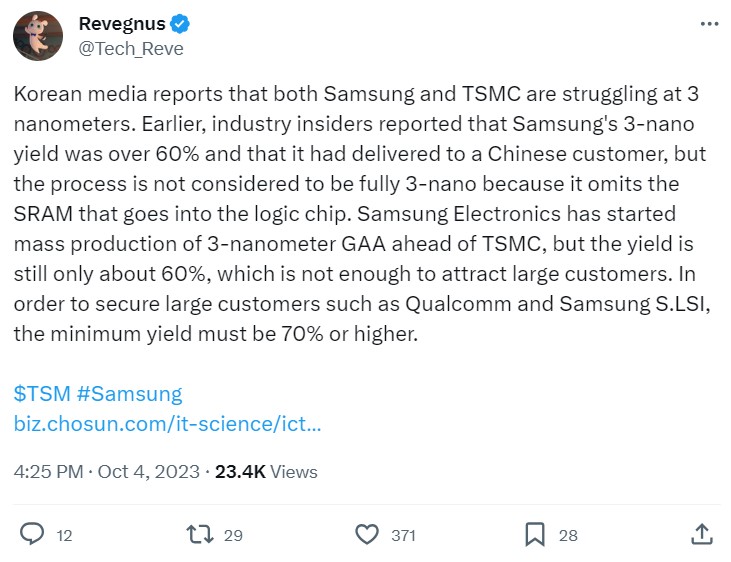

Samsung and TSMC have yet to see yield improvements in their respective 3nm technologies. Both companies could be struggling to exceed 60%, i.e., around 50%, well below what is needed to attract hardware vendors. Though TSMC has already secured Apple as a long-term client, with future SoCs said to be mass produced on the updated N3E process, yet Qualcomm will not place orders if the yields of Samsung’s 3nm GAA node do not climb to 70%. Samsung has fulfilled the first 3nm GAA batch to Chinese customers for their Bitcoin firm, but the chips were reportedly incomplete in their truest form, lacking the SRAM that goes into the logic chip. At a 50% yield, only 5 out of 10 wafers are considered usable, and with Qualcomm being forced to pay for all 10, the company will have little choice but to increase the prices of its Snapdragon products, commencing a vicious cycle that will financially affect its smartphone partners and consumers.(CN Beta, WCCFTech, Chosun Biz, Techspot)

Tenstorrent, a Canada-based company that sells AI processors and licenses AI and RISC-V IP, has announced that it selected Samsung Foundry to bring Tenstorrent’s next generation of AI chiplets to market. Samsung Electronics’ chip factory in Taylor, Texas will manufacture advanced AI processors designed by Tenstorrent. As part of the deal, Tenstorrent plans to use one of Samsung’s advanced manufacturing processes, known as 4nm, to produce the chips. Tenstorrent builds powerful RISC-V CPU and AI acceleration chiplets, aiming to push the boundaries of compute in multiple industries such as data center, automotive and robotics. Hyundai Motor Group and Samsung Catalyst Fund along with other investors funded USD100M in Aug 2023. LG Electronics also announced in May 2023 that it will collaborate with Tenstorrent for its product lines, mainly for connected televisions and automotive chips. (CN Beta, The Register, Kora JoongAng Daily, Tenstorrent, Reuters)

Intel has announced its intent to separate its Programmable Solutions Group (PSG) operations into a standalone business. This will give PSG the autonomy and flexibility it needs to fully accelerate its growth and more effectively compete in the FPGA industry, which serves a broad array of markets, including the data center, communications, industrial, automotive, aerospace and defense sectors.(CN Beta, Intel, AnandTech)

Intel will begin mass production of 1.8nm chips, called 18A by the company, in 2025, according to the company CEO Pat Gelsinger. Ericsson and Intel have announced a strategic collaboration to utilize Intel’s 18A process and manufacturing technology for Ericsson’s future next-generation optimized 5G infrastructure. Intel will also use 18A to produce its own chips, such as Clearwater Forest which is an Xeon processor that will be based on E-Core, launching in 2025. Panther Lake, aimed at PCs, launching that year will also be made with 18A. 18A, like its predecessor 20A, will also use PowerVia and RibbonFET technologies. PowerVia is Intel’s back side power delivery network technology where the power circuits are placed behind the wafer. RibbonFET is the US chip giant’s gate all around technology. (XDA-Developers, CRN, The Elec, Light Reading, Ericsson)

