12-17 #Meaningless : Samsung and ASML have committed to jointly invest KRW1T; Samsung allegedly has its foldable capacity strengthened for Apple; Samsung is allegedly considering a smaller phone than the Galaxy S Ultra; etc.

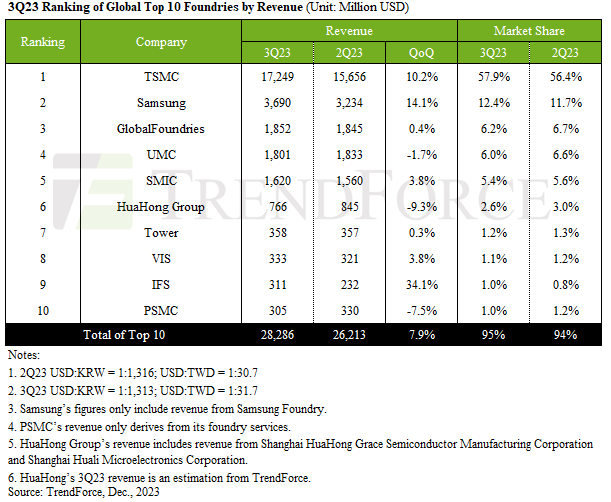

TrendForce’s research indicates a dynamic third quarter for the global foundry industry, marked by an uptick in urgent orders for smartphone and notebook components. This surge was fueled by healthy inventory levels and the release of new iPhone and Android devices in 2H23. Despite persisting inflation risks and market uncertainties, these orders were predominantly executed as rush orders. Additionally, TSMC and Samsung’s high-cost 3nm manufacturing process had a positive impact on revenues, driving the 3Q23 value of the top ten global foundries to approximately USD28.2B—a 7.9% QoQ increase. Looking ahead to 4Q23, the anticipation of year-end festive demand is expected to sustain the inflow of urgent orders for smartphones and laptops, particularly for smartphone components. Although the end-user market is yet to fully recover, pre-sales season stockpiling for Chinese Android smartphones appears to be slightly better than expected, with demand for mid-to-low range 5G and 4G phone APs and continued interest in new iPhone models. This scenario suggests a continued upward trend for the top ten global foundries in 4Q23, potentially exceeding the growth rate seen in 3Q23. (TrendForce, TrendForce)

Samsung Electronics and ASML have committed to jointly invest KRW1T (USD760M) in establishing a cutting-edge research and development (R&D) facility in South Korea. This strategic move, sealed with a memorandum of understanding (MOU) at ASML’s Veldhoven headquarters, aims to propel the development of advanced memory chips leveraging ASML’s state-of-the-art extreme ultraviolet (EUV) equipment. SK Hynix is also part of the semiconductor alliance, signing an MOU with ASML to develop hydrogen gas recycling technology for EUV machines, aiming to reduce power consumption and costs significantly.(Gizmo China, SCMP, Bloomberg, CNBC)

