7-20 #Vulnerable : Qualcomm is suing Transsion; Huawei is suing MediaTek; OPPO and Ericsson have officially entered a global strategic partnership; etc.

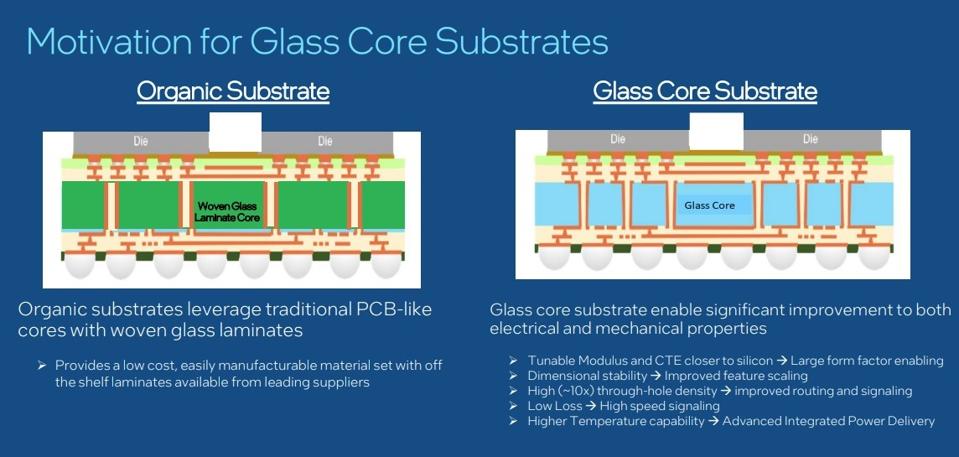

Intel, AMD, Samsung, LG Innotek, and SKC’s US subsidiary Absolics have all highly focused on glass substrate technology for advanced packaging. Intel stated that glass substrates could lay the foundation for achieving an astounding one trillion transistors on a single package within the next decade. Intel allegedly plans to mass-produce glass substrates as early as 2026. Intel has invested approximately a decade in glass substrate technology and currently has a fully integrated glass research line in Arizona, USA. The company stated that the production line costs over USD1B. Absolics has invested around KRW300B to establish the first factory dedicated to producing glass substrate in Covington, Georgia, USA. Samsung has formed an alliance composed of Samsung Electro-Mechanics, Samsung Electronics, and Samsung Display to develop glass substrate, aiming to start large-scale mass production in 2026. AMD plans to launch glass substrate between 2025 and 2026 and to collaborate with global component companies to maintain its leading position. (Gizmo China, TrendForce, CNMO)

Qualcomm is suing Transsion over 4 non-standard essential patents. Transsion does not sell any smartphones with Qualcomm chips. Transsion currently largely uses chips primarily from MediaTek as well as some chips from Unisoc for its smartphones. Transsion is also being sued by Phillips and Nokia is reportedly pressuring Transsion to make payments for its use of patented tech used in its smartphones. (Gizmo China, Winfuture, Yahoo, FT, 9to5Google, Linkedin)

According to TF Securities analyst Ming-Chi Kuo, Apple is reportedly working on new motherboard using Resin Coated Copper (RCC) replacing the traditional bonding sheet with a deposited resin. RCC can reduce the thickness of the mainboard (i.e., it can save internal space) and make the drilling process easier because it’s fiberglass-free. However, RCC will not be adopted in the 2024 iPhone 16 due to its fragile characteristics and inability to pass drop tests. Currently, Ajinomoto is the leading supplier of RCC material. If Apple and Ajinomoto can improve the RCC material before 3Q24, the 2025 new high-end iPhone 17 models will use it. (Apple Insider, Twitter, Medium)

