5-5 #Embrace : Samsung is currently developing next-gen GAA technology; Two major international manufacturers in China have stopped updating their small foldable phone lines; Apple has allegedly renewed discussions with OpenAI; etc.

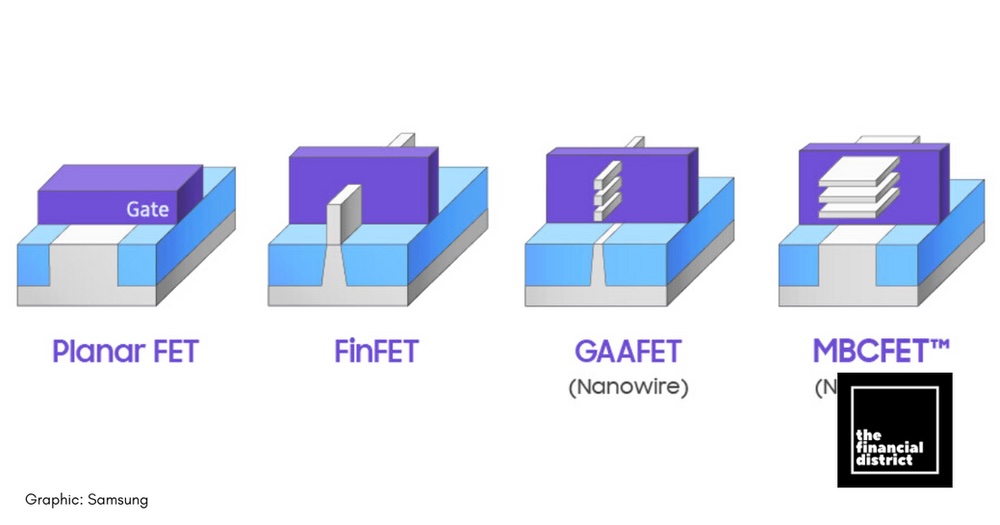

Samsung Electronics is currently developing next-generation “gate-all-around” (GAA) technology, aimed for application in the 2nm foundry processes it plans to mass produce in 2025. GAA technology is a next-generation transistor technology that regulates and amplifies or switches off the flow of current within a semiconductor. Samsung has developed its proprietary GAA technology called “MBCFET”, which shows improvements in performance and efficiency as it evolves. The first-generation 3nm GAA-based process, compared to the previous 5nm process, shows a 23% improvement in performance, a 16% reduction in area, and a 45% reduction in power consumption. The upcoming second-generation 3nm process is expected to achieve a 30% improvement in performance, a 35% reduction in area, and a 50% reduction in power consumption. The third-generation MBCFET is also expected to see significant performance improvements with over 50% reduction in power loss and higher integration due to area reduction. (CN Beta, Gizmo China, IT Home, SamMobile, Business Korea)

MediaTek has confirmed that a “premium segment” Android smartphone will launch in the US later in 2024 with one of the company’s chips inside. (CN Beta, 9to5Google, WCCFTech, Android Authority, Twitter)

