5-11 #GoHome : Apple reportedly has struck an agreement with Samsung Display for foldable display; Apple has cut its 2024 Vision Pro shipments to 400K–450K units; Apple is studying the possibility of working with an electric vehicle (EV) startup company; etc.

Apple reportedly has been working on its own chip designed to run artificial-intelligence (AI) software in data-center servers. Project ACDC (Apple Chips in Data Center) has been in the works for several years. Apple’s server chip will likely be focused on AI inference, rather than on training AI models — an area which experts have said will continue to be dominated by Nvidia. In AI, inference is the process that trained machine learning models use to draw conclusions from brand-new data. (Apple Insider, WSJ, CNBC)

The U.S. has allegedly revoked licenses that allowed companies including Intel and Qualcomm to ship chips used for laptops and handsets to sanctioned Chinese telecoms equipment maker Huawei Technologies. The move comes after the release in Apr 2024 of Huawei’s first AI-enabled laptop, the MateBook X Pro powered by Intel’s new Core Ultra 9 processor. (GSM Arena, Reuters)

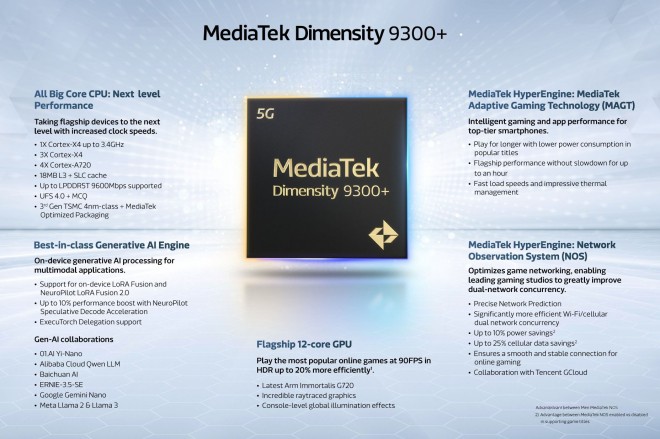

MediaTek has launched the Dimensity 9300+, a new chipset designed for flagship smartphones. The chip is compatible with various LLMs, including Google’s Gemini Nano and Meta’s Llama 2 and 3. MediaTek claims this broad LLM compatibility, coupled with its on-device LoRA (Low-Rank Approximation) Fusion technology, will foster a rich ecosystem of generative AI applications. The Dimensity 9300+ is claimed to be the industry’s first to achieve high-speed operation for specific LLMs. MediaTek touts a speed of 22 tokens / second for Meta’s Llama 2 7B model. Built on a 4nm process, the Dimensity 9300+ packs an octa-core CPU with one high-performance Arm Cortex-X4 core clocked at 3.4 GHz, three additional Cortex-X4 cores clocked at 2.85 GHz, and four Cortex-A720 cores running at 2.0 GHz. (Gizmo China, GSM Arena, MediaTek, CN Beta)

