11-11 #FearMondays : Samsung Foundry’s chip yield for the 3nm node is reportedly less than 20%; Corning is set to receive up to USD32M in funding under the CHIPS and Science Act; LGD has developed a display that can stretch from 12”-18”; etc.

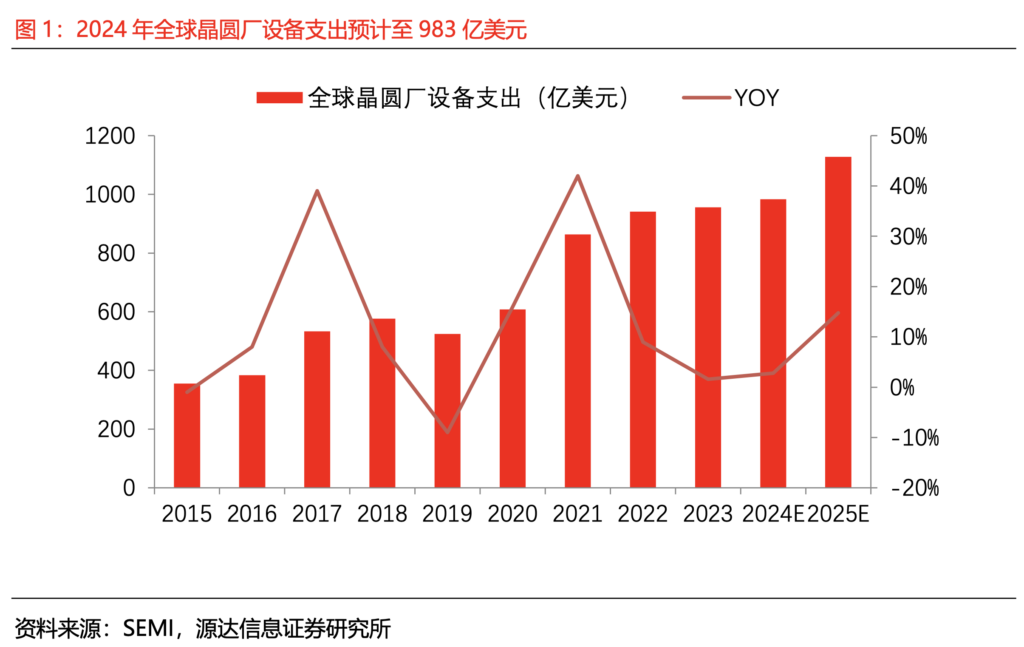

According to the “Mid-Year Total Semiconductor Equipment Forecast Report” released by SEMI in Jul 2024, global wafer fab equipment spending will increase from USD95.6B in 2023 to USD98.3B in 2024, a year-on-year increase of 3%, mainly due to the gradual improvement of the industry and the entry into the upward phase of the cycle. Looking ahead to 2025, the demand for high-performance chips in industries such as artificial intelligence will further increase. Combined with the recovery of demand in industries such as automobiles, consumer electronics and industry, global wafer fab equipment spending is expected to grow to USD112.8B, YoY increase of 15%. (YD Securities report)

