8-3 #Run : Apple’s both foldable devices will allegedly be coming in 2026; Meizu wants to launch its first electric car within 2024; The EU’s AI law officially enters into force on 1 Aug 2024; etc.

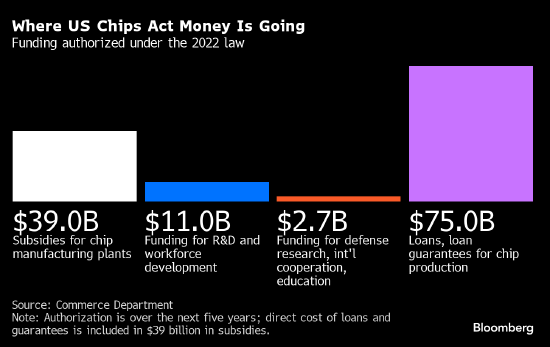

Applied Materials was rejected for funding under the CHIPS act for a research and development center in Silicon Valley. Commerce Department officials allegedly rejected the chipmaking equipment maker’s bid to gain U.S. funding for a USD4B facility in Sunnyvale, California. Applied Materials unveiled plans to build the facility in 2023, and had said it wanted subsidies from the government through the Chips and Science Act. The facility was slated to be completed in 2026. The CHIPS and Science Act was signed into law in Aug 2022, and was authorized about USD280B in new funding for boosting domestic chipmaking research and development. The act included USD39B in subsidies for chip manufacturing on U.S. soil – with chipmakers including TSMC, Samsung Electronics and SK Hynix winning grants to build U.S. chipmaking factories. (CN Beta, Bloomberg, Yahoo, Investing)

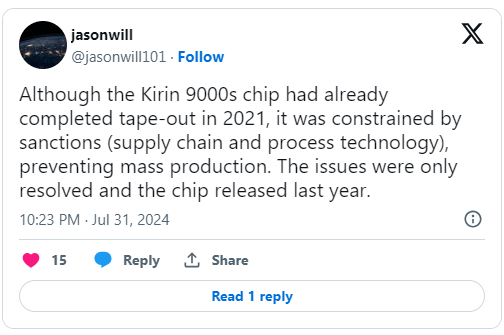

Huawei Kirin 9000S has allegedly reached tape-out status back in 2021, which meant that mass production of the silicon should not have been far off. Unfortunately, Huawei was met with a ton of obstacles in its path thanks to the trade sanctions from the U.S., resulting in the Kirin 9000S delay. The SoC’s existence caused a firestorm of backlash from U.S. lawmakers, with Representative Michael McCaul believing that Huawei violated sanctions with this launch. While there was a sense of immense tension in the air, the U.S. realized that Huawei was limited by the technology it possesses, with a report stating that SMIC’s 7nm node was 4 years behind the most advanced manufacturing process, even though the opposition intended to limit its capabilities by a whole decade. To block Huawei’s and SMIC’s progress altogether, ASML, the Dutch-based company that provides ‘state of the art’ EUV machinery for wafer manufacturing, has been barred from supplying Chinese entities with any hardware that would give them an edge against the U.S. Fortunately, SMIC pulled through and reportedly developed its 5nm process using the older DUV equipment. Sadly, there is no telling when this technology will be ready to use for Huawei’s next Kirin chipset. (WCCFtech, CN Beta, Twitter)