OpenAI, the company behind ChatGPT, is exploring making its own artificial intelligence chips and has gone as far as evaluating a potential acquisition target. The company CEO Sam Altman has made acquiring advanced AI chips a priority, emphasizing the need to reduce reliance on third-party vendors, notably Nvidia, the current main supplier for OpenAI’s GPUs. The shortage of these high-performance processors has escalated costs, with each query for OpenAI’s popular ChatGPT service now costing about USD0.04. To alleviate this issue, OpenAI is evaluating several options, including building its own AI chips, collaborating closely with existing chipmakers like Nvidia, and diversifying its supplier base beyond Nvidia. OpenAI has even explored the possibility of acquiring an existing AI chip-making company, taking inspiration from Amazon’s acquisition of Annapurna Labs in 2015. (Reuters, Gizmo China)

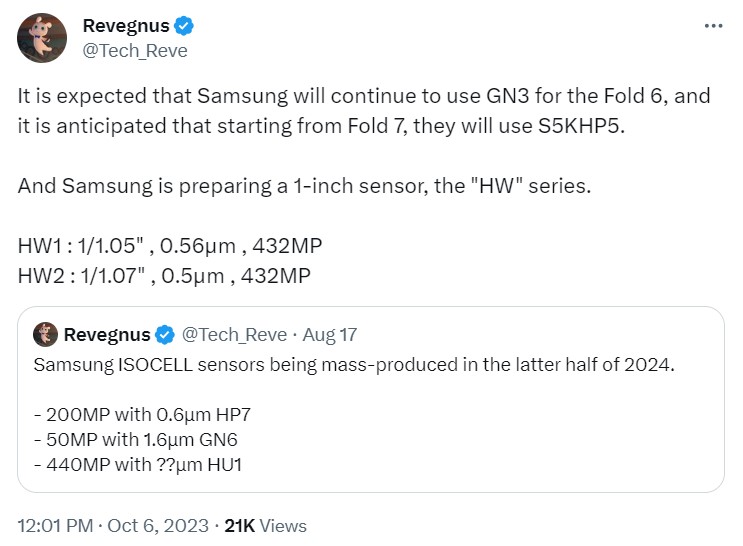

Samsung is reportedly working on two new ISOCELL camera sensors: ISOCELL HW1 and ISOCELL HW2. The ISOCELL HW1 is said to be a 1/1.05” (nearly 1”) sensor with 0.56µm pixels and a whopping 432Mp resolution. The ISOCELL HW2 is a slightly different 1/1.07” (nearly 1”) sensor with a 0.5µm pixel size and a resolution of 432Mp. If this information is accurate, Samsung appears to be working on 1-inch sensors but also featuring extremely high resolution, double that of its current-generation flagship camera sensors. Samsung Galaxy Z Fold 6 will allegedy continue to use the same camera (50Mp ISOCELL GN3 1/1.56”) seen on the Galaxy Z Fold4 and the Galaxy Z Fold5. With the Galaxy Z Fold7, though, Samsung will reportedly jump to a 200Mp camera sensor (ISOCELL HP5 with 1/1.3”) with 0.5µm pixels. (CN Beta, Sparrow News, SamMobile, Twitter)

Samsung has announced the release of its latest lineup of the T-series, the Portable Solid State Drive (SSD) T9. The T9 offers maximum sequential read/write speeds of 2,000 megabytes-per-second (MB/s) on the USB 3.2 Gen 2×2 interface. Approximately two times faster than the previous model T7, speeds of this level allow users to transfer a 4-gigabyte (GB) Full HD video in nearly two seconds. The T9 comes in three different capacity options to fit the needs of every creator. With 1-terabyte (TB), 2TB and 4TB varieties, the T9 makes it possible to complete quick and frequent transfers while providing ample storage for large volumes of data.(CN Beta, GSM Arena, Samsung)

Samsung Electronics is reportedy planning to implement a price increase of over 10% for NAND products during 4Q23. It is anticipated that the increased prices will be applied to new contracts as early as Oct 2022. Samsung Electronics has been implementing a reduction strategy since 1H23 to counter the worst semiconductor downturn it has faced since 2H22. (CN Beta, IT Home, Pulse News, Business Korea, WCCFTech, Digitimes, CTEE, China Times)

