1-8 #TalkTalkTalk : MediaTek and Google collaborate on the design of a new 2×2 multi-radio solution; Samsung is reportedly planning to launch a dual-foldable phone in 2H25; Samsung and Apple may adopt new technologies to increase the capacity of next-gen smartphone batteries; etc.

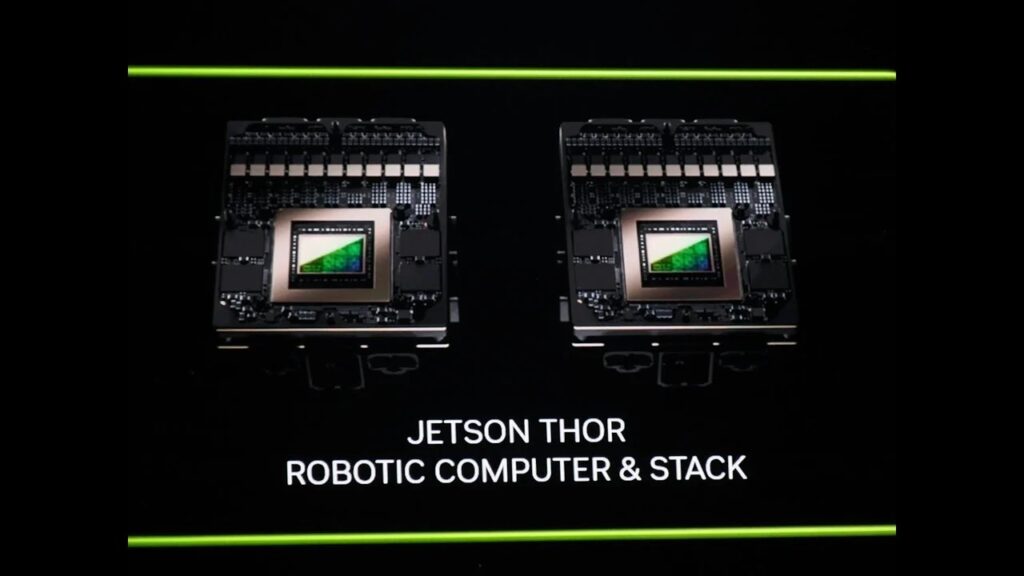

Nvidia is leaning into robotics as it looks to expand beyond its dominant AI chip business. The company plans to launch Jetson Thor, a new compact computer designed for humanoid robots, in 1H25. Deepu Talla, Nvidia’s vice president of robotics, says the timing aligns with recent breakthroughs in generative AI and robotic training using simulated environments. The company’s Jetson platform, first introduced in 2014, has evolved into a comprehensive solution for robotics development. It includes software for training AI models, simulation tools, and hardware for robots. Nvidia’s customers include big names like Amazon, which uses its simulation tech in warehouses, and Toyota, which employs its training software. (CN Beta, WCCFTech, MSN, TweakTown, Financial Times)

GlobalFoundries and IBM have announced that the two companies have reached a settlement in their ongoing lawsuits, resolving all litigation matters, inclusive of breach of contract, trade secrets and intellectual property claims between the two companies. This settlement marks the end of an ongoing legal dispute and allows the companies to explore new opportunities for collaboration in areas of mutual interest. GlobalFoundries bought IBM’s semiconductor plants in 2015. IBM sued the Malta, N.Y.-based company in New York state court in 2021 for allegedly breaking a USD1.5B contract to make high-performance chips for IBM.(CN Beta, IBM, Yahoo)

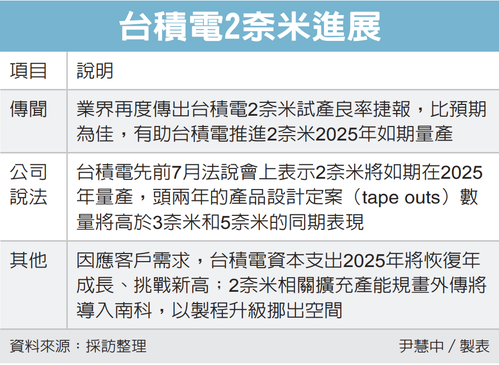

Apple was reportedly looking to launch the iPhone 17 Pro in 2025 with a 2nm chipset, but it might have to delay its plans by 12 months. TSMC is allegedly struggling with wafer yield, and the 2nm chips have yet to be certified for mass production. TSMC currently manufactures 10,000 wafers monthly, with plans to expand to 80,000 by 2026. Its facility in Arizona will contribute to achieving a total production capacity of 140,000. The yield for 2nm wafers is at 60%, indicating that 40% of each wafer is unusable. With the production cost for one wafer at KRW44M (approximately USD30,000), TSMC effectively loses USD120M monthly due to the imperfections of the new process. Hence, Apple will continue using a 3nm process for another year, allowing TSMC to enhance yield and improve pricing. (Chosun, GSM Arena, LTN, UDN)