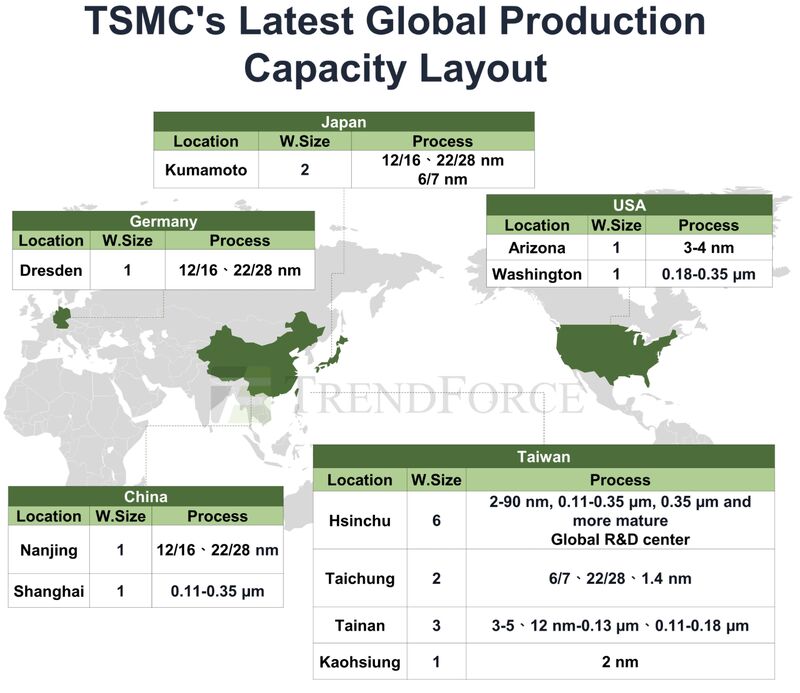

TSMC and partners will break ground in Dresden, Germany, in Aug 2024 to start building the Taiwanese chip maker’s first European fab. Despite being titled ESMC (European Semiconductor Manufacturing Company), the facility is actually a collaboration between TSMC and three European processor firms: NXP, Infineon, and Bosch. Each partner owns 10% of the project and contributed EUR500M to fund the fab’s EUR10B budget. The ESMC facility is intended for making older processors on the 28nm, 22nm, and 16nm / 12nm nodes from TSMC, and is supposed to be capable of manufacturing 40,000 wafers a month when it is complete in 2027. These older process nodes cater to automotive and industrial applications, which prefer cheaper, tried-and-tested chips rather than the cutting edge. (CN Beta, The Register, TweakTown, Nikkei Asia)

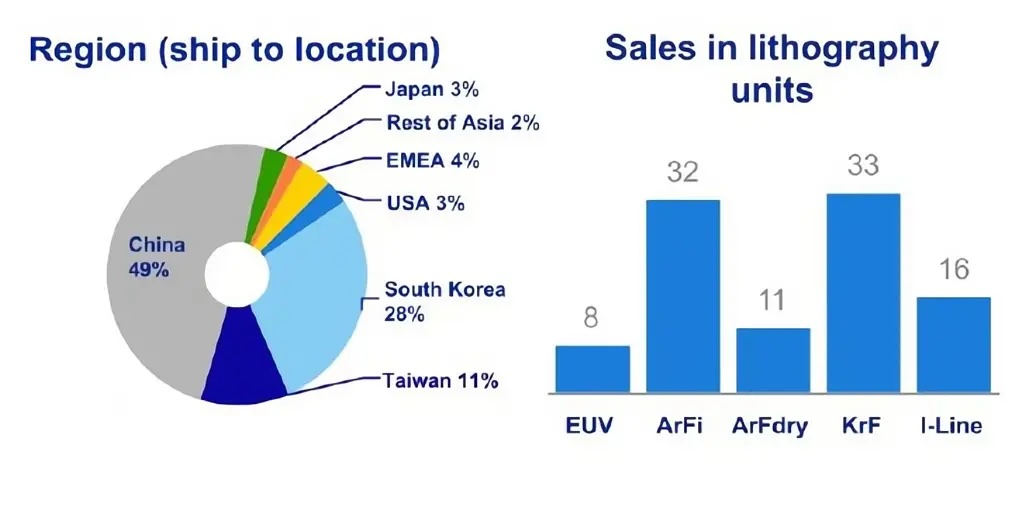

ASML has reported a 9.5% decline in revenue, reaching EUR6.2B for 2Q24. The company’s net income also fell by 19% to EUR1.6B (USD1.74B) for the same period. Veldhoven, the Netherlands-based ASML, which dominates the market for lithography systems — has been facing restrictions on selling most of its advanced product lines in China. Despite these restrictions, China remains a significant market for ASML, accounting for over EUR2B in lithography system sales in 2Q24, approximately 49% of the total sales. (CN Beta, Reuters, Bloomberg, ASML, SCMP, Telecom Lead)

Samsung Electronics’ chip business leader warned that Samsung risked getting caught in a “vicious cycle” if it did not revamp its workplace culture. Jun Young-hyun, who ascended to the role after his predecessor allowed SK Hynix to take a big lead in AI memory chips, said his division’s recent turnaround was based largely on a market rebound. To sustain that recovery, Samsung must take steps to eradicate communication barriers between departments and stop “hiding or avoiding problems”. (Android Headlines, Bloomberg, Business Standard, Fortune, UDN, Sina)