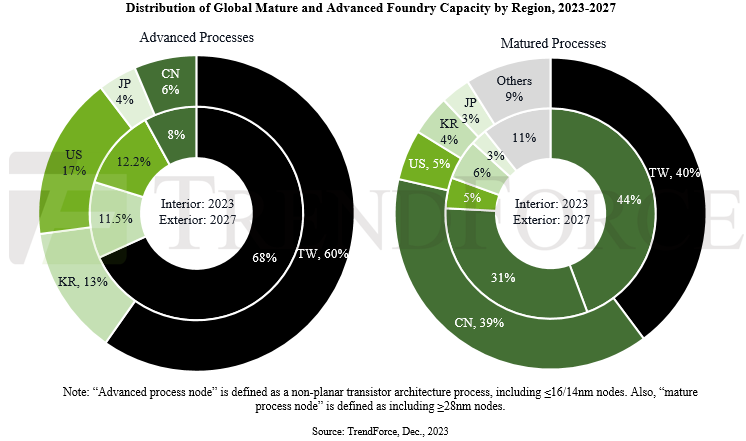

TrendForce’s latest findings reveal that as of 2023, Taiwan holds approximately 46% of global semiconductor foundry capacity, followed by China (26%), South Korea (12%), the US (6%), and Japan (2%). However, due to government incentives and subsidies promoting local production in countries like China and the US, the semiconductor production capacities of Taiwan and South Korea are projected to decrease to 41% and 10%, respectively, by 2027. In advanced manufacturing processes (including 16/14nm and more advanced technologies), Taiwan leads with a 68% global capacity share in 2023, followed by the US (12%), South Korea (11%), and China (8%). Meanwhile, Taiwan holds nearly 80% when it comes to EUV generation processes (such as 7nm and beyond). China is focusing aggressively on mature process technologies (28nm and older), particularly in response to export controls on advanced equipment by the US, Japan, and the Netherlands. By 2027, China’s share in mature process capacity is expected to reach 39%, with room for further growth if equipment procurement proceeds smoothly. (TrendForce, TrendForce)

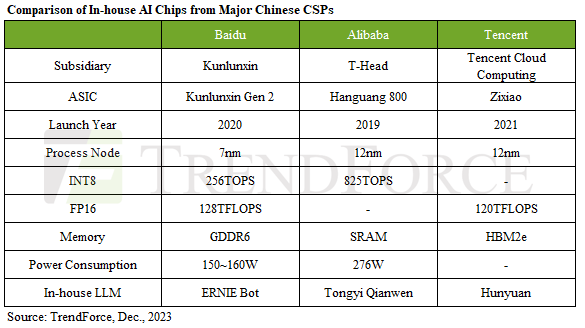

Chinese CSPs like Baidu and Alibaba are actively investing in autonomous AI chip development. Baidu developed its first self-researched ASIC AI chip, Kunlunxin, in early 2020, with its second generation scheduled for mass production in 2021 and the third expected to launch in 2024. Post-2023, Baidu aims to use Huawei’s Ascend 910B acceleration chips and expand the use of Kunlunxin chips for its AI infrastructure. After Alibaba’s acquisition of CPU IP supplier Zhongtian Micro Systems in Apr 2018 and the establishment of T-Head Semiconductor in Sept 2018, the company began developing its own ASIC AI chips, including the Hanguang 800. TrendForce reports that T-Head’s initial ASIC chips were co-designed with external companies like GUC. However, after 2023, Alibaba is expected to increasingly leverage its internal resources to enhance the independent design capabilities of its next-gen ASIC chips, primarily for Alibaba Cloud’s AI infrastructure. (TrendForce, TrendForce, CN Beta)

Nvidia CFO, Colette Kress, recently hinted again that the next-gen chips might be outsourced to Intel. Kress highlighted that Nvidia’s current data center GPUs designed for AI and high-performance computing (HPC) are predominantly outsourced to TSMC. However, in the previous generation, Nvidia’s gaming GPUs were mainly entrusted to Samsung for fabrication. According to Sedaily, Samsung’s foundry was responsible for manufacturing Nvidia’s GeForce RTX 30 series gaming GPUs based on the Ampere architecture. Speaking of foundry partners for AI products, Nvidia anticipates that TSMC will remain a crucial foundry partner for producing AI Hopper H200 and Blackwell B100 GPUs. Any additional orders might be entrusted to Samsung.(CN Beta, TrendForce, Hot Hardware)