Huawei Technologies is suing MediaTek over alleged infringement of its intellectual property patents, the latest example of the Huawei’s efforts to increase its collection of licensing fees and royalties. Huawei holds a large portion of so-called standard-essential patents (SEP), which are crucial for wireless communication standards. It holds about 20% of the world’s patents related to 5G, for example. Huawei has been stepping up its efforts to collect royalties since 2021. Its licensing and cross-licensing partners include European automakers such as Volkswagen, Mercedes Benz, Audi, BMW and Porsche. It inked cross-licensing deals for 5G technologies with OPPO and Samsung in 2023. Huawei in 2023 sought to collect licensing fees from some 30 small and midsize Japanese companies it said were using the Chinese company’s patented technologies. (Phone Arena, Asia Nikkei, Tom’s Hardware)

TM Roh, president and head of Samsung’s Mobile eXperience (MX) division, now wants the next Galaxy foldable phones to be even slimmer. The Z Fold6 is 12.1mm thick, 1.3mm less than its predecessor, and weighs 239g, 14g lighter than before. He has recently asked Samsung engineers to develop an extra-slim foldable smartphone – similar to the bar-type Galaxy S24’s thickness of 7.7mm when folded. Samsung will likely unveil a 10mm Galaxy Z Fold6 Slim model by the end of 2024 and make succeeding models thinner in the coming years. (GSM Arena, KED Global, Gizmo China, Naver)

According to TF Securities analyst Ming-chi Kuo, Sunny Optical will become Apple’s new CCM supplier in 2025, with mass production and shipments in Vietnam for the CCM of the new M5 series MacBook models. Given that Sunny Optical is a first-tier CCM supplier in the world, if MacBook CCM shipments go smoothly, Sunny Optical may become the new CCM supplier for iPhone and iPad in the future. Apple’s annual CCM procurement amounts to approximately USD13–15B, about 3 times Sunny Optical’s yearly revenue. Sunny Optical aims to restore its 2023 lens supply allocation by 2025, fueling its business momentum in 2025. (Apple Insider, Medium)

