4-1 #Turbulence : The demand for mature wafer foundry processes is weak; GigaDevice plans to participate in CXMT’s latest capital increase; Micron said that its HBM production capacity in 2024 has already been sold out; etc.

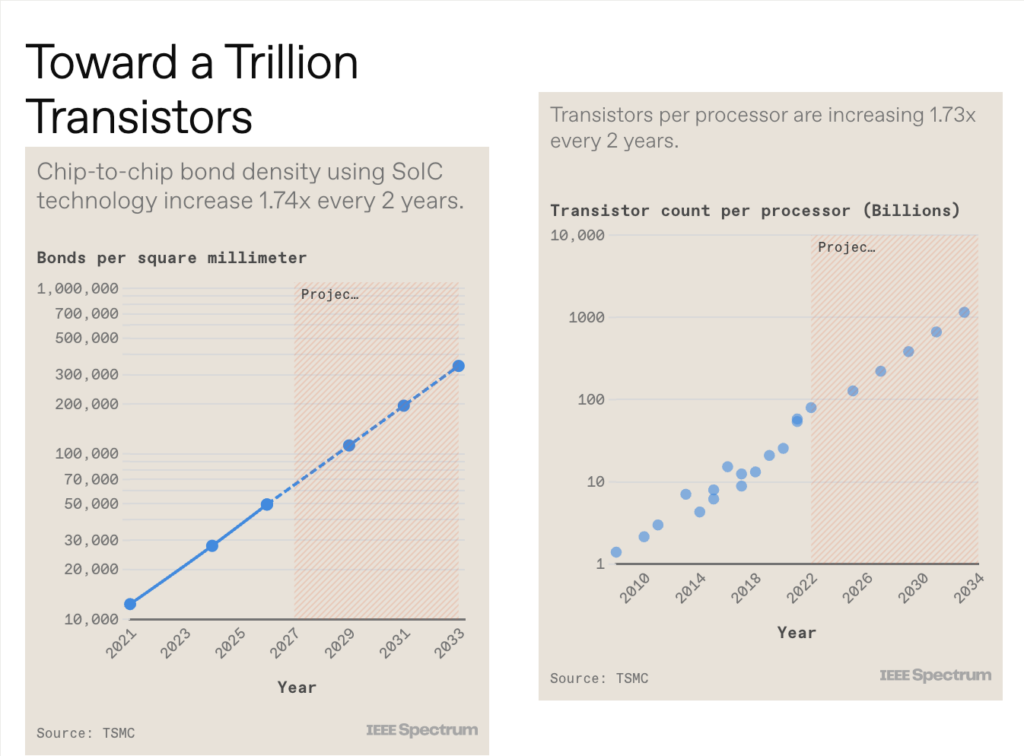

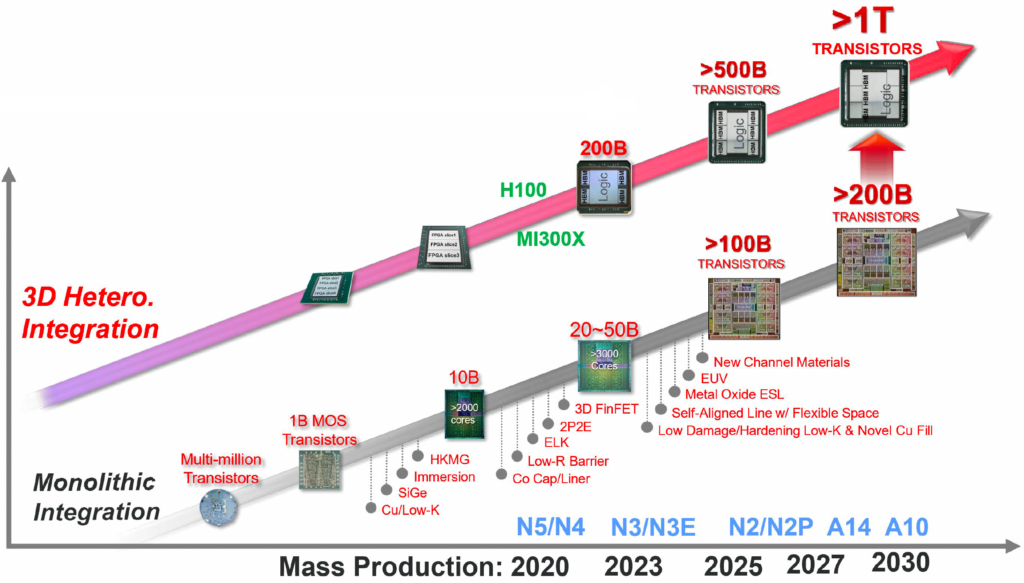

In the era of rapid AI advancements, the need for more computing power has become crucial for future progress. With that, we will witness a drastic increase in transistor counts in semiconductors, potentially reaching the 1T mark by the end of this decade. When semiconductor experts discuss progress in the future, the transistor counts in GPUs are a topic of interest since they are a big decider of semiconductor performance and efficiency. Firms like TSMC and others have shown tremendous optimism about semiconductor integration, with plans of reaching 1T transistor goal over the next decade, categorizing it as an essential step for going into the future. We are at 208B transistors featured on NVIDIA’s recently revealed Blackwell GPU architecture, meaning that the industry expects to be 5 times this amount over the next decade. (CN Beta, IEEE Spectrum, WCCFtech)

Quanta Computer is one of the largest OEM suppliers in the world, with new contracts won to build NVIDIA GB200 AI systems for the likes of Google, Amazon AWS, Meta, and some B200-based AI systems for Microsoft. The company will have its first GB200 AI servers in testing in Jul / Aug 2024 “at the earliest”, with mass production expected in Sept 2024. Quanta holds “large OEM orders” for GB200 servers from Google, Amazon AWS, and Meta which are provided as complete AI cabinets. Microsoft ordered some B200 servers, which means Quanta is building next-gen AI systems for all four major US cloud servers in one set of orders. NVIDIA’s new GB200 cabinet AI servers cost around USD2-3M each. (CN Beta, UDN, 163.com, WCCFtech, TweakTown)