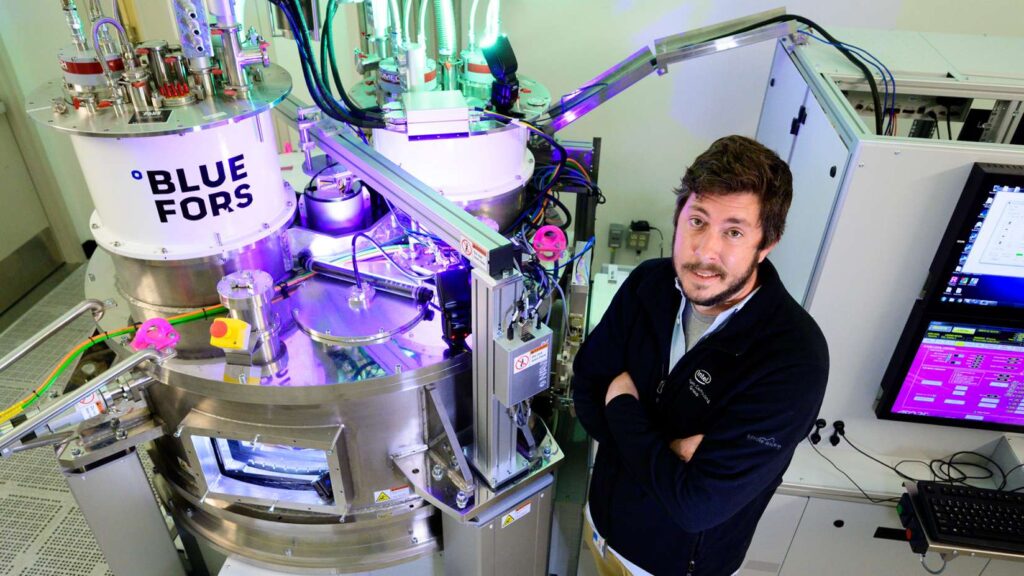

Intel has developed a 300mm cryogenic probing process to collect high-volume data on the performance of spin qubit devices across whole wafers using complementary metal oxide semiconductor (CMOS) manufacturing techniques. The improvements to qubit device yield combined with the high-throughput testing process enabled researchers to obtain significantly more data to analyze uniformity, an important step needed to scale up quantum computers. Researchers also found that single-electron devices from these wafers perform well when operated as spin qubits, achieving 99.9% gate fidelity. This fidelity is the highest reported for qubits made with all-CMOS-industry manufacturing. The small size of spin qubits, measuring about 100nm across, makes them denser than other qubit types (e.g., superconducting), enabling more complex quantum computers to be made on a single chip of the same size. The fabrication approach was conducted using extreme ultraviolet (EUV) lithography, which allowed Intel to achieve these tight dimensions while also manufacturing in high volume. (CN Beta, Market Screener, Intel, Nature)

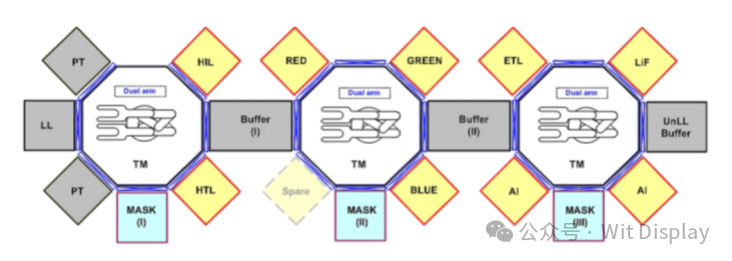

BOE has reportedly decided to use OLED deposition machines from South Korea’s Sunic System for its production of Gen 8 IT OLED panels. The South Korean equipment maker had supplied OLED deposition machines to Samsung Display, LG Display, and BOE in the past but these were for testing, not commercial production. LG Display used Sunic System’s machine for its OLED panel production aimed at Apple Watch and automobiles, but the volume was negligible. Sunic System will supply two units to BOE’s B16 line under the new deal. As the line is in its first phase of construction, the Chinese display panel maker will place orders for two more in the second phase. (The Elec, EET China)

Samsung’s smartphone business is planning to use OLED on silicon (OLEDoS) from Sony for its extended reality (XR) device. Samsung MX Business’ decision to use the Japanese company’s technology over its affiliate Samsung Display, which has also been developing its own OLEDoS technology, reflects Samsung’s need for a new position to oversee the development of new semiconductor devices (not consumer electronics but electronic components such as OLED and transistors). (The Elec)

Two major international manufacturers in China have stopped updating their small foldable phone lines, and there will be no new generation products in 2024. At the same time, one of them may directly adopt a new form in 2025, instead of the traditional clamshell foldable. (IT Home, C114, My Drivers)

