3-23 #LetItGo : MediaTek and Nvidia collaborate on Dimensity Auto Cockpit platforms; Samsung’s memory semiconductor business is reportedly expected to recover in 2024; Samsung is “reviewing” bringing Galaxy AI features to the Galaxy S22 series; etc.

Samsung Electronics will supply its next-generation Mach-1 artificial intelligence chips to Naver by the end of 2024 in a deal worth up to KRW1T (USD752M). With the contract, Naver will significantly reduce its reliance on Nvidia for AI chips. Samsung hopes to price the Mach-1 AI chip at around KRW5M (USD3,756) apiece and Naver wants to receive between 150,000 and 200,000 units of the AI accelerator. Naver, a leading Korean online platform giant, is expected to use Mach-1 chips in its servers for AI inference, replacing chips it has been procuring from Nvidia. Android Headlines, KEDGlobal, Digitimes)

Samsung has reportedly significantly improved its 3nm yield rate in recent times. The yield rate initially hovered around 10-20% but has now increased by over threefold. While the yields were not mentioned for the second-generation 3nm GAA process, it is said to be on par with TSMC’s N3P node. Samsung has to make additional optimizations to its yields, as an earlier report stated that it needs to raise that value to 70% before it can regain the confidence of previous clients such as Qualcomm. Samsung has informed its customers about a rebranding of its 2nd-gen 3nm process. The company will call the process 2nm instead of 2nd-gen 3nm. Its “real” 2nm chips are expected to arrive in 2H25. (WCCFTech, Android Headlines, Twitter)

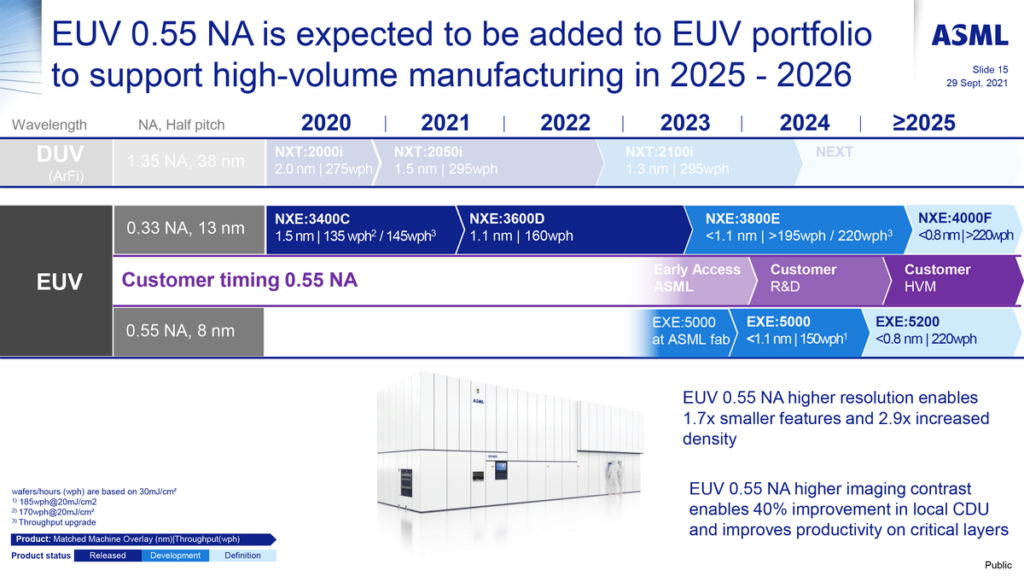

ASML has delivered its 3rd Generation extreme ultraviolet (EUV) lithography tool, the Twinscan NXE:3800E, with a projection lens featuring a 0.33 numerical aperture. The system significantly increases performance compared to the existing Twinscan NXE:3600D machine. It is designed for fabricating chips at leading-edge technologies, including 3nm, 2nm, and small nodes in the next few years. The new system can process over 195 wafers per hour at a 30 mJ/cm2 dose and promises a further increase in performance to 220 wph with a throughput upgrade. In addition, the new tool offers a less than 1.1 nm-matched machine overlay (wafer alignment accuracy). (CN Beta, AnandTech, Tom’s Hardware)