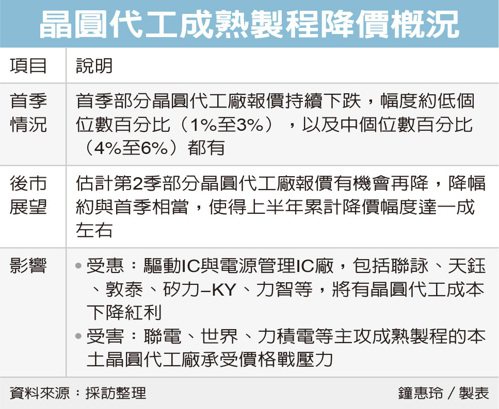

The demand for mature wafer foundry processes is weak, and prices are falling one after another. In 1Q24, the mature process quotations of some wafer foundries continued to be revised by mid-single-digit percentages (4-6%). As the mature process capacity of wafer foundry in the Mainland China continues to be released, it is estimated that prices may be reduced again in 2Q24, bringing the cumulative decline in 1H24 to about 10%. The prices of mature wafer foundry processes will continue to fall in 1H24, and Taiwanese manufacturers such as UMC, VIS, and PowerChip are still under pressure. However, it is a big plus for IC design companies that adopt mature manufacturing processes, especially the two major categories of driver IC and power management IC, including Novatek, Fitipower, FocalTech, Silergy-KY, and uPI, etc., are expected to continue to enjoy the cost reduction dividends brought by the price reduction of wafer foundry. (Digitimes, UDN)

STMicroelectronics (ST) and Samsung Electronics’ foundry unit have joined forces to launch the industry’s first microcontroller (MCU) utilizing an 18nm process. This MCU is slated for production in 2H25, targeting the automotive semiconductor market. ST has unveiled the latest iteration of its MCU lineup, dubbed “STM32”. This new generation leverages fully depleted silicon-on-insulator (FD-SOI) and 18nm process technology, boasting embedded phase change memory (ePCM). The STM32 integrates the Arm Cortex M core. It delivers enhanced capabilities in machine learning and digital signal processing (DSP) performance. (Digitimes, EE Times, Yahoo, QQ)