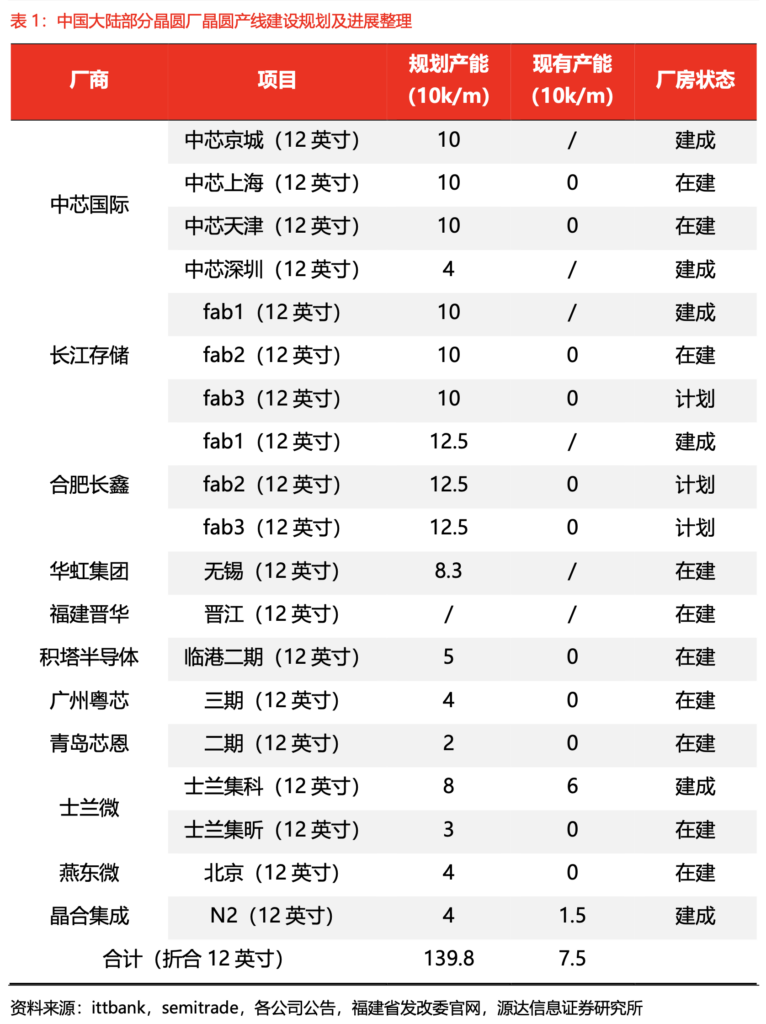

There is a lot of room for wafer fabs in mainland China to expand production, which is expected to boost capital expenditure on equipment. By sorting out some wafer fab production line construction projects in mainland China, the total planned capacity gap exceeds 1M pieces/month. The above information verifies that there is still demand for equipment in mainland wafer fabs, and domestic demand for semiconductor equipment will still be considerable in 2024. (YD Securities report)

Indian semiconductor engineering company Tessolve has acquired Dream Chip Technologies (DCT) for INR4oo crore (USD45.8M). DCT is a German semiconductor chip design firm that focuses on the development and design of ASICs, SoCs, and field programmable gate arrays (FPGAs). DCT released an automotive AI chip in 2023, equipped with Alcatraz, a functional and security core based on Cortex-R52, with two A65 cores and on-chip networks and accelerators, with a computing power of 10 TOPS. Tessolve is located in Bangalore, India. It is mainly engaged in chip design and semiconductor testing and verification. It has a history of 20 years and has 3,000 employees in 10 countries and regions, with 80% of the world’s top 10 semiconductor companies are its customers. Tessolve’s parent company is India’s Hero Electronix, which produces the world’s best-selling motorcycle brand Hero. (CN Beta, Telematics Wire, Data Center Dynamics, Tessolve, Live Mint)

Samsung Foundry is reportedly having a hard time getting the 3nm manufacturing node running efficiently. The company has been plagued with difficulties manufacturing 3nm chips, and this could spell trouble for the Exynos 2500 SoC. Samsung Foundry’s chip yield for the 3nm node is reportedly less than 20%. The foundry division could not be able to attract new contract manufacturing clients, also retaining the existing ones has become a nearly impossible task.(CN Beta, Sammy Fans, SamMobile, Newsway)