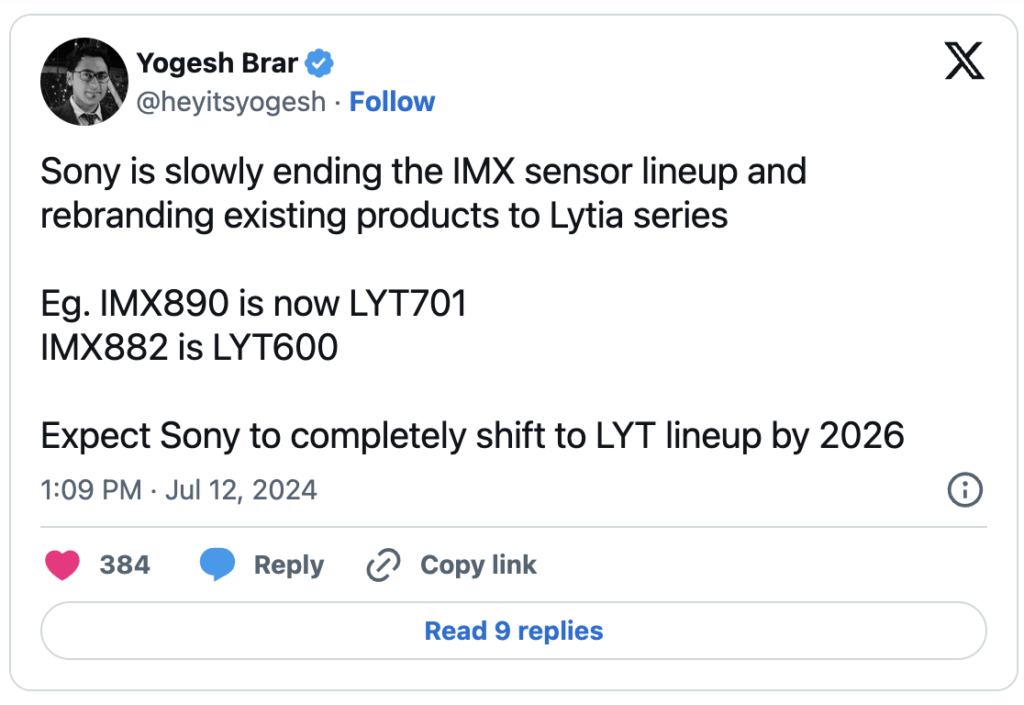

Sony is allegedly making a branding shift for its smartphone image sensors. Sony is considering moving all its mobile image sensors, including the current IMX lineup, under the newer LYTIA brand. The company is gradually phasing out the IMX brand, and some IMX sensors have already been rebranded to LYTIA. Reportedly, the company plans to fully transition to the LYT lineup by 2026. The 50Mp IMX890 and IMX882 sensors have already been rebranded as LYT-701 and LYT-600. (Phone Arena, Twitter)

Samsung has announced it has successfully completed verification of the industry’s fastest 10.7 gigabit-per-second (Gbps) Low Power Double Data Rate 5X (LPDDR5X) DRAM for use on MediaTek’s next-generation Dimensity platform. The 10.7Gbps operation speed verification was carried out using Samsung’s LPDDR5X 16-gigabyte (GB) package on MediaTek’s upcoming flagship Dimensity 9400 System on Chip (SoC), scheduled to be released in 2H24. The two companies have closely collaborated to complete the verification within just 3 months. Samsung’s 10.7Gbps LPDDR5X delivers more than 25% improved power consumption and performance compared to the previous generation.(GSM Arena, Samsung)

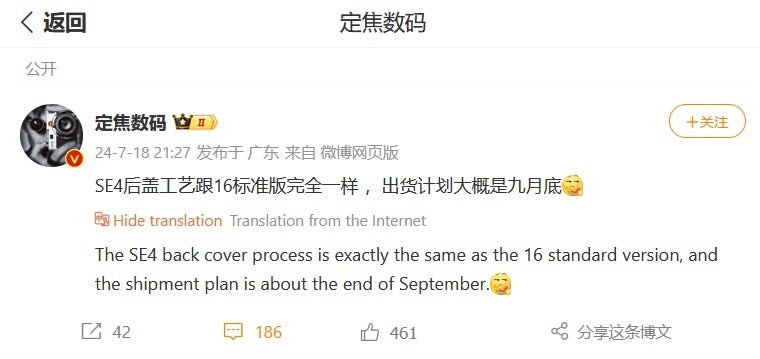

Apple’s new iPhone SE 4 will allegedly feature a back panel process that will be used on the iPhone 16 base model. It will be shipped in Sept 2024. Hence, the iPhone SE 4 copy the camera array to be found on the iPhone 16. The iPhone 16 to have Wide and Ultra-Wide cameras mounted vertically. (Phone Arena, Weibo, Apple Insider)

OPPO and Ericsson have officially entered a global strategic partnership. The agreement involves the cross-licensing of global patents and also covers multiple key areas such as technical cooperation and market promotion. As of 30 Jun 2024, OPPO’s global patent applications exceeded 103,000, of which more than 57,000 were authorized patents. Invention patent applications of the company have accounted for as high as 91%.(Gizmo China, OPPO)

Samsung has been tweaking its first-party apps, which hints some devices could communicate via Low Earth Orbit (LEO) satellites. An APK teardown helps predict features that may arrive on a service in the future based on work-in-progress code. However, it is possible that such predicted features may not make it to a public release.(Android Headlines, Android Authority)

Following the antitrust investigation into Apple regarding Apple Pay, the European Commission sent Apple a Statement of Objections in May 2022. The Commission found that Apple was abusing its dominant position in the mobile wallet market on iOS. Apple restricted the NFC capability in iPhones to the Apple Pay mobile wallet, thereby preventing other payment providers from offering contactless payments similar to Apple Pay. Responding to the concerns raised by the Commission, Apple allows third-party wallet providers access to the NFC input on iOS devices free of charge, without having to use Apple Pay or Apple Wallet. Apple also applies a fair, objective, transparent and non-discriminatory procedure and eligibility criteria to grant NFC access to third-party mobile wallet app developers. Apple will have to follow the above commitments for 10 years throughout the EEA. (Neowin, Europa)

