12-31 #Happy2024 : ADI has recently issued a price increase notice to its Chinese distributors; Royole Technology has defaulted on its employee wages for a year; Samsung and SK hynix are making strides in commercializing “On-sensor AI” technology for image sensors; etc.

Analog Devices Inc (ADI), a major analog IC manufacturer, has recently issued a price increase notice to its Chinese distributors. The notice indicates an estimated price increase of 10-20%, set to take effect in Feb 2024. ADI stated in the price increase letter that the company places a high value on the reliability of stable component production. Therefore, it will not arbitrarily stop the production of components within a controllable range. To maintain a guaranteed supply for customers, the company will increase prices for certain older product lines to offset the cost pressures of sustaining production. If customers object to the price increase, ADI is committed to providing the best possible component replacement solutions. (My Drivers, TrendForce, LTN)

TSMC is reportedly experiencing a surge in the number of New Tape-Outs (NTOs) for the 3nm family in 2024, with Clients such as MediaTek, AMD, Nvidia, Qualcomm, and Intel. Among the 3nm family, the N3P process, set for mass production in 2H24, is also making significant progress. Rumors suggest that Tesla has been added to the list of customers, with plans to utilize the N3P for the production of next-generation Full Self-Driving (FSD) chips after its launch. Currently, Tesla has placed orders with TSMC for numerous chips related to electric vehicles. For instance, the supercomputer chip “D1” is utilizing TSMC’s 7nm technology along with advanced packaging processes. According to TSMC’s previously disclosed process roadmap, the N3P process is an advanced version within the 3nm family, scheduled for production in 2024. Compared to the N3E, the N3P boasts a 5% improvement in performance, a 5-10% reduction in power consumption, and a 1.04 times increase in chip density.(Gizmo China, TrendForce, Evertiq)

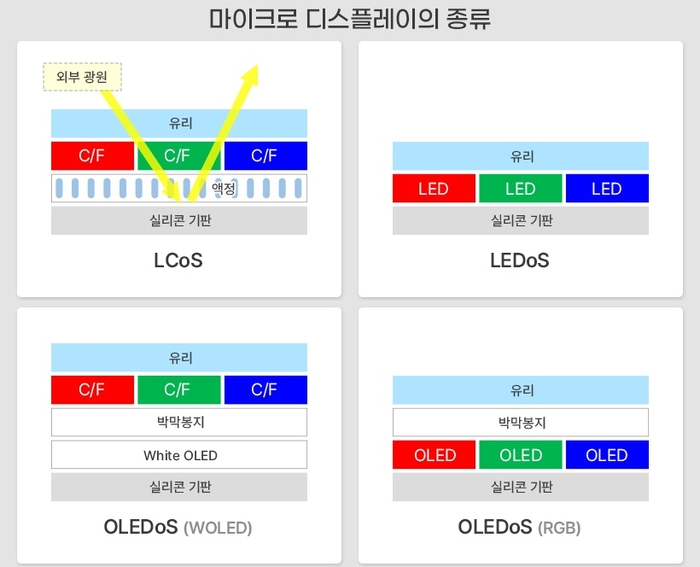

Apple’s second-generation Vision Pro headset will feature more advanced micro-OLED displays that offer higher brightness and improved efficiency, according to market research firm Omdia. Apple is reportedly planning to upgrade the Vision Pro to an RGB OLEDoS display in 2027, a notable improvement over the WOLED with color filter used in the first-generation model. RGB OLEDoS technology produces light and color directly from nearby RGB sub-pixels on a single layer, putting an end to the need for a color filter. This results in significantly higher brightness compared to WOLED and color filter OLEDoS displays, which depend on filtering white light through an RGB color layer. It is also markedly more efficient than WOLED and color filter technology. Samsung is currently the only company capable of supplying RGB OLEDoS displays following its acquisition of eMagin earlier 2023, with the company likely set to take over from Sony in Apple’s supply chain if it proceeds with the upgrade. (My Drivers, MacRumors, Mashable, TechRadar, Live Mint, The Elec, UDN)

