7-13 #StarePinch : Google’s Tensor G4 might be the last SoC to be made by Samsung Foundry; Huawei’s triple-foldable smartphone will allegedly adopt a dual-hinge design; Huawei is t adopt under-display 3D face recognition; etc.

Google’s Tensor G4 might be the last SoC that is mass produced by Samsung Foundry, as the Tensor G5 is said to leverage TSMC’s cutting-edge 3nm process when it powers the upcoming Pixel 10 series in late 2025. Since Samsung’s 3nm GAA process is said to be suffering from yields as low as 20%, Google has to partner up with TSMC. Google’s and TSMC’s alliance seems to be progressing smoothly, as the Pixel 10’s Tensor G5 is said to have reached the ‘tapeout’ stage.(CN Beta, TrendForce, Business Korea, WCCFTech)

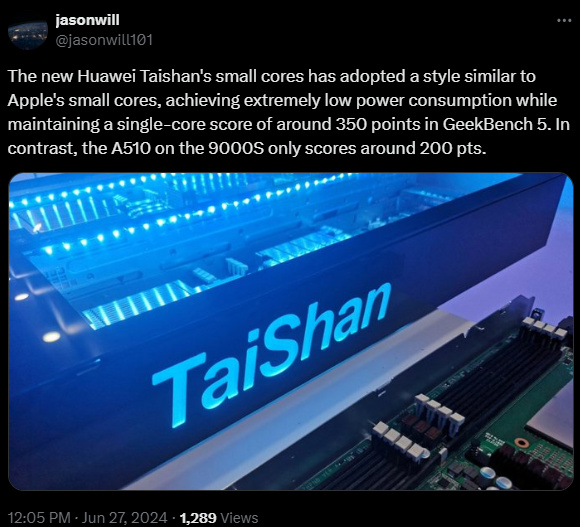

Huawei is allegedly working on next-generation Taishan cores that are more powerful and energy-efficient than ever before. The Taishan cores are said to be used in Huawei’s upcoming CPU architecture and will serve as the power-efficient cores. The new cores allegedly have lower power consumption, while outperforming the Kirin 9000s’ Cortex-A510 cores. Huawei’s upcoming Taishan V130 architecture will aim to compete with Apple’s M3 chip and be based on the 5nm manufacturing node. (GSM Arena, Gizmo China, Twitter, My Drivers)

Advanced Micro Devices (AMD) will acquire Finnish artificial intelligence startup Silo AI for about USD665M in cash as the company tries to enhance its AI chip capabilities to compete against industry leader Nvidia. The US chipmaker is acquiring the Helsinki-based company, which describes itself as Europe’s largest private AI lab and has customers that include Allianz SE, Unilever Plc and Bayerische Motoren Werke AG unit Rolls-Royce.(CN Beta, AMD, Forbes, Reuters, Yahoo)

