12-28 #Calling : Huawei’s first overseas factory will be completed in France; ASML has shipped first High-NA EUV to Intel; Xiaomi’s first EV SU7 is unveiled; etc.

The Deputy General Manager of Huawei France, Minggang Zhang, has revealed Huawei’s first overseas factory will be completed in the northeastern Alsace region of France, in Brumath in Bas-Rhin. Huawei is investing EUR200M in the project. Instead of smartphones, this factory will produce components for 4G and 5G base stations, including chipsets and motherboards. Huawei entered France in 2003 and currently has 6 R&D centers and 1 global design center in Paris, providing nearly 10,000 job opportunities. (CN Beta, SCMP, TechNode, IT Home)

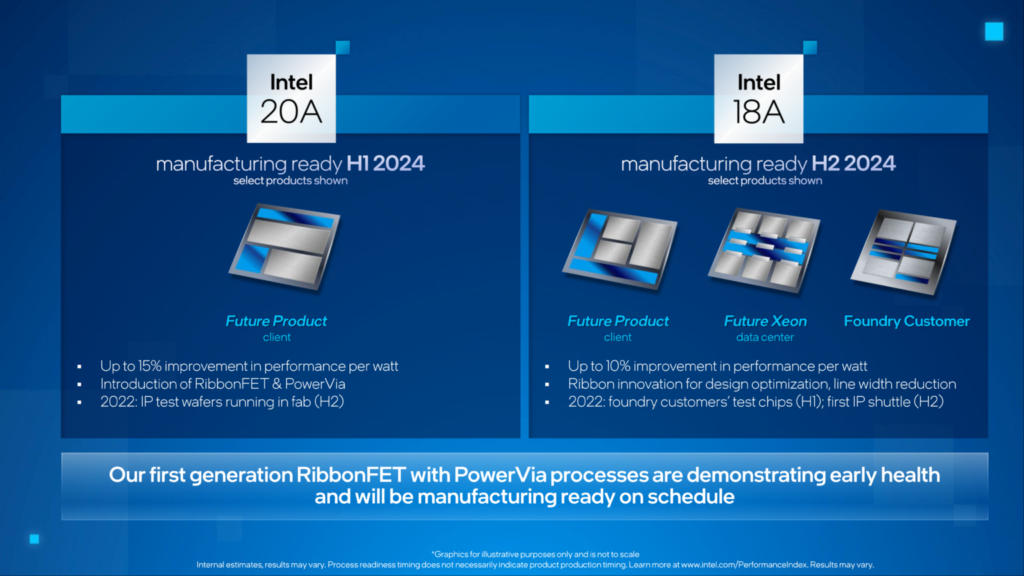

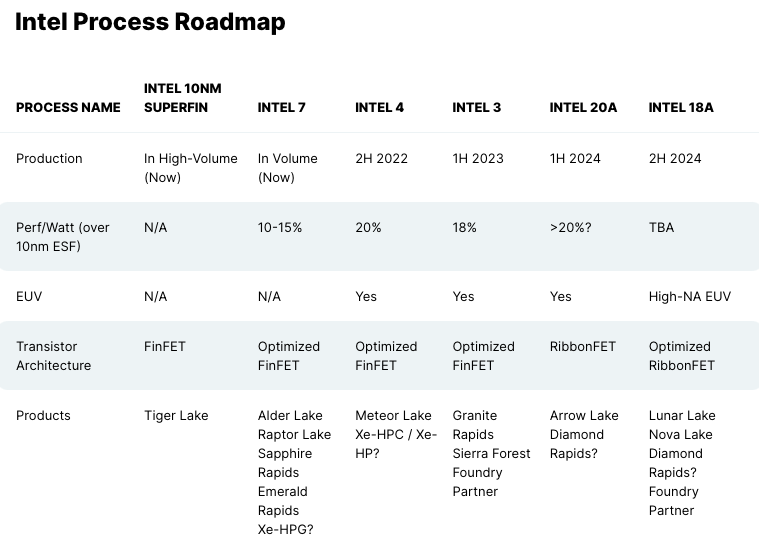

Intel’s Senior VP, Sanjay Natarajan, has disclosed that Intel is all set to initiate production for its 20A (2nm process) in 2024. The company expects to achieve manufacturing readiness for 20A within 1H24 as planned with Arrow Lake being the lead product which is expected to launch in 2H24. Intel Vice President John Guzek, has also confirmed that the development line of the Glass Substrate technology for next-gen chips will become operational in 2025 so we can expect chips utilizing the new solution in the second half of this decade.(CN Beta, IEEE, WCCFtech, Nikkei)