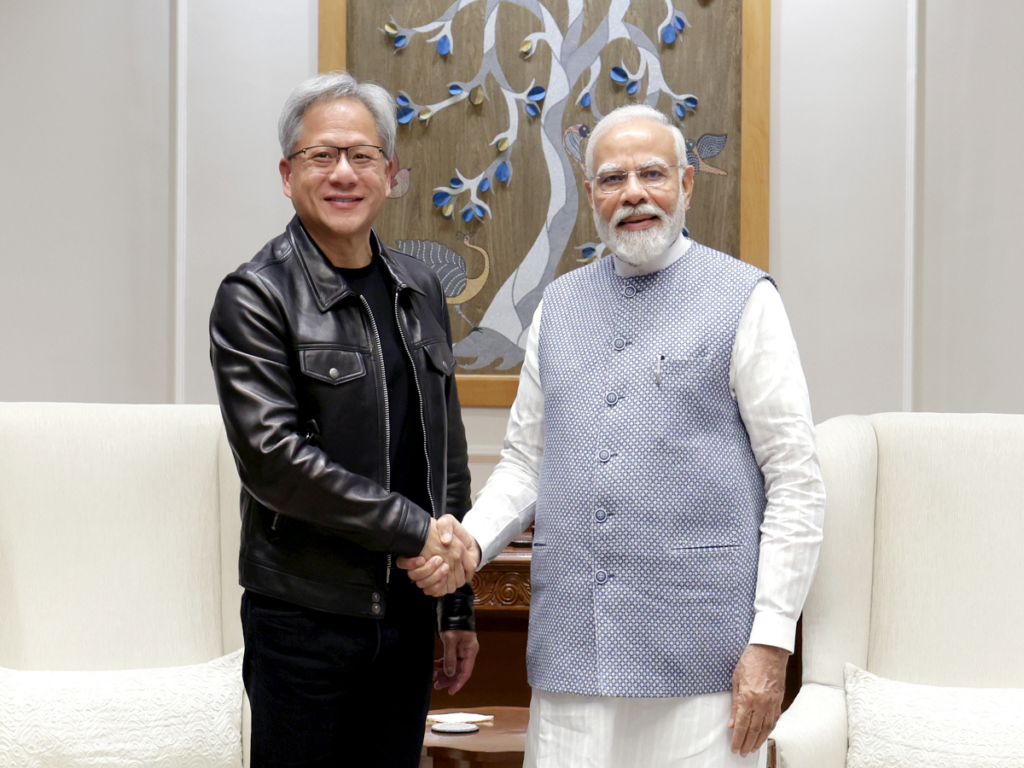

In the wake of the unveiling of India’s USD1.25B AI mission, Nvidia has partnered up with Indian telecoms and enterprises for the installments and production of GPU-based servers. Indian high-performance computing solution providers such as Netweb Technologies, the conglomerate Reliance Industries, telecom operator Tata Communications, and data center operator Yotta Data Services have collaborated with Nvidia to manufacture or install GPU-based servers in India. The Indian government has approved a budget of INR103B (USD1.25B) for the India AI Mission to stimulate local AI development. It is expected to include over 10,000 GPUs of supercomputing capacity, which will be made available to various stakeholders for research to foster the establishment of the local AI ecosystem. (Digitimes, UDN)