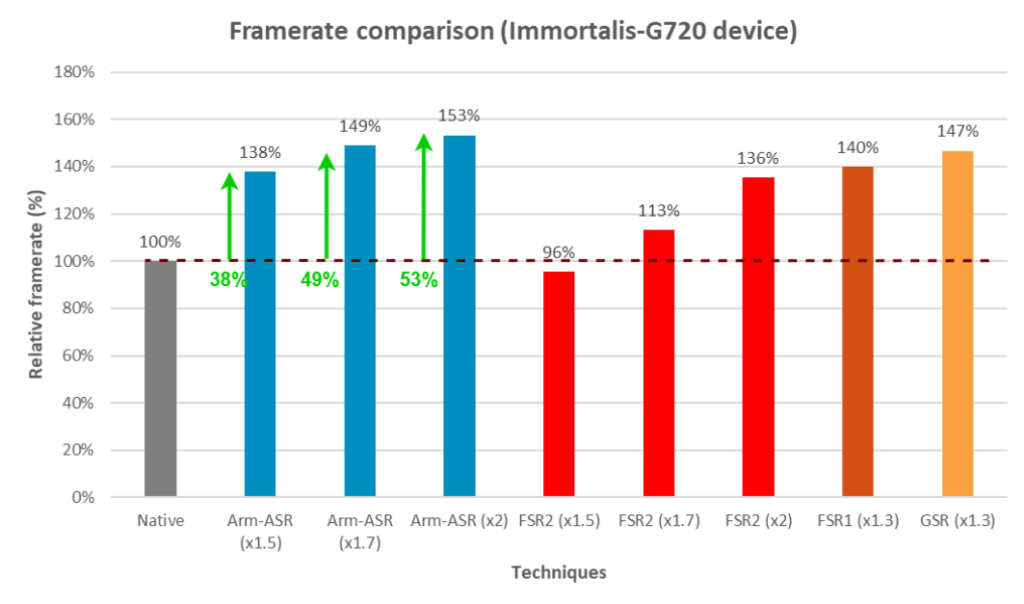

Arm has introduced its own upscaling technology, based on AMD’s FSR2, called Arm Accuracy Super Resolution (Arm ASR). Arm’s implementation of the temporal upscaler is focused on mobile applications, allowing more lightweight devices to run the technology despite requiring more processing horsepower. The company also made it available to game developers via an open-source license, letting them implement it without additional licensing costs. (CN Beta, ARM, The Verge, Tom’s Hardware)

ASE Technology, the world’s largest IC packaging and testing services provider, has opened a second facility in Silicon Valley through a sub-subsidiary to expand its capacity in the U.S. semiconductor testing market. ASE Technology said ISE Labs, a unit of ASE Technology’s wholly owned subsidiary ASE Inc., has doubled its R&D lab and business space to more than 150,000 square meters with the new facility in San Jose and reinforced its commitment to Silicon Valley by expanding its footprint in North America. ASE Technology said ISE Labs purchased the building in late 2023 and has built it out specifically to accommodate the engineering needs of its North American clients. (CN Beta, ASE Global, Focus Taiwan, Yahoo)

Huawei’s triple-foldable smartphone will allegedly adopt a dual-hinge design with an inner and outer folding mechanism. The details imply that the device is still in the development stage. Note that the dual-hinge support will enable users to easily fold or unfold the device inside and outside. This will eventually uplift the flexibility aspects to the next level. The device features a 10” display. This panel fetches effective crease-controlling properties. The phone is said to have a screen pressure bar component to offer superior as well as more reliable performance. (Android Headlines, Gizmo China, Huawei Central)

The President of Samsung Electronics, Roh Tae-Moon has indicated that there are hopes that Flip 6 and Fold 6’s advancements in AI and other aspects can boost its sales by 10% over the 2023 series. The Flip 5 and Fold 5 shattered pre-order records for Samsung in South Korea, as the brand achieved 1.02M pre-orders. (CN Beta, Yahoo, YNA, SamMobile)

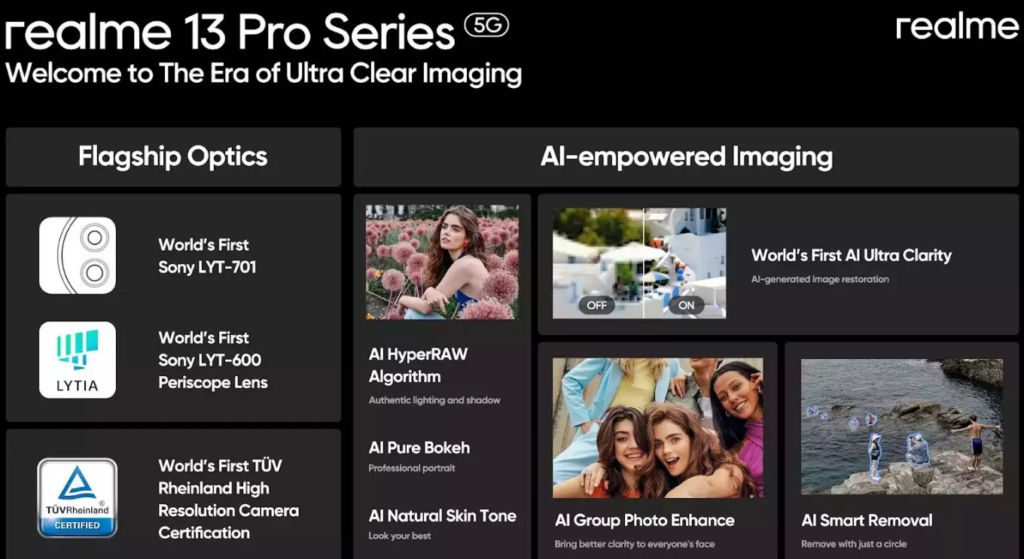

realme has introduced an in-house solution for AI photography, called Hyperimage+. It described it a three-layer architecture consisting of flagship optics, on-device AI imaging algorithms, and cloud-based AI image editing. The base layer is “cutting-edge optics, consisting of multiple lenses, periscope lenses and large sensors”, which will be part of the new 13 Pro lineup. Building upon this, we have AI imaging algorithms and AI image editing that process image data to enhance the visual quality of photo and video content. The new comprehensive approach is developed to take mobile photography to the next level, allowing users to “enjoy ultra-clear camera with AI from the convenience of their smartphone”. realme has also shared their partnership with Sony and TUV Rheinland for their upcoming realme 13 Pro. (GSM Arena, India Times, PR Newswire)