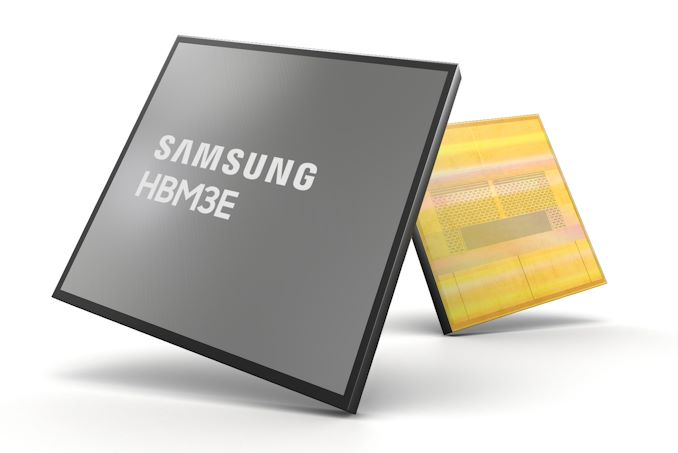

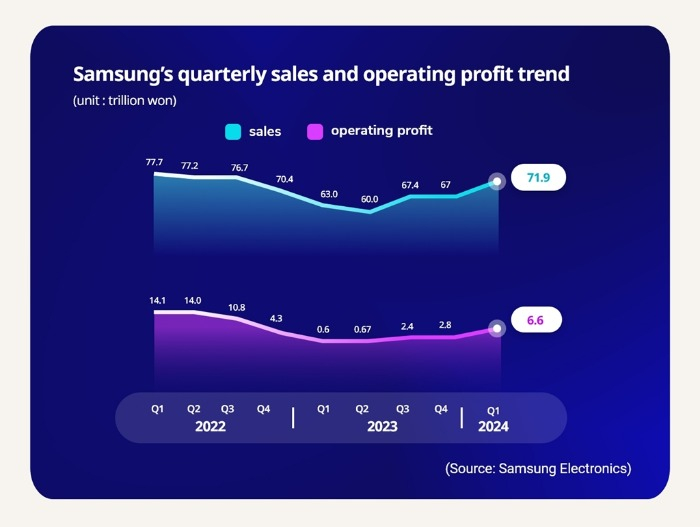

Samsung has reportedly signed a new USD3B agreement with AMD to supply HBM3e 12-layer DRAM for use in the Instinct MI350 series AI chips. Samsung has also agreed to purchase AMD GPUs in exchange for HBM products. AMD plans to launch the Instinct MI350 series in 2H24 as an upgraded version of the Instinct MI300 series. The MI350 series is reportedly expected to adopt TSMC’s 4nm process, delivering improved computational performance with lower power consumption. The inclusion of 12-layer stacked HBM3e memory will enhance both bandwidth and capacity. Samsung’s HBM3e 12H DRAM offers up to 1280GB/s bandwidth and 36GB capacity, representing a 50% increase compared to the previous generation of eight-layer stacked memory. Advanced Thermal Compression Non-Conductive Film (TC NCF) technology enables the 12-layer stack to meet HBM packaging requirements while maintaining chip height consistency with eight-layer chips. (Yahoo, TrendForce, TechNews, SamMobile, Viva100)

Kim Jae-june, Samsung’s memory business vice president, has indicated that the company will adjust its memory chip product mix to increase the output of advanced memory chips for servers and storage systems to meet the growing demand for artificial intelligence (AI) devices. The company’s memory chip production will focus on high-bandwidth memory (HBM), double data rate 5 (DDR5) and high-capacity solid-state drive (SSD) chips instead of PC and mobile chips. The company plans to increase supply of HBM chips in 2024 by more than threefold versus 2023. (Business Korea, KED Global)

Samsung has started the mass production of its HBM3E “Shinebolt” memory, which will first ship in 8-Hi stacks in May 2024 and will be followed by the 12-Hi variant 2Q24. The next-gen memory solution will offer up to 36 GB capacities per stack for up to 288 GB products on an 8-module chip like AMD’s MI300X. In addition, the company plans to strengthen leadership in the server market through mass production and customer shipment of 1b nano 32Gb (gigabit) DDR5-based 128GB (gigabyte) products in 2Q24 NAND plans to respond in a timely manner to demand for AI by developing an ultra-high capacity 64TB SSD and providing samples in 2Q24, and also enhance its technological leadership by starting mass production of V9 for the first time in the industry in 3Q24. (WCCFtech, CN Beta, Samsung)

SK Hynix has announced that the company’s high-bandwidth memory (HBM) production capacity has already sold out for the rest of 2024, and even most of 2025 has already sold out as well. SK hynix currently produces various types of HBM memory for customers like Amazon, AMD, Facebook, Google (Broadcom), Intel, Microsoft, and NVIDIA. The latter is an especially prolific consumer of HBM3 and HBM3E memory for its H100 / H200 / GH200 accelerators, as NVIDIA is also working to fill what remains an insatiable (and unmet) demand for its accelerators. As a result, HBM memory orders, which are already placed months in advance, are now backlogging well into 2025 as chip vendors look to secure supplies of the memory stacks critical to their success. (CN Beta, Reuters, AnandTech, Barron’s, Digitimes, Techpowerup)