LG Energy Solution (LGES) has signed an agreement to supply Toyota with lithium-ion batteries for electric vehicles that will be assembled in the U.S. The deal will support Toyota’s expanding battery EV line-up, which includes a new model that will be assembled at a manufacturing plant in Kentucky, its largest globally, starting in 2025. LG Energy Solution will supply Toyota with 20 gigawatts worth of batteries every year from 2025. LG Energy Solution CEO Youngsoo Kwon has indicated that LG Energy Solution will invest about KRW4T (USD3B) “to establish new production lines for battery cells and modules exclusively for Toyota, with completion slated for 2025”. (CN Beta, CNBC, Carscoops, Yahoo)

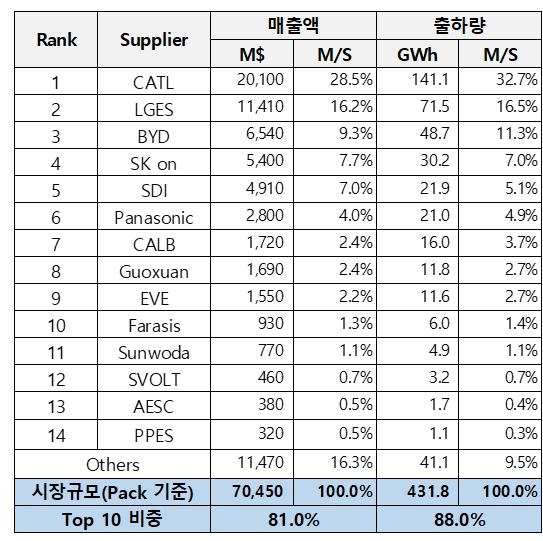

According to energy market research firm SNE Research, global battery sales for 1H23 totaled 431.8 GWh. Based on the battery pack, the market size is USD70.5 B (KRW94.3 T). China’s CATL led the market, accounting for 28.5% of sales and 32.7% in shipping volume. Among the South Korean top 3, LG Energy Solution ranked second with a market share of 16.2% in terms of sales. SK innovation (7.7%) and Samsung SDI (7.0%) followed, ranking fourth and fifth, respectively. In terms of shipment volume, LG Energy Solution (16.5%) was second, SK innovation (7.0%) was fourth, and Samsung SDI (5.1%) was fifth. (CN Beta, Business Korea, 199IT)

Samsung SDI (the battery manufacturing wing of Samsung Electronics) is reportedly all set to invest USD1.97B to develop its second battery manufacturing plant in joint partnership with Stellantis N.V. in the US. StarPlus Energy, a joint venture between Samsung SDI and Stellantis, announced that both giants plan to build a second battery plant in Indiana, where they have their first factory. The second battery plant will aim to go into operation in 2027 with an initial production capacity of 34 gigawatt hours (GWh) a year. The first factory aims to have an annual production of 33GWh, up from the initial target of 23GWh, with operations set to begin in 1Q25. (CN Beta, Just Auto, KED Global, SamMobile, YNA)