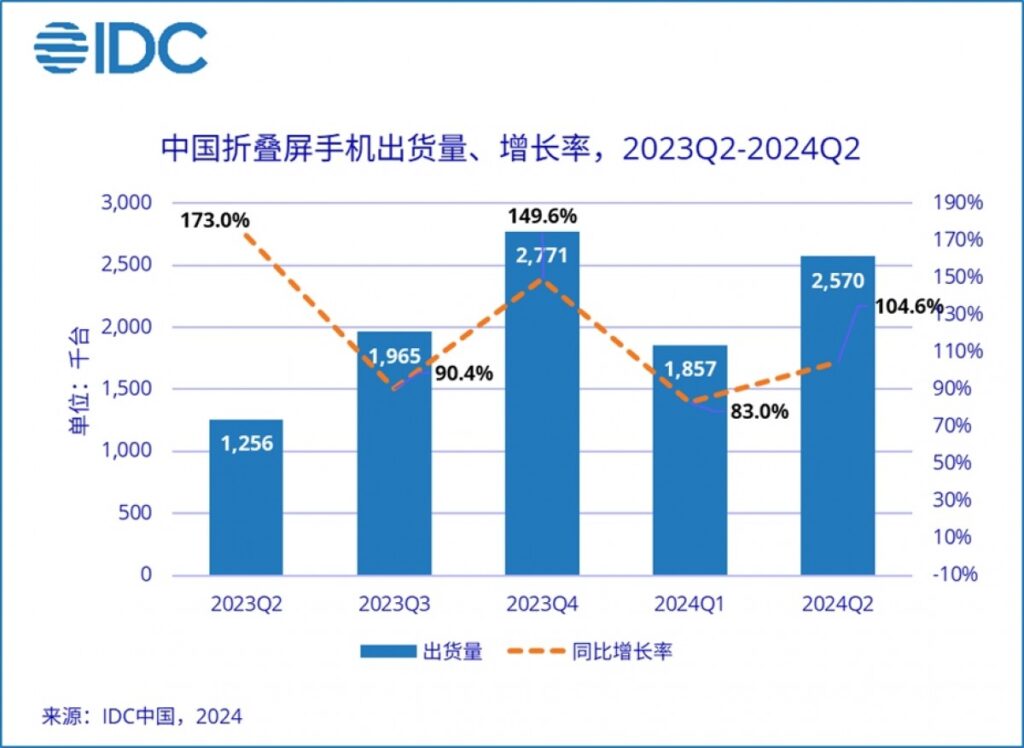

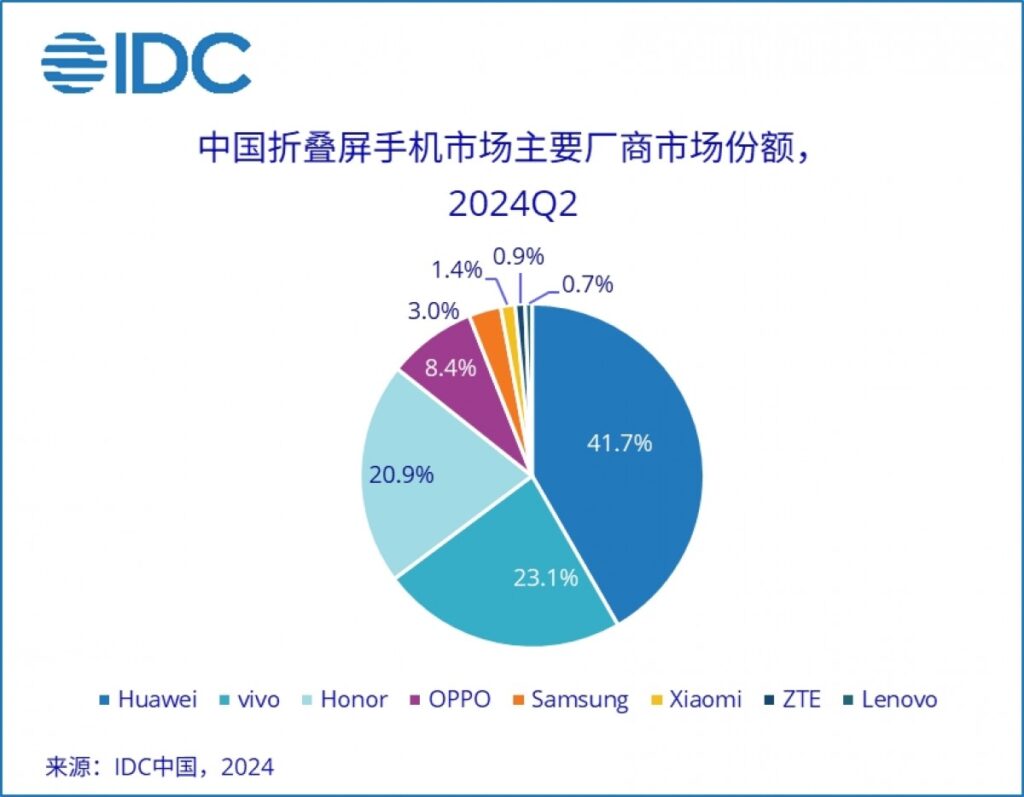

According to IDC, 2.57M units of foldable smartphones are shipped in China, a 104% YoY increase. Huawei dominates the Chinese foldable market with 41.7% of all sales, almost twice as much as the second company, which is vivo. IDC has attributed Huawei’s top position to the Mate X5 and Pocket 2 which come with China-made chipsets and satellite connectivity. (GSM Arena, My Drivers)

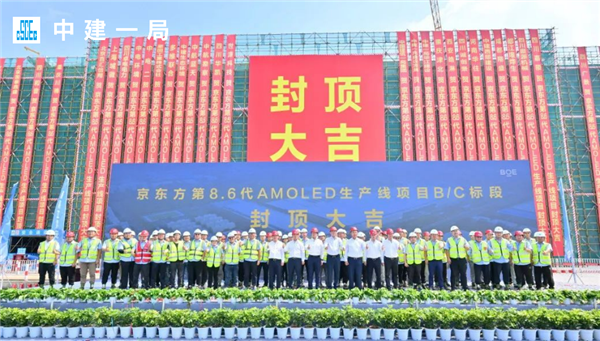

The main structure of the B/C section of BOE’s Gen-8.6 AMOLED production line project, undertaken by China Construction First Bureau Group, has been capped. It is understood that the project is located in the High-tech West Zone of Chengdu City, Sichuan Province, with a total investment of CNY63B. The total construction area of the B/C section is about 552,000 square meters. The production line is the first Gen-8.6 AMOLED production line in China and the second in the world. The production line project is divided into 2 phases and is expected to be mass-produced by the end of 2026. The project has a designed production capacity of 32,000 glass substrates (size 2290mm x 2620mm) per month, and the planned product is Gen-8.6 AMOLED panels, mainly positioned in medium-sized AMOLED panels. (CN Beta, Sina, EET-China)

Apple is allegedly working on a pair of foldable devices including a clamshell foldable iPhone codenamed V68 which, when open, turns into an iPhone with the design and dimensions of a traditional iPhone model. The second foldable is an M5-powered iPad / Mac hybrid with a 20.3” nternal display when fully opened. According to Haitong Securities analyst Jeff Pu, both foldable devices will be coming in 2026. Pu expects the foldable iPad / Mac hybrid to debut first. It is currently tracking for release in 2Q26. The foldable iPhone, he states, will follow in late 2026. (Phone Arena, 9to5Mac, CN Beta)