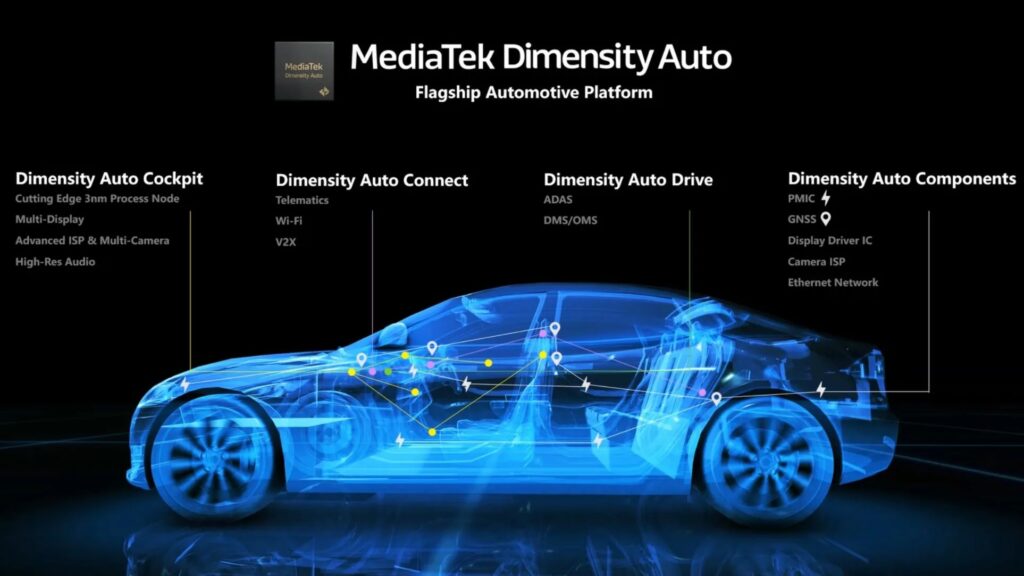

MediaTek is bringing advanced AI capabilities into vehicles with its new Dimensity Auto Cockpit platforms, in partnership with Nvidia DRIVE technology. The Dimensity Auto Cockpit portfolio offers powerful AI in-cabin experiences for the next generation of intelligent vehicles. The highly integrated platform consists of four new automotive SoCs, including Dimensity Auto Cockpit CX-1, CY-1, CM-1, and CV-1, comprehensively spanning premium (CX-1) to entry (CV-1) segments. All will come with support for NVIDIA DRIVE OS, allowing automakers to leverage familiar features to ranges of vehicles. (CN Beta, AnandTech, MediaTek, Tom’s Hardware, MediaTek, Nvidia)

Construction on Intel’s New Albany, Ohio, manufacturing site began as early as late 2022, but a series of setbacks since then have delayed the expected timeline. Initial plans were for a grand opening in 2025, but that was revised to late 2026 or early 2027. Intel has committed a massive USD20B in greenfield investments to three Ohio fab sites, but its latest progress report shows less than a quarter of that budget has left the company’s accounts (so far). (CN Beta, Cleveland, WSJ, Business Journals)

Apple is scrapping plans to build a MicroLED display for the Apple Watch, according to Bloomberg’s Mark Gurman. The company has reportedly stopped working on the display “around the same time as the company’s decision to cancel work on a self-driving car”. MicroLED was too expensive and too complex for Apple to design, so Apple is now reorganizing its display engineering teams and laying off employees in the U.S. and Asia. Apple currently uses an OLED display in its Apple Watch, which makes the screen bright and vibrant. (Bloomberg, Apple Insider, MacRumors, The Verge)