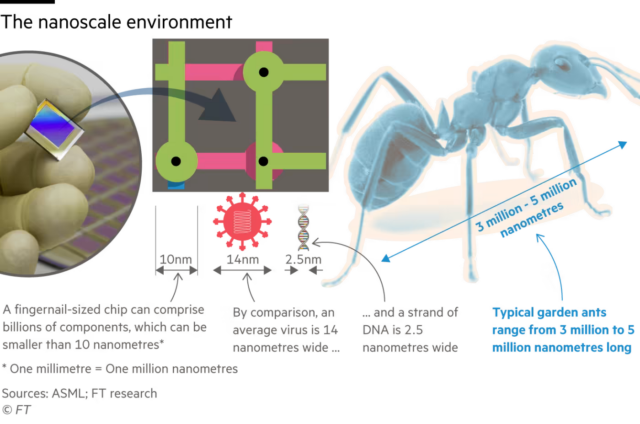

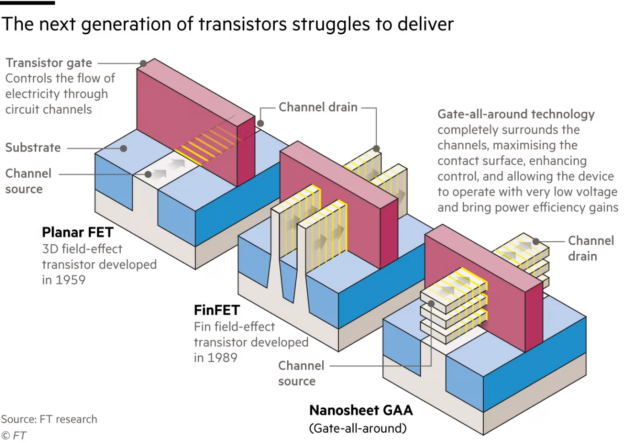

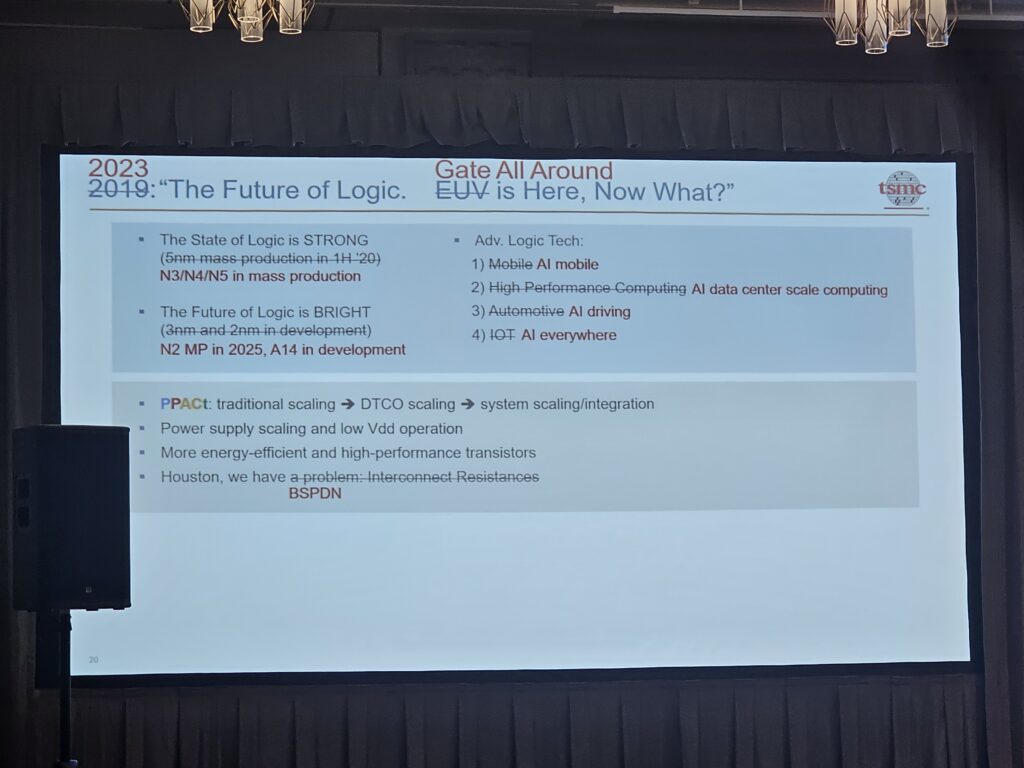

TSMC has reportedly shown the process test results for its “N2” (2nm) prototypes to some of its biggest customers, including Apple and Nvidia. Samsung is allegedly offering cut-price versions of its latest 2nm prototypes in an effort to attract the interest of big-name customers including Nvidia. Intel has also made bold claims about producing its next generation of chips by the end of 2024. TSMC, which has said that mass production of N2 chips will begin in 2025, typically launches the mobile version first, with Apple as its lead customer. Versions for PC and then high-performance computing chips designed for higher power loads will come later. TSMC has indicated that its N2 technology development was “progressing well and on track for volume production in 2025, and will be the most advanced semiconductor technology in the industry in both density and energy efficiency when it is introduced”. (Phone Arena, Financial Times, Ars Technica)

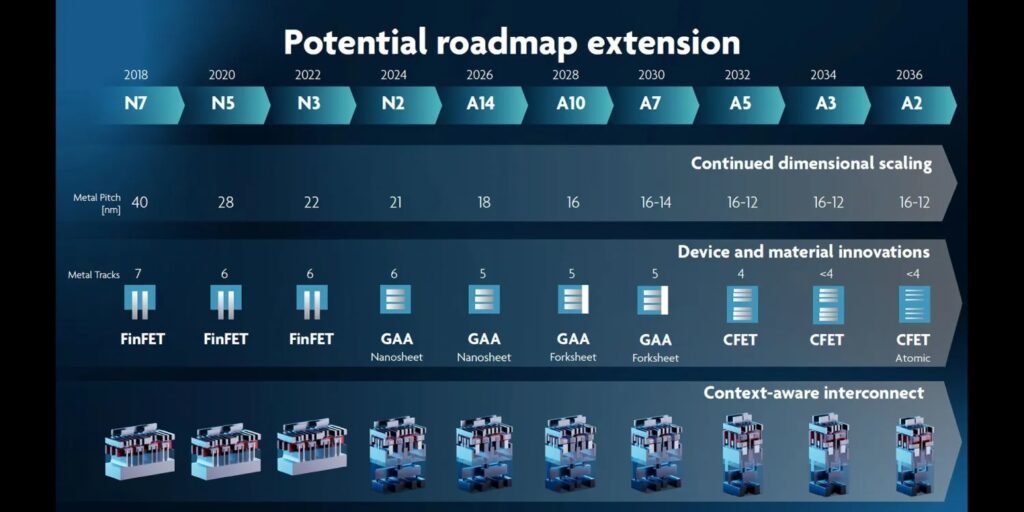