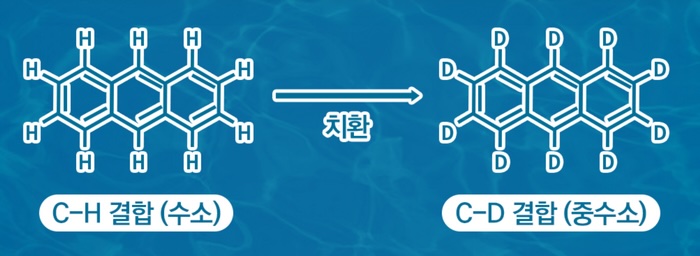

LG Display (LGD) is making significant strides in the application of deuterium to enhance the efficiency and lifespan of OLED panels. Previously, deuterium, a heavy form of hydrogen, was only employed in specific OLED materials, particularly in blue panels. However, LG Display’s latest research and development efforts aim to broaden its use across red, green, and essential OLED material layers. The process, which involves replacing hydrogen with deuterium, has been time-consuming and costly, restricting its use to specific areas. However, the successful application in blue panels has encouraged the company to extend its usage to improve overall panel performance. (CN Beta, OLED-Info, ETNews, Display Daily)

Royole Technology has defaulted on its employee wages for a year. The Employee Rights Protection Committee signed an application for the settlement of the remaining claims by Royole Technology as a demand. The Royole workers have not received the wage for the past 8 months, while the employees haven’t seen it for the past 12 months. Due to the ongoing financial crisis, thousands of company employees have already left the company over the past couple of years. In response, the company said the business has significantly suffered losses and is only able to pay social security deposits. Only 200–300 employees are now left with the company, consisting of engineers who maintain the production line. (Gizmo China, Sina, Sohu, IT Home)

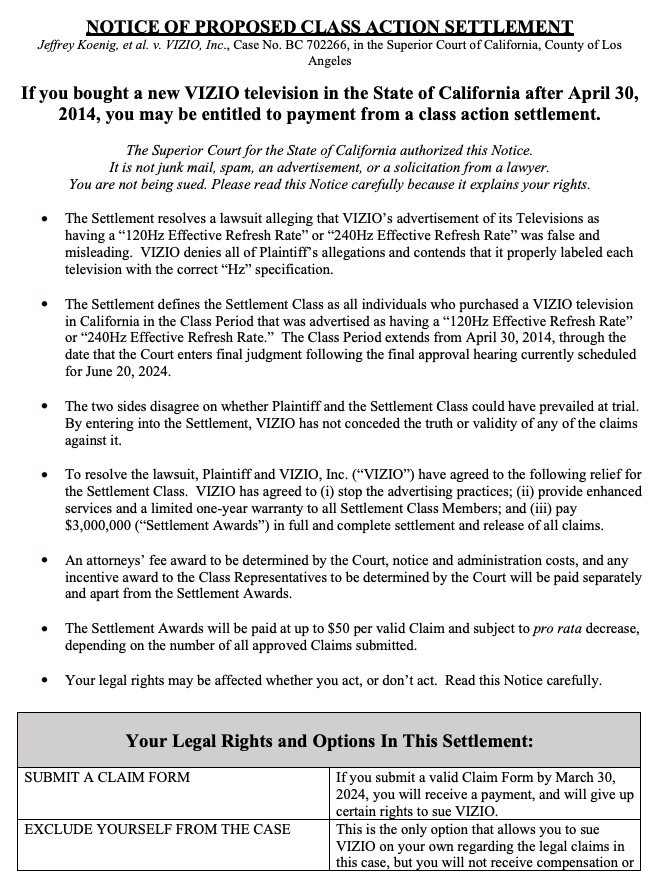

Vizio has agreed to pay out USD3M after a 2018 class action lawsuit alleged that its marketing of 120Hz and 240Hz “effective” refresh rates was “false and deceptive”. Vizio denies that it did anything wrong. The deadline for filing claims is 30 Mar 2024, and requires some sort of evidence of ownership, including proof of purchase or the serial number, to qualify. In addition to paying out for verified claims, Vizio would “stop the advertising practices” and “provide enhanced services and a limited one-year warranty to all Settlement Class Members”. (The Verge, Refresh Rate Class Action)

Samsung Electronics and SK hynix are making strides in commercializing “On-sensor AI” technology for image sensors, aiming to elevate their image sensor technologies centered around AI and challenge the market leader, Japan’s Sony, in dominating the next-generation market. SK hynix’s technology embeds an image sensor onto an AI chip, processing data directly at the sensor level, unlike traditional sensors that relay image information to the Central Processing Unit (CPU) for computation and inference. This advance is expected to be a key technology in enabling evolved Internet of Things (IoT) and smart home services, reducing power consumption and processing time. Samsung has unveiled a 200Mp image sensor with an advanced zoom feature called Zoom Anyplace, which uses AI technology for automatic object tracking during close-ups. Samsung has set a long-term business goal to commercialize “Humanoid Sensors” capable of sensing and replicating human senses, with a road map to develop image sensors that can capture even the invisible by 2027.(Android Authority, SamMobile, Business Korea)

