3-16 #Decade : MediaTek is now turning its focus to the fast-growing premium segment; SMIC is rumored to be assembling a team dedicated to 3nm chip development; Samsung is allegedly looking to bring back the squarish design for its smartwatches; etc.

According to Anku Jain, managing director, MediaTek India, MediaTek is now turning its focus to the fast-growing premium segment with its latest 5G chipsets, having attained a dominant 50% market share, outpacing rival Qualcomm in the highly competitive India smartphone market. MediaTek is now working with every Android phone brand with the exception of Google, with over 15 design wins in 1Q24 itself, far outpacing that of rival Qualcomm, carrying on the momentum from 2023.(Android Headlines, Economic Times)

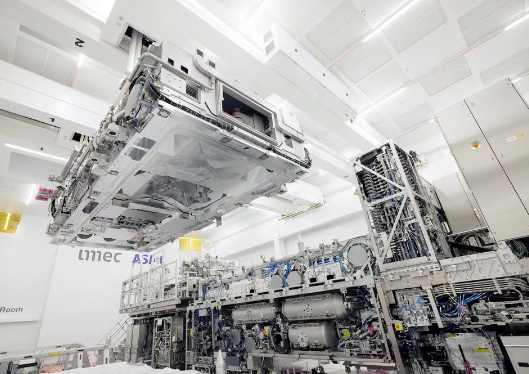

Semiconductor Manufacturing International Corp (SMIC) is rumored to be assembling a team dedicated to 3nm chip development. SMIC’s initial goal is to begin operations of its 5nm production line that will not just mass produce Huawei chipsets for a wide range of products but also AI silicon. It is reported that the SMIC will accomplish this using the existing DUV machinery that it will likely re-purpose since ASML, the only company in the world that can supply cutting-edge EUV technology, has been barred from supplying this equipment to not just SMIC but any company of Chinese origin. However, SMIC is looking beyond the 5nm threshold, just as it did when it partnered with Huawei to launch the 7nm Kirin 9000S. SMIC has formed an internal research and development team that will commence work on the 3nm node. Receiving subsidies will be of paramount importance to SMIC, especially given that an earlier report stated that its 5nm chips would be up to 50% more expensive than TSMC’s on the same manufacturing process due to using the older DUV equipment. (Phone Arena, WCCFTech, JoongAng)

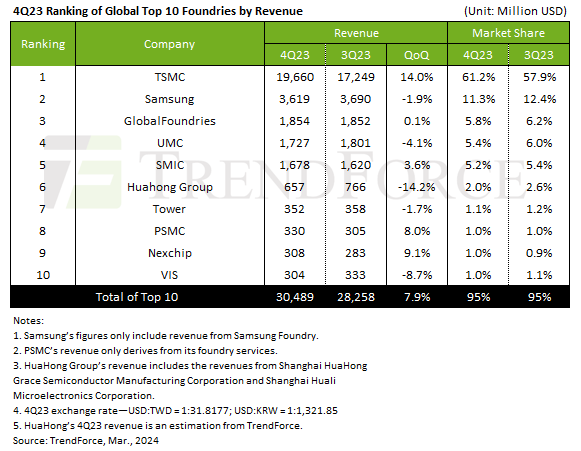

TrendForce report reveals a notable 7.9% jump in 4Q23 revenue for the world’s top ten semiconductor foundries, reaching USD30.49B. This growth is primarily driven by sustained demand for smartphone components, such as mid and low-end smartphone APs and peripheral PMICs. The launch season for Apple’s latest devices also significantly contributed, fueling shipments for the A17 chipset and associated peripheral ICs, including OLED DDIs, CIS, and PMICs. TSMC’s premium 3nm process notably enhanced its revenue contribution, pushing its global market share past the 60% threshold this quarter. TrendForce remarks that 2023 was a challenging year for foundries, marked by high inventory levels across the supply chain, a weak global economy, and a slow recovery in the Chinese market. These factors led to a downward cycle in the industry, with the top ten foundries experiencing a 13.6% annual drop as revenue reached just USD111.54B. Nevertheless, 2024 promises a brighter outlook, with AI-driven demand expected to boost annual revenue by 12% to USD125.24B. (TrendForce, TrendForce)