SK hynix has unveiled that the company is working on a solid-state drive of unprecedented 300TB capacity. In addition to 300TB SSDs, SK Hynix is working on a variety of products that could be useful both for datacenter AI training and inference (HBM4, HBM4E, CXL Pooled Memory Solutions, Processing-In-Memory solutions), for edge AI devices (LPDDR6, GDDR7, PIM), and for on-device AI inference (LPDDR6, GDDR7, high-capacity DDR5). (CN Beta, Tom’s Hardware)

Micron Technology has announced it is leading the industry by validating and shipping its high-capacity monolithic 32Gb DRAM die-based 128GB DDR5 RDIMM memory in speeds up to 5,600 MT/s on all leading server platforms. Powered by Micron’s industry-leading 1β (1-beta) technology, the 128GB DDR5 RDIMM memory delivers more than 45% improved bit density,1 up to 22% improved energy efficiency2 and up to 16% lower latency1 over competitive 3DS through-silicon via (TSV) products.(Gizmo China, Micron, TweakTown, IT Home)

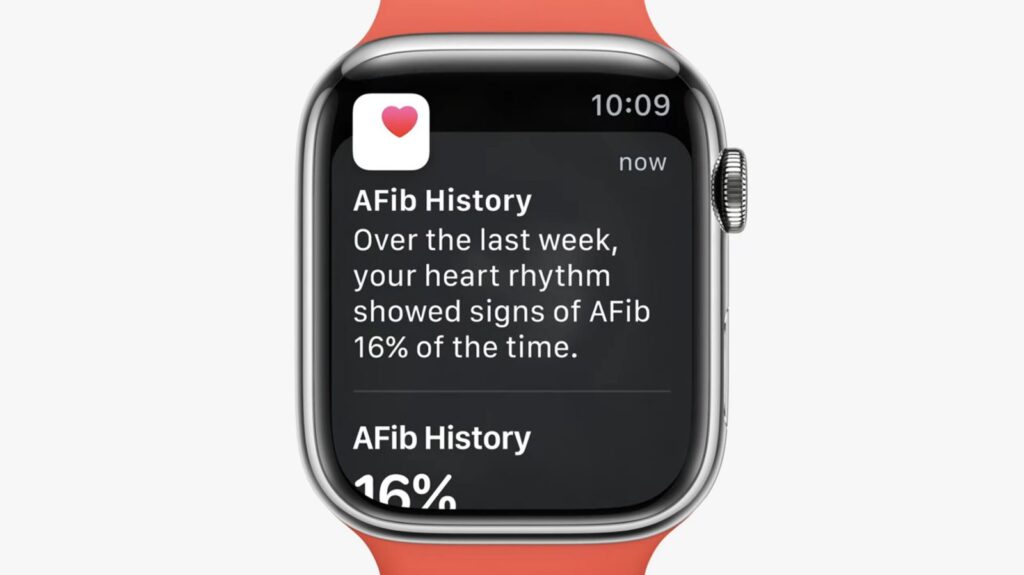

Apple’s atrial fibrillation (AFib) history feature on Apple Watch has been qualified by the FDA under its Medical Device Development Tools (MDDT) program, the first digital health technology feature of its kind to do so. Since 2022, Apple Watch has supported AFib History, which allows users diagnosed with atrial fibrillation to view an estimate of how frequently their heart is in this type of irregular rhythm. The feature analyzes pulse rate data collected by a photoplethysmography (PPG) sensor to identify episodes consistent with AFib and provides the user with a retrospective estimate of AFib burden (a measure of the amount of time spent in AFib during past Apple Watch wear). Apple says the feature is intended for individuals aged 22 years or older who have been diagnosed with atrial fibrillation. (The Verge, Mashable, 9to5Mac, MacRumors, CN Beta)

Lidar company Luminar is slashing its workforce by 20% and will lean harder on its contract manufacturing partner as part of a restructuring that will shift the company to a more “asset-light” business model, as it aims to scale production. The cuts will affect around 140 employees, and are starting immediately. Luminar is also cutting ties with “the majority” of its contract workers. The company said in a regulatory filing that the changes will reduce operating costs “by USD50M-65M on an annual basis”. (TechCrunch, The Verge, CN Beta)