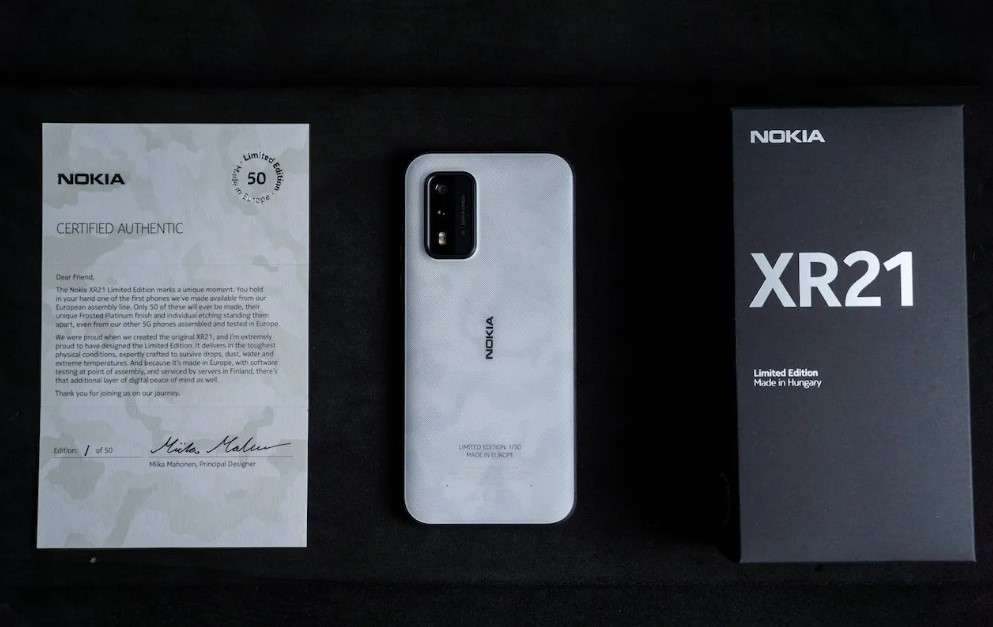

Finnish firm HMD Global, which makes Nokia-branded smartphones, will start building 5G models in Europe. To start, the company is announcing production of the rugged dust and water-resistant Nokia XR21 within the continent, which Enterprise customers can now order. The device will reportedly specifically be made in Hungary. HMD has previously built smartphones that are licensed with the Nokia name in Asian regions, including China and India, using Taiwanese manufacturing partner Foxconn. HMD claims it is the first company to build smartphones in Europe. To celebrate, it’s building 50 limited-edition “Made in Europe” Nokia XR21s with a special frosted platinum color and a special certificate of origin in the box.(CN Beta, TechCrunch, The Verge, HMD Global)

Xiaomi has launched ‘Xiaomi Easy Finance (XEF)’, a digital loan disbursal program for consumers, starting with Redmi 12. Xiaomi is partnering with Axio, a digital consumer financial services player, for a strategy alliance to privude users with a semaless and hassle-free smartphone ownership experience; and Trustonic, a trusted leader in security and services. Under the XEF program, customers would be able to own a Redmi smartphone by enjoying benefits of instant approvals and a convenient digital process. It offers consumers the opportunity to own Redmi smartphone siwth no-cost EMI options. (Gizmo China, Hindustan Times, Economic Times)

Luca Rossi, senior vice resident at Lenovo and president of its Intelligent Devices Group (IDG), has said the company has committed to a net zero emission policy by 2050, and analyzing the components used in its hardware is part of the equation. He has further added that on repairability, they have a plan that by 2025 more than 80% of the repair parts will be repaired again so that they they enter into the circular economy to reduce the impact to the environment. (GizChina, The Verge, The Register)

TF Securities analyst Ming-Chi Kuo latest survey indicates that shipments of Meta’s HMD (head-mounted display) / metaverse hardware continue to decline significantly, suggesting that continued downsizing of the HMD / metaverse business may be of limited help in mitigating losses. The original shipment forecast for Quest 3 in 2H23 was set at over 7M units. However, due to anticipated weak demand, the current shipment forecast for 2H23 has been cut to between 2–2.5M units, with shipments in 2024 estimated at around 1M units. Quest series shipments are expected to decline further in 2023, dropping about 50% YoY to 3.5M units. There’s also a possibility of a YoY decrease in shipments for 2024. The new Ray-Ban Meta Smart Glasses are forecast to ship only about 1.5M units over the entire lifecycle. It is lower than the initial target of 2M units for its predecessor, the Ray-Ban Stories Smart Glasses. The Ray-Ban Stories Smart Glasses ended up shipping only about 300K–400K units, significantly below expectations. More worryingly, the actual number of active users of Ray-Ban Stories Smart Glasses was less than 50K. (CN Beta, Medium, Twitter)