MediaTek has teamed up with Google to collaborate on the design of a new 2×2 multi-radio solution that includes Wi-Fi, Bluetooth and Thread, to enable and power new use cases for the next generation of the smart home. The typical smart home relies on a variety of different wireless technologies, including high-speed Wi-Fi, low-power Thread, and audio/data via Bluetooth. MediaTek’s Filogic family, representing reliable and always-on connected solutions, will feature a new chipset that combines all these protocols to enable a seamless user experience in the smart home. In addition, the latest Filogic chipsets will also support Matter, an IP-based global standard that is designed to simplify the smart home ecosystem by allowing internet-connected devices from different manufacturers to communicate more easily and securely. Matter aims to make devices across major smart home systems work better together, with Thread improving the connections between them. (Android Headlines, MediaTek)

After debuting the world’s first tri-fold smartphone, the Huawei Mate XT in 2024, the company is reportedly preparing its successor. This new device could launch later 2025, featuring upgraded internals, including the powerful Kirin 9020 chipset. While the Kirin 9020 powers Huawei’s latest Mate 70 series, its development is constrained by the lack of advanced EUV lithography machinery. As a result, Huawei relies on SMIC’s DUV equipment, limiting the chipset to a 7nm process. (Gizmo China, Weibo, Sohu)

Samsung is reportedly planning to launch a dual-foldable phone in 2H25. Samsung’s dual-foldable device reportedly folds twice inwards (like the shape of G). It will have a regular phone-like screen when it is fully folded. When completely unfolded, it will resemble a large-screen tablet. It isn’t clear if the device will have a separate cover display. Samsung is said to be planning to unveil the device alongside the Galaxy Z Flip 7 and the Galaxy Z Fold 7 in mid-2025. The foldable display on the device will be made by Samsung Display. The hinges for the device are being tested by multiple brands, including Korea’s FineMtech and KH Vatec and China’s Huanli. Samsung will not use an under-display camera on its dual-folding device. Samsung is reportedly planning to manufacture less than 300,000 units of this upcoming foldable phone. (Android Central, SISA Journal, SamMobile)

China’s Huanli Intelligent Tech will allegedly be the first vendor of hinges to Samsung for Galaxy Z Flip 7. Prior first vendor, South Korea’s KH Vartec, will be the secondary vendor. The first vendor, which Samsung procures the hinges needed for the foldable phone first, can secure over 70% of the orders. The first vendor, which Samsung procures the hinges needed for the foldable phone first, can secure over 70% of the orders. Fine M-Tec, which has also supplied some hinges for the series in 2024, is expected to convert its exiting line for other products. It is supplying the cradle hinge for the case of Galaxy Buds to Samsung, as well as the back plate used in foldable phones. Amphenol and AVC are supplying hinges to Chinese smartphone makers’ foldable phones. AUFLEX, a partner to Samsung Display, is also preparing to enter the market. Some of these companies are also in talks with Apple for their foldable phone. (Sina, The Elec)

TF Securities analyst Ming-Chi Kuo has previously mentioned that Samsung would start supplying Apple with 48Mp sensors for the iPhone 18, which will likely launch 2 years from now. Samsung is allegedly developing a 3-layer stacked sensor for Apple in the PD-TR-Logic configuration. A stacked camera sensor has processing chips present at the back, with the “3-layer” term indicating that there will be a total of three chips on top of one another in a sandwich form. The advantage of adding a stacked camera sensor to an iPhone is that the distance at which the pixel values have to travel shrinks substantially, reducing the processing speeds. Assuming this technology debuts for the iPhone 18 series, Samsung’s unnamed 3-layer stacked sensor is more advanced than Sony’s Exmor RS lineup. (Patently Apple, WCCFTech, Twitter, CN Beta)