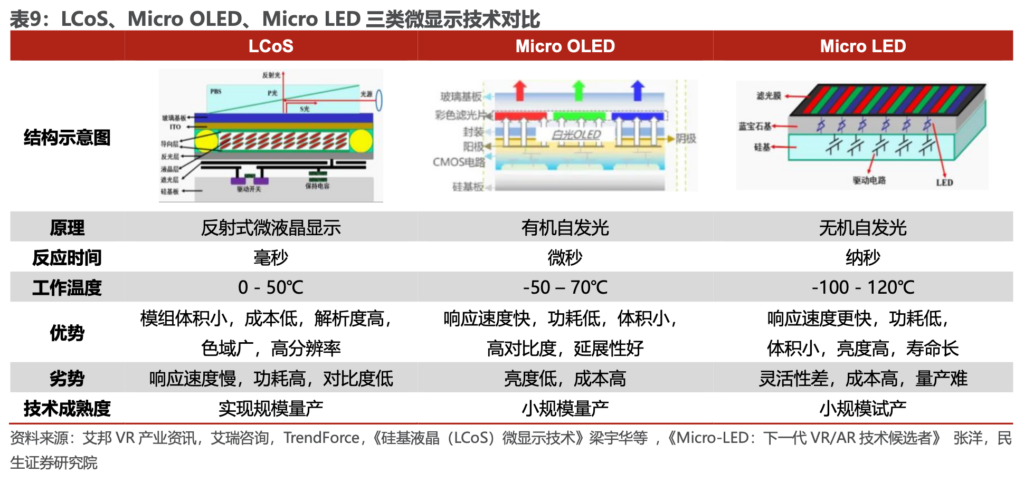

The micro-display technologies used in AR mainly include LCoS, Micro OLED, and Micro LED. LCoS is a small-size matrix liquid crystal display device based on liquid crystal photoelectric response and CMOS technology. It is derived from LCD technology and has developed rapidly with the help of mature semiconductor technology and liquid crystal production lines; Micro OLED is a technology based on organic light-emitting diodes. Thanks to the close integration of CMOS technology and OLED technology, it uses a single-crystal silicon substrate and directly integrates the drive circuit on the substrate, thereby greatly reducing the overall volume and weight of the screen; Micro LED display technology is based on lateral micron-sized semiconductor diode technology. Its pixel unit is below 100μm, inheriting the high efficiency, high brightness and self-luminescence of LED, and has the advantages of energy saving and small size. (Minsheng Securities report)

Startups promote the development of the optical waveguide industry based on their own technical reserves. Specifically, Lumus leads the industry standards with its patented array optical waveguide technology, especially the innovative design of Z-Lens. Lingxi-AR has strengthened its professional service capabilities in the field of optical cold processing through cooperation with MDK Opto. North Ocean Photonics has achieved AR display with a large field of view and high definition with the precision process of holographic grating waveguides. The core technology independently mastered by Greatar Technology provides a fast and low-cost mass production solution. Raypai Technology has promoted the mass production and market application of geometric optical waveguide modules with its independent core intellectual property rights. These companies have not only made breakthroughs in technology, but also accelerated the commercialization process of optical waveguide technology through strategic cooperation, injecting new vitality into the development of the AR/VR industry. (Minsheng Securities report)