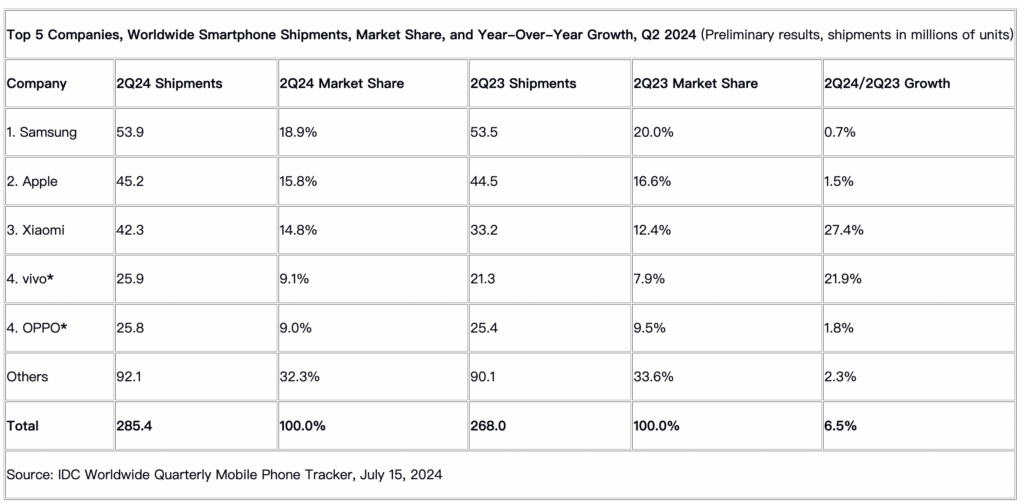

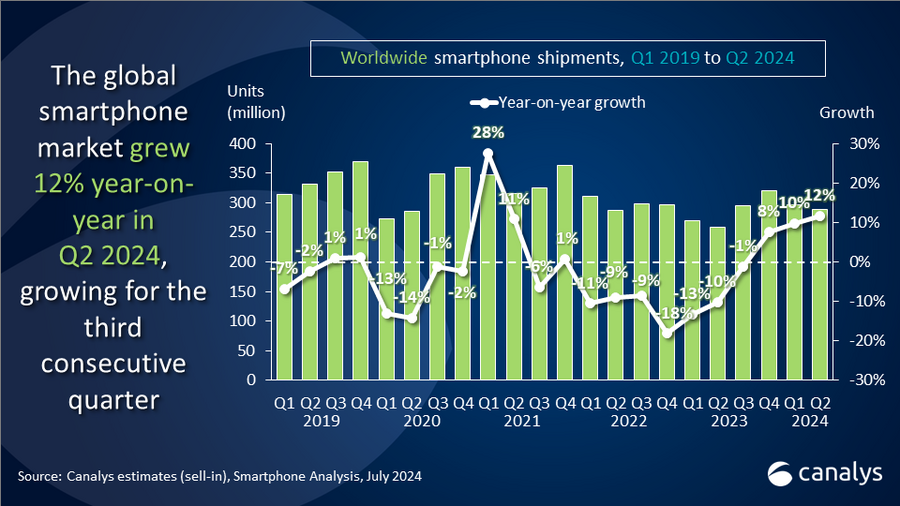

According to IDC, global smartphone shipments increased 6.5% year over year to 285.4M units in 2Q24. Although this marks the fourth consecutive quarter of shipment growth and builds the momentum towards the expected recovery in 2024, demand has yet to come around in full and remains challenged in many markets. Samsung captured the top position in 2Q24 with 18.9% share of shipments, thanks to a strategic focus on its flagships and a strong AI strategy. Apple finished the quarter in second place with 15.8% share with improved performance in China and other key regions. The leading companies both saw modest growth year over year. Xiaomi placed third in 2Q24 with 14.8% share while vivo and OPPO tied for the fourth position with 9.1% and 9.0% share respectively. (IDC, Android Central)