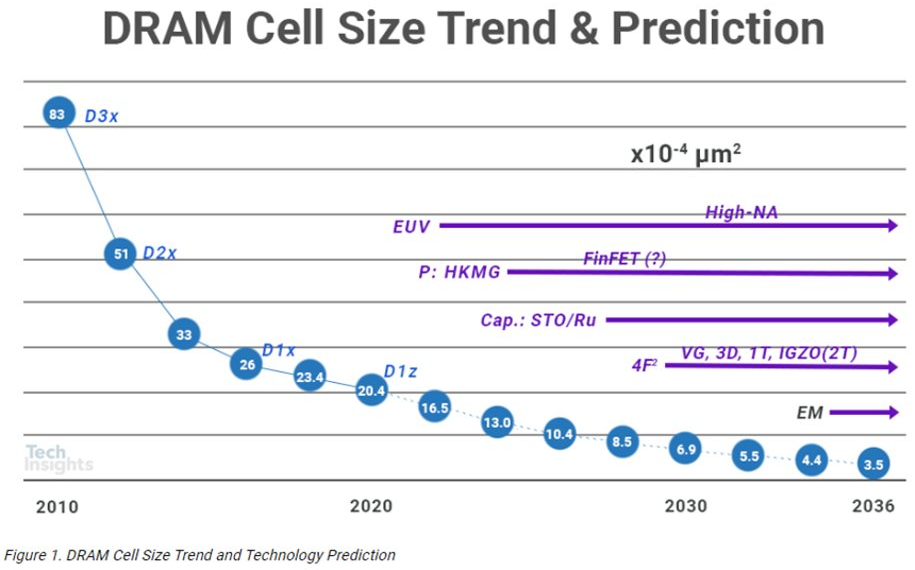

Dynamic Random Access Memory (DRAM) is made of transistors and capacitors. A transistor carries current to enable information (the bit) to be written or read, while a capacitor is used to store the bit. Today, the area per bit is at about 20.4E-4 µm2. Soon, driving higher density of bits (i.e., further reduction of the area per bit) by reducing the footprint of the capacitors by making them taller will not be possible because etch and deposition processes for capacitor fabrication cannot handle the extreme (high) aspect ratio. Our industry is expected to be able to maintain 2D DRAM until reaching ~10.4E-4 µm2 area per bit, which is about five years out. After that the lack of space becomes a problem that will likely demand going vertical—3D DRAM. (CN Beta, LAM Research)

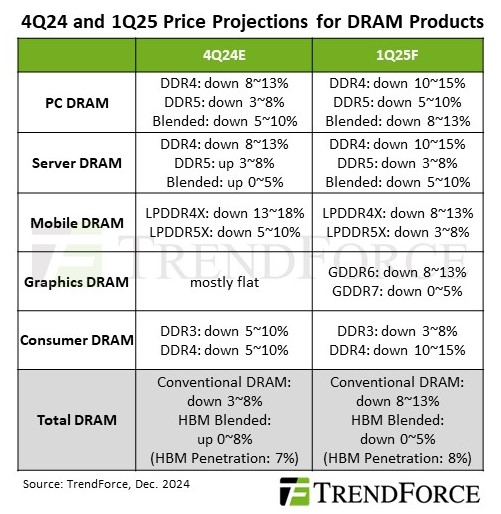

TrendForce’s latest investigations reveal that the DRAM market is expected to face downward pricing pressure in 1Q25 as seasonal weakness aligns with sluggish consumer demand for products like smartphones. Additionally, early stockpiling by notebook manufacturers—over potential import tariffs under the Trump administration—has further exacerbated the pricing decline. Conventional DRAM prices are projected to drop by 8% to 13%. However, if HBM products are included, the anticipated price decline will range from 0% to 5%. TrendForce points out that smartphone brands’ DRAM stockpiles have largely returned to healthy levels after two consecutive quarters of inventory adjustments. However, in 1Q25, smartphone brands are expected to maintain a passive procurement strategy to secure more favorable contract pricing. Manufacturers are anticipated to frontload 1Q25 shipments by year-end to address inventory and financial pressures for 2024. This strategy is expected to result in contract price declines for LPDDR4X and LPDDR5X, falling by 8–13% and 3–8%, respectively. (CN Beta, TrendForce, TrendForce)

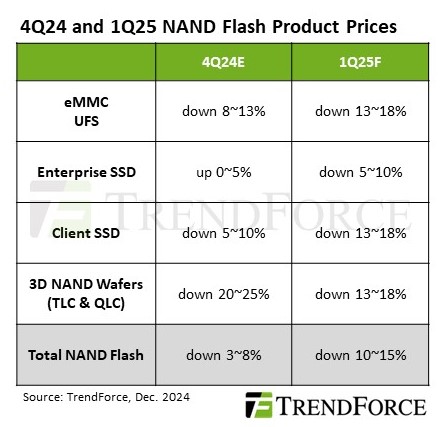

TrendForce’s latest investigations reveal that NAND Flash suppliers are expected to face mounting inventory levels and deteriorating demand for orders in 1Q25, with average contract prices forecast to decline by a QoQ of 10-15%. While wafer price declines are expected to narrow, enterprise SSD orders may offer some buffer against further price erosion. Client SSD and UFS products, on the other hand, are likely to experience continued price drops due to weak sales of consumer electronics and conservative buyer sentiment. As for eMMC products, smartphone manufacturers are expected to prioritize inventory digestion and favor lower-priced module products in 1Q25. Additionally, season procurement peaks for education projects have passed, while telecom and network infrastructure projects face delays. TrendForce points out that amid uncertain demand in 1H25 and ongoing price declines, module makers are expected to show limited interest in wafer procurement, focusing only on specific specifications in small quantities. Contract prices of wafers are projected to fall by a QoQ of 13-18% in 1Q25—with the potential for even steeper declines—among intensified competition among suppliers and cautious procurement strategies by module makers. (TrendForce, TrendForce)