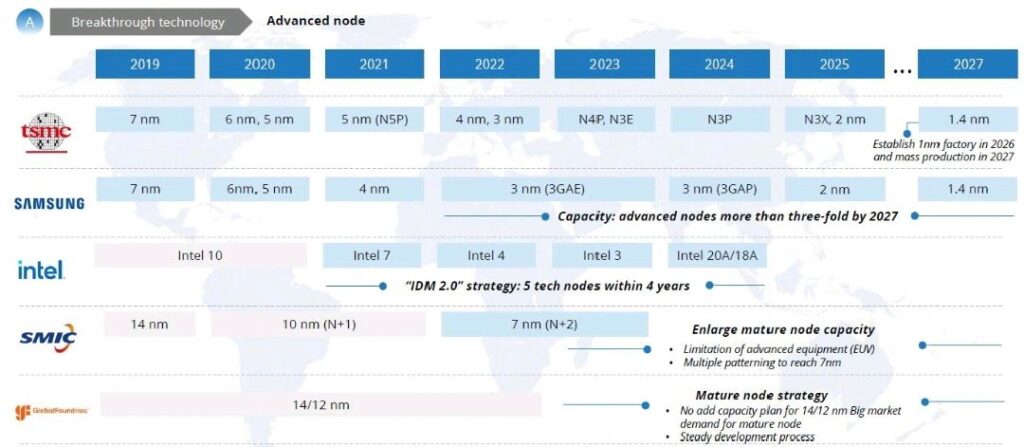

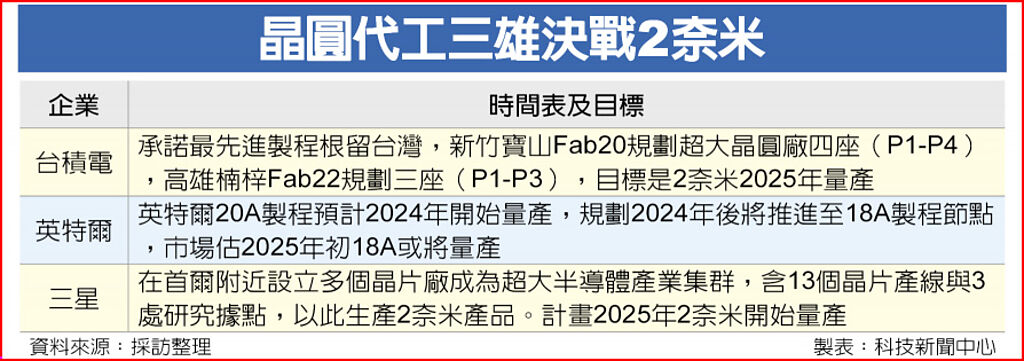

According to SEMI, TSMC and Intel are expected to complete their 2-nanometer (nm) or under fabs within 2024. Intel is expected to be the fastest among chip foundries to commercially offer a 2nm chip. Its PC CPU Arrow Lake is the first to be made with a 2nm node, the CPU tile of the chiplet is expected to be 2nm. The other tiles are expected to be made by TSMC. While TSMC’s capacity is only a third of Intel’s for 2024, once its main customer Apple applies 2nm to their application processors for iPhones, its capacity is expected to take a major leap. (The Elec, Patently Apple, China Times, SemiWiki)