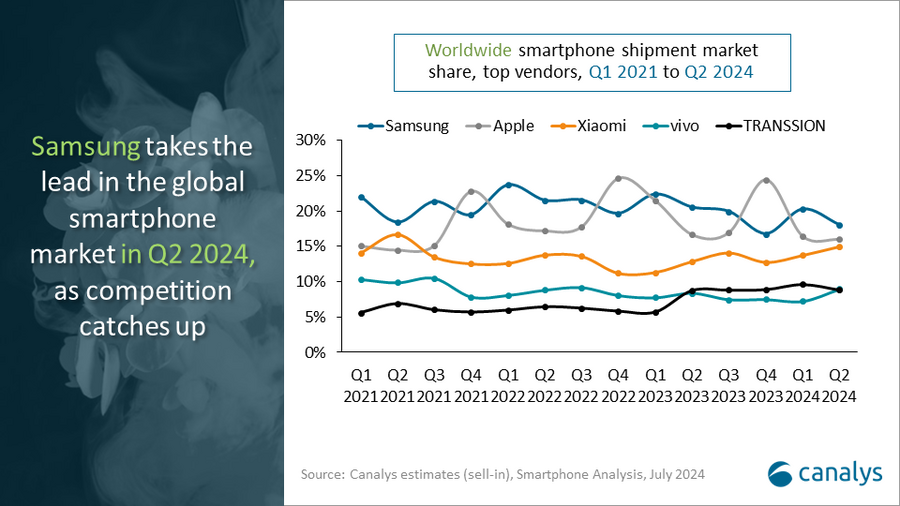

According to Canalys, the global smartphone market hit the third quarter streak of YoY growth, with a 12% shipment expansion in 2Q24, reaching 288M units. Samsung remained the global leader with an 18% market share as it renewed its emphasis on the high-end market as a strategic priority. Apple followed closely with a 16% market share, ranking second. Xiaomi came closely after Apple this quarter with a 15% market share, growing the fastest among the top five players with a 27% annual growth. vivo ranked fourth worldwide with a 9% market share. Transsion took the fifth spot this quarter, also with a 9% market share. (Android Central, Canalys)