Samsung allegedly has been developing a microLED Galaxy Watch with a target release year of 2025. However, with Apple’s microLED project falling through, Samsung’’ project also falls into uncertainty. It is uncertain whether the micro LED Galaxy Watch will be released in 2025 as originally planned. (CN Beta, GizChina, WCCFtech, Twitter)

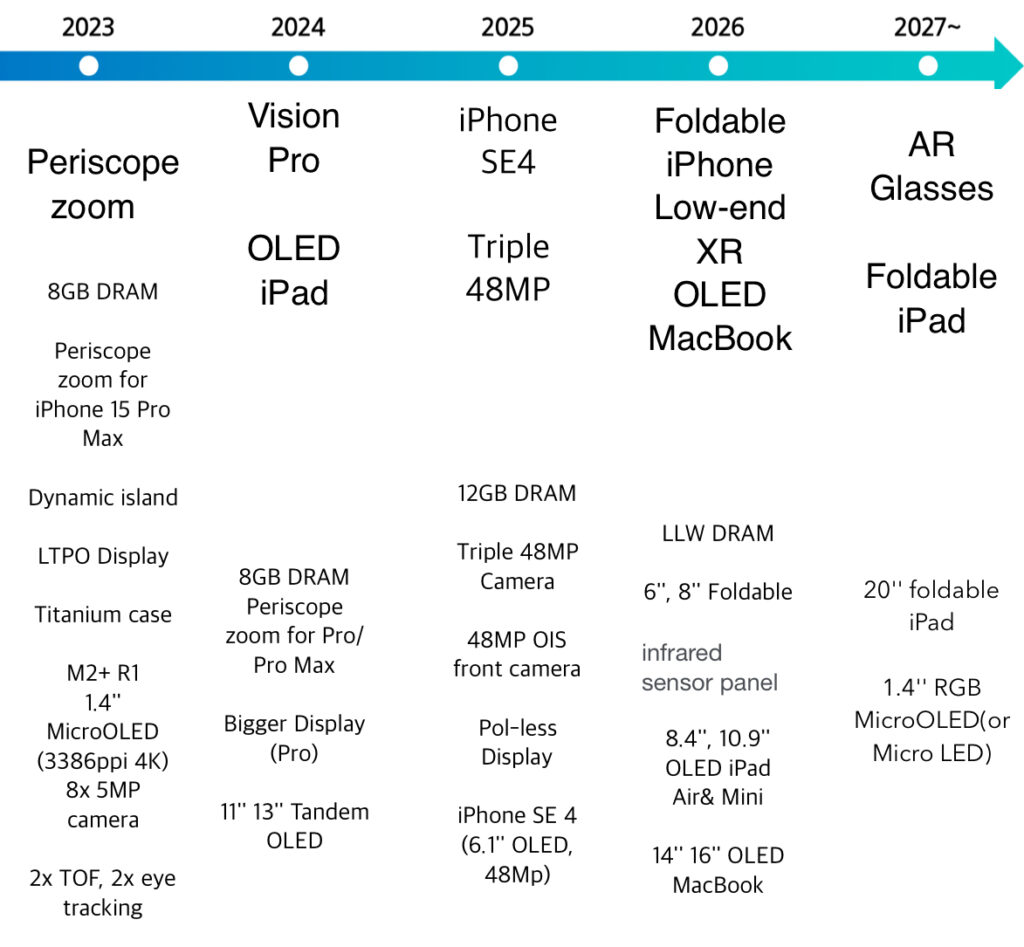

An Apple roadmap detailing big product announcements and feature upgrades has been produced by Samsung Securities. After the launch of iPhone 15 series (8GB RAM and periscope zoom) in 2023, and Vision Pro in 2024, it is believed iPad with 11” and 13” OLED display as well as larger displays and 5x periscope cameras for iPhone 16 (Pro and Pro Max) are to be launched soon in 2024. In 2025, new iPhone SE with 6.1” OLED display and iPhone 17 series with triple 48MP cameras and 48MP front camera with optical image stabilization (OIS) are to be launched. In 2026, a foldable iPhone is rumoured to be launched follows by a foldable iPad in 2027. (CN Beta, Twitter, Tom’s Guide)