Intel has taken the jobs away from 311 California workers in the run-up to Christmas, according to the latest data available from the West Coast state’s Employment Development Department WARN filings. The redundancies are set to affect 235 workers in the chipmaker’s Folsom offices, as well as 76 from other Santa Clara-based workspaces. In all cases, workers have been given until the end of the month, and the end of 2023, before they have their contracts cut. (Android Headlines, TechRadar, EDD, The Register)

Samsung Electronics has delayed mass production plans at its new chip plant in Taylor, Texas. Mass production at the upcoming USD17B fab would begin in 2025, according to the President Choi Siyoung of Samsung’s foundry business. Samsung previously said the factory would start production in 2H24 when it announced the investment in 2021. Taiwan Semiconductor Manufacturing Company (TSMC) has postponed production at its new Arizona fab to 2025 from 2024 due to a shortage of experienced construction workers and machine installation technicians. (Android Headlines, Bloomberg, BNN, UDN, Guancha)

Semiconductor industry players Robert Bosch GmbH, Infineon Technologies AG, Nordic Semiconductor ASA, NXP Semiconductors, and Qualcomm Technologies, have formally established Quintauris GmbH. Headquartered in Munich, Germany, the company aims to advance the adoption of RISC-V globally by enabling next-generation hardware development. The formation of Quintauris was formally announced in Aug 2023, with the aim to be a single source to enable compatible RISC-V-based products, provide reference architectures, and help establish solutions to be widely used across various industries. The initial application focus will be automotive, but with an eventual expansion to include mobile and IoT. (CN Beta, Quintauris, Tom’s Hardware, Business Wire)

Canon, one of the world’s major manufacturers of lithography equipment, announced the release of the FPA-1200NZ2C Nano-imprint Lithography (NIL) semiconductor equipment in Oct 2023. Canon’s Semiconductor Equipment Business Manager, Kazunori Iwamoto, explained that nano-imprint lithography involves imprinting a mask with the semiconductor circuit pattern onto a wafer. With a single imprint, complex 2D or 3D circuit patterns can be formed in the appropriate locations. By improving the mask, it might even be possible to produce 2nm chips. Reportedly, Canon’s nano-imprint lithography is capable of producing a minimum 5nm process size. In the 5nm process segment of the advanced semiconductor manufacturing equipment market, currently dominated by ASML’s EUV exposure machines, Canon’s nano-imprint lithography might have the opportunity to narrow the gap. (CN Beta, TrendForce, SmBOM, Canon)

ASML has announced that it had begun shipping the industry’s first extreme ultraviolet (EUV) lithography tool with a 0.55 numerical aperture (High-NA) to Intel. The unit will be shipped from Veldhoven, the Netherlands, to Intel’s site near Hillsboro, Oregon, and will be installed there over the next few months. The machine is so big that it takes 13 huge containers and 250 crates to ship it. It is believed that each High-NA EUV scanner costs somewhere around USD300-400M. High-NA EUV lithography tools equipped with a 0.55 NA (High-NA) lens can achieve a resolution of 8nm, a notable advancement over standard EUV tools with a 0.33 NA (Low-NA) lens that offer a 13nm resolution. High-NA technology are projected to play a crucial role for post 2nm-class process technologies that will either need to use Low-NA EUV double patterning or High-NA EUV single-patterning. (CN Beta, Phone Arena, Digitimes, Tom’s Hardware)

Samsung Electronics and Naver have unveiled their jointly developed artificial intelligence (AI) semiconductor, which has been in development over the past year. Known for its power efficiency being approximately 8 times greater than chips from competitors like Nvidia, this product is expected to be used to power Naver’s mega-scale AI model, HyperCLOVA X. The AI semiconductor developed by Naver and Samsung Electronics was revealed in the form of a Field-Programmable Gate Array (FPGA). FPGA is a semiconductor that allows developers to modify the design primarily used in the production of prototypes before mass production. This semiconductor is specialized for “inference,” the process of producing logical outcomes using new data after an AI model has completed its “learning” phase. (CN Beta, Sammy Fans, Business Korea, Digitimes)