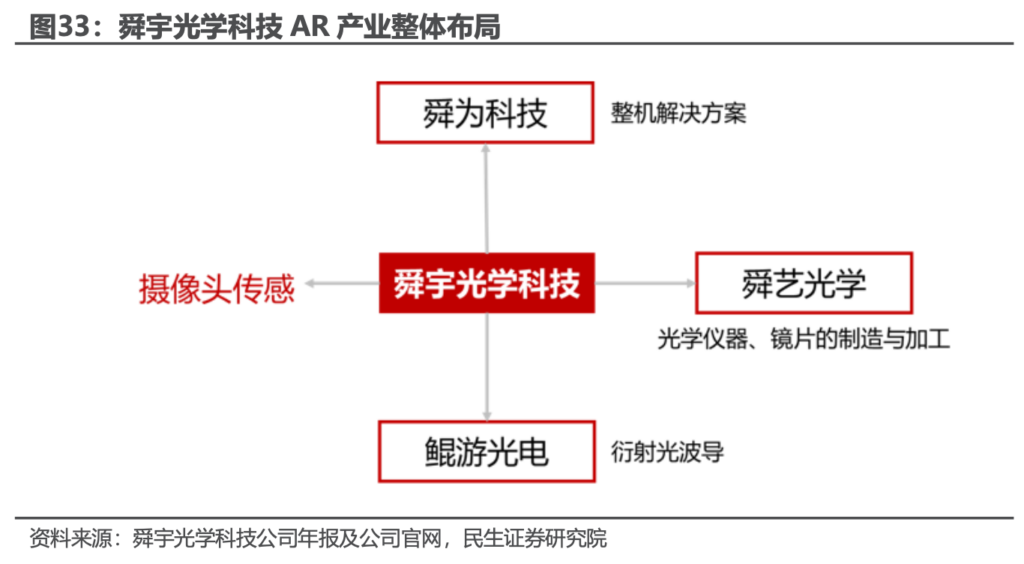

Sunny Optical has been deeply involved in the XR track for many years, and its products focus on diffractive optical waveguides. The company holds a 3.56% stake in North Ocean Photonics, which is deeply involved in diffractive optical waveguides, and established Sunway Technology in 2021. Sunny Optical focuses on developing XR smart glasses system solutions. In 2022, it reached a cooperation with Micro-LED microdisplay manufacturer JBD and launched a full-color LCoS binocular diffractive waveguide module with core advantages such as 85% transmittance, high heat dissipation efficiency and integrated beam structure, with brightness >200nits, field of view of 40°, weight of about 46g, and resolution of 1080×720. (Minsheng Securities report)

Corning is set to receive up to USD32M in funding under the CHIPS and Science Act. The US Commerce Department said the proposed funding will help Corning increase production of its glass products used in the chip-making process. Corning will put the funding toward the production of its High Purity Fused Silica and Extreme Ultra-Low Expansion Glass. As noted in the press release, both types of glass are used in lithography machines and photomasks used to image a chip’s pattern onto a silicon wafer. It will also allow Corning to “scale a novel manufacturing process” in its Canton, New York plant, which is expected to create 130 new manufacturing jobs and more than 175 construction jobs.(CN Beta, Commerce, The Verge, Tom’s Hardware)