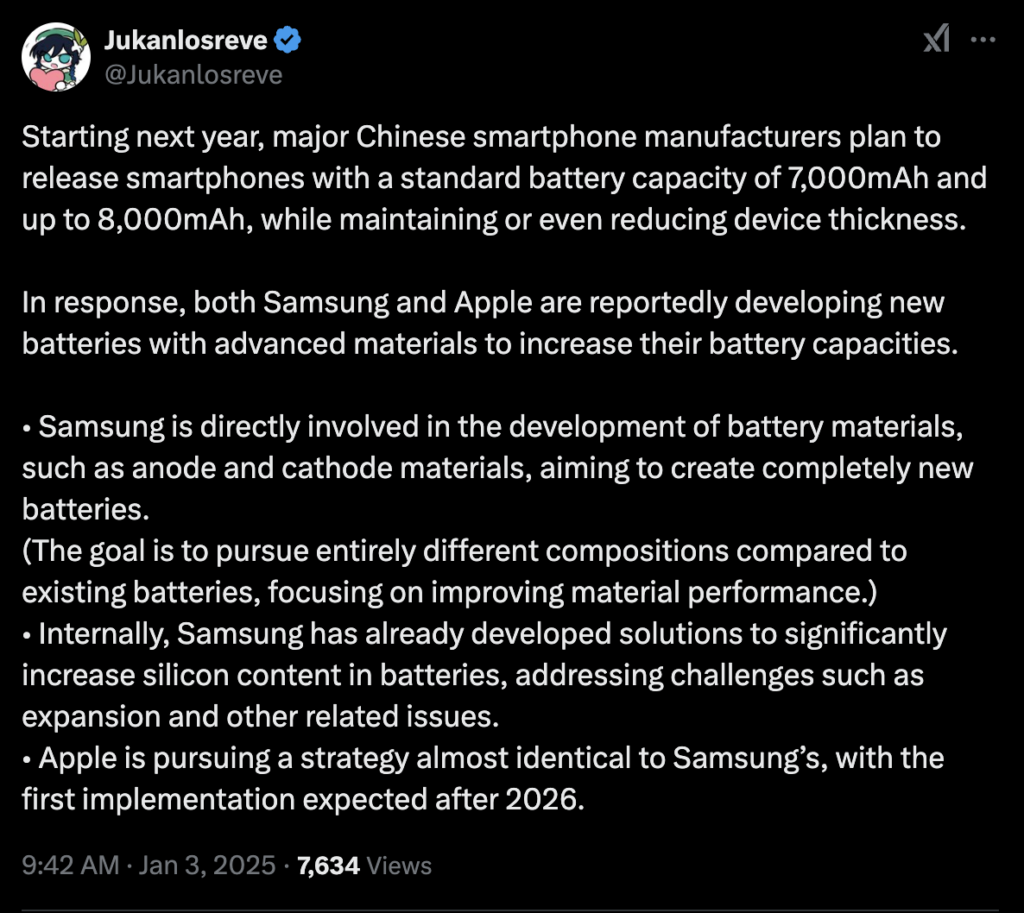

Chinese smartphone OEMs are popular for packing large batteries into their smartphones. In contrast, major players like Samsung and Apple typically opt for traditional battery capacities inside their phones. While Samsung’s M-series and F-series include a few models with batteries as large as 7000mAh, this trend doesn’t extend to its flagship series. Samsung and Apple may adopt new technologies to increase the capacity of next-gen smartphone batteries. The company is reportedly considering the use of new materials such as high-silicon to ramp up capacity. Samsung is directly taking part in the “development of battery materials such as anode and cathode materials”, while aiming to develop completely new battery units to power future Galaxy devices. Apple is also entering the fray and is following a strategy similar to Samsung’s. However, Apple may not make use of the rumored new battery tech until after 2026. (CN Beta, SammyFans, Neowin, Twitter, Naver)

Qi2 adoption continues expanding exponentially with new wireless power applications rolling out throughout 2025, including an acceleration in Qi2 Android devices, according to the Wireless Power Consortium (WPC). When Qi2 devices began rolling out in the fall of 2023, only Apple iPhone supported it. Android smartphones with Qi2 began appearing in late 2024 and consumers can expect an acceleration in Android devices with Qi2 built in during 2025. Two leading Android handset members have stated their Qi2 intentions, namely Samsung and Google. The growth of the Qi2 ecosystem will continue with the introduction of Qi2 Ready certified devices. These devices—smartphones and accessories such as cases—deliver the full Qi2 user experience when paired together in approved combinations. (Android Central, Business Wire)