Development of TSMC’s 1.4nm-class manufacturing technology is well underway, according to the company. TSMC has also re-emphasized that mass production using its 2nm-class fabrication process is on track for 2025. TSMC’s 1.4nm production node is officially called A14. For now, TSMC has not disclosed when it plans to start high-volume manufacturing (HVM) on A14 and its specifications, but with N2 scheduled for late 2025 and N2P set for late 2026, it is reasonable to guess that A14 is coming after that (2027-2028). When it comes to features, A14 is unlikely to adopt vertically-stacked complementary field effect transistors (CFETs), although TSMC is exploring the technology. Therefore, A14 will probably rely on the company’s 2nd or 3rd generation gate-all-around FETs (GAAFETs) — just like N2 nodes. (CN Beta, 9to5Mac, Tom’s Hardware, Twitter)

Samsung Display’s A Business Team, which handles demand from Apple, allegedly has its foldable capacity strengthened. Samsung Display has reorganized its Apple business team to improve the efficiency of its foldable display development. Samsung is focused on strengthening its capabilities to respond to Apple’s foldable display needs. Allegedly, both Samsung Display and LG Display are working on projects for Apple’s foldable devices. Among these projects may be a panel that is 20.25”. Apple has been reportedly working on foldable devices as early as 2016. (Android Authority, The Elec, The Elec)