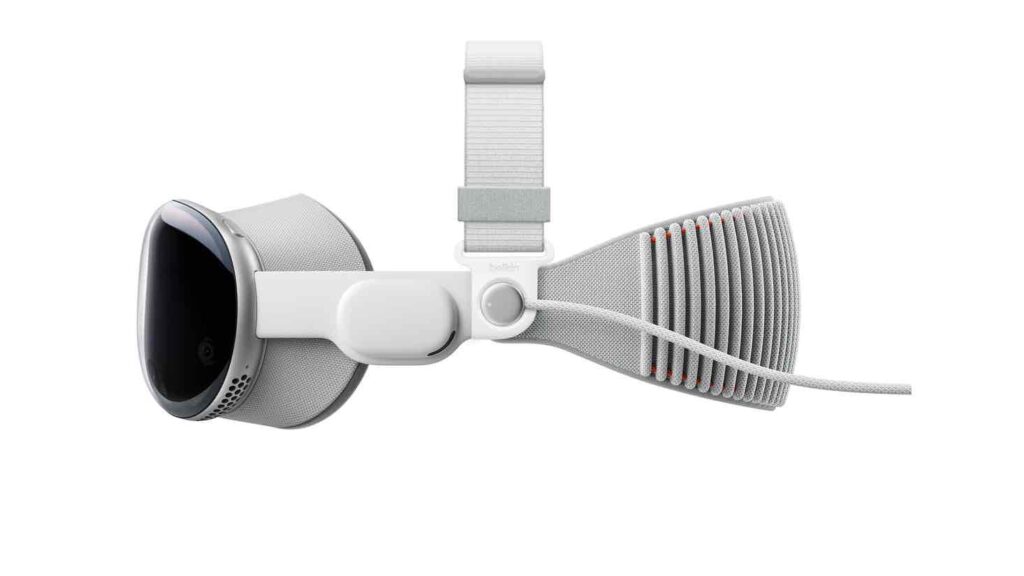

Apple is reportedly considering two options on how to apply the color filter on the OLED panel that will be used on the more affordable Vision Pro device. The yet unnamed device will use a panel that is based on a glass board with white OLED deposited on it with a red, green, and blue (RGB) color filter atop them to form the colors. This method is called W-OLED+CF. In term of resolution Apple is considering 1,500ppi. As it uses a glass board, it is not OLED on silicon (OLEDoS), where the OLED is deposited on a silicon board. Vision Pro used a OLEDoS with a resolution of 3,391ppi supplied by Sony. Apple is showing preference of directly forming the color filter on the thin-film encapsulation (TFE) that covers the panel. Another option, which is the more standard option, is to form the color filter on the glass board, and combining it with another glass board with W-OLED deposited on it. The W-OLED glass board will be the bottom board and the color filter board will be the top board in this case. Apple is preferring forming the filter directly on TFE as this will require only one glass board and will allow it to make the MR device thinner. Samsung Display will likely handle developing Apple’s desired W-OLED+CF panel. (GSM Arena, The Elec)

LG Display (LGD) has developed a display that can stretch from 12”-18”, making the prototype currently the world’s most stretchable screen. The company claims it can be stretched up to 10,000 times. The 50% stretchable display is an improvement from the company’s most recent 2022 prototype, which was able to extend its display size by 20%. The MicroLED display has a pixel density of 100 pixels per inch, around what might be found in a 21”-24” monitor with 1920 x 1080 resolution. It is capable of displaying full colors with its RGB pixels. The key to device’s rubberlike quality is in its silicon-based substrate, also used in contact lenses, as well as a new wiring system. LGD claims that the panels will deliver a high resolution of 100ppi even when stretched up to 18”.(CN Beta, Tom’s Guide, Korea JoongAng Daily)

Samsung Electronics is reportedly set to launch high-capacity and high-heat-dissipation Bonding Vertical (BV) NAND Flash with more than 400 layers in 2026. Samsung plans to introduce its tenth generation of 3D NAND (V10) with over 400 layers around 2026, followed by V11 in 2027. Currently, Samsung’s latest NAND product features 286 layers in the V9 NAND series. Starting from V10, Samsung will adopt bonding technology that first stacks the cells before connecting them to the peripheral circuits manufactured on other wafers, thereby improving performance and stability. To strengthen its DRAM leadership, Samsung plans to release the sixth-generation 10-nanometer DRAM, or 1c DRAM, and seventh-generation 10nm DRAM, or 1d DRAM, as early as the end of 2024 for use in advanced AI chips such as HBM4. it will unveil sub-10 nm DRAM, or 0a DRAM, in 2027. The key feature of 0a DRAM is the application of the vertical channel transistor (VCT) 3D structure, like the technology used in NAND flash, to enhance performance and stability.(KED Global, CN Beta, TrendForce, WCCFtech, Digitimes)