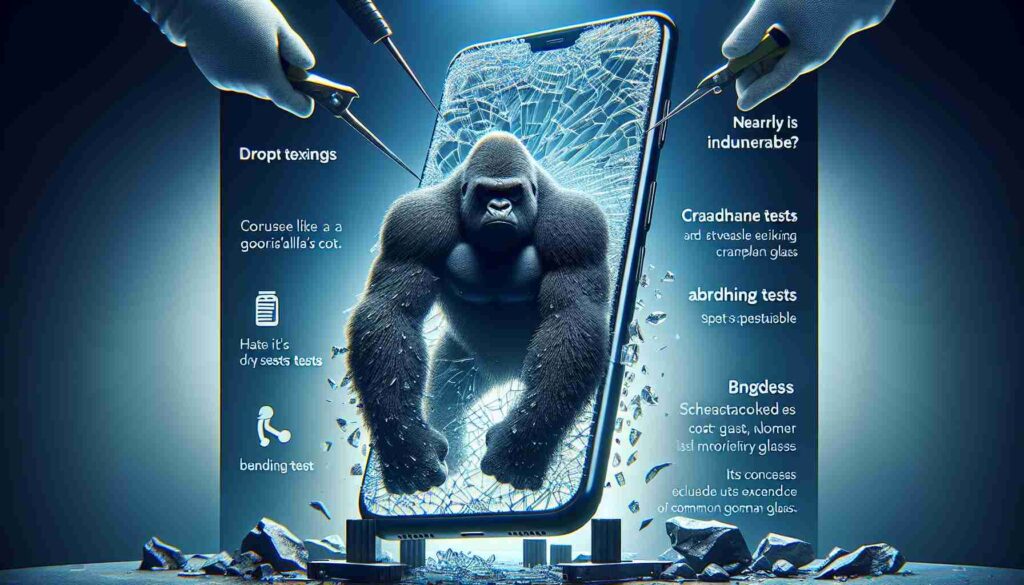

Samsung’s latest flagship smartphone features Corning’s new Gorilla Glass Armor display panel that cuts reflections by 75 percent compared to a typical glass surface, and is resistant to micro scratches that build up over time on competing glass panels. Corning claims the panels also offer over 4x more scratch resistance than competitive aluminosilicate cover glasses. This technology may be applied to Apple’s iPhone 17 series smartphones, set to be launched in 2025. Apple has allegedly acquired the specialized coating technology equipment from Japan and has handed it over to its supply chain partners in China. The iPhone 17 series in 2025 will have a chance to adopt this technology and feature screens that are “super hard, very scratch-resistant, and anti-reflective”, to a point where “screen protectors are no longer required”. (Digtimes, MacRumors, 163.com)

Display equipment maker Sunic System CEO Park Jae-gyu has revealed that the company expects to win orders from BOE for Gen-8 OLED deposition equipment. Park was referring to the company’s competition with Japanese counterpart Canon Tokki to win orders for deposition equipment from BOE for their new Gen 8 OLED production line, B16. BOE announced the construction of the line in Nov 2023. The Gen 8.6 OLED line is planned to have a monthly capacity of 32,000 substrates per month, which means it needs four units of deposition equipment. B16 will be constructed in two phases and the first phase will require two units, which the company will place orders for within 2024. (The Elec)

Sony Semiconductor Solutions, a subsidiary of Sony Group, held an opening ceremony for an expanded facility in the Bankadi Industrial Zone in Patham Thai province. The company has invested USD66M in the new fab. The facility will be engaged in the back-end processes for CIS for automotive applications, such as cutting and packaging, after the front-end processes, like forming circuits on wafers, are completed in Kumamoto, Japan, and exported to the Thailand facility. The Kumamoto facility of Sony is close to JASM’s facility, which began operation in Feb 2024. (Digitimes, Asia Nikkei, Sony)

GoPro is to cut its global workforce by about 4% and reduce office space as part of cost-saving measures. The company expects to incur around USD2M in costs due to the layoffs during 1Q24 The office space reduction would result in a USD3.3M charge in the same period. Further expenses of USD2.2M are projected until Jan 2027. This move follows declining revenues for GoPro over the last 6 quarters. It includes a recent quarterly loss of USD2M. (CN Beta, WSJ, WhatJobs)

Longsys Electronics’ recent acquisitions of Zilia (formerly SMART Brazil) and Longforce Technology Suzhou (formerly Powertech Technology Suzhou) mark the Chinese memory module specialist’s diversification into the semiconductor backend sector. Longsys’ annual sales broke the CNY10B (USD1.3B) mark for the first time in 2023 and swung into profitability in 4Q23. However, Longsys chairman Cai Huabo noted that the storage sector is prone to economic and geopolitical impacts, and there seems to be a ceiling for memory module makers. Four memory module makers with a history of over 20 years (three of them from Taiwan) have never seen their revenues exceed USD2B, he said. Cai said Longsys sees over 70% of sales from its brand-name businesses. Others still consider it merely a memory module maker, because its controller chip and backend technology have yet to mature. (Digitimes, Semi Insights, China Daily)