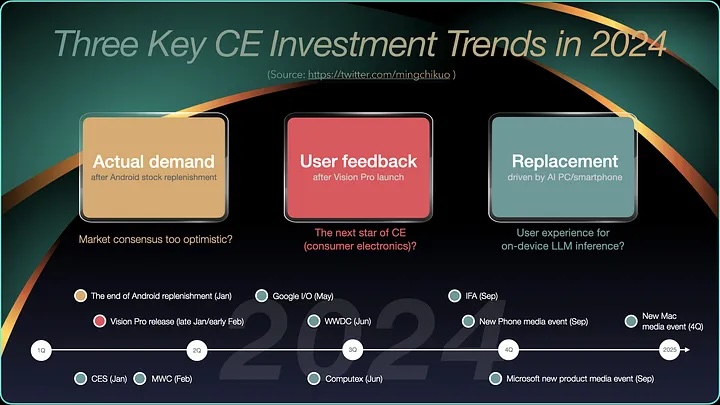

TF Securities analyst Ming-Chi Kuo has disseminated some notes online covering a wide variety of topics for 2024. He indicates the actual demand for Android smartphones after stock replenishment. The current stock replenishment started in May-Jul 2023. After Huawei announced the Mate 60 Pro in late Aug 2023, it increased component purchases due to better-than-expected demand, forcing competitors to follow suit to ensure they had enough components, thereby boosting the momentum of stock replenishment. This stock replenishment will end around Jan 2024. It is important to note that the strong stock replenishment momentum may give the illusion of an improved demand structure. His latest view is slightly different from the market’s optimistic consensus on Android smartphone demand in 2024. The actual demand / order changes after stock replenishment will affect upstream semiconductor and AI smartphone trading sentiment of related stocks. (Phone Arena, Medium, Twitter)

According to TF Securities analyst Ming-Chi Kuo, Information related to AI devices from different vendors may benefit short-term trading sentiment, but the operating system is the core that genuinely dominates the fundamentals of the AI device industry. The mainstream hardware specifications of AI devices in 2024 will include built-in 7–10B LLM (for inference), 40–50 TOPS AI computing power, 10–20 token/s or more inference speed, 8–16GB or more DRAM, etc. Investment opportunities arise from the proof of the user experience created by the above mainstream specifications and the driven specification upgrades. All relevant vendors are expected to focus on promoting AI PC/smartphone as a key point in their 2024 campaigns. (Phone Arena, Medium, Twitter)

According to TF Securities Ming-Chi Kuo, Vision Pro is the most important product for Apple for 2024. Shipments in 2024 are estimated to be approximately 500,000 units. Vision Pro is currently in mass production and will begin mass shipments in the first week of Jan 2024. Vision Pro will most likely hit the store shelves in late Jan or early Feb based on the current mass shipment schedule. If user feedback on Vision Pro is better than expected, it will help strengthen the market consensus that “Vision Pro is the next star product in consumer electronics” and the related supply chain stock price. (Medium, Twitter)

Honor Tech (HTech) is all set to expand its product categories in India. The company is reportedly planning to launch an Honor ecosystem of devices in the country and these include various AIoT products. HTech is also aligned with the government’s vision to make India a manufacturing hub, and is planning to start manufacturing Honor products in the coming year, empowering local businesses and communities at large. HTech is looking at building an end-to-end supply chain in India. The first product on the list could be the Honor Choice Earbuds X5. (Gizmo China, Zee Business, 91Mobiles)

The Chinese company Unitree has announced its first-ever humanoid bipedal robot, the Unitree H1. With a planned price tag of under US$90,000, the H1 is intended to rival other humanoid bots such as those made by Tesla, Figure and Agility Robotics. As far as basic specs go, it stands 1,805 mm tall (71 in), weighs about 47 kg (104 lb) and can carry a payload of up to 30 kg (66 lb). Joints in the hip, knee and ankle give each leg a total of five degrees of freedom, while joints in the shoulder and elbow give each arm a total of four degrees. Unitree’s own M107 motors deliver 360 Nm (266 lb ft) of torque at each joint. Flexible fingers are reportedly in the works. The H1 is able to “see” its surroundings in 360 degrees via a head-mounted Intel RealSense D435i depth-sensing camera and a Livox MID360 LiDAR module. (CN Beta, New Atlas, TrendHunter, CSDN)