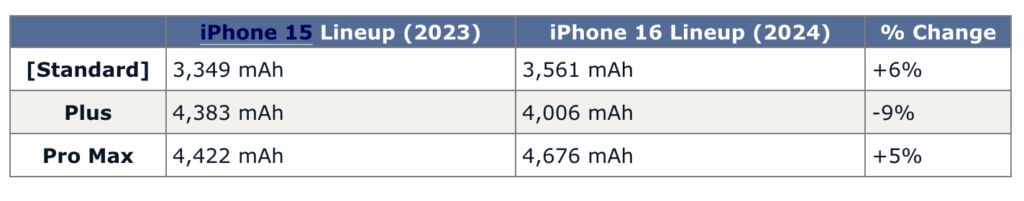

Apple’s upcoming iPhone 16 lineup will feature bigger battery capacities compared to previous-generation models with the exception of the iPhone 16 Plus, which will have a smaller battery than its predecessor. The figures show that the iPhone 16, iPhone 16 Pro, and iPhone 16 Pro Max will feature larger batteries than their predecessors, but the iPhone 16 Plus is allegedly facing a reduction in terms of battery capacity compared to the iPhone 15 Plus. It is rumored that the battery casing of the Apple iPhone 16 series will be replaced from aluminum-plastic film to stainless steel, and the material will be provided by Chinese suppliers. It is reported that the all-steel casing will use laser welding process, which can improve the service life of the battery, mainly increasing the number of cycles. (CN Beta, GSM Arena, MacRumors, Weibo)

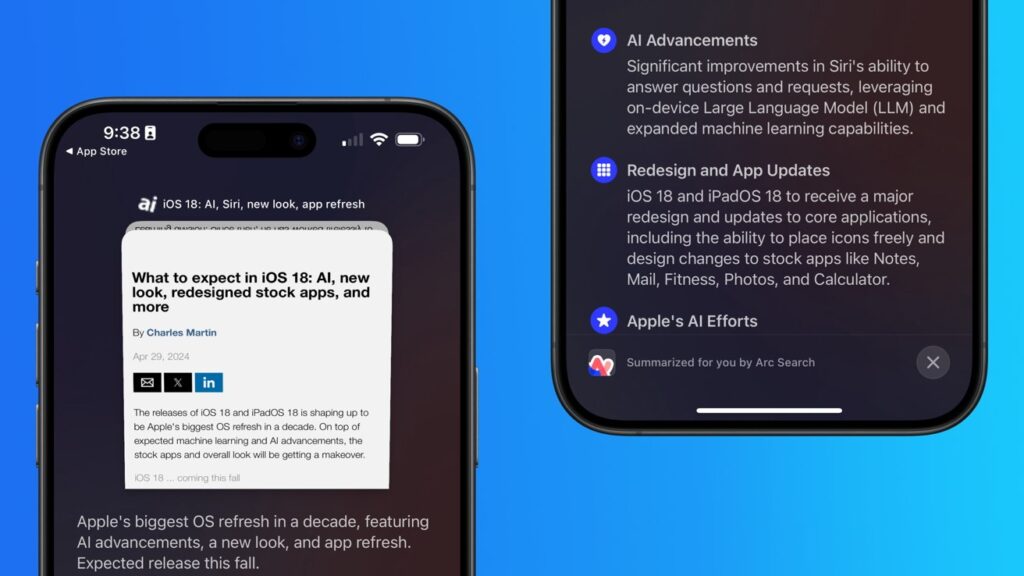

Apple has allegedly renewed discussions with OpenAI about using the startup’s technology to power some new features coming to the iPhone later in 2024. The companies have begun discussing terms of a potential agreement and how OpenAI features would be integrated into Apple’s next iPhone operating system, iOS 18. (Apple Insider, Bloomberg, Reuters)