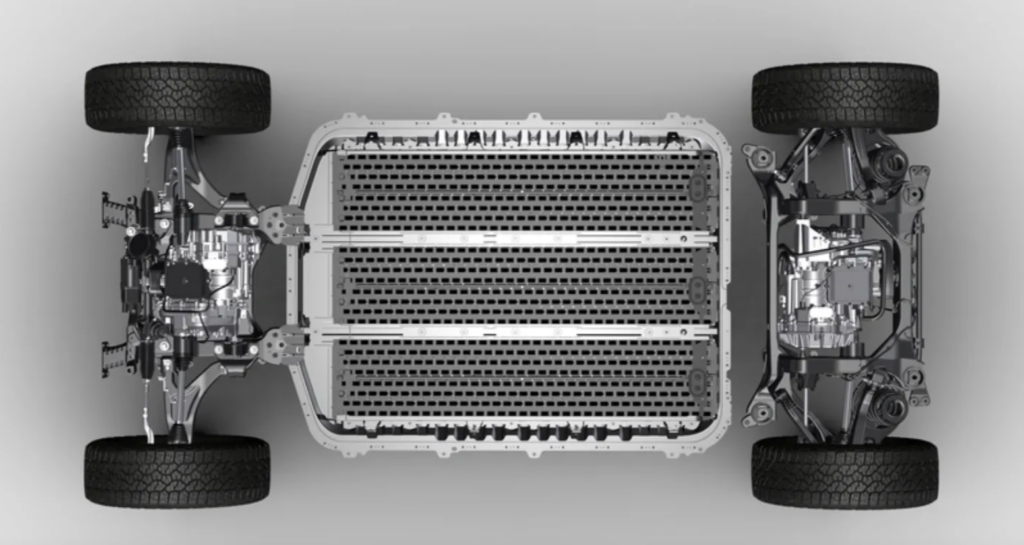

LG Energy Solution (LGES) said its subsidiary LG Energy Solution Arizona has signed a battery supply agreement with U.S.-based automotive manufacturer Rivian. Under the agreement, LGES, which supplies Tesla, General Motors (GM) and Hyundai Motor, will provide Rivian with its advanced 4695 cylindrical batteries for over 5 years, totalling 67GWh. The battery packs that Rivian currently uses in its R1T and R1S vehicles are assembled at its Normal, Illinois, factory using cells manufactured in South Korea by Samsung SDI. Now, the cells will be produced in the US to better comply with tax credit requirements outlined by the Inflation Reduction Act.(CN Beta, KED Global, Yahoo, The Verge, Reuters, Rivian)

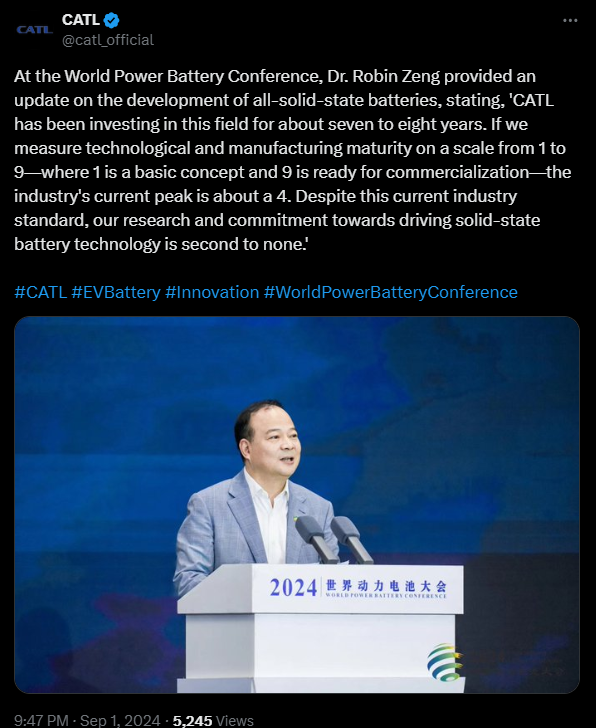

CATL is closer to manufacturing solid-state batteries and has reportedly begun sampling 20Ah cells with a view to mass production. The company is aiming for small-scale solid-state battery production by 2027. It has dedicated a team of over 1,000 people to R&D on the project. It has achieved an energy density of 500 Wh/kg, nearly twice that of cells in mainstream electric vehicles.(CN Beta, BestMag, Notebook Check, Twitter)

Since its establishment in 2012, Foxconn Zhengzhou Factory has produced more than 1.2B smartphones, becoming the world’s largest smart device production base and the first “lighthouse factory” in Henan Province, training nearly 3M skilled industrial workers for Henan. According to data, in Sept 2010, construction of Foxconn Zhengzhou Factory began. This factory is known as the Port Area Foxconn. It is Foxconn’s largest factory in mainland China and Apple’s largest assembly plant in the world. Most of Apple’s high-end iPhone models are assembled and produced here. After Foxconn Zhengzhou went into production, Zhengzhou quickly became an important global mobile phone production base, covering an area of 5.6M square meters and with a peak workforce of more than 350,000 people. (CN Beta, C114, IT Home)