The Bureau of Industry and Security (BIS) under the U.S. Department of Commerce allegedly plans to survey over 100 companies in sectors such as automotive, aerospace, and defense starting Jan 2024 to assess the dependence of U.S. companies on Chinese-made general-purpose semiconductors. Following the survey, the Department of Commerce is expected to initiate the process of imposing tariffs on these Chinese semiconductors. Additionally, measures to ban U.S. defense companies from importing Chinese semiconductors are also being considered. The U.S. Commerce Department’s heightened regulation of the Chinese semiconductor industry has cast a shadow over China’s export front. U.S. companies are likely to reduce their reliance on Chinese semiconductors to avoid the uncertainty of additional regulations. The regulations are seen as directly targeting companies like Yangtze Memory Technologies (YMTC, for NAND), Changxin Memory Technologies (CXMT, for DRAM), and Semiconductor Manufacturing International Corporation (SMIC, as a foundry). In fact, a report from the White House in June 2022 mentioned that American companies like Western Digital and Micron are under direct threat due to YMTC’s aggressive pricing. In contrast, Samsung Electronics and SK hynix are expected to benefit. It is anticipated that U.S. procurement of general-purpose semiconductors will shift towards South Korean products as an alternative to Chinese ones. (CN Beta, WCCFTech, TweakTown, Business Korea, TechNews)

Tesla’s Head of Design Franz von Holzhausen has confirmed that Tesla is working on an inductive wireless charging solution that will enable garage owners to equip their homes with wireless charging pads. The wireless charging pads, internally known as “Project Garfield”, would sit on the floor and would allow Tesla owners to charge the vehicles simply by driving over the pad. This innovation could reduce the reliance on wall chargers and address situations where owners forget to plug in their vehicles overnight. (Gizmo China, Notebook Check)

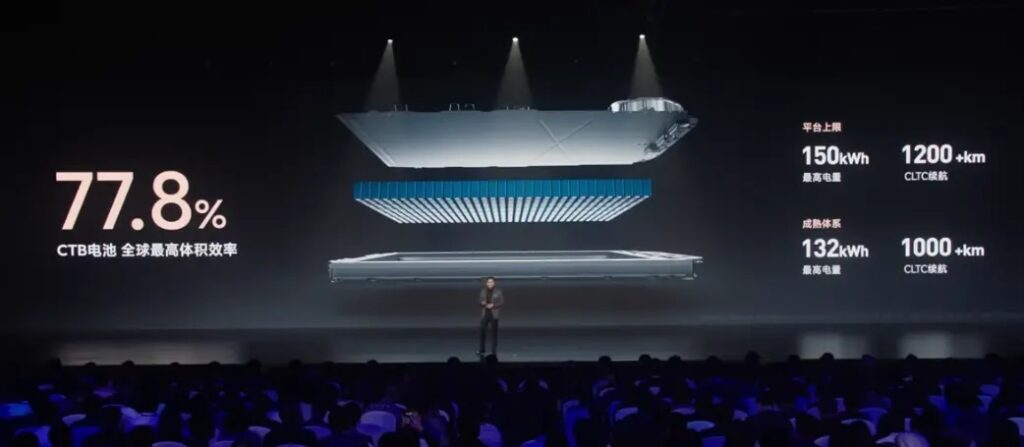

Xiaomi officially releases 800V battery pack. Xiaomi’s 800V battery pack is equipped with CTB integrated body technology and has the world’s highest battery pack volume efficiency of 77.8%. The thickness of the battery pack and bottom plate is only 120mm, which can bring more space to the passenger compartment. At the same time, Xiaomi’s 800V battery pack platform has a maximum power limit of 150kWh, and a CLTC battery life of 1,200+km. However, the cost of such a battery will be very high, which is not conducive to promotion among car owners. Therefore, Xiaomi’s 800V battery pack adopts a mature system in the industry, with a maximum battery capacity of 132kWh, achieving a CLTC endurance of 1,000+km with one battery. (CN Beta, Techgoing, IT Home)

The completion of Russian tech company Yandex’s restructuring is expected to be postponed until early 2024. For more than a year, Yandex and the Kremlin have been engaged in negotiations to try spin off Yandex’s Russian businesses from its Dutch parent company, Yandex NV. The company is aiming to recoup shareholder funds through the sale of its main revenue-generating Russian businesses, such as its search and ride-hailing operations. It then plans to develop four other business lines internationally. (CN Beta, Reuters, Wion)

In Oct 2023, Xiaomi CEO Lei Jun announced HyperOS, which will take over from MIUI when the updates to Android 14 hit. Xiaomi unveils the brand new HyperOS logo. (GSM Arena, Twitter)