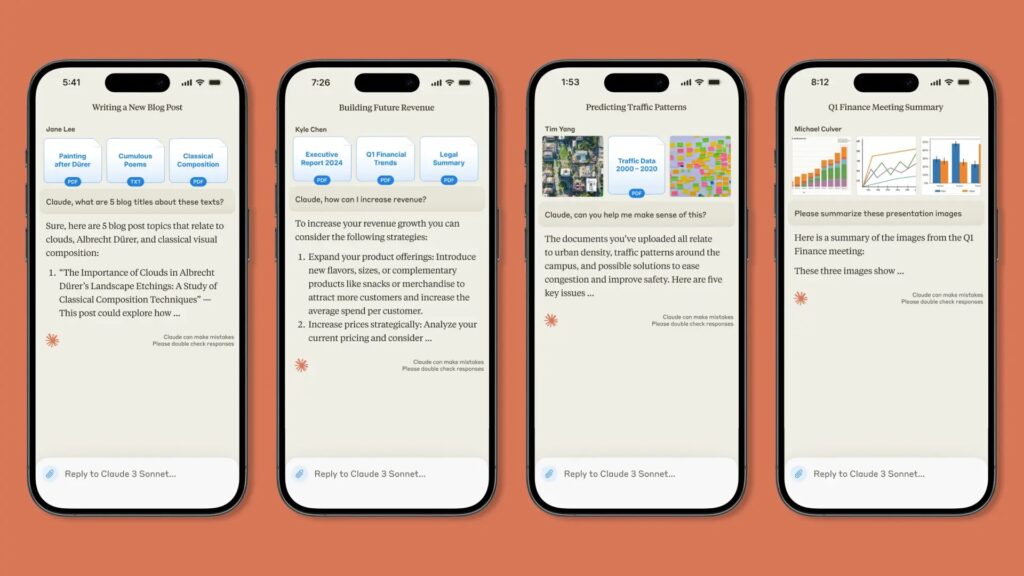

Anthropic has released a Claude mobile app for Apple iOS that any user can download for free. The app syncs users’ conversations with Claude across devices, allowing them to jump from a computer to the app (or vice versa) without losing their chat history. Users will also be able to upload files and images straight from their iPhone’s gallery or take a photo on the spot, if they need Claude to process or analyze them in real time. The new Team plan provides greater usage than the Pro tier so that members can have more conversations with the chatbot. It also enables users to process longer documents, such as research papers and contracts, thanks to its 200,000 context window. The Team plan gives users access to the Claude 3 model family, as well, which includes Opus, Sonnet and Haiku. It will cost subscribers USD30 per user per month, with a minimum head count of five users per team. (CN Beta, Engadget, Apple Insider, Anthropic)