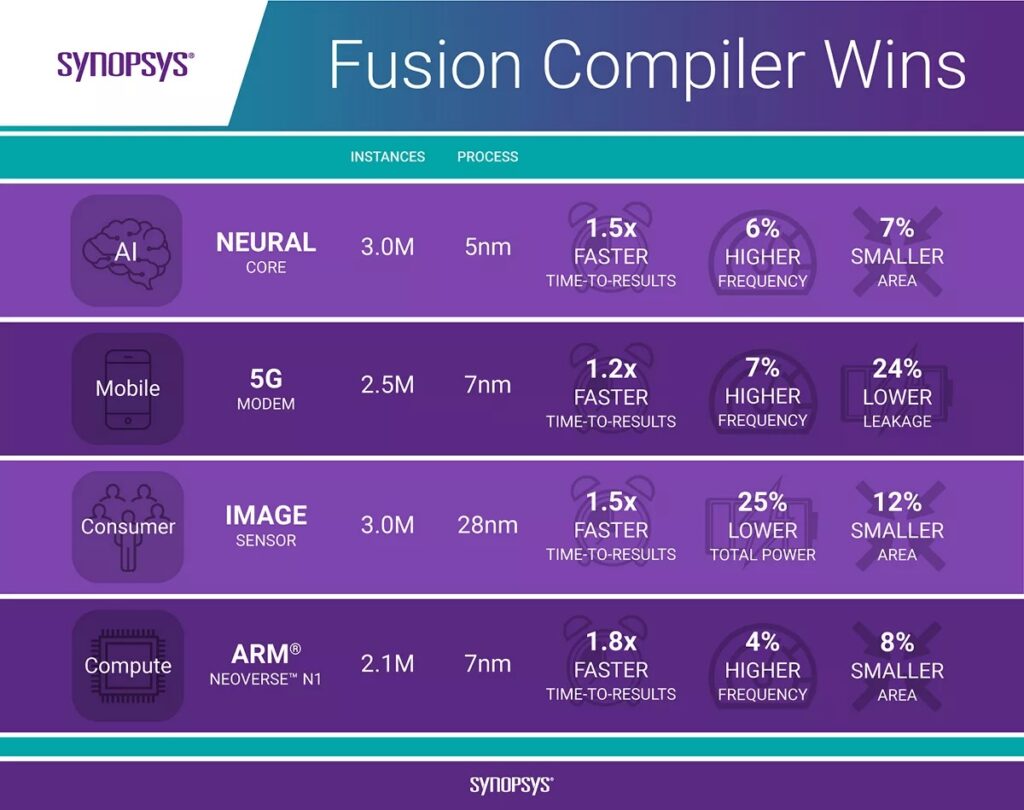

Synopsys has announced that Samsung Electronics has achieved successful production tapeout for its high-performance mobile SoC design, including flagship CPUs and GPUs, with 300MHz higher performance using Synopsys.ai full stack AI-driven EDA suite and a broad portfolio of Synopsys IP on Samsung Foundry’s latest Gate-All-Around (GAA) process technologies. Samsung has partnered with the company so Synopsys can assist with maximizing yield and improving the chip’s performance. Although Samsung had already been manufacturing 3nm chips before this, these new chips will be the firm’s first complex and high-performance 3nm chips. These new chips use Samsung Foundry’s 3nm Gate All Around (GAA) process. (Android Authority, Synopsys, GizChina, Shiftdelete)