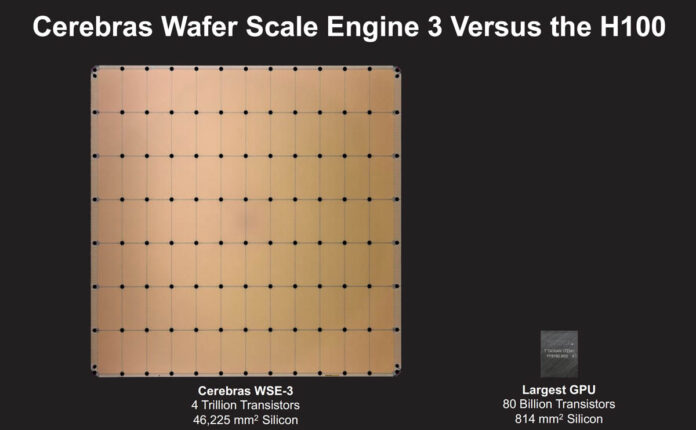

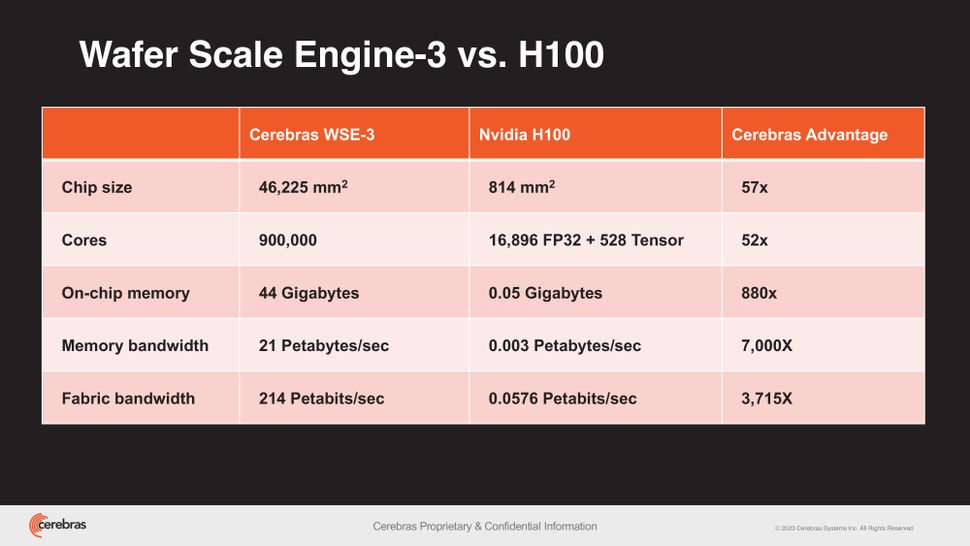

Cerebras Systems has unveiled its Wafer Scale Engine 3 (WSE-3), which packs 4 trillion transistors made on TSMS’s 5nm-class fabrication process; 900,000 AI cores; 44GB of on-chip SRAM; and has a peak performance of 125 FP16 PetaFLOPS. Ceberas’s WSE-3 will be used to train some of the industry’s largest AI models. The first generation WSE-1 in 2019 is based on TSMC’s 16nm process, with an area of 46,225 square millimeters, 1.2 trillion transistors, 400,000 AI cores, 18GB SRAM cache, and supports 9PB/s memory bandwidth and 100Pb/s interconnect bandwidth , power consumption is as high as 15 kilowatts. The second generation WSE-2 in 2021 will be upgraded to TSMC’s 7nm process. The area remains unchanged at 46,225 square millimeters, the number of transistors has increased to 2.6 trillion, the number of cores has increased to 850,000, the cache has been expanded to 40GB, and the memory bandwidth has been 20PB/s. Interconnect bandwidth 220Pb/s. Today’s third-generation WSE-3 has once again been upgraded to TSMC’s 5nm process. The number of transistors continues to increase to an astonishing 4 trillion, the number of AI cores further increases to 900,000, the cache capacity reaches 44GB, and the external memory capacity is optional 1.5TB, 12TB, and 1200TB. (CN Beta, STH, Tom’s Hardware, Cerebras, Forbes)

The RISC-V “Swordless Alliance” is officially established. The alliance aims to promote RISC-V technological innovation and ecological development and demonstrate the promising prospects of RISC-V. The first batch of alliance partners include: Arteris (AIP), Imagination, Synaptics, Damo Academy Xuantie, China Telecom, Haier Technology, Xinsheng Technology, etc. At present, T-Head Semiconductor processor has been authorized by more than 300 companies and has shipped more than 4B units, making it one of the most popular processor IPs in the RISC-V field. Wujian is a one-stop chip design platform for AIoT, which can help chip design companies reduce design costs and compress design cycles. As the basic common technology platform for system chip development, Wujian is composed of SoC architecture, processor, various IP, operating system, software driver and development tools and other modules. It can undertake about 80% of the general design workload of AIoT chips. (CN Beta, IT Home, My Drivers)

Samsung Electronics is expected to receive more than USD6B in US chip subsidies as the Joe Biden administration is wooing its allies amid an intensifying tech rivalry with China. The larger-than-expected subsidies from the 2022 CHIPS and Science Act will likely come with the condition that Samsung, the world’s largest memory chipmaker, commit to extra US investments beyond its ongoing project in Texas. Samsung is currently building a chip manufacturing plant in Tyler, Texas, which is expected to be operational later in 2024 and will employ 2,000 people. The plant was originally expected to cost about USD17B, but the latest estimates put the cost at more than USD25B. (CN Beta, Bloomberg, KED Global)