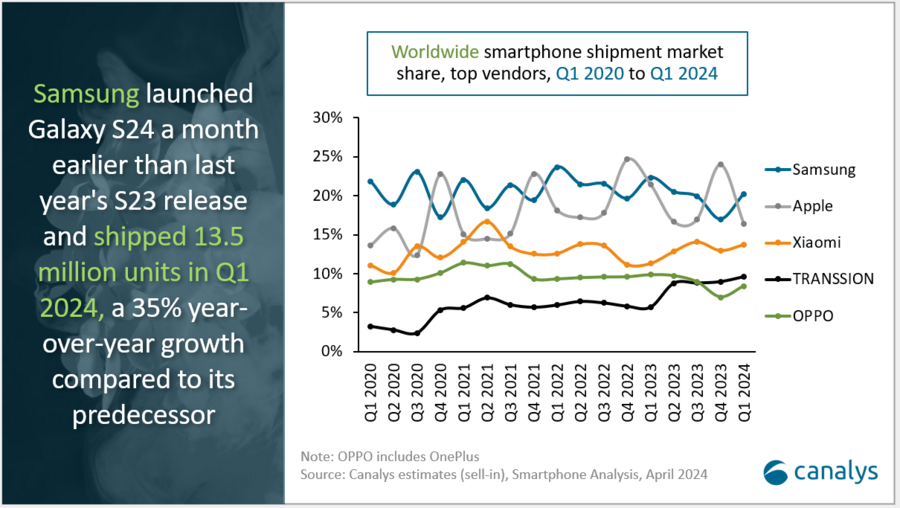

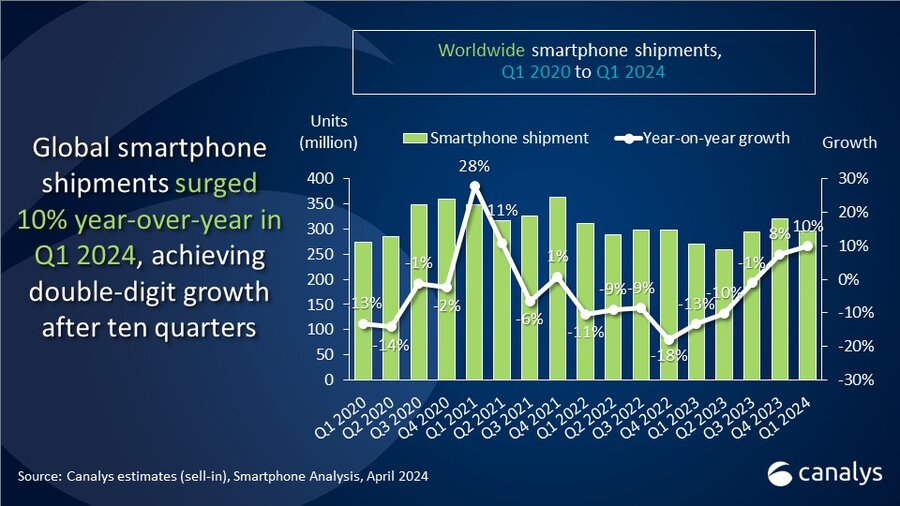

According to Canalys, the worldwide smartphone market experienced a 10% YoY growth in 1Q24, reaching 296.2M units. The market performed better than expected, reaching double-digit growth after ten difficult quarters. The surge was primarily fueled by vendors introducing refreshed portfolios and macroeconomic stabilization in emerging market economies. Samsung regained the lead position, shipping 60.0M units, buoyed by updates to its A-series and early premium offerings. Apple slipped to second spot, shipping 48.7M units, as it experienced a double-digit decline amid headwinds in its core markets. Xiaomi maintained third place with 40.7M shipments and a 14% market share. TRANSSION and OPPO rounded out the top five, shipping 28.6M and 25.0M units respectively, securing 10% and 8% market share. (GSM Arena, Canalys)

Alphabet paid Apple USD20B in 2022 for Google to be the default search engine in the Safari browser, according to newly unsealed court documents in the Justice Department’s antitrust lawsuit against Google. Google has disclosed that Google pays 36% of the revenue it earns from search ads to Apple. The agreement with Apple is the most important of Google’s default deals, since it sets the search engine for the most used smartphone in the US. (Apple Insider, Phone Arena, Bloomberg)

Llama Group, formerly known as Radionomy and the current owner of the brand, has revealed that the new Winamp music platform is slated for an official launch on 1 Jul 2024. The company has asserted that the upcoming Winamp platform represents a “unique solution” to the monetization challenges facing today’s music industry. Llama Group aims to onboard 50,000 artists to the platform in 2024 alone, with a long-term goal of incorporating 1M music creators into this “innovative” platform within the next 5 years.(CN Beta, Yanko Design, TechSpot, Business Wire)

Peloton, the exercise equipment maker and online fitness course provider, said it is laying off 15% of its workforce (about 400 people) as part of cost-cutting measures. The company also said its CEO, president, and board director, Barry McCarthy, would step down after 2 years in the role. (CN Beta, TechCrunch, Peloton)

Hyundai has agreed to spend nearly USD1B on Motional. Hyundai has invested USD475M directly into Motional as part of a broader deal that includes buying out joint venture partner Aptiv. As part of the deal, Hyundai will spend another USD448M to buy 11% of Aptiv’s common equity interest in Motional. Hyundai Motor Group decided to obtain stable management rights in Motional to proactively develop autonomous driving technology and internalize core technology. (TechCrunch, Korea Herald, KED Global)

Apple is testing a version of its Safari web browser that includes UI tweaks, advanced content blocking features, and a new AI-powered tool dubbed Intelligent Search. The software, which is expected to debut as Safari 18 later in 2024. The new Safari will also feature a new user interface (UI) for customizing popular page controls, a “Web eraser” feature, and AI-driven content summarization tools. The Intelligent Search is designed to summarize text by identifying key phrases and topics on the webpage. Intelligent Search supposedly uses Apple’s on-device AI technology, specifically the Ajax language-learning model, to deliver AI-enhanced browsing and text summarization. Web Eraser lets user remove unwanted parts of a web page such as banner ads, text, images, or entire page sections.(Apple Insider, Neowin)