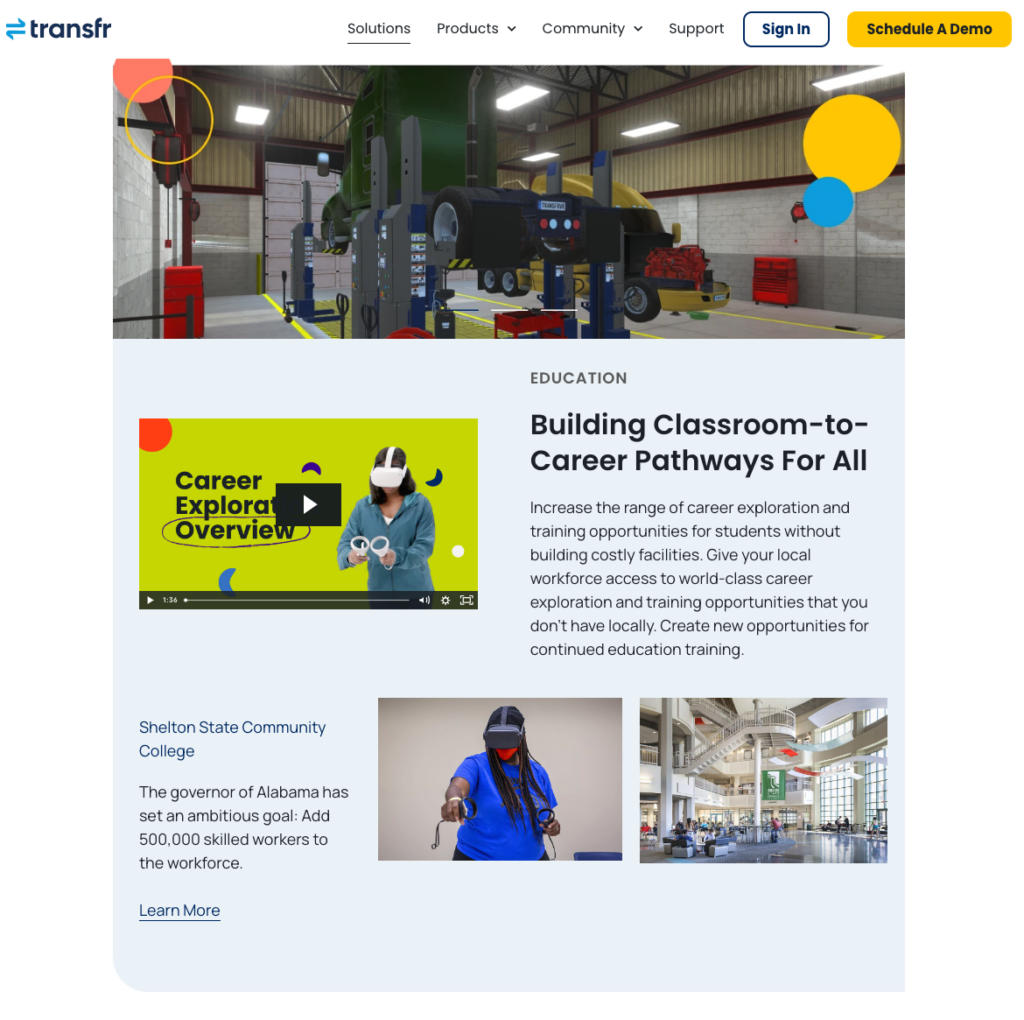

Transfr, an emerging leader in virtual reality-based skills training for middle-skilled careers, has announced a USD40M investment. The Series C growth capital investment round was led by ABS Capital to further develop Transfr’s virtual reality (VR) simulation and training platform and to expand its programs to accommodate its rapidly growing customer base, which has more than doubled year over year from 2019-2023. The round brings Transfr’s total raised to USD90M, and CEO and founder Bharani Rajakumar says that it will be put toward building out Transfr’s executive team, scaling its platform and investing in the creation of new training simulations that cover a wider range of skills and scenarios. (TechCrunch, Transfr)