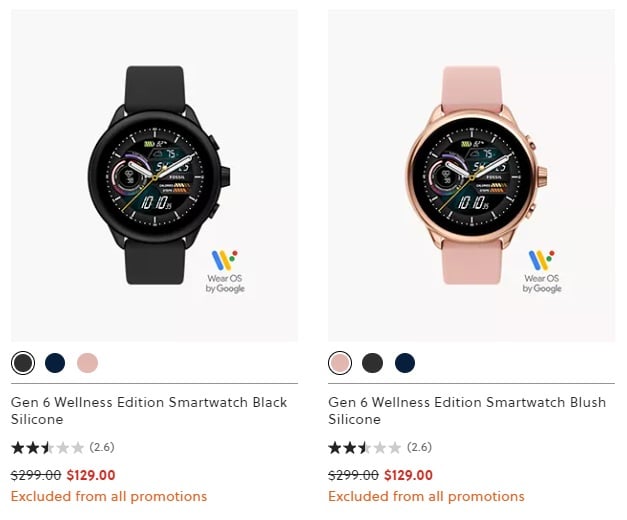

Fossil might have given up on Google’s Wear OS smartwatches. Fossil allegedly will not release another Wear OS-based watch in the future. The company’s usual late-summer product launch timeframe has also come and gone without any new devices. Notably, more than 2 years have passed since the launch of Fossil Gen 6, the brand’s latest Wear OS watch. The most recent development for the lineup was the rollout of Wear OS 3.5 update in Nov 2023. The company is purportedly waiting for Qualcomm to release a new Wear OS platform. (Android Headlines, Reddit, 9to5Google)

Meta has announced that it has started rolling out its multimodal AI features to Meta’s Ray-Ban glasses that can tell users about things Meta’s AI assistant can see and hear through the camera and microphones of the glasses. The company CEO Mark Zuckerberg has demonstrated the update where he asked the glasses to suggest pants that would match a shirt he was holding. (The Verge, Meta, Morning Brew, Tom’s Hardware, Instagram)

Early 2023, Microsoft laid off the entire teams behind Windows Mixed Reality, AltspaceVR and MRTK. During that time, Microsoft officially announced that AltspaceVR will be killed and MRTK development will be stopped. However, Microsoft did not provide any information on the future of Windows Mixed Reality. Now Microsoft has revealed that Windows Mixed Reality will be removed from future releases of Windows. As part of this deprecation, the Mixed Reality Portal app, and Windows Mixed Reality for SteamVR and Steam VR Beta will be deprecated. Windows Mixed Reality is now part of both Windows 10 and Windows 11, and you can expect it to be removed in the coming months. (Android Headlines, Microsoft, MSPoweruser)

Sales of VR headsets and AR glasses in the U.S. plummeted nearly 40% to USD664M in 2023, as of 25 Nov 2023, according to data from research firm Circana. That is a much steeper drop than last year, when sales of AR and VR devices slid 2% to USD1.1B. Meta is spending billions of dollars a quarter to fulfill CEO Mark Zuckerberg’s dream of a futuristic virtual world that he calls the metaverse. Meta’s Reality Labs unit, which is developing VR and AR technologies, lost USD3.7B in 3Q23 on sales of USD210M. In total, the division has lost about USD25B since the beginning of 2022. Heading into 2024, the big wild card for the VR market is Apple. Ramon Llamas, IDC research director, said, Apple’s entry next year will bring much needed attention to a small market, but it will also force other companies to compete in different ways. Andrew Boone, an analyst at JMP Securities, said he was initially so impressed by Apple’s Vision Pro demos that he began to worry about Meta’s future in the market. (My Drivers, CNBC, ExtremeTech)

Apple is reportedly continuing work on a new HomePod model that features a curved LCD display. The device, codenamed B720, apparently features the same design as the current HomePod but with a curved, convex LCD screen at the top to display content. Apple is believed to be working to adapt Apple Music and Apple Podcasts to be compatible with the new display, which will show a blurred animation based on the colors of the album art when a song or podcast is playing. The screen could also potentially show important notifications. (MacRumors, CN Beta, 9to5Mac, Twitter)