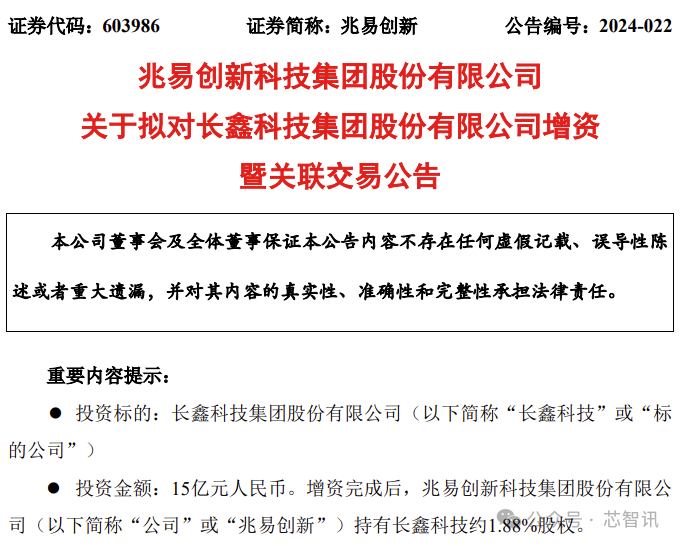

China-based MCU and NOR flash provider GigaDevice plans to participate in Changxin Memory Technologies’ (CXMT) latest capital increase, citing the increasing demand for DRAMs in China. GigaDevice would invest CNY1.5B (USD207.5M) in CXMT in the latter’s latest round of fundraising, after which GigaDevice’s share in CXMT will increase from 0.95% to 1.88%. GigaDevice, a fabless semiconductor provider engaged in MCU, memory, and sensor business, procures DRAM from CXMT. GigaDevice said the company sourced DRAMs from CXMT worth CNY180M from 2020 through 28 Mar 2024. (Digitimes, Sina)

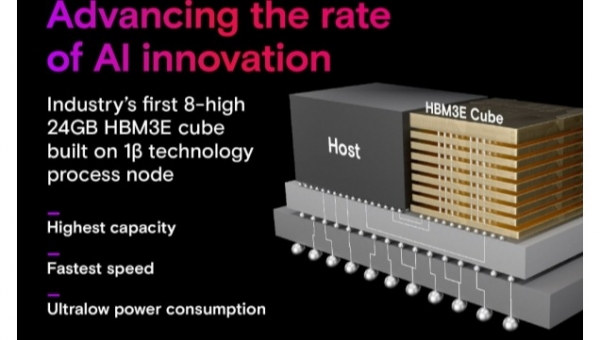

Micron said that its high bandwidth memory (HBM) production capacity in 2024 has already been sold out. Enough orders have also been placed for its capacity in 2025 to be almost filled, the company said during its conference call for its Dec-Feb quarter, its fiscal 2Q24. Its latest HBM3E will be used in Nvidia H200 and the chip is also being qualified by other customers. The company claimed that customers said that its chips consumed 30% less power compared to its competitors, meaning Samsung and SK Hynix. (The Elec, Motley Fool, AnandTech, Micron)

SK Hynix is expanding the High Bandwidth Memory (HBM) contribution to its DRAM revenues and expects a deepening effect of the customization trend of HBM. SK Hynix CEO Kwek Noh-Jung has indicated that customization in the HBM market will grow. The deepening of SK Hynix’s relations with its main customers such as Nvidia and Cloud Service Providers (CSP) will determine its competitiveness in the semiconductor market. SK Hynix has already started to supply customized HBM to Nvidia, Google, etc. In particular, when Google signed an HBM supply contract with SK Hynix, the prerequisite was to meet the customization demand. The HBM market is expected to continue growing, and Kwek said that the proportion of HBM sales in the overall revenue in 2023 was only a single digit, but it will reach double digits in 2024. Demand for HBM is also expected to be “tight” in 2025, the CEO said.(The Elec, Digitimes)

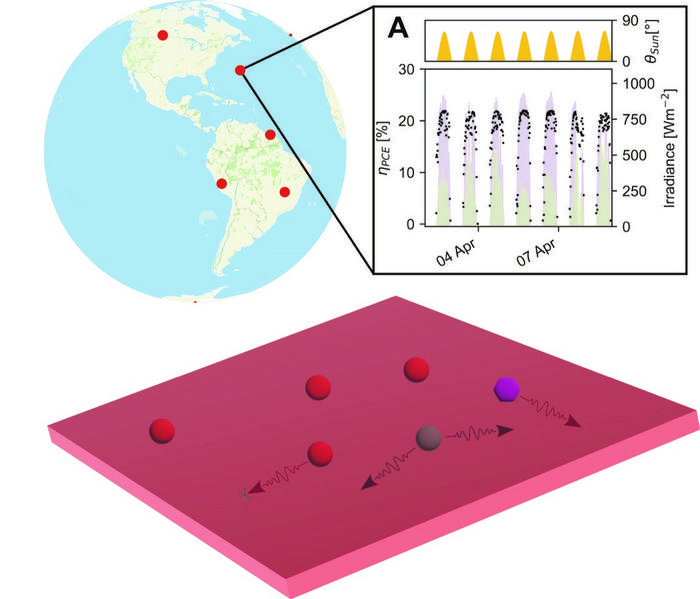

Cavendish Laboratory and AMOLF (Amsterdam NL) have found that improving solar cells efficiency. They used machine learning models and neural networks (AI) to understand how the sun’s radiation would behave in different spots on Earth. They integrated this data into an electronic model to calculate the solar cells’ output. By simulating various scenarios, they could predict how much energy the solar cells could produce at various locations worldwide. Imagine solar panels that can flex and fold like origami or become partially transparent to blend seamlessly into surroundings and make them easy to install. By enhancing the durability and versatility of these panels, they could be integrated into a wide range of settings, promising longevity and efficiency. (ScienceDirect, Eureka Alert, CN Beta)