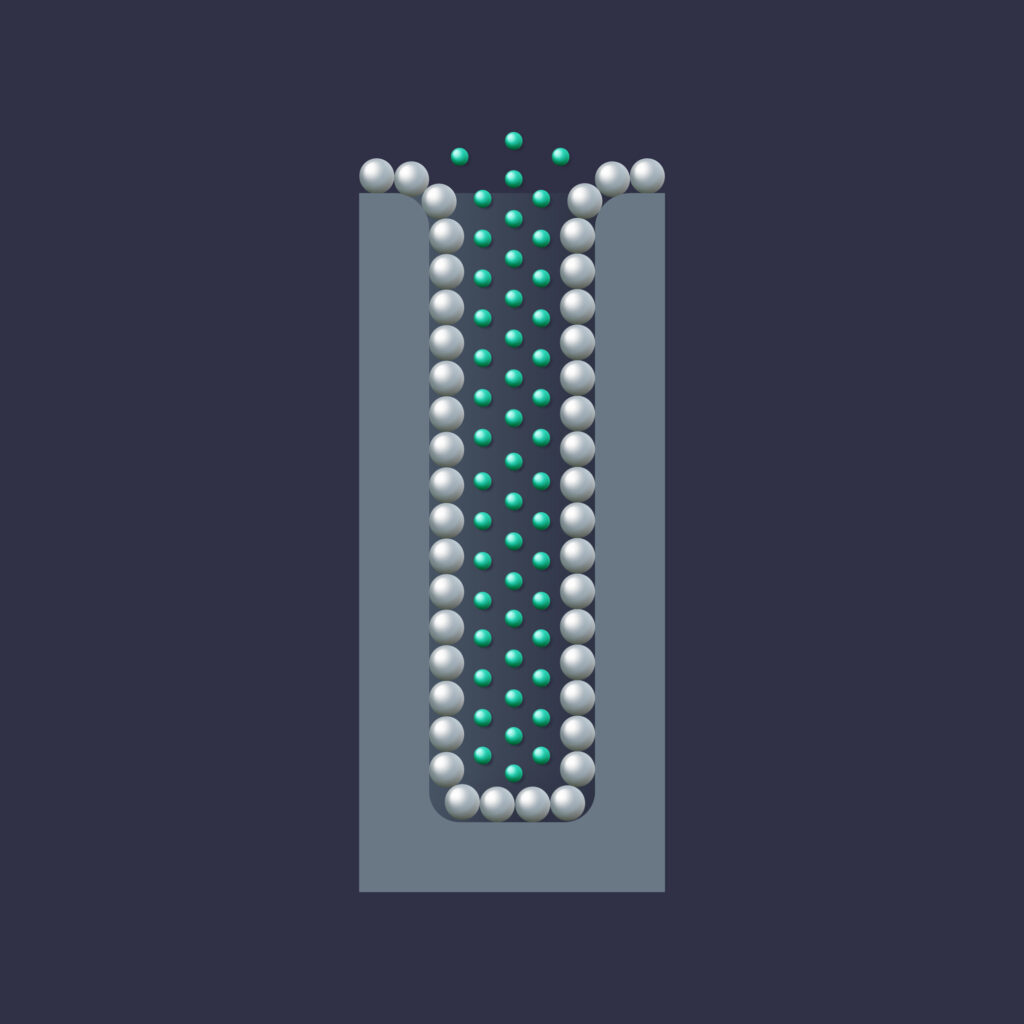

Lam Research has launched its latest cryogenic etch technology, Lam Cryo 3.0, marking a significant advancement in the production of 3D NAND flash memory. The technology is said to etch more than twice as fast as traditional dielectric processes, with a reduced environmental footprint, boasting a 40% reduction in energy consumption per wafer and up to a 90% reduction in emissions. The technology has already been used to manufacture 5M wafers. It creates high aspect ratio (HAR) features with angstrom-level precision, while delivering lower environmental impact and more than double the etch rate of conventional dielectric processes.(CN Beta, PR Newswire, Investing)

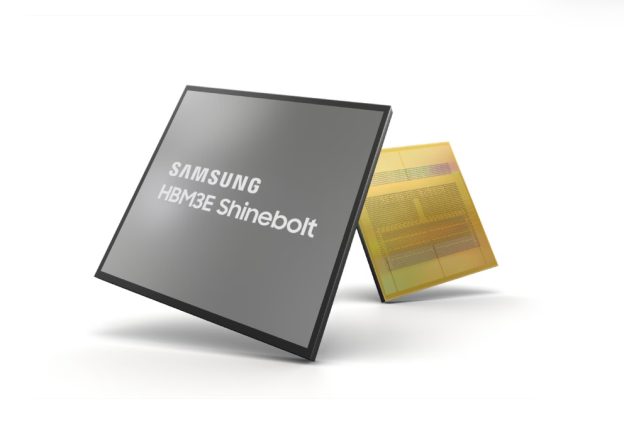

Samsung Electronics projected an ambitious expansion in its sales and supply of high bandwidth memory (HBM) for 2H24. The company noted that it will start supplying fifth-generation eight-layer HBM3E chips to its clients in 3Q24. Additionally, it plans to begin mass production of twelve-layer HBM3E chips and start supplying them in the latter 2H24. Samsung said sales of HBM products soared more than 50% in 2Q24 from 1Q24. Kim Jae-joon, vice president of Samsung Electronics, said mass production of the company’s eight-layer HBM3E will begin in 3Q24, indicating that the company has secured a client for these chips, believed to be Nvidia. The company said it is now working on developing the sixth-generation HBM4 and aims to begin production within 1H25. (CN Beta, Sina, YNA, BNN, Korea Times, MK)