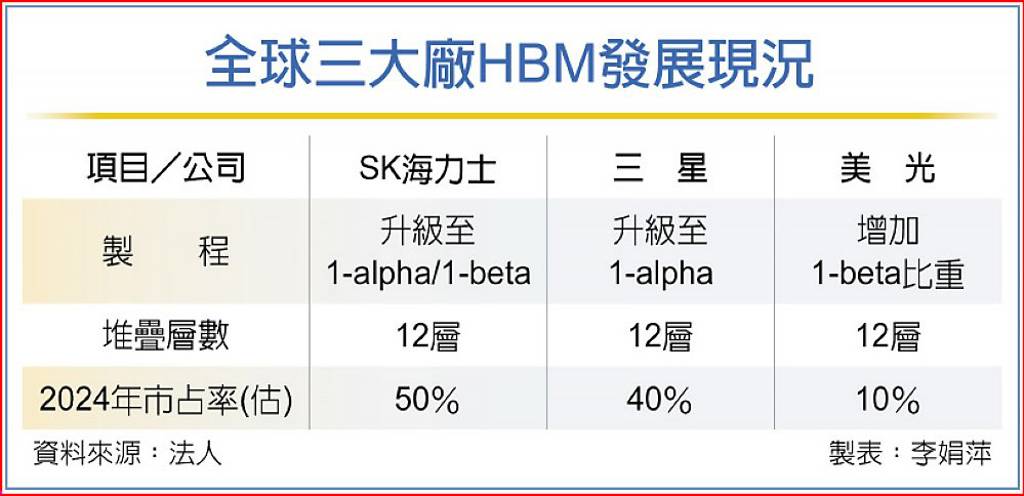

SK Hynix, Samsung, and Micron, the world’s top three memory manufacturers, are actively investing in high-bandwidth memory (HBM) capacity expansion plans. By 2025, the additional production will reach approximately 276,000 units, bringing the total capacity to 540,000 units, an annual increase of 105%. Currently, SK Hynix remains the primary supplier for HBM, along with Micron, both utilizing 1beta nm processes and already shipping to NVIDIA. Samsung, using a 1alpha nm process, is expected to complete qualification in the 2Q24 and begin deliveries mid-year. (CN Beta, TrendForce, CTEE)

The JEDEC Solid State Technology Association, a pivotal organization in the development of microelectronics industry standards, is finalizing the next iteration of its High Bandwidth Memory (HBM) DRAM standard, HBM4. The specification includes 24 Gb and 32 Gb density layers, accommodating stack configurations from 4-high up to 16-high using through-silicon vias (TSV). The development committee has reached a preliminary consensus on speed bins reaching up to 6.4Gbps. (CN Beta, JEDEC, Guru3D)

Goodix supplies side-mounted capacitive fingerprint sensor to Samsung for Galaxy Z Fold 6 and Galaxy Z Flip 6. Goodix has been a Samsung supplier for the past several years. The Chinese firm also makes under-display fingerprint sensors, both optical and ultrasonic.(Android Headlines, SamMobile, Twitter)

Huawei could soon ditch the iconic ‘three punch holes’ design in favor of under-display 3D face recognition. Huawei has allegedly started testing an under-display 3D face recognition. (CN Beta, 163.com, Twitter, Huawei Central)