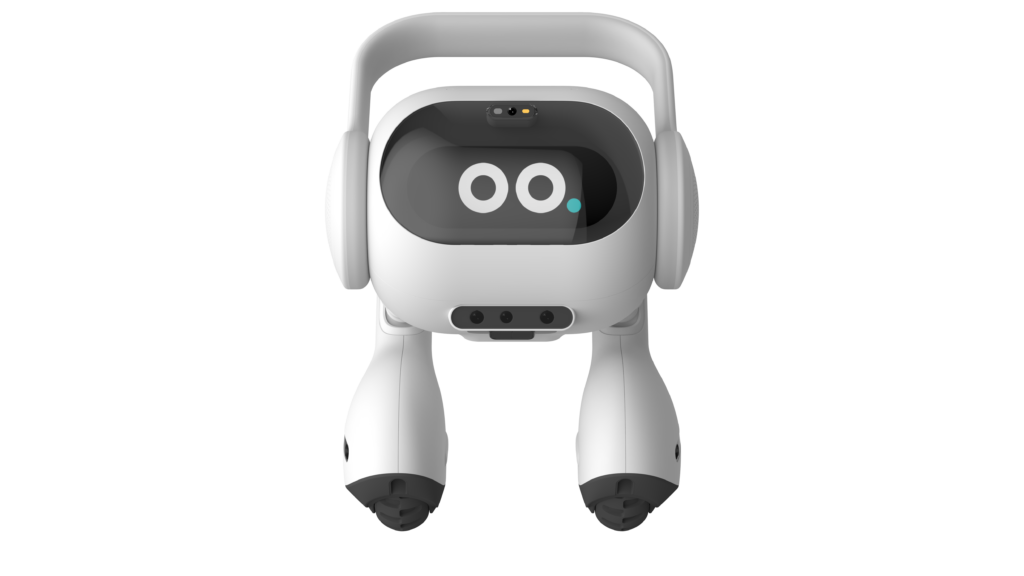

LG has disclosed its smart home AI agent comprising robotic and multimodal capabilities. The device is part of the company’s “Zero Labor Home” vision. The smart home agent has a two-legged wheel design that enables it to move freely in an area all by itself. With its multi-modal technologies, it can verbally interact with people and show emotions through gestures and movements. These movements are possible due to the robot’s articulated leg joints. Additionally, the robot possesses voice and image recognition combined with natural language processing. These enable it to learn and understand the context of conversations and respond to the communicator. (Neowin, Android Headlines, LG)

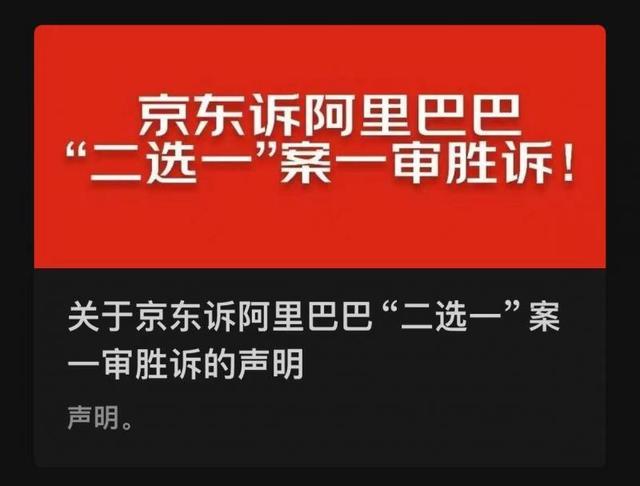

JD.com, a major player in the Chinese e-commerce market, achieved a significant legal victory over its rival Alibaba. A court in Beijing ruled in favor of JD.com, ordering Alibaba to pay a hefty sum of CNY1B (~USD141M) for engaging in unfair market practices. For years, Alibaba had been pressuring online merchants to choose exclusively between its platform and others – a practice known as “picking one from two”. This tactic, while common, was deemed monopolistic and harmful to competition. The ruling against Alibaba is a clear message that such practices will no longer be tolerated. (Gizmo China, SCMP, WSJ, Sina, The Paper)

Alibaba Group’s recent leadership shake-up is a strategic move to reinforce its position as a top player in China’s e-commerce landscape. With the appointment of Eddie Wu Yongming as the head of Taobao and Tmall Group (TTG), Alibaba is not just changing faces; it’s signaling a deeper commitment to integrating advanced technology into its business model. Eddie Wu, who also leads Alibaba’s cloud unit, brings a tech-savvy approach to the company’s e-commerce operations. This change arrives at a critical moment when Alibaba faces intense competition from PDD Holdings, known for its budget-friendly platform Pinduoduo. By emphasizing artificial intelligence and consumer-centric operations, the company aims to streamline its services, potentially leading to lower operating costs for merchants and, subsequently, better margins for Alibaba. This approach is expected to involve algorithm-driven traffic distribution, similar to Pinduoduo’s strategy, making the platform more efficient and less labor-intensive.(Gizmo China, SCMP, Sina)