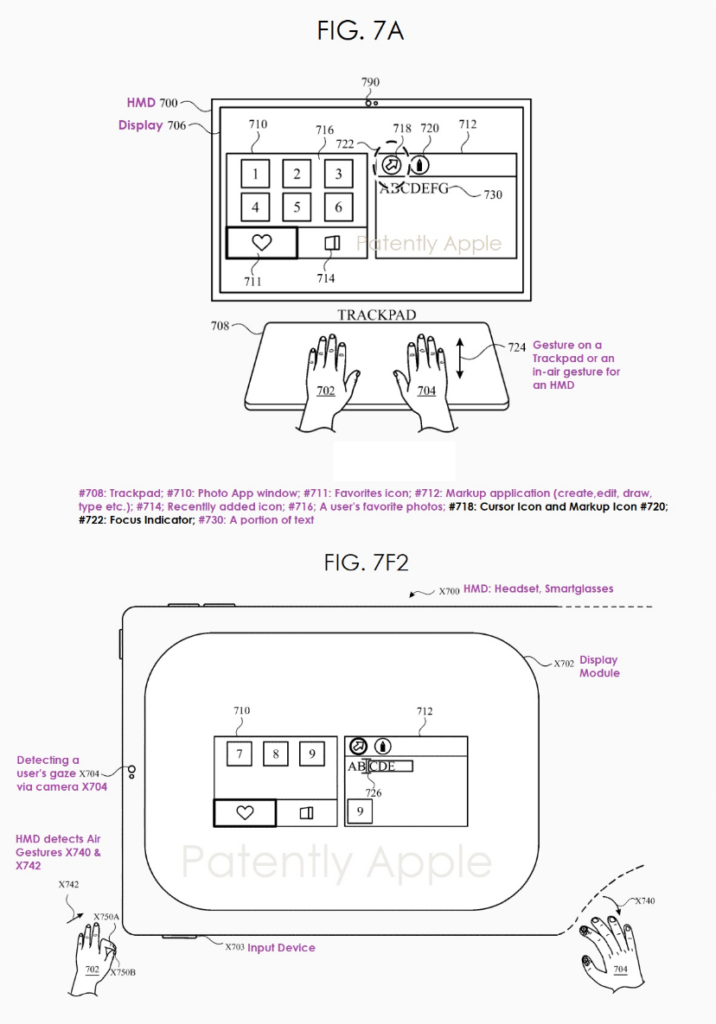

Apple’s new patent application titled “Devices, Methods, And Graphical User Interfaces For Using A Cursor To Interact With Three-Dimensional Environments” relates to techniques for controlling and / or moving a cursor, such as by using air gestures for Vision Pro or future smart glasses or a trackpad with Macs. Apple says this patent application is for devices “that provide computer-generated experiences, including, but not limited to, electronic devices that provide virtual reality and mixed reality experiences via a display”.(Apple Insider, USPTO, Patently Apple)