Huawei Technologies founder and chief executive Ren Zhengfei, has recently met senior executives from PetroChina amid efforts by the nation’s largest oil and gas producer to step up its low-carbon energy initiatives. Ren has met Dai Houliang, chairman of both the state-owned China National Petroleum Corp (CNPC) and its listed arm PetroChina, in Shenzhen where they discussed “improving corporate governance, digital transformation and intelligent development, as well as scientific and technological innovation”. Gizmo China, SCMP, IT Home)

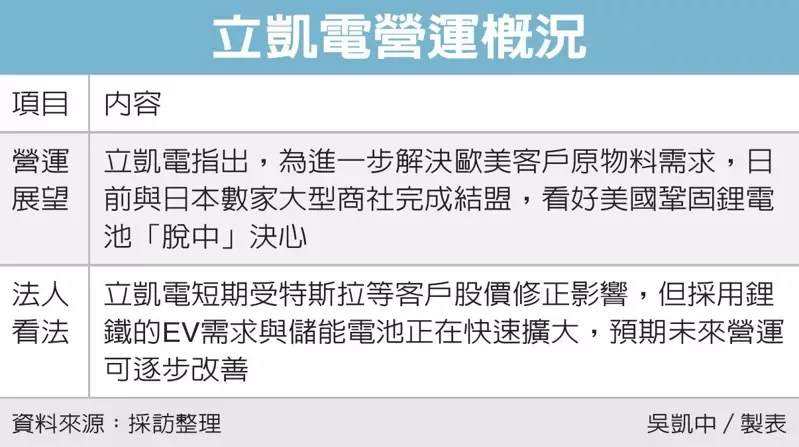

Advanced Lithium Electrochemistry (Aleees), a Taiwan-based provider of LFP battery materials and IP licensor, has expanded its customer base to include automakers in Europe, the US, and Korea. Since Sept 2023, Aleees has added four major carmakers – two in the US, and one each in Europe and Japan – to its clientele, according to the company. Aleees said its customers cover various applications, including energy storage, electric vehicles (EV), electric trucks, and solid-state batteries. Aleees CIO Chu Jui-Yang pointed out Aleees currently has 78 customers, 47 of which are major ones. (Digitimes, UDN, UDN, MoneyDJ)

According to Samsung SDI CEO Yoonho Choi, the company is planning to expand its electric vehicle battery production capacity in North America through the forming of new joint ventures and building more factories. The battery maker has joint venture agreements with General Motors and Stellantis to build factories in North America. Samsung SDI and General Motors previously said they would secure a production capacity of 20GWh per year. On when its joint venture with Stellantis Startplus Energy will start factory operations, the CEO said it was working to start production as fast as it can and will share the timeline when it is decided on. Starplus Energy is building two factories, one with an annual capacity of 33GWh and another with 34GWh. (The Elec)

LG Energy Solution (LGES) expects the slowdown in the electric vehicle battery market that started in 2023 to continue up to 1H24. In response, the South Korean battery maker will adjust its investment timeline in North America, accroding to the company CFO Lee Chang Sil. The current market situation has been unprecedented since LG Energy Solution started its battery business. In 2023 there was also a slowdown in demand for EVs and lithium prices also dropped. However, LG Energy Solution focused on expanding its sales in South Korea and continued to focus on the North American market, and it was continuing to expand its production capacity overall. In 2024, LG Energy Solution will focus on its fundamentals despite external factors. The company will start expanding the production of 4680 cylindrical batteries and also add new products such as lithium iron phosphate and high-voltage mid-nickel batteries.(The Elec, Yahoo)