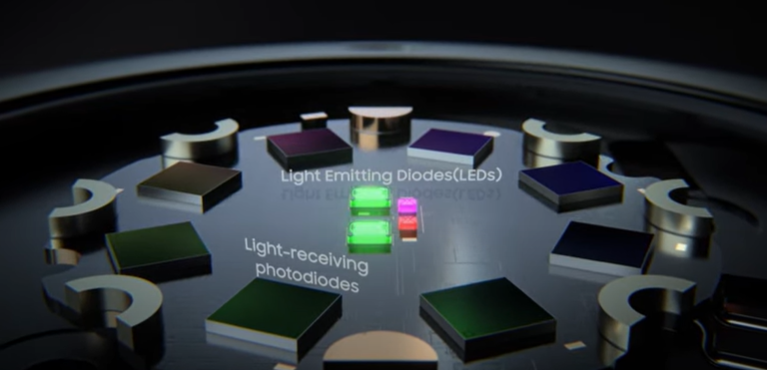

Samsung is introducing the newest iteration of its BioActive Sensor. The new sensor will enable advanced predictive and preventative wellness features, in addition to more accurate health measurements. There are three upgrades to the new sensor: enhancing the performance of light-receiving photodiodes, adding additional colors of light-emitting diodes (LEDs) and arranging them optimally across the sensor. Samsung more than doubled the performance of each photodiode, successfully decreasing the number needed to maintain capacity from eight to four. The new sensor now includes Blue, Yellow, Violet and Ultraviolet LEDs in addition to an increased number of Green, Red and Infrared LEDs. Samsung announced its next-generation BioActive sensor that will come in the next Galaxy Watch.(Android Authority, Samsung)

CATL has released a new battery with an impressively long cycle and supports ultra-fast charging. The CATL Tianxing logistics commercial battery was announced alongside two other products – the supercharging version and the long endurance version. The CATL Tianxing battery is designed for commercial vehicles as well as upstream and downstream partners, according to the company. The Tianxing L-Supercharger version has 4C supercharging capabilities and an impressive 8-year 800,000km warranty. It supports ultra-fast charging that is rated to charge from 0 to 60% in 12 minutes. It also has a large capacity of 140 degrees and achieves a cruising range of 350km. The battery’s long life is due partly to its slow decay rate and can last as long as the vehicle. The CATL Tianxing L-long-range battery has a claimed cruising range of 500km when moving at an average speed of 80km/h. The battery’s capacity is 200kWh while its energy density is 200Wh/kg.(Gizmo China, 36Kr, CATL)

Microsoft has reportedly told employees in China that starting in Sept 2024 they will only be able to use Apple iPhones for work, effectively cutting off Android-powered devices from the workplace. The company will soon require employees based there to use Apple Inc. devices to verify their identities when logging in. The measure, part of a companywide effort to fortify Microsoft products and services against hackers, will affect hundreds of workers across the Chinese mainland and is intended to ensure that all staff use the Microsoft Authenticator password manager and Identity Pass app. Microsoft chose to block those devices from accessing its corporate resources because they can’t connect to Google’s mobile services in the country.(The Register, India Times, Bloomberg, Gizmo China, EEO, OfWeek)