Princeton University has developed a 3D printing technique that can be used to produce soft plastics with programmable stretchability and strength. The materials used are cost-effective, recyclable and scalable – a combination of properties rarely found in commercial manufacturing to date. The research focuses on the use of thermoplastic elastomers, a widely used class of polymers. By specifically aligning the internal nanostructures using 3D printing, the scientists were able to create materials that are flexible and stretchable in one direction while remaining rigid in another. The key technology lies in the structure of the material at nanoscale level. The use of block copolymers creates rigid cylindrical structures with a thickness of just 5nm–7nm within a flexible polymer matrix. They developed a process in which the printing rate and targeted sub-extrusion influence the alignment of these nanostructures. In addition, thermal tempering, i.e. targeted heating and cooling, significantly improves the material properties and even enables self-healing: damaged parts can be repaired by tempering them again without losing functionality. (CN Beta, Wiley, Princeton Materials Institute, 3PRINTR)

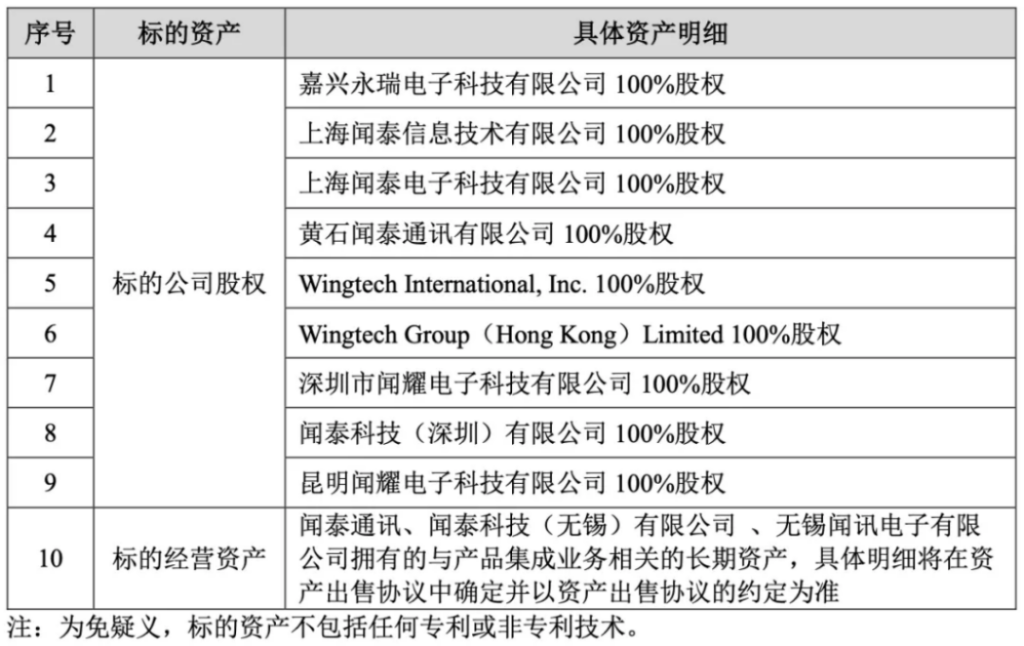

Wingtech Technology announced that based on the changes in the geopolitical environment and the company’s business development needs, it will build a new development pattern through strategic transformation in the future. At the same time, in order to maintain the development of the product integration business and its industry position, it plans to gradually transfer the product integration business to high-quality platforms with lean manufacturing advantages in consumer electronics and other fields. Wingtech intends to transfer the equity and target operating assets of 9 target companies related to the product integration business owned by the company and its holding subsidiaries to Luxshare or its designated party. Since Wingtech has also transformed from its original main mobile phone motherboard design business to an ODM manufacturer integrating R&D, manufacturing and delivery, the company has invested USD80M to build a large-scale mobile phone manufacturing center in Jiaxing City, Zhejiang Province. Since then, the Redmi mobile phone supported by Wingtech has emerged and become a phenomenal product with sales exceeding 100M units. However, due to the two-way squeeze of the upstream and downstream supply chains on ODM manufacturers, the profit margins are limited, resulting in the unsatisfactory performance of Wingtech Technology. From 2016 to 2018, although Wingtech’s revenue increased from CNY13.417B to CNY17.335B, its net profit margin never exceeded 2%. Wingtech Technology’s business is mainly divided into semiconductor business and product integration business. The semiconductor integration business is very profitable, thanks to Wingtech’s acquisition of Nexperia Semiconductor. This acquisition directly improved Wingtech’s performance.(CN Beta, Sina, Forbes)