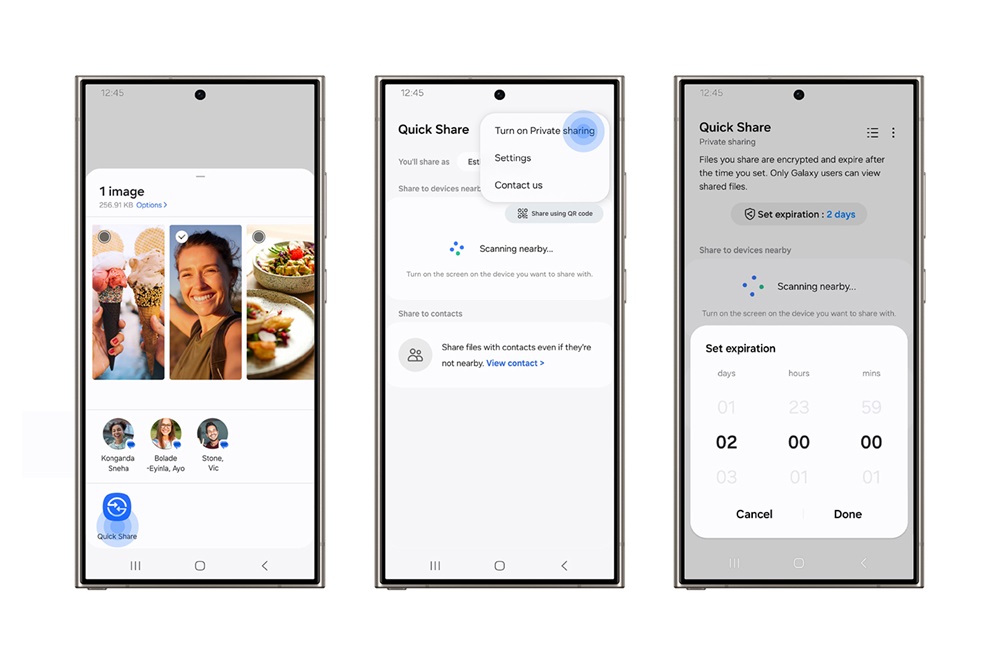

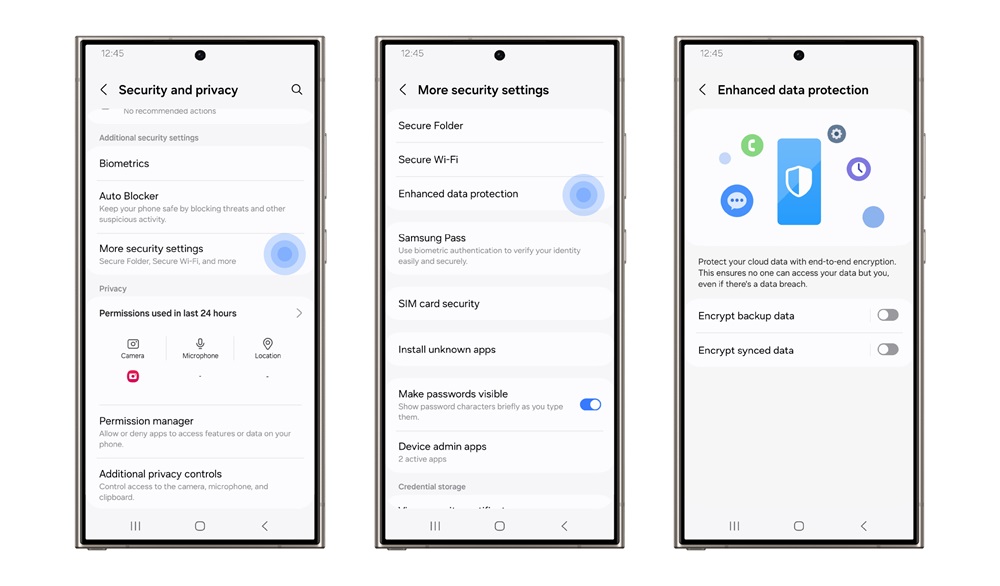

Samsung has launched two new security features for Galaxy devices to enhance user privacy and data protection. The company introduced “Quick Share’s Private Sharing” and “Enhanced Data Protection with End-to-End Encryption” to address growing concerns over data privacy and ownership. Samsung’s Quick Share now features Private Sharing, a tool designed for privacy-preserving file transfers. This function allows users to share files securely, ensuring that only intended recipients can access the shared data. With Private Sharing, users can set permissions and expiration dates for the data, providing an additional layer of security. Enhanced Data Protection, available on the Galaxy S24 and later models, employs end-to-end encryption (E2EE) to protect user data. E2EE ensures that data can only be decrypted on the user’s device, making it inaccessible to anyone, including Samsung.(Android Headlines, Samsung)

Apple is allegedly putting pressure on Tencent and ByteDance to make significant changes to two of China’s most popular apps in order to remove loopholes that circumvent Apple’s typical 30% commission. The loopholes are linked to mini-apps that allow users of Tencent’s social-messaging app WeChat and ByteDance’s short-video app Douyin to play games, hail taxis, and make online purchases without leaving the app. Apple reportedly told both companies they need to prevent mini-app creators from including links to outside payment systems that circumvent its commission system. Apple said it would not approve future updates to WeChat or Douyin until the companies complied. (Engadget, Bloomberg, MacRumors)

Samsung Electronics Chairman Jay Y. Lee has allegedly ordered the company’s mobile division, Samsung MX, to reexamine its plans. Lee’s strict orders reportedly came after people accused Samsung of copying Apple’s design language for the Galaxy Buds 3, Galaxy Buds 3 Pro, and the Galaxy Watch Ultra. They look like Apple’s AirPods, AirPods Pro, and Apple Watch Ultra, respectively. (Android Headlines, SamMobile, Aju News, Twitter)

Bee has raised USD7M in a round led by Exor to build out its wearable AI assistant that listens to user to learn more about the user, take notes, surface contextual reminders and build lists. The company also has a companion Apple Watch app. Co-founder and CEO Maria de Lourdes Zollo said the company wants to give each consumer a “cloud phone” — essentially a mirror of smartphone with access to user’s accounts and notifications. At the moment, some of the features in early testing include the ability to read notifications and get reminders about important messages and events, write emails or tweets, and get shopping suggestions on demand. The device currently just has a mute button to stop recording, but the company is exploring ways to also use the button to trigger commands.(Android Headlines, TechCrunch)