Infinix has announced the launch of its first self-developed power management Cheetah X1 chip. The chip will be the foundation for the new All-Round FastCharge 2.0 in its upcoming NOTE 40 Series of smartphones. All-round Support Module accommodates eight charging scenarios and consolidates functions by consolidating protocols and adjusting charge. These eight scenarios include up to 100W multi-speed wired charging, wireless charging, wired reverse charging, wireless reverse charging, bypass charging, AI charging protection for night charging , extreme-temp tech for -20°C, and multi-protocol charging. This integration ensures consistent performance across demanding use cases. (CN Beta, Premium Times, PR Newswire)

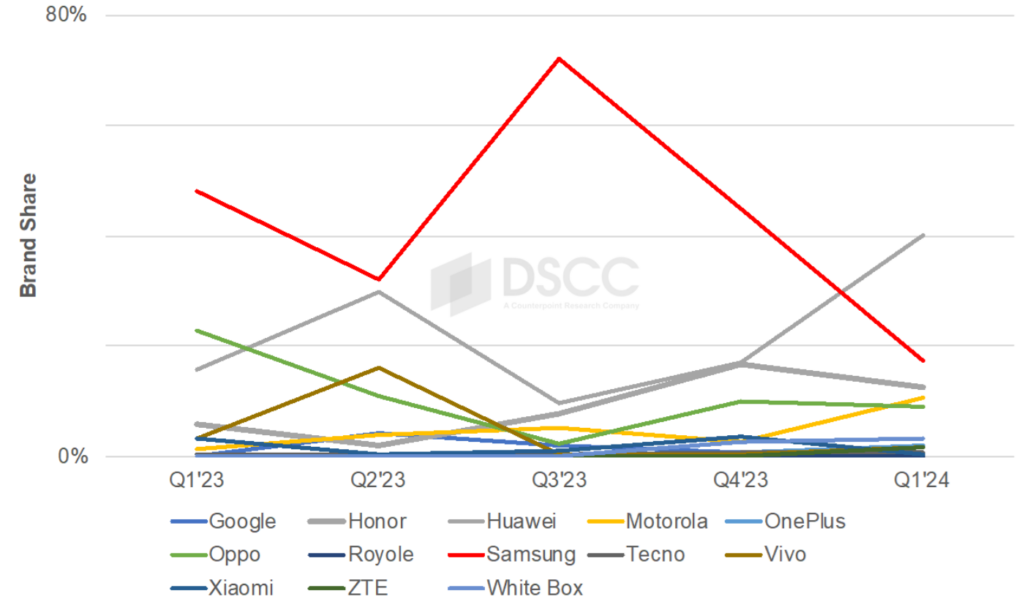

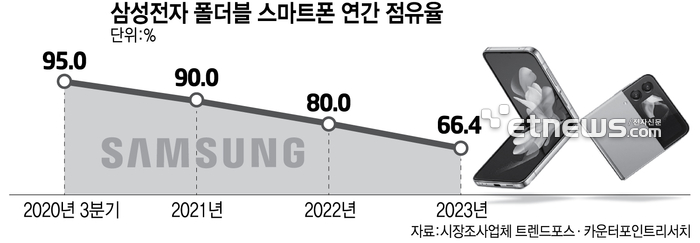

Foldable smartphone shipments rose 33% YoY in 4Q23 to 4.2M, the fourth highest total to date, according to Display Supply Chain (DSCC). Samsung led the market in Q4’23 despite lower than expected sell-through of its Galaxy Z Flip 5 and Z Fold 5. Huawei and Honor each gained share in 4Q23. In 4Q23, 23 different foldable models shipped. Of the top 10 best-selling models, there were four from Samsung, two each from Honor and OPPO and one each from Huawei and Xiaomi. The Samsung Galaxy Z Flip 5 remained the best-selling model followed by the Huawei Mate X4, the Honor Magic Vs2, the Samsung Galaxy Z Fold 5 and the OPPO Find N3 Flip. In 1Q24 and 2Q24, Huawei is expected to overtake Samsung in the foldable phone market share for the first time on the strength of the Mate X5 and Pocket 2 and the lack of new products from Samsung. (Android Headlines, DSCC)

Samsung is allegedly planning to launch a more affordable Galaxy Z Fold, which is dubbed Galaxy Z Fold6 FE, not the expensive Ultra variant. It may not support the S-Pen stylus. This device has been internally coded as “Q6A”. (Gizmo China, ET News, Twitter)

Eazeye monitor is the world’s first naturally lit, anti-eye-strain monitor. The portable monitor uses ‘transflective’ LCD or TLCD, meaning the monitor can be front- or backlit to produce an image. In TLCD displays, natural light acts as a light source and in darker environments, a full-spectrum LED backlight illuminates it like a regular monitor. When used outdoors, directly facing the sun, Radiant produces a brighter, more visible image than a standard 100-nit monitor. Eazeye says it uses 70% less electricity compared to similar-sized monitors that have their brightness maxed out to achieve a viewable screen image.(CN Beta, New Atlas, Shift Delete)