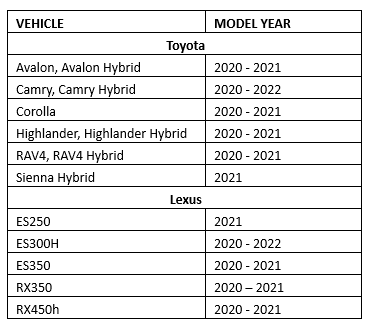

Toyota is conducting a safety recall involving certain 2020-2022 Toyota and Lexus models in the United States. Approximately 1M vehicles are involved in this recall. The subject vehicles have Occupant Classification System (OCS) sensors in the front passenger seat that could have been improperly manufactured, causing a short circuit. This would not allow the airbag system to properly classify the occupant’s weight, and the airbag may not deploy as designed in certain crashes, increasing the risk of injury.(Digital Trends, Toyota)

Bird, a company that operates scooter- and bicycle-sharing operations globally, has filed for bankruptcy, with the aim to sell its United States operations. The Chapter 11 filing will allow Bird, which describes itself as “the largest micromobility operator in North America”, to restructure while the company works to sell off its assets, according to an announcement. For now, the company has entered into a “stalking horse” sale agreement with its lenders, which will establish a minimum value for Bird’s assets. A sale of those assets is expected to happen in the next 3-6 months. (Engadget, CNBC, CNN, PR Newswire, TechCrunch)

Xiaomi Auto’s official website is online, listing several sections such as SU7, super motor, high-voltage platform, super-large die-casting, smart driving, and smart cockpit. Xiaomi SU7 has a length of 4997mm, a wheelbase of 3000mm, and a height of 1440m. It is equipped with Xiaomi’s CATL cells and has a battery capacity of 101kWh. It supports 800V super fast charging, has a cruising range of 220km in 5 minutes, and a CLTC cruising range of 800km. In terms of safety, Xiaomi SU7 has a solid and stable vehicle design, a comprehensive and reliable passive safety system, an innovative armored cage steel-aluminum hybrid body design, and all four core structural parts have been strengthened. 90.1% high-strength steel and aluminum alloy, maximum strength of 2000MPa, torsional stiffness of 51000N·m/deg, passed high standards of 40 crash tests, leading the industry in data standards. Xiaomi SU7 is on the way to mass production and will be officially released on 1H24. (CN Beta, CN Beta, Xiaomi EV, Reuters, CNBC)

Xiaomi founder Lei Jun has revealed that the first phase of Xiaomi’s self-developed intelligent driving technology has a total investment of CNY3.3B, which has been increased to CNY4.7B. The dedicated team has more than 1,000 people, more than 200 test vehicles have been invested, and the test mileage has exceeded 10M kilometers.(CN Beta, East Money)