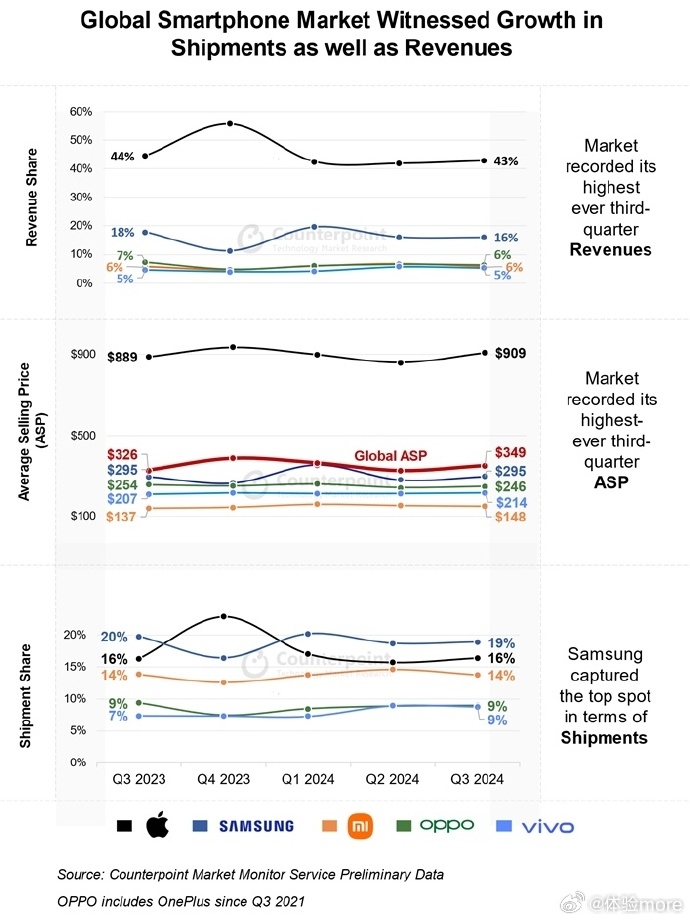

Global smartphone shipments grew 2% YoY in 3Q24, according to Counterpoint Research. While shipment growth may have slowed in recent quarters, global smartphone revenue growth accelerated in 3Q24 recording 10% YoY growth to reach the highest-ever levels for a third quarter. Apple led the market in smartphone revenues capturing a 43% share and recording its highest-ever Q3 revenues, shipments, and ASPs. With most major brands recording strong revenue growth, the ≥USD400 segment gained a net 2% share YoY in 3Q24. The ongoing premiumization wave, observed across regions has incentivized OEMs to rethink their premium portfolio and device financing strategies. Counterpoint expects the premiumization trend to continue in the coming years and project global smartphone ASPs to rise at a CAGR of 3% from 2023 through 2028. (CN Beta, Counterpoint Research)

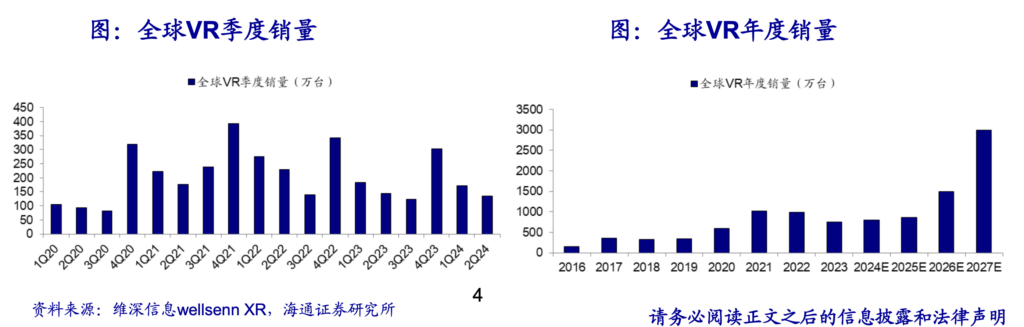

According to Wellsenn XR, global VR sales in 2Q24 were 1.35M units, down 6% YoY. The main reasons for the sales decline include: Sony’s PS VR2 cumulative sales were only 80,000 units; Meta’s basic market was stable; Apple Vision Pro sales were 80,000 units, with a small contribution to the incremental sales; price, wearing comfort, and lack of content ecology caused Apple Vision Pro sales to fall short of expectations. Wellsenn XR has lowered its VR sales forecast for 2024, and expects global sales to reach 7.97M units in 2024, a 6% increase from 2023. In 2024, the VR market will reverse the downward trend in sales over the past two years and return to a positive growth track, but the VR industry will still be in a period of low sales in 2024 and 2025. (Haitong Securities report)