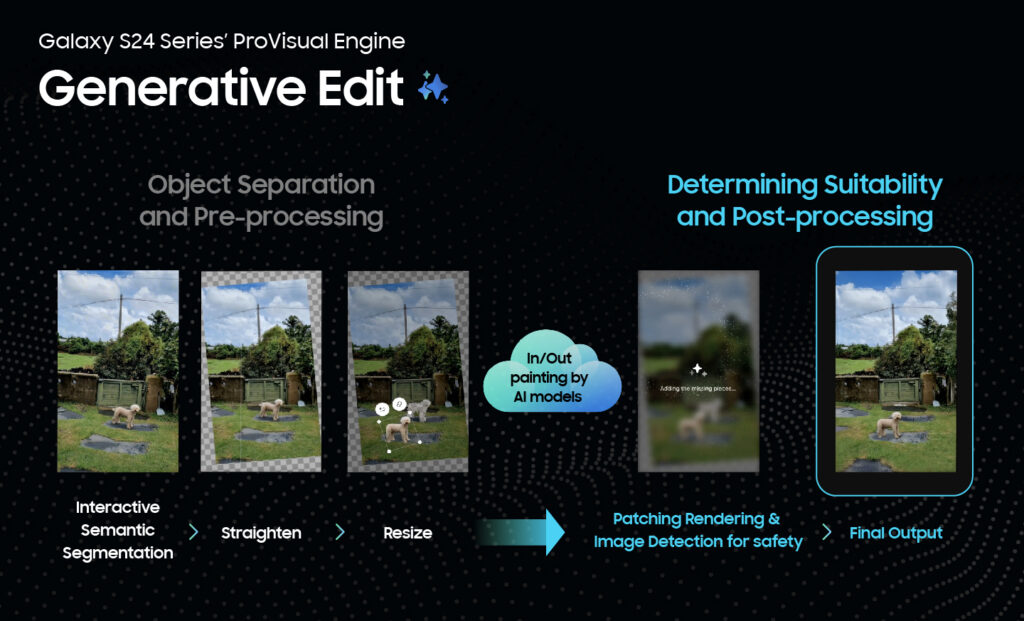

Samsung Galaxy S24 Ultra boasts an impressive array of features, some of which include its advanced camera capabilities. Samsung has highlighted the same capabilities and features that set the Galaxy S24 Ultra apart from the rest. These are part of Galaxy’s ProVisual Engine, a suite of AI-powered tools that aid both amateur and professional photographers and videographers alike in all stages of the creative process —from capturing the best shot or footage to editing it to get the most optimal result.(Phone Arena, Samsung)

JEDEC organization will reportedly finalize the LPDDR6 memory standard development in 2024. Samsung and SK Hynix are working together to get a certification on LPDDR6 RAM as soon as possible. Samsung has been improving LPDDR5 (to 5X and 5T) by focusing on low price and high power efficiency rather than actual performance. LPDDR6 RAM with Qualcomm Snapdragon 8 Gen 4 could bring the next step of artificial intelligence features in smartphones as early as 2025. (GizChina, ETNews, GSM Arena)

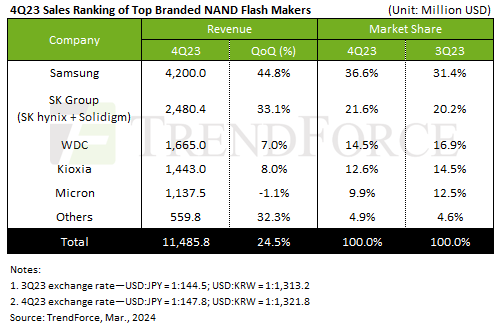

TrendForce reports a substantial 24.5% QoQ increase in NAND Flash industry revenue, hitting USD11.49B in 4Q23. This surge is attributed to a stabilization in end-demand spurred by year-end promotions, along with an expansion in component market orders driven by price chasing, leading to robust bit shipments compared to the same period in 2022. Additionally, the corporate sector’s continued positive outlook for 2024 demand—compared to 2023—and strategic stockpiling have further fueled this growth. Looking ahead to 1Q24, despite it traditionally being an off-season, the NAND Flash industry is expected to see a continued increase in revenue by another 20%. This anticipation is underpinned by significant improvements in supply chain inventory levels and ongoing price rises, with clients ramping up their orders to sidestep potential supply shortages and escalating costs. The ongoing expansion of order sizes is expected to drive NAND Flash contract prices up by an average of 25%. (CN Beta, TrendForce, TrendForce)