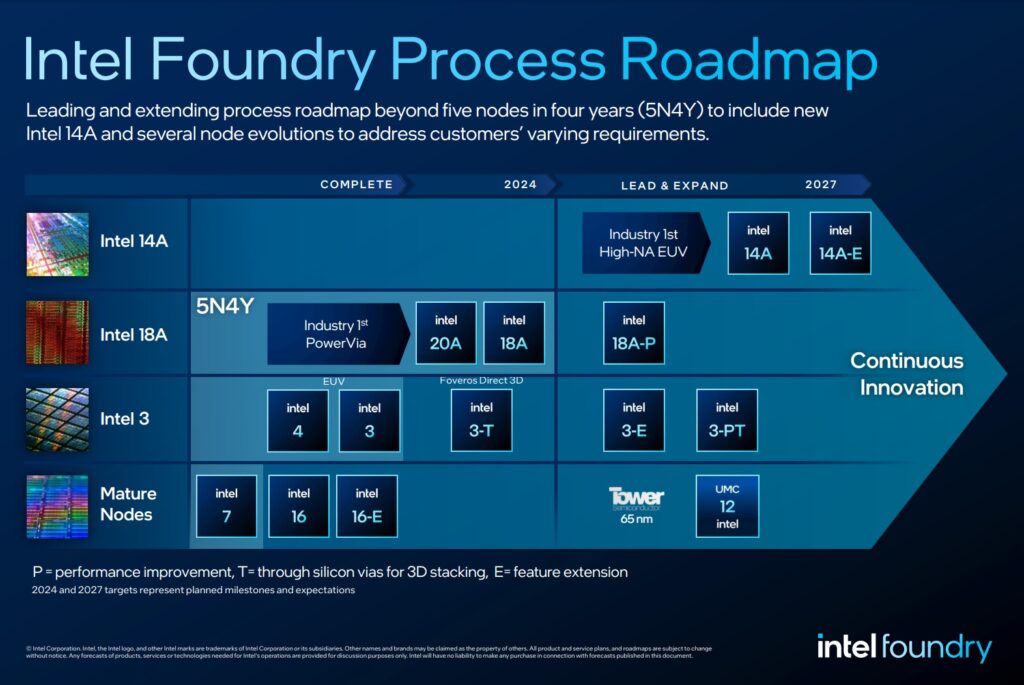

Intel has outlined its new process roadmap which included the announcement of its 14A node. It is estimated to hit the market in 2026 or 2027 and marks the first node to make use of High-NA lithography. It’s expected to incorporate PowerVia backside power delivery and RibbonFET GAA transistors. The announcement of the 14A node follows what has become known as Intel’s “4 nodes in 5 years” roadmap, which is now all but completed. It began with the launch of Intel 7, which is the node used to make 12th, 13th and 14th Gen processors. Parts of Meteor Lake are built using the Intel 4 node. Intel 3 is less relevant to consumers as it is used for Sierra Forest and Granite Rapids Xeon families. 20A is where it gets interesting for consumers as its the node Intel will use to build its Arrow Lake CPU family, which is expected to arrive later in 2024 and replace the current 14th Gen desktop lineup. Beyond 20A lies 18A, which is set to start production later in 2024. Intel’s next-next Gen Panther Lake CPU family is expected to use this node. (CN Beta, TrendForce, Yahoo, iFeng, Patently Apple)

Intel has secured the majority of high-NA extreme ultraviolet (EUV) equipment that ASML is manufacturing up to the 1H25. ASML is manufacturing five units of the kit in 2024, which will all go to the US chipmaker. As ASML’s production capacity for high-NA EUV equipment is around 5-6 units per year, this means Intel is getting all the initial stock. Intel’s rivals Samsung and SK Hynix are expected to get their hands on the kit sometime during 2H25. (TrendForce, TweakTown, The Elec, WCCFtech)

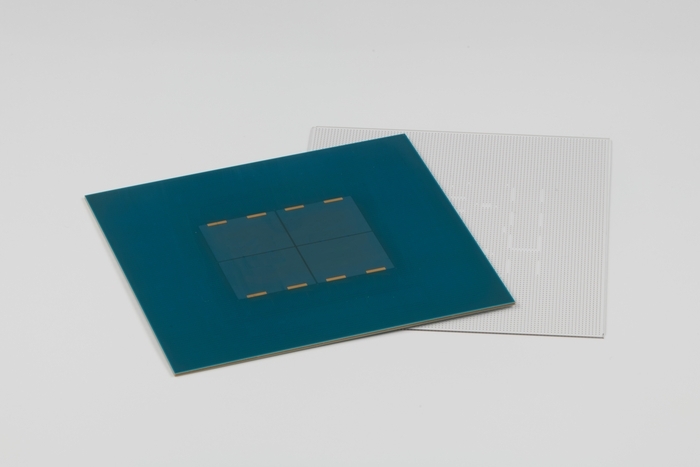

Samsung’s Electro-Mechanics (SEMCO) division is stepping towards the production of glass substrates semiconductors as it races against Intel. Samsung plans to build a “pilot” production line for its next-gen packaging technology by the end of 2024, with a completion date set for Sept 2024. Glass substrates has numerous benefits, such as higher packaging strength, which ensures more extended durability and reliability, and a higher interconnected density since glass is usually much thinner than organic material, allowing the integration of multiple transistors into a single pack. It is said to overcome flaws associated with traditional methods and open a new wave of innovation for computing chips employing glass substrates. Samsung plans to produce glass substrates by 2026, which may put it in the lead when it comes to timing the markets. (CN Beta, Tom’s Hardware, WCCFTech, ET News)