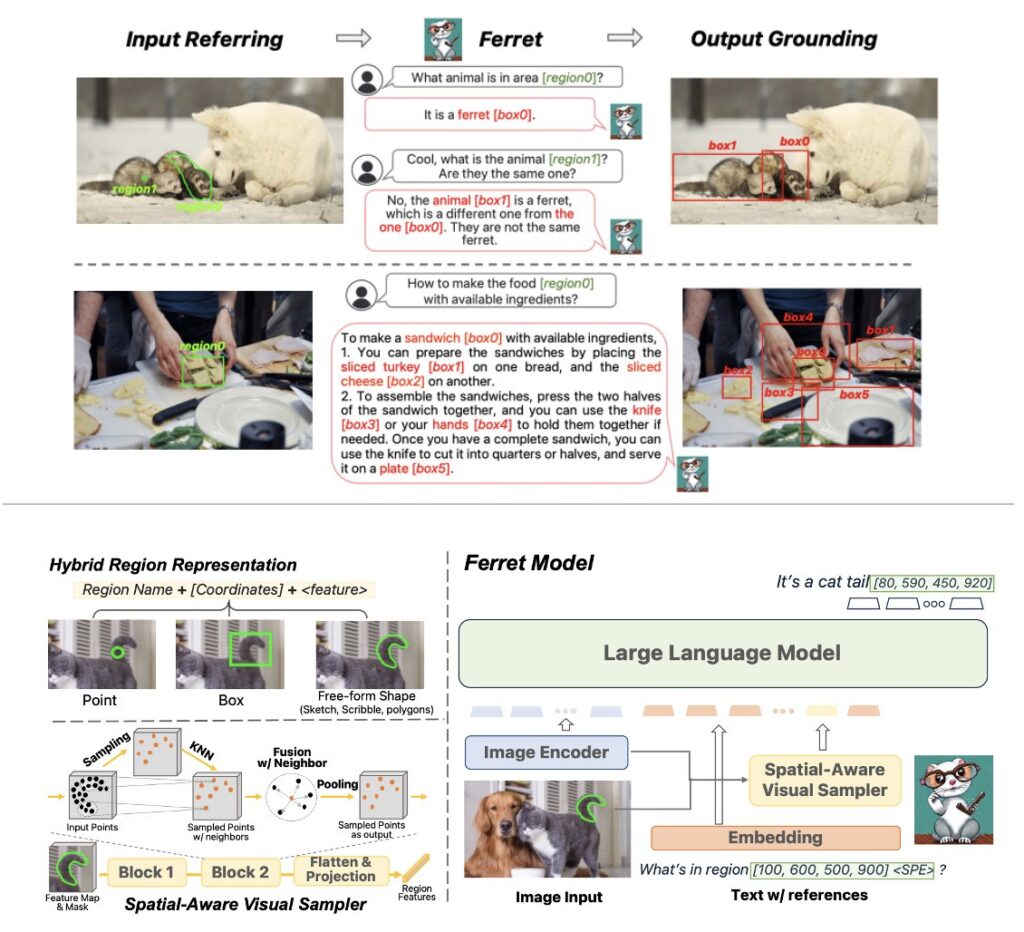

Apple and Columbia University released an open source multimodal LLM, called Ferret. Ferret’s release to open-source is being performed under a non-commercial license, so it cannot be commercialized in its current state. Ferret’s use as being a system that can “refer and ground anything anywhere at any granularity” in an image. It can also do so by using any shape of region within an image. In simpler terms, the model can examine a region drawn on an image, determine the elements within it that are of use to a user in a query, identify it, and draw a bounding box around the detected element. It can then use that identified element as part of a query, which it can then respond to in a typical fashion. (Apple Insider, VentureBeat, Cornell University, Twitter)

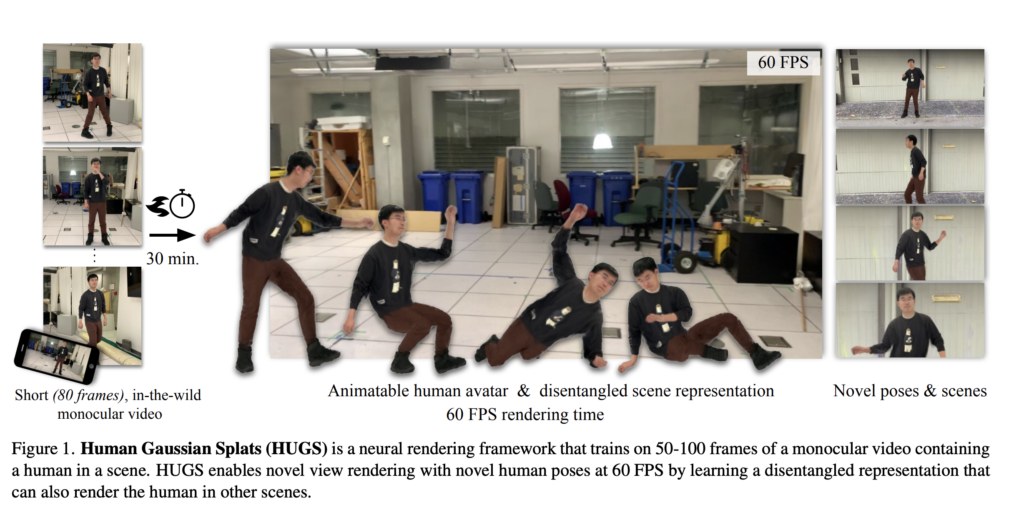

Apple has announced significant strides in artificial intelligence (AI) research through two new papers introducing new techniques for 3D avatars and efficient language model inference. The advancements could enable more immersive visual experiences and allow complex AI systems to run on consumer devices such as the iPhone and iPad. In the first research paper, Apple proposes HUGS (Human Gaussian Splats) to generate animated 3D avatars from short monocular videos (i.e. videos taken from a single camera). Its method takes only a monocular video with a small number of (50-100) frames, and it automatically learns to disentangle the static scene and a fully animatable human avatar within 30 minutes. In the second paper, Apple researchers tackled a key challenge in deploying large language models (LLMs) on devices with limited memory. The proposed system minimizes data transfer from flash storage into scarce DRAM during inference. (Apple Insider, VentureBeat, Arxiv, Arxiv)