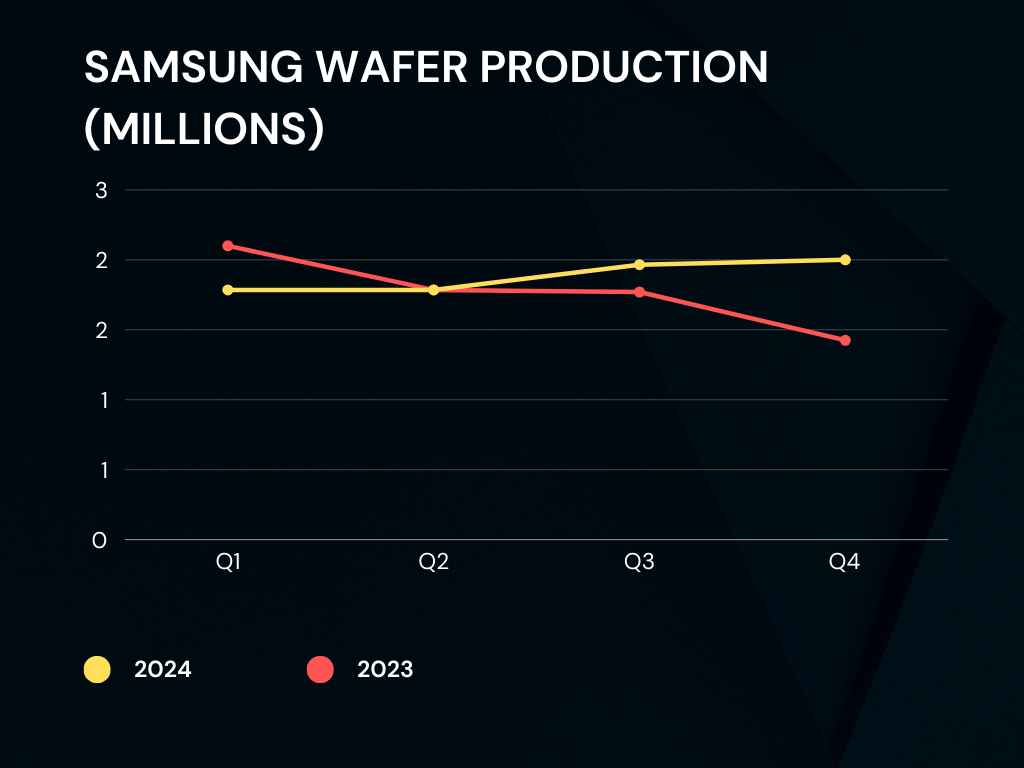

Samsung’s memory semiconductor business is reportedly expected to recover in 2024. Omdia has predicted that by the end of 2024, Samsung’s DRAM manufacturing will look to recuperate the returns that they had been deprived of for the past year. According to Omdia, Samsung’s wafer production in 1Q24 was 1.575M units, maintaining a 25% decrease compared to last year (2.1M units), but is expected to increase to 1.785M units in 2Q24, bringing it to a similar level as last year. Furthermore, Omdia anticipates that production will gradually increase compared to the previous year from 2H24. Looking at the quarterly figures, the 3Q23 forecast is 1.965M units, which is 11% higher than the same period last year (1.77M units). For 4Q24, it is projected that quarterly production will exceed 2M units, recovering to pre-memory semiconductor downturn levels. This represents a 41% increase compared to 4Q23 when Samsung implemented significant production cuts (1.425M units). (CN Beta, Twitter, Appuals, MSN, SEDaily)