Apple reportedly has struck an agreement with Samsung Display (SDC) for the development of foldable devices, according to Digitimes. Apple already signed a pact with SDC in Apr 2024, with Apple likely to introduce 2 foldable devices in 2026. Apple’s foldable panel orders for SDC reportedly will amount to about 34M units in 2026, as many as 65M units in 2027, and 100M units in 2027, adding that the foldable panels are said to be bigger than the typical sizes for the iPhone. Apple reportedly is developing 2 models of foldable devices, one of them featuring a 20.3” display for which volume production may start at the end of 2025 at the earliest but is more likely to begin in 1H26. In 2H26, Apple is expected to introduce 4 new iPhone models, with one of them reportedly coming with a foldable display. (CN Beta, GizChina, Neowin, Digitimes)

Samsung Galaxy S25 series will reportedly feature “Battery AI”, which may extend the longevity of their batteries by up to 10%. Battery AI could be an intelligent feature baked into the next version of Galaxy AI that increases the overall runtime without affecting the smartphone’s performance. (Android Central, WCCFtech, Yahoo, GSM Arena)

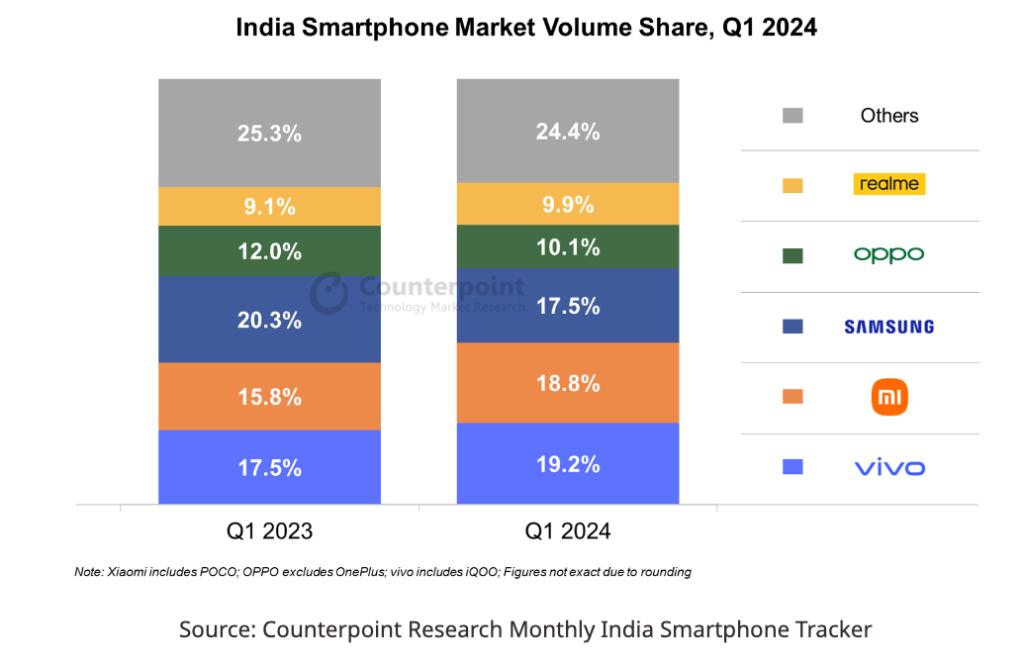

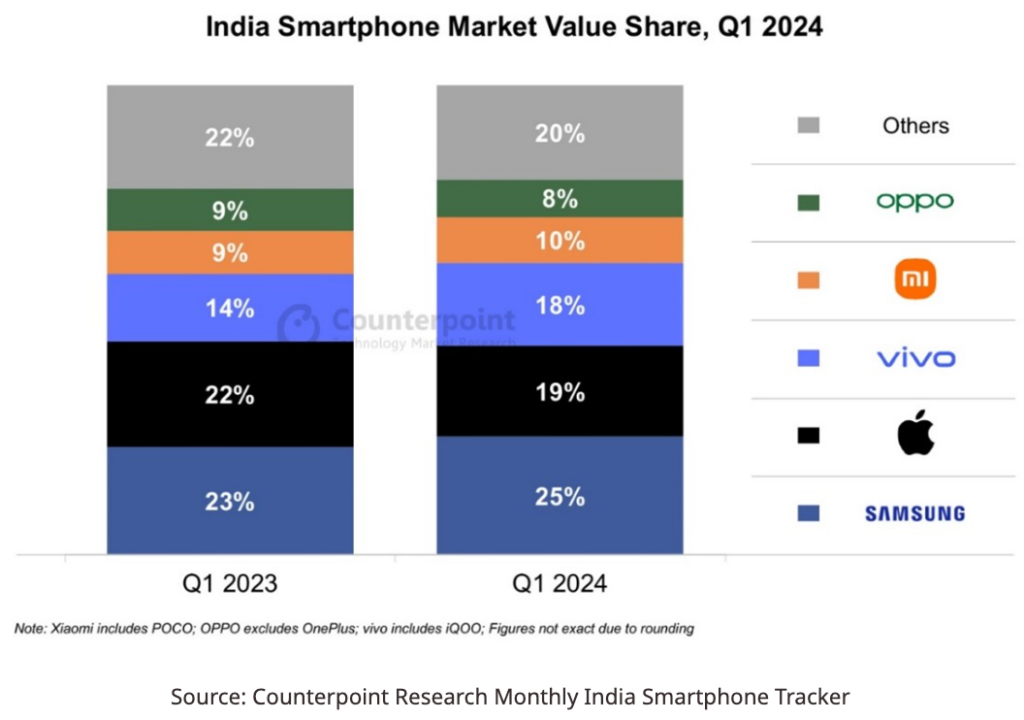

India’s smartphone shipments in 1Q24 grew 8% YoY in terms of volume and 18% in terms of value, according to Counterpoint Research. Volume growth was primarily driven by healthy inventory levels and the low base of 1Q23. Value growth was driven by the ongoing premiumization trend and new launches during the quarter, such as the Samsung Galaxy S24 and OnePlus 12 series. The premium segment (>INR 30,000) reached 20% volume share, its highest