Samsung allegedly plans to renegotiate NAND prices with major mobile, PC, and server customers in Mar / Apr 2024, and the rate of increase is rumored to be as high as 15-20%. Samsung, SK Hynix, and other large memory makers have not yet completed price negotiations with customers for 1Q24. As the overall NAND price continues to rise and the NAND industry is expected to maintain the trend of production reduction in 2024, major customers are actively securing purchasing volume. In 2023, Samsung and SK Hynix are estimated to report losses of nearly KRW11T (USD8.38B) and KRW8T respectively in the NAND business due to inventory buildup in the NAND market as a result of sluggish demand and oversupply. (CN Beta, Digitimes)

Samsung Electronics and SK hynix have reportedly stopped selling their old semiconductor equipment to China. The move comes in response to the United States urging them to align with its controls on semiconductor exports to China. Samsung Electronics and SK hynix are reportedly storing their used semiconductor equipment in warehouses instead of selling it. Korean companies used to sell old equipment to China when there were no geopolitical tensions between the U.S. and China. However, given the current sensitive climate, they are being cautious. This shift in policy reflects the broader geopolitical landscape affecting global semiconductor trade, with companies adapting to the complex dynamics between the U.S. and China. (CN Beta, FT, Reuters, The Register, Korea JoongAng Daily, Business Korea)

Battery maker LG Energy Solution has announced that it will collaborate with Qualcomm Technologies to work on advanced Battery Management System (BMS) diagnostic solutions for EV batteries. The advanced BMS solutions will combine LGES’ BMS software and the Snapdragon Digital Chassis developed by Qualcomm. According to Qualcomm, the Snapdragon Digital Chassis is a set of cloud-connected platforms for telematics and connectivity, the digital cockpit, and advanced driver assistance systems. LGES aims to work on a BMS supporting hardware and software AI solutions with the Snapdragon Digital Chassis. The advanced BMS solution will provide an 80-time increase in computing power, enabling more sophisticated battery algorithms. It will also allow BMS to function without connection with servers. (CN Beta, Batteries News, Electrive, Digitimes)

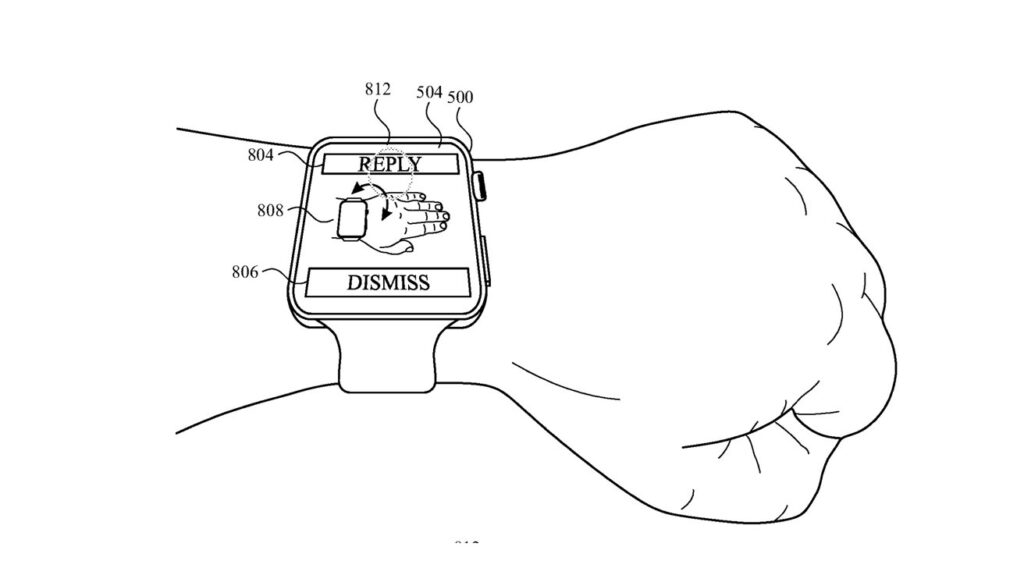

Apple’s patent application details several new ways to control Apple Watch with a new array of gestures. The new functionality could radically change how users interact with Apple’s smartwatch and future wearables. One of the most interesting new gestures described in the patent starts with the palm flat and fingers outstretched, then moving the fingers from side to side horizontally. This “side-to-side” motion could be used to reply to a text message or answer a call and can be combined with other gestures. A clenched fist is central to many new user interface (UI) elements.(Apple Insider, USPTO)

Ventiva is a privately-held company based in Silicon Valley, and is a leader in a crop of companies introducing a new way to cool devices. Ventiva has developed a technology they call an Ionic Cooling Engine (ICE). This device creates a small, very power efficient electrical current, that stimulates air flow across it. Put simply, this is a fan with no moving parts. The appeal of Ventiva’s approach with ICE is that it can be made very small. Small enough to fit into all our gadgets. It is quiet, uses very little power and can be manufactured into pretty much any device, but is still capable of moving heat away from the toasty bits of the device.(CN Beta, Techspot)