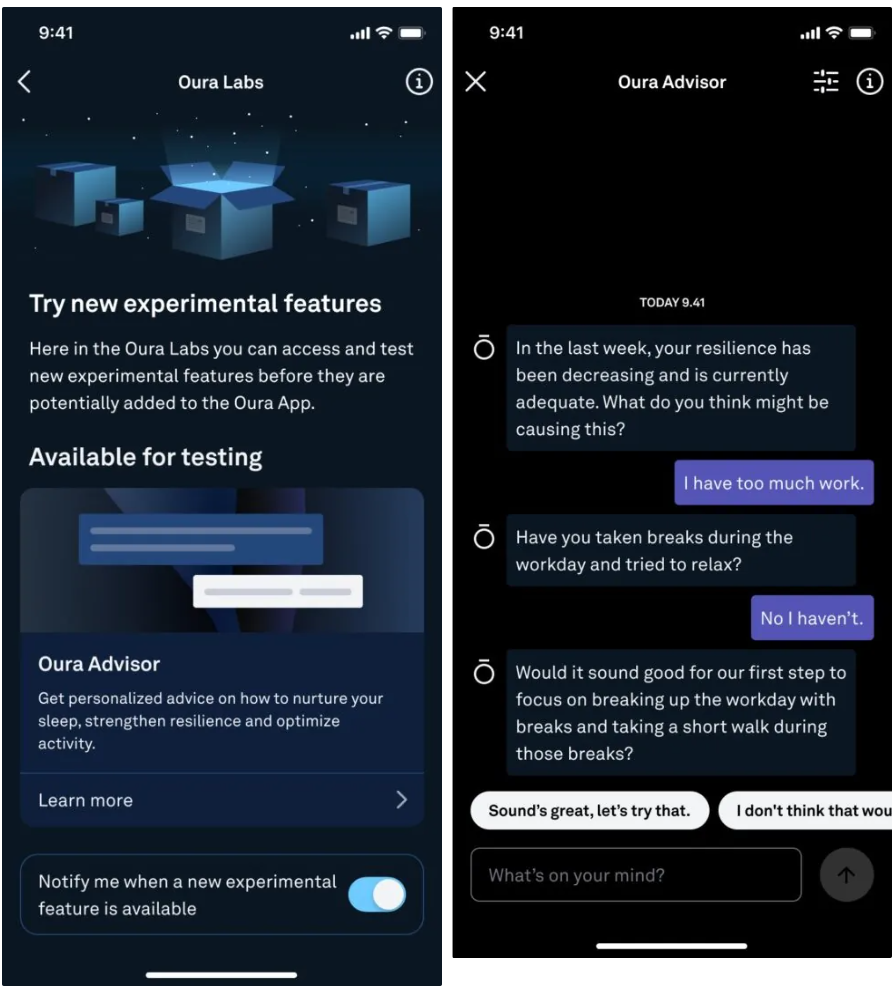

Oura has introduced Oura Advisor, a new feature released as part of the Oura Labs program. Oura Labs was launched in Apr 2024 to invite users to test new experimental features currently in development for the smart ring platform. The newest addition to the program, Oura Advisor leverages AI to create a more personalized experience for users with specific wellness goals. The tool allows members to customize their focus areas and desired coaching intensity. It then provides individualized insights and recommendations related to each user’s unique goals. Individuals can chat with the AI health coach around the clock to address specific questions and habits or to share progress updates.(Android Authority, Mashable, TechRadar)

Apple‘s Vision Pro spatial computing headset has yet to sell 100,000 units in 2Q24 since it launched in the U.S. in Feb 2024, according to IDC. The device is projected to see a 75% drop in domestic sales in the 2Q24, but the launch of Vision Pro internationally in Jul 2024 is expected to offset that decline. IDC believes that a more affordable version at roughly half the price of the current USD3,500 unit should rekindle interest in 2025, but sales are not expected to rise significantly over the coming year. Apple is expected to produce fewer than 400,000 Vision Pro headsets in 2024 due to the complexity of manufacturing, according to TF Securities analyst Ming-Chi Kuo. IDC’s Francisco Jeronimo predicts that will more than double sales when it arrives in the 2H25. (CN Beta, Bloomberg, MacRumors)

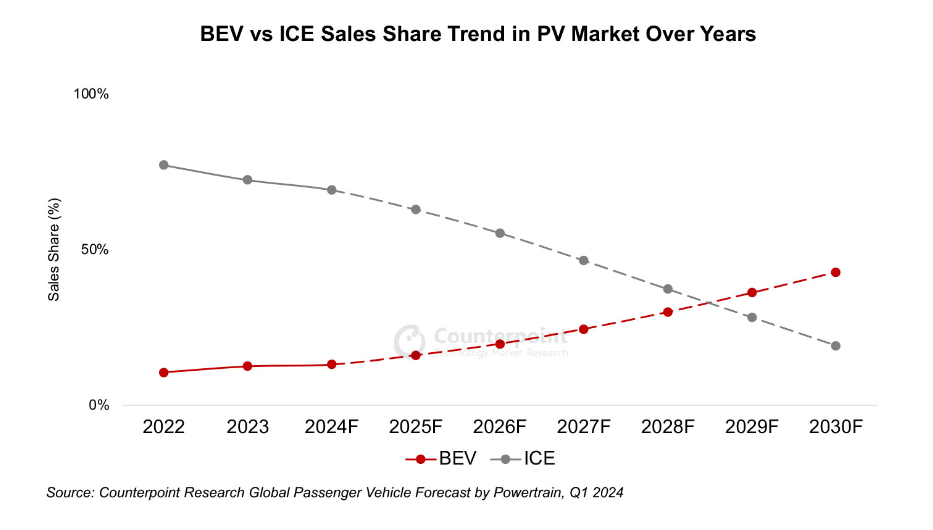

According to Counterpoint Research, battery electric vehicles (BEVs) are set to hit the 10M milestone in 2024, marking a significant achievement for the global passenger vehicle market. This milestone will coincide with the resumption of long-term decline for internal combustion engine (ICE) vehicles, whose market share is projected to drop below 50% in 4 years. China remains a dominant force in the BEV market, with its BEV sales projected to be four times that of North America in 2024. Besides, China will maintain more than 50% share of the global BEV sales until 2027 and is expected to register more BEV sales than North America and Europe combined in 2030. From 2025, Europe and the US will start emerging as major growth drivers. (CN Beta, Counterpoint Research)