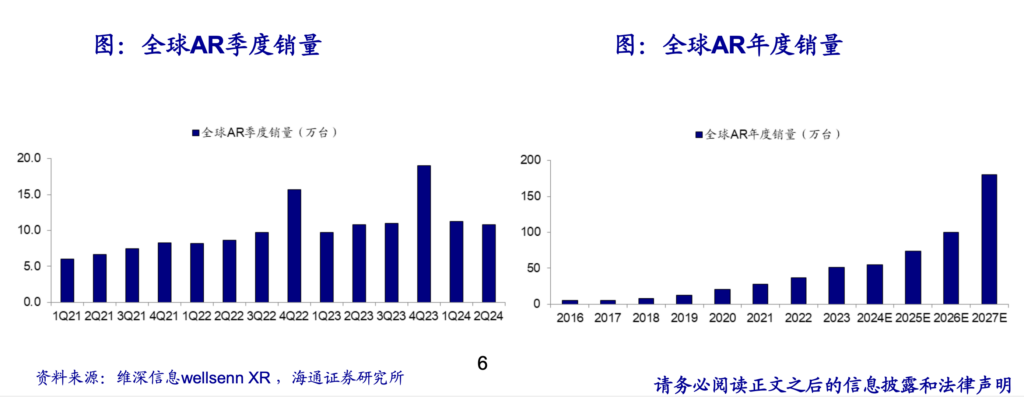

Global AR sales in 2Q24 were 108,000 units, the same as in 2023. The overall market in 2Q24 was sluggish, the traditional 618 promotion day of e-commerce platforms was sluggish in 2024, the overall consumer environment was down, AR manufacturers’ cash flow was tight in 2024, and the weakening of channel promotion was also a major factor causing the overall sluggish sales. It is estimated that global AR sales in 2024 will be 550,000 units, with a growth rate of 8%. The growth focus mainly comes from AI+AR glasses. Haitong Securities expects that 2024-2025 will be a new variable for the development of the industry. (Haitong Securities report)

According to the teardown report of Wellsenn XR, the module accounts for the highest proportion of the cost of the entire Apple Vision Pro, followed by the computing and storage modules, and then the structural parts and assembly links. (Haitong Securities report)

Taking Huawei’s AR glasses Vision Glasses released in 2022 as an example, it adopts Micro OLED+BirdBath light display solution, of which the screen is supplied by Vision, and its value accounts for 48.22% of the total hardware cost, while the value of the BirdBath optical module accounts for 30.14% of the total hardware cost, and the optical solution cost accounts for 78.36%. Compared with the 47% cost share of the light display solution in the Microsoft Hololens developer version, there is a significant improvement. In addition, in addition to the Micro OLED+BirdBath light display solution commonly used in split designs, the Micro-LED+resin diffraction optical waveguide solution has also gradually been implemented and applied to all-in-one AR glasses, bringing consumers a better display and wearing experience, and is expected to become the final solution. (Minsheng Securities report)

Apple is likely to launch a refreshed Apple Vision Pro headset before a cheaper version of the product arrives. Apple is believed to be working on “several ideas” for its overall Apple Vision product line and its future intentions. Currently, it is expected that an updated Apple Vision Pro will be the first, ahead of a rumored cheaper “Apple Vision” headset. The next Apple Vision Pro would likely sport an M5 processor and other internal changes, but would otherwise be very similar to the existing model. It is expected to arrive in late 2025. Apple is also said to be investigating the “smart glasses” concept as seen from Meta, which has already been shown off in demonstrations.(Apple Insider, Bloomberg)