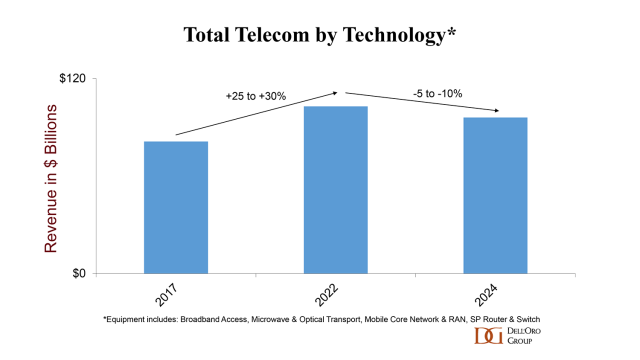

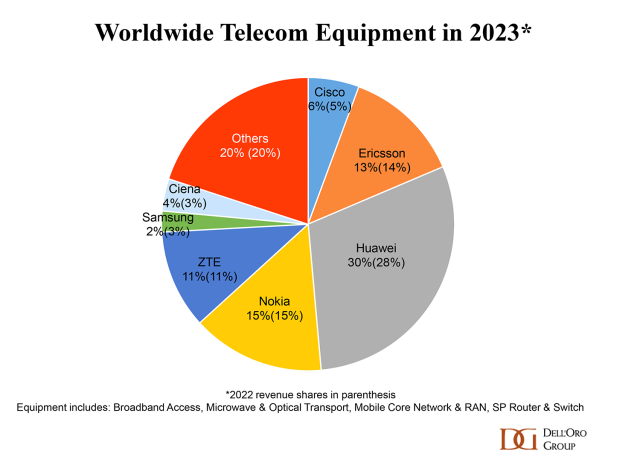

Preliminary Dell’Oro Group data indicated Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the US government and other countries to limit its addressable market and access to the latest chip silicon. The research company noted Huawei’s share of global revenue widened to 30% in 2023 compared with 28% in 2022. Nokia’s share was flat at 15% while Ericsson’s fell from 15% in 2022 to 14%. ZTE was fourth overall, with its share flat at 11%, and Cisco increased its proportion from 5% to 6%. The telecom equipment sector enjoyed 5 consecutive years of growth and stable trends, including up to the end of H1 2023, but began to decrease in H2 2023, which the research company partially attributed to “challenging comparisons in some of the advanced 5G markets” and a “slow transition towards standalone” next-generation networks. (CN Beta, Mobile World Live, Dell’Oro Group)

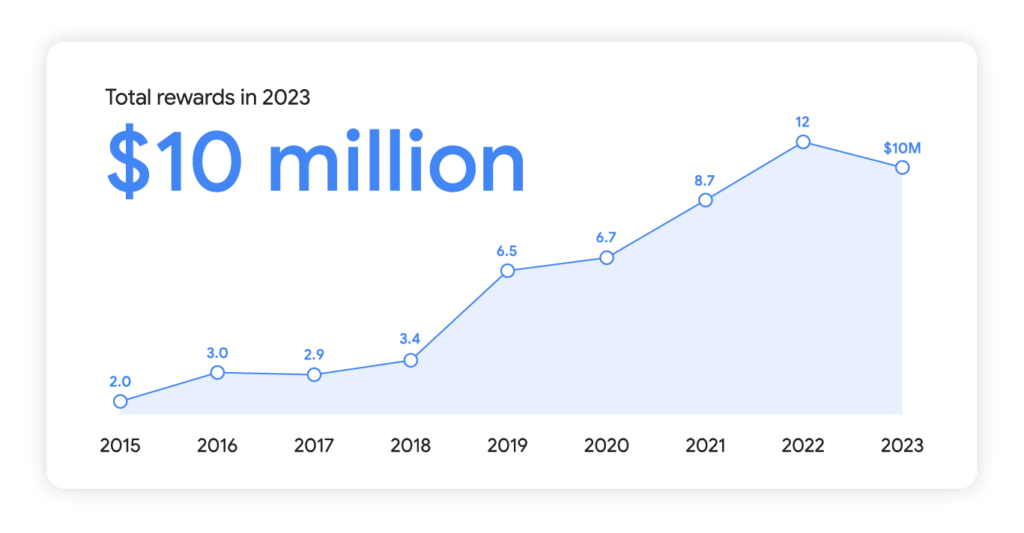

Google dished out USD10M to researchers worldwide in 2023 for sniffing out and safely flagging security issues in its products and services. In 2023, 632 researchers from 68 different countries received rewards, but the total amount was a bit less compared to the USD12M that Google’s Vulnerability Reward Program awarded to researchers in 2022. n 2023, Google made a new addition to the VRP by including generative AI. Google hosted a live hacking event aimed at large language models, where researchers attempted to coax secrets out of Bard, now Gemini, by feeding it specific prompts. Google raked in 35 reports from this event, paying out over USD87,000 in bounties. (Android Central, Google)