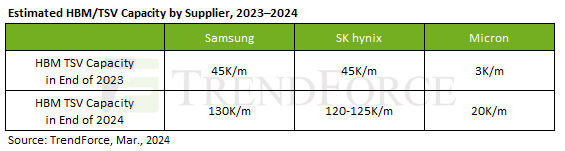

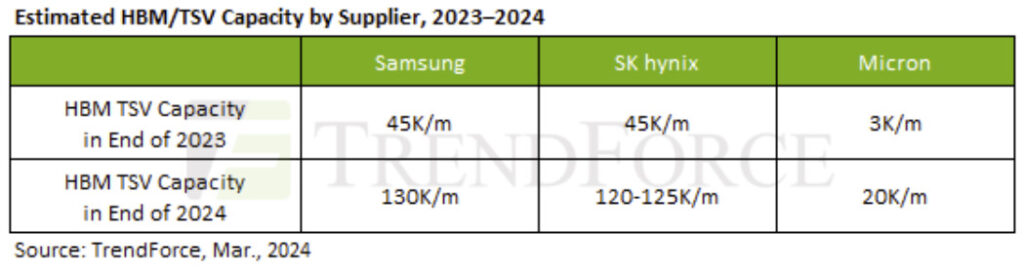

TrendForce reports that significant capital investments have occurred in the memory sector due to the high ASP and profitability of HBM. Senior Vice President Avril Wu notes that by the end of 2024, the DRAM industry is expected to allocate approximately 250K/m (14%) of total capacity to producing HBM TSV, with an estimated annual supply bit growth of around 260%. Additionally, HBM’s revenue share within the DRAM industry—around 8.4% in 2023—is projected to increase to 20.1% by the end of 2024. The die size of HBM is generally 35–45% larger than DDR5 of the same process and capacity (for example, 24Gb compared to 24Gb). The yield rate (including TSV packaging) for HBM is approximately 20–30% lower than that of DDR5, and the production cycle (including TSV) is 1.5 to 2 months longer than DDR5. (CN Beta, TrendForce, TrendForce)

Kyung Kye-hyun, President and CEO of Samsung Electronics’ DS (Device Solutions) Division, declared the company’s ambition to regain its position as the world’s leading semiconductor manufacturer within the next 2-3 years. Kyung outlined specific plans to lead the market by developing high-capacity modules utilizing 12nm-class 32Gb DDR5 DRAM and securing dominance in the HBM3 and HBM3E markets through mass production of 12-layer stacked HBM (High Bandwidth Memory). Additionally, he unveiled preparations for the AI era, emphasizing the importance of advancing AI architectures and diversifying beyond traditional semiconductor businesses by investing in advanced packaging and emerging sectors. (CN Beta, Business Korea, Chosun)