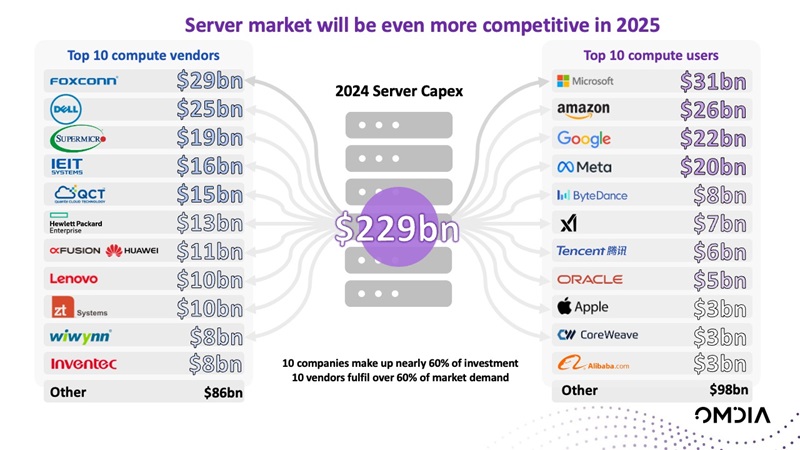

Fueled by soaring demand for AI-optimized servers from major US cloud providers, Foxconn’s ODM direct business will achieve astronomical growth in 2024, securing the top spot in Omdia’s global server market analysis. Foxconn will overtake Dell, which claimed the lead from HPE in 2018, marking the first time a non-US company tops the server market rankings. The four largest cloud providers—Microsoft, Amazon, Google, and Meta—will comprise nearly half of 2024’s data center capex, amplifying their influence on the competitive server market. Foxconn is not the only vendor benefiting from the surge in demand for AI-optimized servers. Quanta Cloud Technologies (QCT), ZT Systems and Super Micro grew their server revenue more than 100% in 2024. Dell won big strategic clients like CoreWeave and xAI. It also developed a portfolio of professional services and reference designs, including AI consulting services. (CN Beta, Omdia, Digitimes)

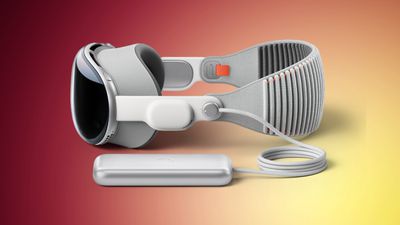

Apple’s first-generation Vision Pro headset may have now ceased production, following reports of reduced demand and production cuts earlier in 2024. Apple has allegedly reduced production of the Vision Pro headset ahead of potential plans to stop making the current version of the device completely by the end of 2024. Vision Pro suppliers have now produced enough components for 500K-600K headsets. Some factories suspended production of Vision Pro components as early as May 2024 based on Apple’s weak sales forecasts, and warehouses remain filled with tens of thousands of undelivered parts. Apple is said to have told Luxshare that serves as the Vision Pro’s assembler, that it would need to wind down production in Nov 2024. Luxshare was making around 1,000 Vision Pro headsets per day as of Oct 2024, which was half that being produced at its peak. Moreover, Apple has purportedly suspended work on the original second-generation Vision Pro for at least a year to focus on developing a lower-cost headset. Interestingly, Apple told suppliers to prepare to build 4M low-cost headsets over the entire lifespan of the future product. (CN Beta, MacRumors, The Information)