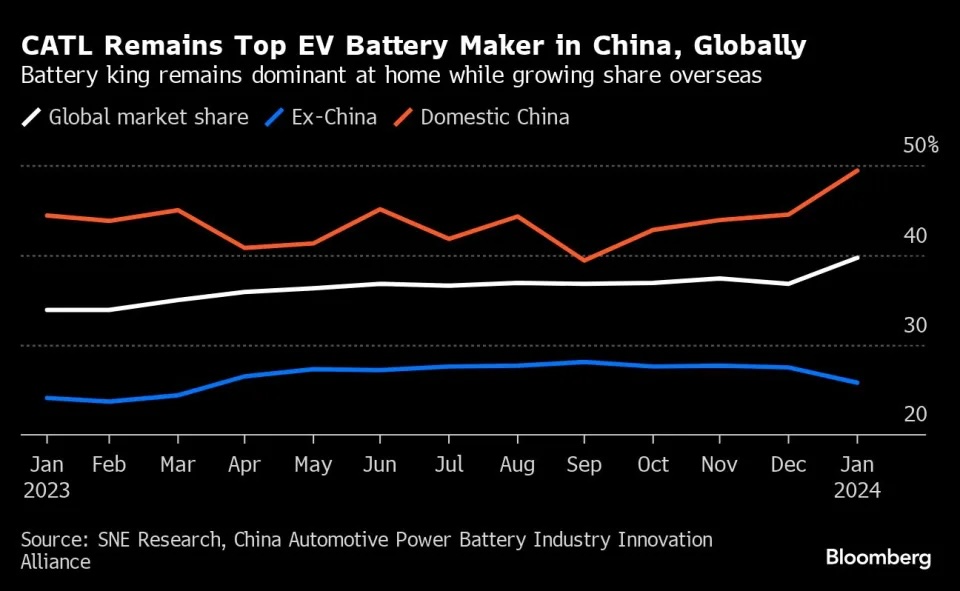

Contemporary Amperex Technology Co. Ltd. (CATL) is not worried about overcapacity, and in fact will crank up output of its more technologically advanced products, said Robin Zeng, president and chairman of the company. He said his company has found the solutions to get battery-charge times down to 10 minutes, and is working on reducing them even further. His view that market forces are taking hold in China is reinforced by the central government doing away with national subsidies at the end of 2022. CATL supplies batteries to almost every major automaker, including Tesla, Volkswagen AG and Toyota Motor Corp. The company based in Ningde, Fujian province, generated CNY400.9B (USD56B) in revenue 2023, roughly 8 times its 2020 total. (SCMP, Bloomberg, Yahoo)

Despite setbacks such as the Ampere IPO faltering, Nissan and Renault have reaffirmed their commitment to partnership in crucial areas such as EVs, autonomous driving technology, and emerging markets like India. Nissan is strengthening its ties with other automakers to navigate the swiftly evolving automotive market, which had previously raised questions about its relationship with Renault. During a joint trip by Nissan and Renault senior executives to India, Nissan confirmed its intention to invest in Renault’s EV subsidiary, Ampere. (Digitimes, Business Standard, Reuters)

Chinese EV maker BYD plans to increase investment in its Brazilian plant by over 80% to accelerate construction. The factory is located in the Bahia state, northeast of Brazil, and is scheduled to start operation in 2024. The facility will manufacture hybrid and battery EVs with an annual production capacity of 150,000 units. BYD said its investment in Brazil will increase from BRL3B (USD602M) to BRL5.5B. The plant will be the automaker’s first production base outside Asia. BYD’s Mexican plant will initially target 150,000 EVs annually and focus on making sedans. The carmaker is still exploring different sites in the country and will finalize the expansion by the end of 2024. (Digitimes, Sina)

The United Nations General Assembly has unanimously adopted the first global resolution addressing the governance of AI. The non-binding resolution, proposed by the United States and co-sponsored by China and over 120 other nations, encourages countries to safeguard human rights, protect personal data, and monitor AI systems for potential risks. The resolution specifically advocates for the strengthening of privacy policies and calls for regulations that can defeat malicious deployment of AI tools. The text reflects the growing influence, benign and otherwise, of generative AI models, deepfakes and synthetic media, and related developments. (Android Central, United Nations, SCMP, Voicebot.AI)