A renowned cybersecurity firm Kaspersky’s anti-phishing system thwarted over 709M attempts to access phishing and scam websites in 2023, marking a 40% increase compared to the previous year’s figures. Messaging apps, artificial intelligence platforms, social media services, and cryptocurrency exchanges were among the pathways most frequently exploited by threat actors to scam users. Kaspersky’s previous annual analysis of the spam and phishing threat landscape revealed a persistent trend for 2022: a marked increase in phishing attacks. The trend continued in 2023, with attacks surging by over 40%, reaching a staggering 709,590,011 attempts to access phishing links. (Android Headlines, Kaspersky)

Recent rumors suggesting Sony would be pulling out of the Chinese smartphone market have been firmly refuted by the company itself. Sony has issued a statement clarifying its continued commitment to the region. (Gizmo China, IT Home)

NRG esports and its sister entertainment brand, Full Squad Gaming, have formed an expansive global partnership with Samsung Galaxy. In addition to supporting NRG’s competitive prowess, the companies plan to produce several content campaigns that highlight Samsung Galaxy phones to key target demographics. These include aspiring mobile pro players, college students, creators and mobile game developers.(VentureBeat, Yahoo)

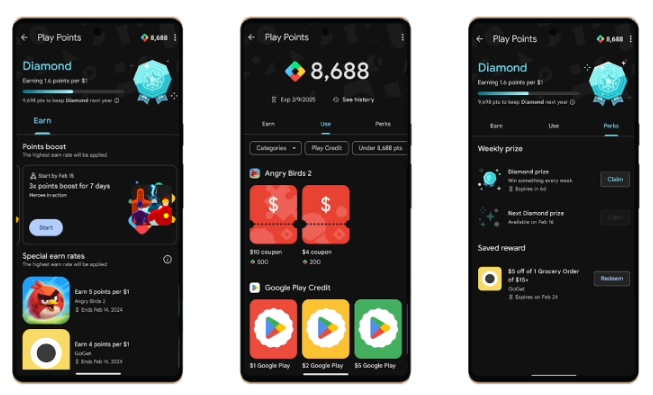

Google has unveiled new tools and features that will enhance the gaming experience on Google Play. Google has talked about Play Pass Enhancement. Google Play Pass subscribers in select markets will now receive in-game items and discounts on popular games, including titles like EA SPORTS FC Mobile, Mobile Legends: Bang Bang, Monopoly Go and Roblox. This additional offering complements the existing catalog of over 1,000 ad-free games and apps, providing increased value to subscribers without changing the monthly price. Discovering exclusive promotions, in-game items, and updates for downloaded games is made easier with new features in the Google Play Store. Users can now view the latest YouTube videos directly on the Games tab and store listing page, ensuring they stay informed about their favorite games. AdMob has also transformed in-game advertisements, offering interactive elements that seamlessly blend into the gaming experience, avoiding intrusive pop-ups or video interruptions.(VentureBeat, Google Blog, Google Blog)

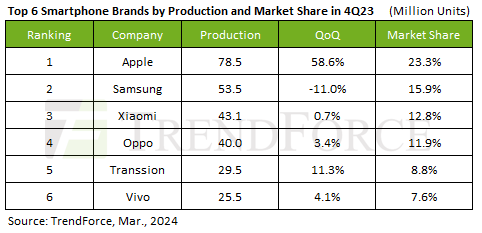

TrendForce’s latest insights reveal a significant rebound in global smartphone production, marking the end of an eight-quarter slump in 3Q23. In a strategic year-end surge, brands amped up production to capture more market share, propelling 4Q23 smartphone output up 12.1% to reach 337M units. Despite this impressive final quarterly growth, 2023 rounded off with a slight 2.1% dip in annual production—totaling 1.166B units. The outlook for 2024 hints at a brighter future, free from the inventory pressures of the previous year. However, the pace of market recovery remains under scrutiny. The spotlight is on AI applications, with industry giants joining forces to usher in the next wave of AI-powered smartphones. (TrendForce, TrendForce)

Samsung is allegedly looking to bring back the squarish design for its smartwatches. It would be similar to previous models like the Galaxy Gear, Gear 2 and Gear Live. The Gear S2 was the first Samsung smartwatch with a circular design and a physical rotating bezel. Samsung has stuck with this design language ever since, with the current generation Galaxy Watch 5 models having the same circular design. (SamMobile, The Verge, 9to5Google, CN Beta)

Apple has acquired Canadian AI startup DarwinAI, which specializes in creating smaller and faster AI systems. DarwinAI a visual quality inspection company that provides end-to-end AI solutions for several top brands. Its technology is used by manufacturers to visually inspect components during the manufacturing process.(Android Authority, Android Headlines, Bloomberg)