ever, and 51% value share of the overall Indian smartphone market in 1Q24. More than one-third of mid-tier consumers are willing to upgrade to the premium segment. Factors driving this trend include affordable financing schemes, better value for trade-ins, and bundled schemes, along with the demand for top-tier features such as AI, gaming, and imaging enhancements. (GSM Arena, Counterpoint Research)

TrendForce projects that Apple will ship 4.5M-5M OLED iPad Pros in 2024. That is the 11” and 13” combined, and it is a lower sales volume expectation than their LCD and mini-LED-equipped predecessors. TrendForce expects AMOLED tablets to hit 9M units in 2024, about 7% of the tablet market. TrendForce notes that the tandem technology is a vital interim solution to enhance both performance and longevity until OLED efficiency breakthroughs are achieved in the near future. The report continues that while OLED panels are complex and hard to manufacture, especially at this size, capacities, and improved yields are expected after 2026. (GSM Arena, 9to5Mac, TrendForce)

Oura is announcing Cardiovascular Age, a new metric from the smart ring that will tell users whether their cardiovascular age is older or younger relative to their chronological or “real” age. Oura says it analyzes age-related observations in a photoplethysmography or PPG signal, which can reflect information about arterial stiffness (how thick or stiff user’s artery walls are) and pulse wave velocity (a measure of arterial stiffness and pressure moving blood vessels). After at least 14 days of using the Oura App, Oura will be able to give an estimate on whether user is averaging below or above chronological age. (Android Authority, CNET)