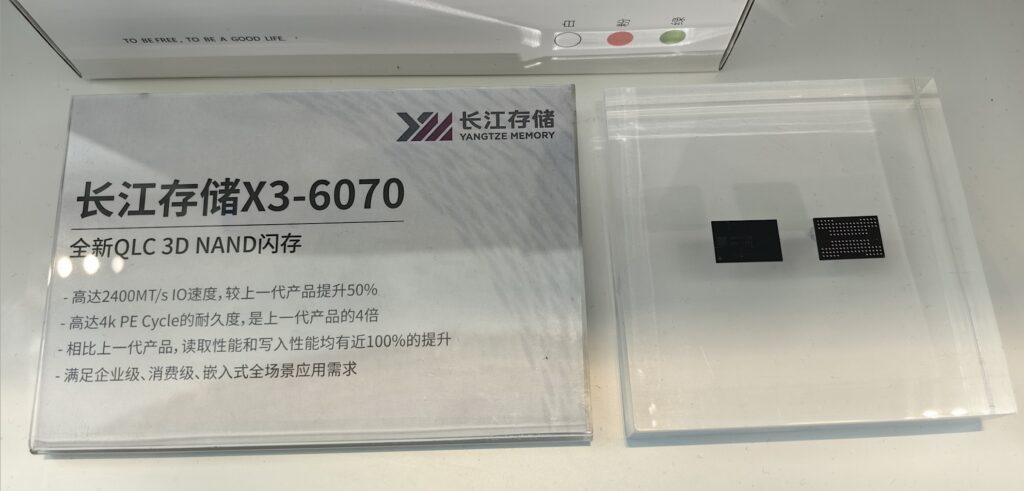

Yangtze Memory Technology Company (YMTC) has showcased its latest QLC 3D NAND storage, dubbed “X3-6070”. Its IO interface speed has reached 2400MT/s, which is a full 50% increase compared to the previous generation’s 1600MT/s. At the same time, the read and write speeds have been improved by nearly 100%. It can handle 4,000 reads and writes. It also features a 70% improvement in storage density and a 50% boost in IO speed. YMTC has advanced its QLC NAND development by introducing QLC NAND SSDs with Xtacking architecture for enterprise storage. It will be offered to mobile phone customers and other application businesses in the future. (CN Beta, Digitimes)

Bloomberg’s Mark Gurman believes Apple’s next new Apple Watch in 2024, potentially to be called the Apple Watch X for its 10th edition, will include a new hardware sensor that can detect trends in blood pressure. This first iteration will likely only alert users for upward trending in blood pressure, rather than offer exact readings. Another rumored improvement would be a built-in ability to monitor for sleep apnea. (Apple Insider, CN Beta, Bloomberg)

Samsung announces it has rebranded One UI’s “Game Launcher” on Galaxy phones to “Gaming hub for mobile”. The Gaming Hub gives users access to “Instant Plays”, which is a feature the original launcher had since it was available. Samsung highlights the feature, stating mobile gamers will find “immediate access” to titles without downloading them. Instant Plays is still in a “limited” beta with a few select games for those in the U.S. and Canada. (Android Authority, Samsung, Android Central, Gaming Hub)

Samsung’s Noh Tae-moon, head of the MX division, has revealed that the company is “reviewing” bringing Galaxy AI features to the Galaxy S22, S22+, and Galaxy S22 Ultra. He has explained that Galaxy AI is aiming for ‘hybrid AI’ that combines not only cloud-based AI but also on-device AI technology that is greatly affected by hardware performance. To do on-device AI that takes these hardware limitations into account, a lot of efforts are needed. Resources and efforts are being invested. They are gradually preparing plans to support a fully-fledged Galaxy AI experience. (Android Headlines, 9to5Google, GSM Arena, Naver)

Apple is allegedly in talks to build Google’s Gemini artificial intelligence (AI) engine into the iPhone. The negotiations are about licensing Gemini for some new features coming to the iPhone software in 2024, adding that the terms or branding of an AI agreement or how it would be implemented have not been decided. (Apple Insider, Bloomberg, Reuters, The Standard)

Apple has allegedly held preliminary talks with Baidu about using the Chinese company’s generative artificial-intelligence (AI) technology in its devices in China. Apple has been exploring using external partners to help accelerate its AI ambitions. It has held discussions with companies including Google and OpenAI about using their technology to power its mobile features. Baidu has rolled out more than 40 generative AI models, all approved under new regulations in China. The Chinese government has not authorized any models made by companies based in other countries, like ChatGPT and Google’s Gemini. (WSJ, Bloomberg, Reuters)

Samsung has decided to provide longer-term support for some Enterprise Edition (EE) devices. Tablets launched in 2024 or later will receive support for 8 years. Currently, only the Galaxy Tab Active5 launched in Jan 2024 can enjoy this service. More new models will be launched in the future. For enterprise-grade phones like the Galaxy Xcover7, Samsung will provide 7 years of support, just like it does with the S24 series for consumers. It is important to note that Samsung only promised 4 operating system updates and 5 years of support for the Tab Active and Xcover when they were released. It is unclear if this will affect consumer tablets, but future Galaxy S phones already match Xcover’s 7-year support. (CN Beta, GSM Arena, Linkedin, SamMobile)