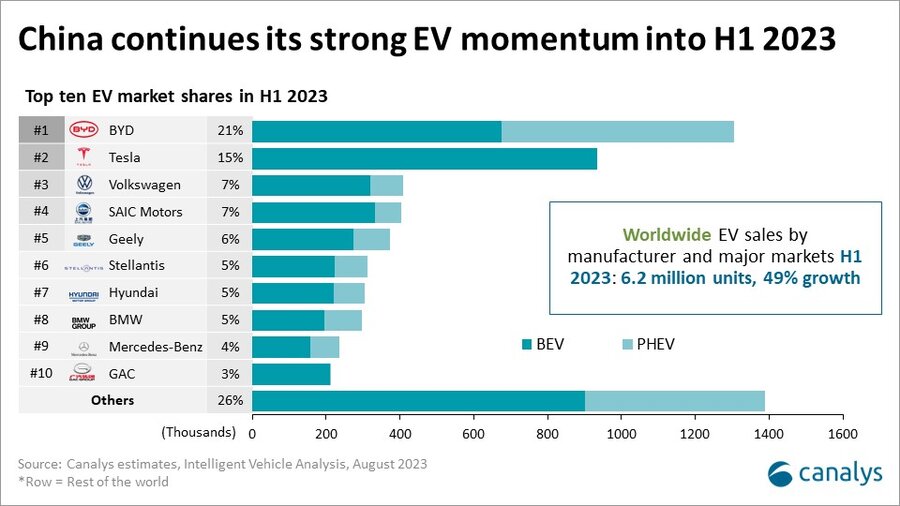

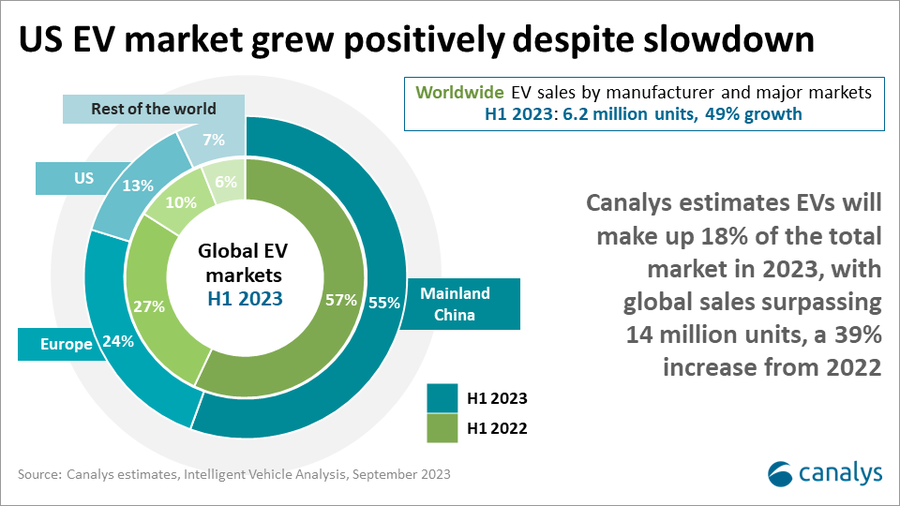

Canalys’ latest research shows worldwide sales of electric vehicles (EVs) grew by 49% to 6.2M units in 1H23. EVs constitute 16% of the global light vehicle market, marking a significant increase of 12.4% from 1H22. The 1H23 saw strong growth in the EV market, reflecting increasing EV popularity. Mainland China was by far the largest EV market, with 55% of global EV sales in H1 2023, a total of 3.4M units. This represents 31% of all light vehicle shipments in the region, up from 15% in the full year 2021. China’s growth rate in 2H23 stood at 43%, a notable decrease from the extraordinary 118% seen in 1H22. The end of Mainland China’s EV support scheme caused disruption, uncertainty, and a price war. (Canalys)

Mitsubishi Motors has reportedly decided to withdraw from automobile production in China. The company has started final withdrawal talks with China’s Guangzhou Automobile Group (GAC), a major automaker with which Mitsubishi has a joint venture. The JV, known as GAC Mitsubishi Motors, was launched by GAC, Mitsubishi Motors and trading house Mitsubishi in 2012, focusing on SUV sales in China. GAC Mitsubishi Motors has a factory in Hunan province. The company halted production in Mar 2023; it will not resume operations. The Hunan plant is Mitsubishi’s only factory in China. As it withdraws from China, Mitsubishi will devote resources to Southeast Asia and Oceania, regions that account for about a third of Mitsubishi’s consolidated sales. (CN Beta, NTD, Asia Nikkei, Reuters)

SoftBank CEO Masayoshi Son said he believes artificial general intelligence (AGI), artificial intelligence that surpasses human intelligence in almost all areas, will be realised within 10 years. Son said he believes AGI will be 10 times more intelligent than the sum total of all human intelligence. He noted the rapid progress in generative AI that he said has already exceeded human intelligence in certain areas. Son has spoken of the potential of AGI – typically using the term “singularity” – to transform business and society for some years, but this is the first time he has given a timeline for its development. He also introduced the idea of “Artificial Super Intelligence” at the conference which he claimed would be realised in 20 years and would surpass human intelligence by a factor of 10,000.(CN Beta, Euro News, Reuters, Entrepreneur)