Apple is reportedly gearing up to bring advanced OLED screens to iPads, with high-end iPads expected to feature the technology by 2024. Apple is primarily focusing on incorporating OLED displays into its devices, and the company’s plans for foldable devices remain uncertain. The production for a new MacBook Air model with an OLED screen is slated to begin in 2H25 at the earliest. Apple has allegedly “started evaluating the possibility of making foldable iPads” once the switch to OLED is complete. (Apple Insider, Asia Nikkei, 9to5Mac, CN Beta)

TrendForce’s Senior Research Vice President, Eric Chiou, has mentioned that the next-generation Apple Watch panel would use Micro LED as the display technology, with a size larger than the current Apple Watch Ultra at 2.12”. The product will have two key suppliers: German LED giant ams OSRAM, which will exclusively supply Micro LED chips smaller than 10x10um, and South Korean panel manufacturer LG Display, responsible for the chip mass transfer engineering in addition to providing LTPO glass backplates. Chiou pointed out that the adoption of small-sized chips inherently helps compress costs. Considering Apple’s strong bargaining power in the supply chain, he estimated that when the product is launched in 2026, the cost of the Micro LED display panel could be controlled below USD120, equivalent to 2.5-3 times the current price of OLED panels—a reasonable range for a new technology. (MacRumors, TrendForce, CN Beta)

Visionox has officially announced that the first module of Visionox’s ViP AMOLED mass production project was successfully lit. ViP stands for “Visionox intelligent pixelization” and is a metal-mask-free RGB self-aligning pixelization technology. ViP technology has the characteristics of no fine metal mask (FMM), independent pixels, and high precision. It is claimed to increase the effective light-emitting area (aperture ratio) of AMOLED from the traditional 29% to 69%. It can also Increase the pixel density to more than 1700 ppi, and use Visionox Tandem stacked devices to achieve 6 times the device life or 4 times the brightness compared to FMM AMOLED. (CN Beta, IT Home)

Honor’s flagship smartphone reportedly offers a 160Mp periscope telephoto camera. Higher-resolution sensors on periscope and telephoto cameras can enable much better long-range zoom in theory, owing to all those extra pixels delivering increased detail. (Android Authority, Weibo)