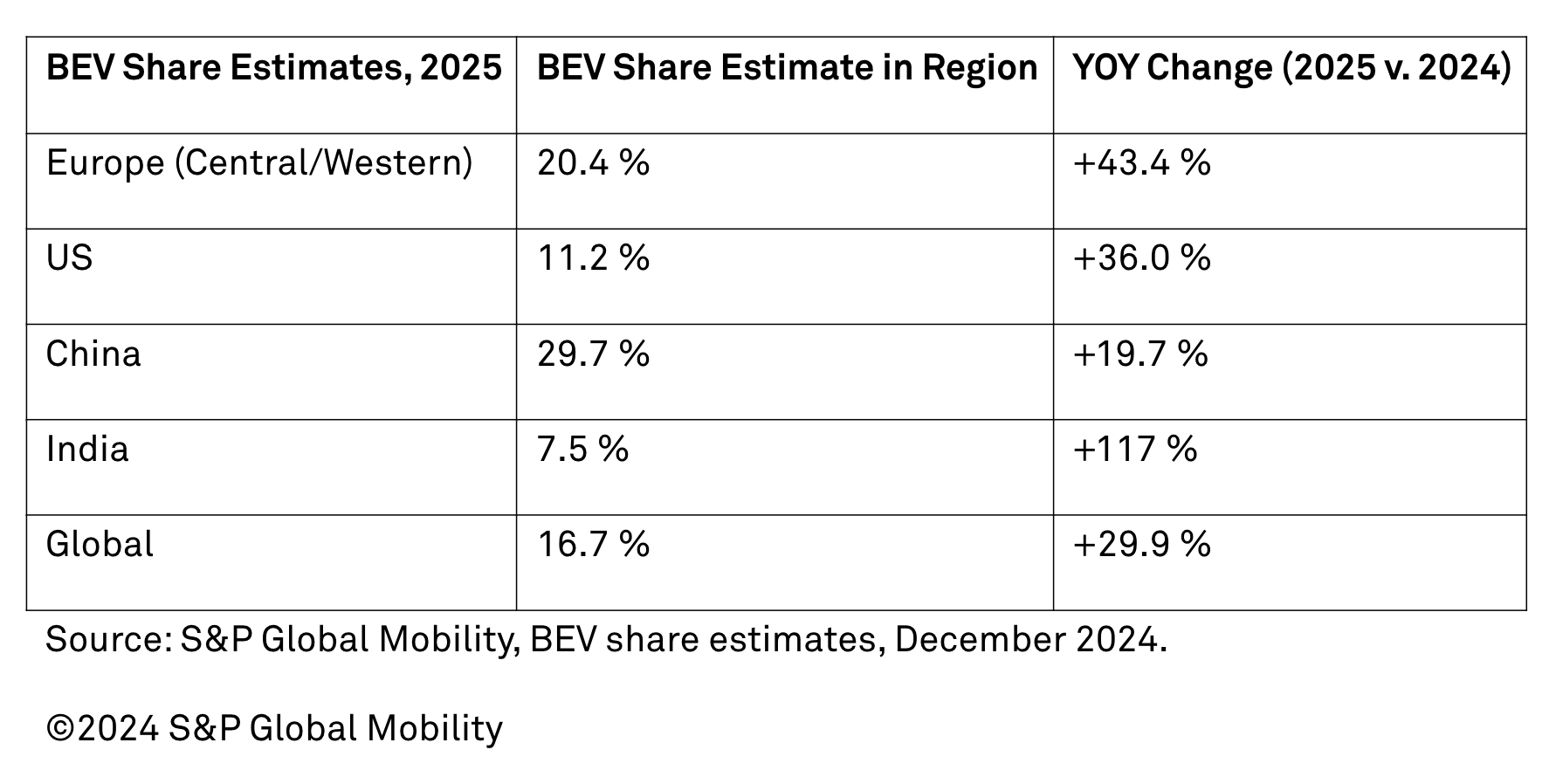

Global new light vehicle sales in 2025 are expected to rise 1.7% YoY, to 89.6M units, according to a new forecast by S&P Global Mobility. The global auto sector remains focused on managing production and inventory levels in response to regional demand patterns, which include slower growth in key markets, in some cases related to slower electric vehicle adoption rates. The forecast outlook incorporates several factors, including improved supply, tariff impacts, still-high interest rates, affordability challenges, elevated new vehicle prices, uneven consumer confidence, energy price and supply concerns, risks in auto lending and the challenges of electrification. Despite the gloom, electric vehicles remain an important automotive growth sector, and S&P Global Mobility projects global sales for battery electric passenger vehicles to post 15.1M units for 2025, up by 30% compared to 2024 levels, accounting for an estimated 16.7% of global light vehicle sales. For reference, 2024 posted an estimated 11.6M BEVs globally, for 13.2% market share. (Digital Trends, S&P Global)