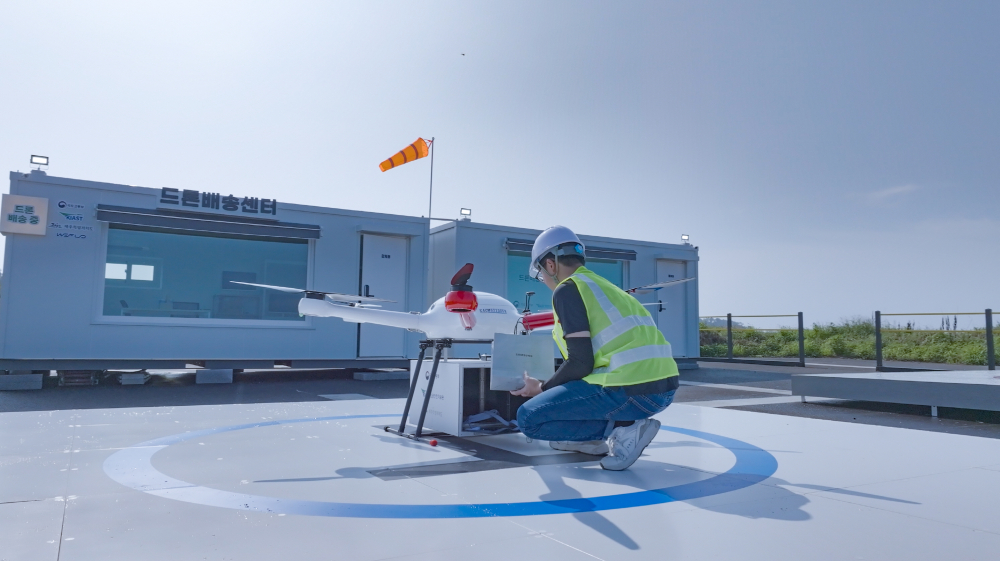

Samsung is using drones to deliver the Galaxy Z Fold 6 and Galaxy Z Flip 6 in its home country South Korea. The company says it is a pilot aimed at speeding up foldable deliveries to nearby areas. If the pilot is successful, it may launch a drone delivery service for other mobile products in the future. This drone delivery service for Samsung’s new foldables is the company’s collaborative project with the Korean Ministry of Land, Infrastructure, and Transport. The firm uses the government’s drone delivery infrastructure, including drones, take-off and landing zones, and control systems built under the Drone Demonstration City Construction Project.(Android Headlines, Samsung)

TF Securities analyst Ming-Chi Kuo believes that Apple’s iPhone 16 orders for 2H24 are around 87M units, which is lower than the 91M iPhone 15 units that Apple ordered in 2023. Kuo said that certain suppliers may have been asked to increase production, but that may be related to “specific reasons within individual industries or components”. He suggests that expectations that Apple Intelligence will drive iPhone 16 sales “may be too optimistic” as the feature is available in U.S. English only. (Medium, MacRumors)

Meta is allegedly planning to spend billions to buy roughly 5% of Essilor Luxottica, the EUR88B European eyewear giant it has collaborated with on two generations of Ray-Ban smart glasses. Google has reportedly approached the company’s leadership about putting its Gemini AI assistant in future smart glasses. It is “extremely unlikely” that Meta will lose its partnership with Essilor Luxottica to Google, adding that it was likely Meta will indeed invest in the company. It also noted that Google previously partnered with Luxottica (prior to its merger with Essilor) to make the Google Glass almost a decade ago. (Android Authority, Financial Times, The Verge, Reuters)

Samsung has temporarily halted sales of the Galaxy Buds3 Pro, due to quality control issues. Some have reported about earbud joints not sitting flush, blue dye marks on earbuds, loose case hinges, scuffs or scratches on the case lid, the Galaxy Bud3 Pro not sitting properly inside the case, etc. (Neowin, YNA, Samsung)

Investigation of Proof News have found that subtitles from 173,536 YouTube videos, siphoned from more than 48,000 channels, were used by Anthropic, Nvidia, Apple, and Salesforce. The dataset, called YouTube Subtitles, contains video transcripts from educational and online learning channels like Khan Academy, MIT, and Harvard. The Wall Street Journal, NPR, and the BBC also had their videos used to train AI, as did The Late Show With Stephen Colbert, Last Week Tonight With John Oliver, and Jimmy Kimmel Live. Proof News created a tool to search for creators in the YouTube AI training dataset. YouTube Subtitles does not include video imagery but consists of plain text of videos’ subtitles, often along with translations into languages including Japanese, German, and Arabic. According to EleutherAI, the dataset is part of a compilation the nonprofit released called the Pile. Apple, Nvidia, and Salesforce describe in their research papers and posts how they used the Pile to train AI. (Gizmo China, Wired, Cornell University)

Samsung has announced that it has signed an agreement to acquire Oxford Semantic Technologies, a UK startup specializing in knowledge graph technology. Oxford Semantic Technologies holds cutting-edge technological capabilities in the areas of knowledge representation and semantic reasoning. With its AI-centric engine, RDFox, the company currently collaborates with organizations across Europe and North America involved in the finance, manufacturing and e-commerce sectors. Combined with on-device AI technology, such as that on Samsung’s Galaxy S24 series, personal knowledge graph technology facilitates hyper-personalized user experiences while ensuring sensitive personal data remains secure on the device. It will be applicable across all of Samsung’s products, extending beyond just mobile devices to televisions and home appliances. (Android Authority, Samsung, Phone Arena)