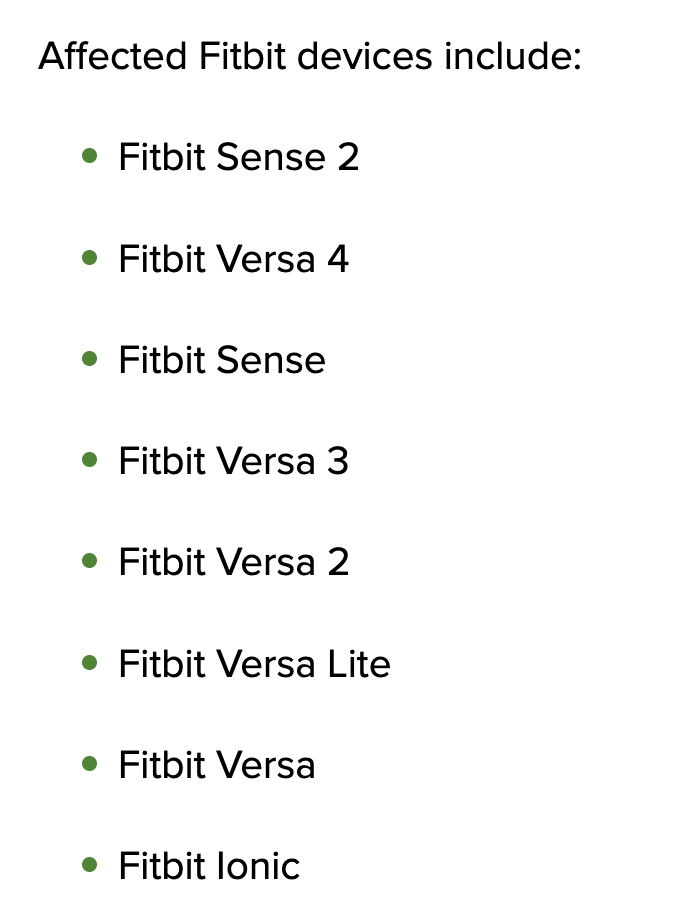

Google has announced that it is developing a Personal Health Large Language model based on its Gemini models to analyse Fitbit data so that it can provide wellness advice and recommendations. The new model will power its upcoming experimental Fitbit Labs program and other AI features in the future. Google explained that the new model will power personalized health and wellness features in the Fitbit mobile app, providing insights and recommendations based on the data it gathers from Fitbit and Pixel devices. (Android Authority, Google, Bloomberg, Nasdaq, Mashable, CNet)

Google has announced it will remove third-party apps and watch faces from the Fitbit app gallery in the EU. The company says this decision was made after “a careful assessment of the impact of new regulatory requirements”. EU users will be able to continue downloading and installing third-party apps until June 2024. (Android Headlines, Google, 9to5Google, Android Authority)

Samsung Galaxy Ring could reportedly offer some diet and wellness-related features. The company plans to link the Galaxy Ring to Samsung Food and Samsung e-Food Center. Samsung Food is an AI-powered personalized food & recipe service that offers meal planning intelligence and smart home compatibility. By linking the Galaxy Ring to the service, Samsung is reportedly planning to offer users customized diet plans based on their health information gathered by the wearable. For instance, the Galaxy Ring might make meal recommendations based on a user’s calorie consumption and Body Mass Index (BMI). (Android Authority, Chosun)

Apple has confirmed that it at one point considered creating an Apple Watch for Android. After a 3-year investigation, Apple says that it determined an Apple Watch with Android support was not doable because of technical limitations.(CN Beta, 9to5Mac)

Following the demise of Apple’s own automotive project, the company’s attention has turned to the next-generation CarPlay and its relationship with automakers. Although Apple first debuted a next-generation CarPlay concept in the summer of 2022, only two automakers thus far, Porsche and Aston-Martin, have committed to the product. More carmakers have signed on to the more comprehensive and built-in Android Automotive technology. This is different from the first-gen Android Auto, in that the Automotive system is embedded in the vehicle at the factory. Bloomberg’s Mark Gurman reports that Apple’s next-gen CarPlay still runs on the iPhone, which provides greater flexibility, but no opportunity for licensing. (Bloomberg, Apple Insider)