Joby Aviation has achieved a significant milestone by successfully completing a 523-mile test flight of its hydrogen-electric air taxi at its Marina, California facility. The flight, powered by liquid hydrogen, was conducted on 24 Jun 2024, and resulted in water as the only emission. The aircraft landed with over ten percent of its hydrogen fuel remaining, marking a crucial step towards regional flights in the US with zero emissions other than water. (CN Beta, New Atlas, Ubergizmo)

Samsung will launch an upgraded version of its voice assistant Bixby within 2024 based on its own artificial intelligence models, according to the company’s mobile chief TM Roh. Bixby launched in 2017 with Samsung’s Galaxy S8 smartphone. The voice assistant has a variety of functions including live translations and restaurant recommendations. The Bixby Vision tool allows a person to use their phone camera to scan whatever is in front of them and then Bixby will offer up information about it. (Android Central, CNBC)

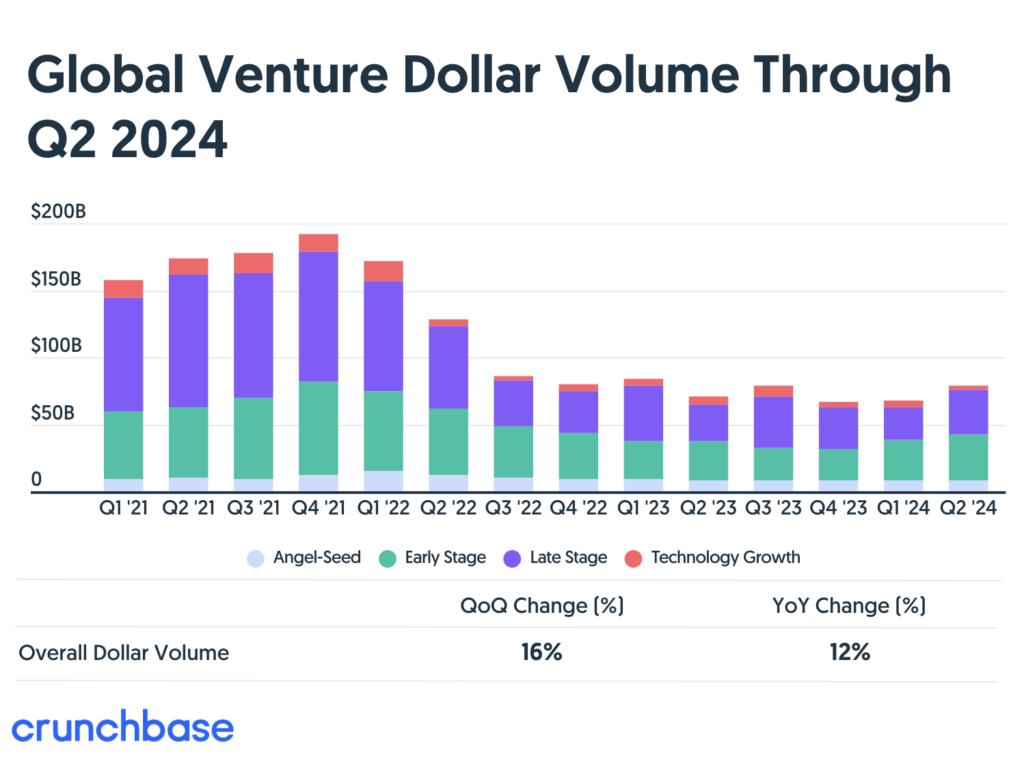

According to Crunchbase, global startup funding picked up in 2Q24, reaching USD79B— rising 16% quarter over quarter and 12% from the USD71B invested in Q2 2023. Mega-rounds — fundings USD100M and above — accounted for much of the increase this past quarter. Funding to companies in AI more than doubled QoQ to USD24B— representing 30% of all dollars invested, the largest quarter for AI funding in recent years. And there are signs that larger M&A deals increased in 2Q24, providing much-needed liquidity to venture capital markets. (CN Beta, Reuters, Crunchbase, Fortune)