Meta has begun testing multi-modal AI updates for Ray-Ban Meta smart glasses since Dec 2023, and officially brought Meta AI with Vision to users in the United States and Canada at the end of Apr 2024. Among them, the system can help user understand the world around user by interpreting the pictures the user sees and the questions the user asks. Considering the billions of dollars Meta has poured into AR glasses over the past 6 years, and the lackluster response to the first-generation Meta Ray-Ban, the second-generation device needs to be a winner. Third parties estimate Meta has sold more than 1M units. (CN Beta, The Verge, Yahoo)

According to TF Securities analyst Ming-chi Kuo, Apple has cut its 2024 Vision Pro shipments to 400K–450K units (vs. market consensus of 700K–800K units or more). Apple cut orders before launching Vision Pro in non-US markets, which means that demand in the US market has fallen sharply beyond expectations, making Apple take a conservative view of demand in non-US markets. The Apple Vision Pro 2, which is rumored to be launched in 2026, will have a starting price of USD1,500 and will add two new suppliers. Samsung and SeeYa are rumored to enter Apple’s supply chain, with the Chinese display maker currently in the phase of sending its client samples for evaluation. (CN Beta, WCCFtech, Apple Insider, WCCFtech, Medium, Twitter)

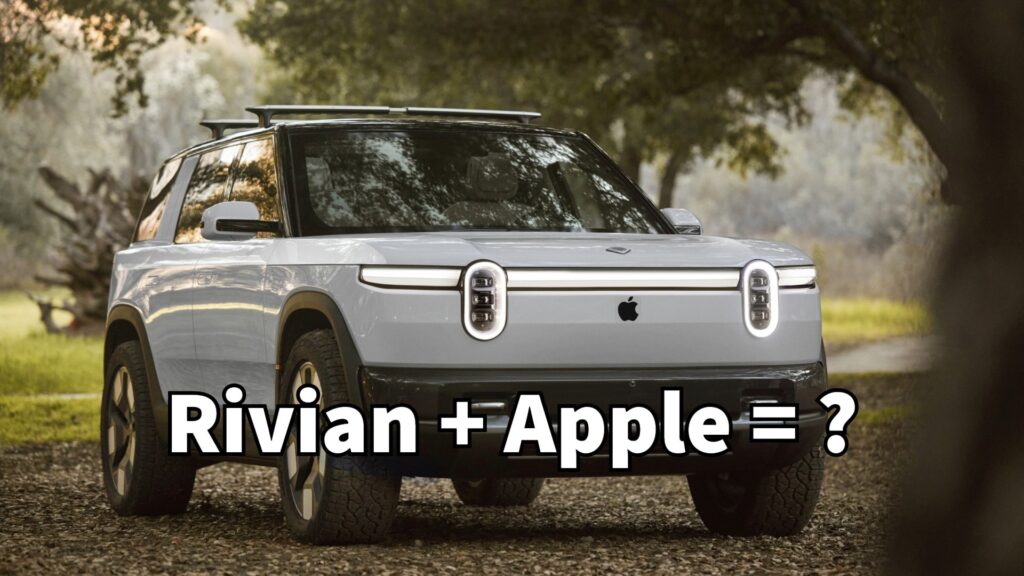

Speculation has surfaced among supply chains that Apple is studying the possibility of working with an electric vehicle (EV) startup company. The speculation comes just weeks after Apple reportedly terminated its so-called Project Titan, switching resources from developing cars to Generative AI. Having invested about USD10B over 10 years into Project Titan, Apple may not have abandoned its car ambition entirely. Rivian may still be under financial pressure, but its EV partnership with Amazon continues, with rather good order visibility for 2H24. A partnership with Rivian might also indirectly involve Amazon, which could open the door to collaboration between Apple and Amazon in generative AI. (Apple Insider, Digitimes, 9to5Mac)