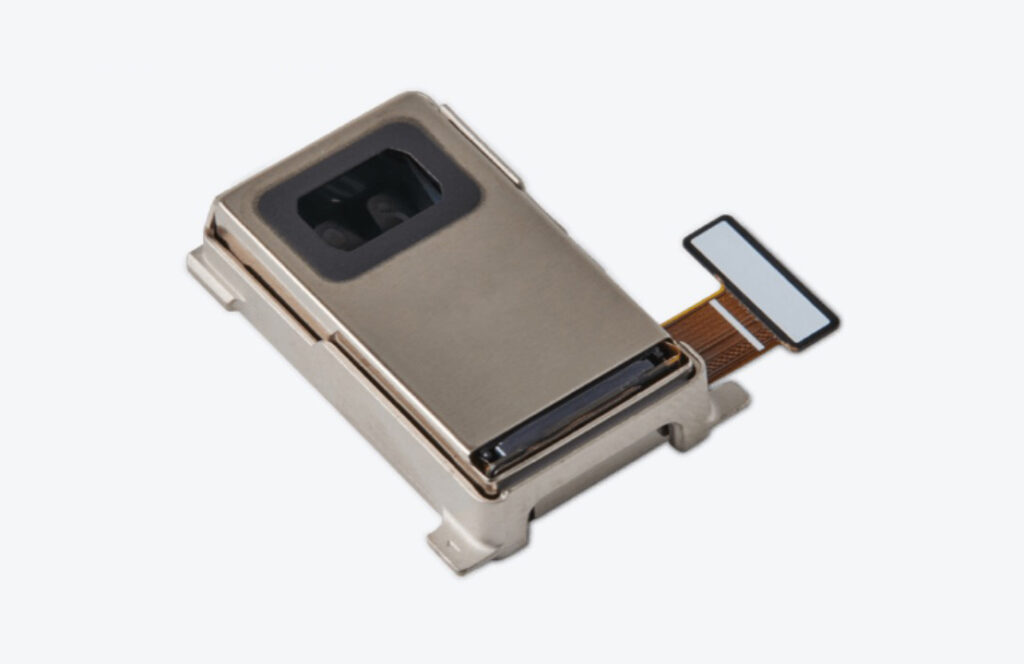

LG Innotek is expected to see its share in folded zoom OIS actuator in Apple’s supply chain grow in 2025 as the iPhone maker is expected to apply the technology to two models in the iPhone 16 series. Apple has applied folded zoom to only the iPhone Pro Max model in its latest iPhone 15 series. LG Innotek is the sole supplier of the modules. Besides modules, for actuators used with them, LG Innotek has around 70% market share while compatriot Jahwa Electronics holds around 30%. For iPhone 15, both South Korean companies struggled to secure production yields but this has improved over time since the phones launched. This means Apple will most likely place more orders to LG Innotek, which it seems to rely on more than Jawha when it comes to yield, to make sure production of iPhone 16 is not disrupted. Jawha spent KRW191B in 2022-2023 to expand its ball guide actuator production capacity, but it has accrued KRW51.9B in operating loss in 2023 up to 3Q23. Jawha co-developed its ball guide actuator technology with Samsung Electronics and Samsung Electro-Mechanics. It still supplies them also to Samsung.(The Elec)

According to Haitong Securities analyst Jeff Pu, Apple iPhone 17 Pro Max will likely feature a 48Mp telephoto lens. Focused on Apple supplier Largan Precision, Pu said the iPhone 17 Pro Max’s upgraded 48Mp Telephoto lens will be optimized for use with Apple’s upcoming Vision Pro headset, set to be released in the U.S. in early 2024. Pu did not provide any additional details about the lens, or how it will interface with the Vision Pro. (CN Beta, MacRumors)