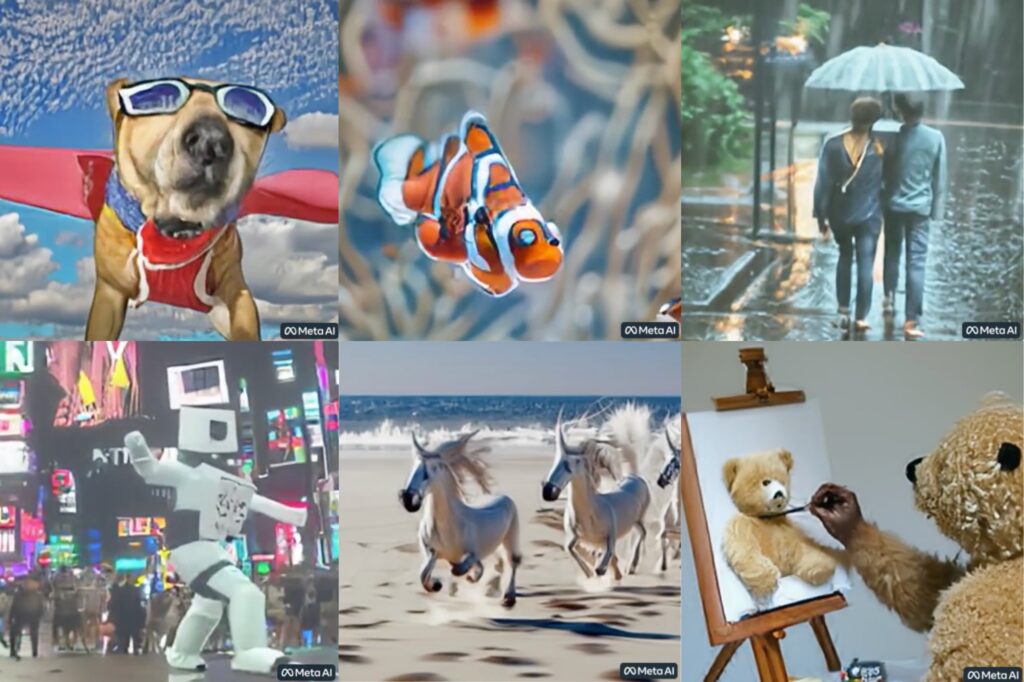

According to Tom Alison, the head of Facebook, as part of Meta’s “technology roadmap” for now until 2026, the company is developing an AI model to power recommendations for its videos and user Feeds. Now in its third phase, Alison said Meta is working to continue validating the use of large language models (LLMs) and generative AI to power more products, and scale it. The first phase of Meta’s “technology roadmap” was to switch the current recommendations systems from computer chips to GPUs, or graphics processing units, “to perform better”. The company started looking into using LLMs and generative AI to power recommendations in 2023. In addition to video, Alison said Meta is working on other generative AI efforts, including digital assistants and improving its chatting tools in Feed and Groups. (CN Beta, Cyber News, CNBC, Quartz)

Cognition AI introduces Devin, the world’s first AI software engineer capable of coding, creating websites and software through a single prompt, designed to work alongside human engineers. The AI tool is not intended to replace human engineers but to assist them and make their work easier. Devin has had success passing practical engineering interviews from “leading AI companies”. It has “completed real jobs” on the freelancing platform Upwork. It can build and deploy apps from start to finish. It can find and fix bugs, too. When it was evaluated on a benchmark asking AI to resolve issues found in real-world open-source projects on GitHub, Devin managed to fix 13.86% unassisted. (CN Beta, Business Insider, Cognition Labs, Dataconomy, Medium)

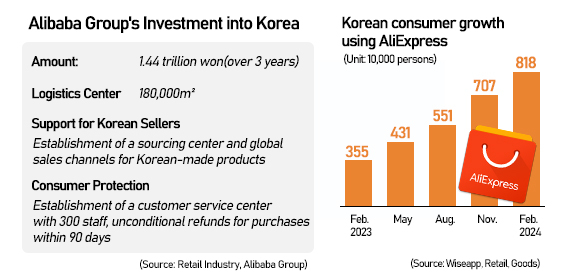

China’s Alibaba Group will invest USD1.1B over the next 3 years to create a logistics network in South Korea, aiming to take on local e-commerce giant Coupang by leveraging low prices and speedy deliveries. Alibaba started its South Korean e-commerce business in 2018 under the name AliExpress. It plans to construct a logistics center on a 180,000-square-meter lot in 2024. It is currently selecting the site in the greater Seoul region. Coupang, which has over 100 of its own distribution centers, leads South Korea’s online shopping market and is seeing sales growth. Tech giant Naver and major retailer Shinsegae Group are in pursuit. (CN Beta, Reuters, Asia Nikkei, Korea Herald, Pulse News)