After Huawei and Xiaomi, Meizu is planning to enter the electric vehicle business. Meizu is owned by the Geely Group and wants to launch its first electric car within 2024, which will be based on the Geely Sustainable Experience Architecture (SEA) platform, as confirmed by the company COO of Meizu, Liao Qinghong. Meizu’s first car will be called the DreamCar MX. It is expected to feature Meizu FlyMe, an intelligent link between the vehicle operating system and the smartphone operating system. (CN Beta, Sohu, TechNode, Electrive, Car News China)

BYD is making significant inroads into the North American market and could soon berth in Canada. The biggest Chinese EV maker has already entered the Mexican market. BYD already has a global presence in the Middle East and Oceania. It currently does not retail passenger vehicles in Canada. Based on Ottawa’s public document, either BYD lobbyists or the automaker itself are aware that Canada is considering tariffs on Chinese EVs. The documents also hint that BYD is prepared to comply with Canadian tariffs and other requirements to sell passenger EVs in the market. (Gizmo China, Teslarati, Electrek, Auto News)

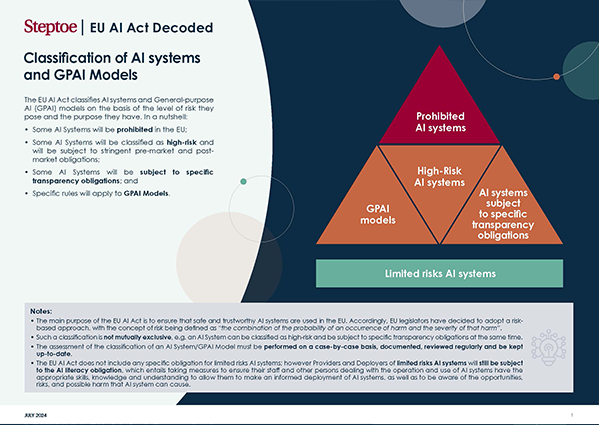

The European Union’s landmark artificial intelligence (AI) law officially enters into force on 1 Aug 2024. The AI Act is a piece of EU legislation governing artificial intelligence. First proposed by the European Commission in 2020, the law aims to address the negative impacts of AI. The regulation sets out a comprehensive and harmonized regulatory framework for AI across the EU. A subset of potential uses of AI are classified as high risk, such as biometrics and facial recognition, AI-based medical software, or AI used in domains like education and employment. High-risk systems used by public sector authorities or their suppliers will also have to be registered in an EU database. A third “limited risk” tier applies to AI technologies such as chatbots or tools that could be used to produce deepfakes. These will have to meet some transparency requirements to ensure users are not deceived. Penalties are also tiered, with fines of up to 7% of global annual turnover for violations of banned AI applications; up to 3% for breaches of other obligations; and up to 1.5% for supplying incorrect information to regulators. (CN Beta, Europa, CNBC, TechCrunch)

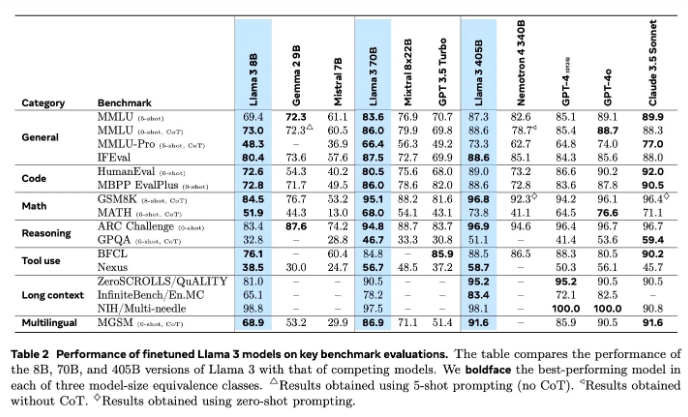

Meta’s CEO Mark Zuckerberg has indicated that to train Llama 4, the company will need 10x more compute than what was needed to train Llama 3. However he still wants Meta to build capacity to train models rather than fall behind its competitors. Meta released Llama 3 with 8B parameters in Apr 2024. The company has released an upgraded version of the model, called Llama 3.1 405B, which had 405B parameters, making it Meta’s biggest open source model. Meta’s CFO, Susan Li, also said the company is thinking about different data center projects and building capacity to train future AI models. She said Meta expects this investment to increase capital expenditures in 2025. Training large language models can be a costly business. Meta’s capital expenditures rose nearly 33% to USD8.5B in 2Q24, from USD6.4B a year earlier, driven by investments in servers, data centers and network infrastructure.(CN Beta, The Register, TechCrunch)