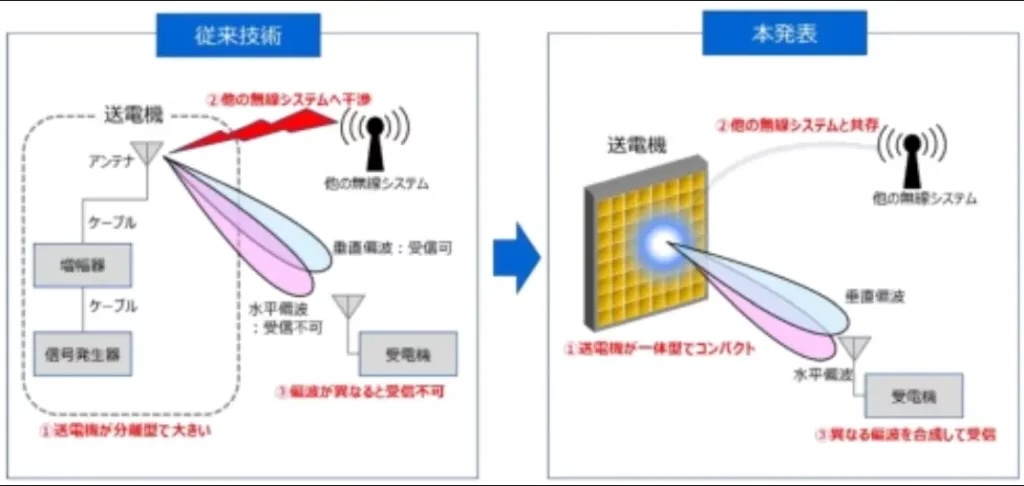

Toshiba is breaking new ground in the realm of wireless power supply systems with the utilization of microwaves to transmit electricity over considerable distances. envisions commercializing this ground-breaking technology after 2025, opening doors to a future where sensors and cameras can be powered without relying on conventional batteries. One notable aspect of Toshiba’s wireless power supply system lies in its ability to detect Wi-Fi signals, and sending a microwave beam in that direction. What sets Toshiba’s technology apart is its claim to be the sole system globally capable of seamlessly coexisting with both wireless LAN and power supply system radio waves. It mitigates the concerns related to radio interference that have plagued similar technologies. (IT Home, Gizmo China)

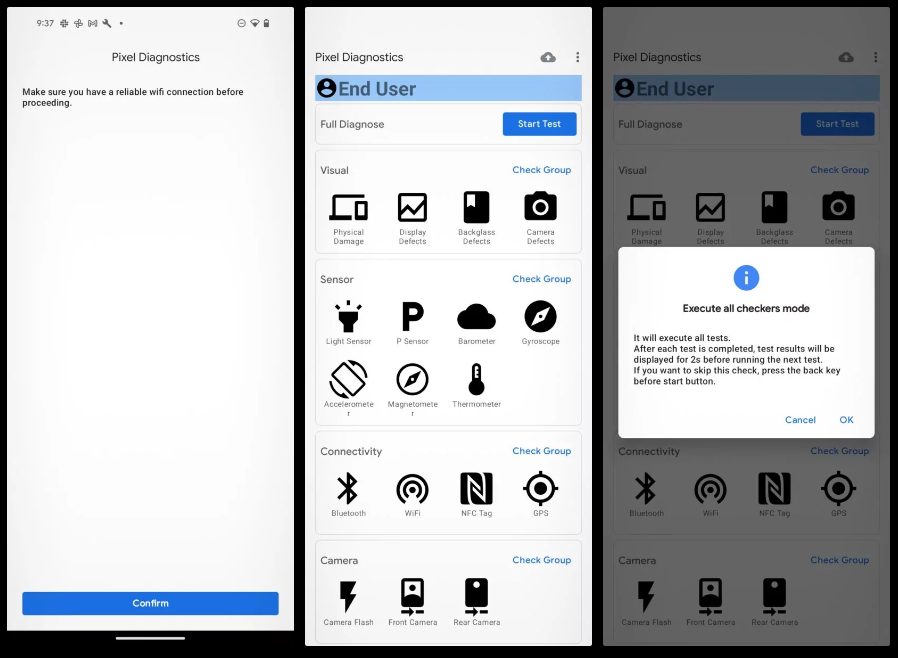

Google has introduced a new Pixel Diagnostic app for Pixel phones. The app can be accessed through the Phone app and allows users to test their devices for issues before and after repairs. To access the Pixel Diagnostic app, user need to dial *#*#7287#*#* in the Phone app. Before proceeding with the diagnostic tests, a reliable Wi-Fi connection is needed. A screen that lets user perform a full diagnostic or check Pixel for specific issues with grouped diagnostic tests is shown. Google says the Pixel Diagnostic app is available for all Pixel phones in the US, UK, Canada, Australia, and European countries or regions where Pixel devices are sold.

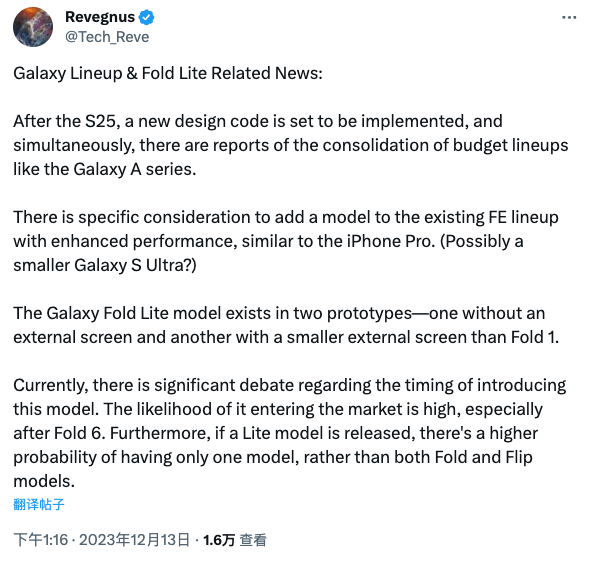

Samsung is allegedly considering a smaller phone than the Galaxy S Ultra but with a similar feature set. The combination of higher-end specs and a smaller form factor could help Samsung compete with Apple’s iPhone Pro models. This model could be added to the Galaxy FE lineup. Samsung will reportedly change the design language of all its smartphones after the launch of the Galaxy S25 series. It means that starting with the Galaxy S26, we could see a drastically different design on Samsung phones. Samsung is reportedly also working on a cheaper Galaxy Z Fold phone. Currently, there are rumored to be two prototypes the company is working on. One of those models doesn’t have an external screen, while the other has a very small cover display. It is expected to be launched after the Galaxy Z Fold6. (Android Headlines, Naver, Twitter, SamMobile)

Foxconn plans to invest an additional INR139.11B (USD1.67B) in India’s Karnataka state. Foxconn is responsible for assembling approximately 70% of iPhones globally and renowned as the largest contract manufacturer worldwide, is steadfast in diversifying production beyond China. This pivot comes in response to disruptions caused by the COVID-19 pandemic and escalating geopolitical tensions. With this recent infusion of funds, Foxconn’s investment in the facility is set to reach around USD2.7B, solidifying its position as a pivotal element in the company’s manufacturing landscape in India. (Apple Insider, Bloomberg, Mint, Buisiness Today, Reuters, RFI, CN Beta)

Samsung’s upcoming Galaxy S24 series will be Samsung’s first phone with built-in AI (artificial intelligence) and LLM (Large Language Model) capabilities. President of Samsung MX (Mobile eXperience), TM Roh allegedly wants that definition to be something other than “AI Phone”. the MX division is on a quest to find the perfect definition for whatever the Galaxy S24 is to the mobile evolutionary ladder.(SamMobile, Phone Arena, iNews)

Signify, the company that owns smart lighting brands Philips Hue and WiZ, is restructuring in the face “of ongoing market volatility and uncertainty”. Signify has announced a “new customer-centric organization and structural cost reductions”. This appears to signal that the company is focusing more effort on products that consumers and businesses can buy and less on making products for other manufacturers and specialty lighting applications like projectors and lamp electronics.(CN Beta, The Verge, Android P0lice, Signify, Hueblog)

General Motors (GM) head of product for infotainment, Tim Babbitt, blames safety for why CarPlay and other third-party systems needed to go. Babbitt thinks that the systems provided by Apple and Google are unreliable and force users to seek out their device to complete a task while driving. Babbitt claims GM’s solution cuts the smartphone from the equation entirely, and is therefore safer. According to Babbitt, CarPlay and Android Auto have stability issues that manifest themselves as bad connections, poor rendering, slow responses, and dropped connections. And when CarPlay and Android Auto have issues, drivers pick up their phones again, taking their eyes off the road and totally defeating the purpose of these phone-mirroring programs. Solving those issues can sometimes be beyond the control of the automaker. (Apple Insider, Motor Trend)

Apple, Visa and Mastercard have been hit with a new proposed class action that accuses them of conspiring to thwart competition for point-of-sale payment card network services, causing merchants to pay artificially higher fees for credit and debit transactions. In a complaint filed in East St. Louis, Illinois, federal court, beverage retailer Mirage Wine & Spirits said Apple struck unlawful agreements with Visa and Mastercard to refrain from competing with the two credit card companies. (CN Beta, 9to5Mac, Reuters)