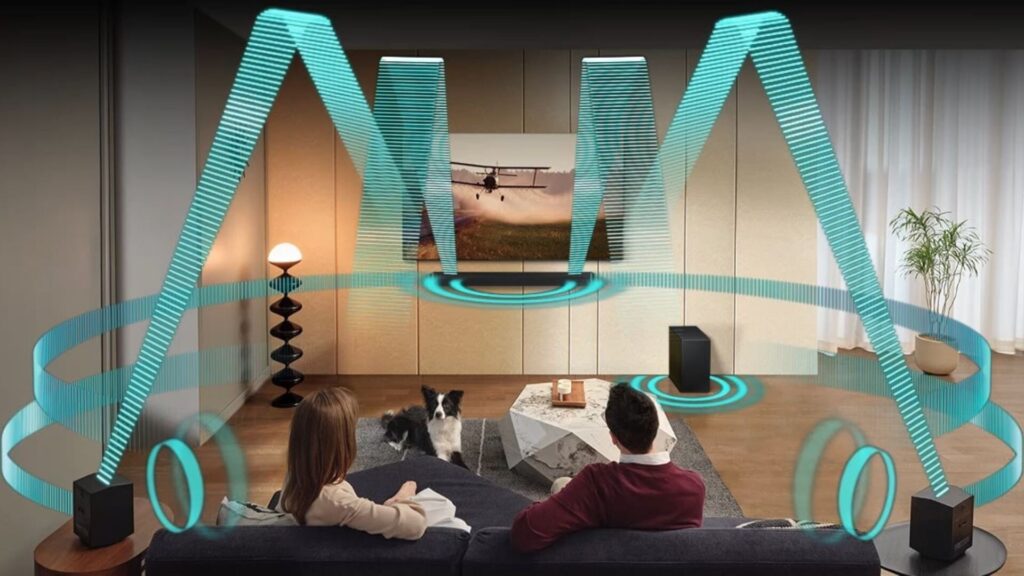

Samsung has announced that its 2025 TV and soundbar lineup will feature Eclipsa Audio, a 3D audio technology developed in partnership with Google. Eclipsa Audio allows creators to adjust audio data, such as the location and intensity of sounds and spatial reflections, to create an immersive three-dimensional sound experience. Samsung is integrating Eclipsa Audio across its 2025 TV lineup, ranging from the Crystal UHD series to the premium flagship Neo QLED 8K models, giving consumers more purchasing choices for their next TV. Samsung and Google developed it under the Alliance of Open Media’s Immersive Audio Model and Formats (IAMF). IAMF enables creators and platforms to deliver high-quality, immersive audio with efficient encoding and flexible rendering adaptable to various playback environments such as headphones, multi-speaker setups, and VR systems. It is codec-agnostic, so it plays nicely with the theme of democratizing 3D audio for both consumers and creators. (Android Authority, Samsung, CN Beta)

TiVo, a wholly-owned subsidiary of entertainment technology company Xperi Inc, has announced that it will be entering the U.S. television market with Sharp Home Electronics Company of America, marking a key milestone of the continued expansion of smart TVs Powered by TiVo. Already available in Europe, TiVo OS has 8 partners, such as Sharp Europe, to introduce its smart TVs Powered by TiVo with over 33 brands including Bush, Daewoo, Digihome, Panasonic, Sharp, Telefunken, and Vestel. The Sharp Smart TV Powered by TiVo will be the first television in the series to be made available to American consumers, as soon as Feb 2025. (Android Headlines, Yahoo, The Verge, Business Wire)

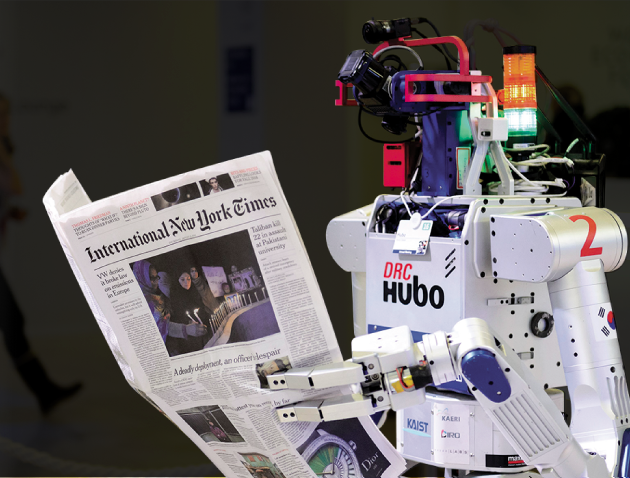

Samsung has announced that it will become the largest shareholder in Rainbow Robotics to accelerate future robot development such as humanoid robots. Samsung first acquired a 14.7% stake in the Korean firm in 2023 with investment of KRW86.6B, and exercises a call option to increase its stake to 35%. Through collaboration with Rainbow Robotics, Samsung will further strengthen its foundation in the development of advanced robot technology. Rainbow Robotics was founded in 2011 by researchers from the Korea Advanced Institute of Science & Technology’s (KAIST) Humanoid Robot Research Center who developed the first two-legged walking robot “Hubo” in Korea. By combining Samsung Electronics’ AI and software technology with Rainbow Robotics’ robotics technology, the collaboration plans to accelerate the development of intelligent advanced humanoids. (Android Headlines, Samsung, KED Global)

Jong-hee Han, one of the CEOs and Vice Chairman of Samsung Electronics, and Young-hyun Jeon, the Head of Samsung Electronics’ DS Division have expressed their wishes for Samsung to establish itself as the leader in the AI space. Both high-level executives said they would lay the foundation for Samsung to leap forward with super-gap technologies and find new growth engines. Super Gap is Samsung’s strategy of using advanced technologies to widen the gap from its competitors. Both believe that 2025 will be the turning point for AI and that the company needs to go beyond existing methods to succeed. They believe that AI will provide the company with more opportunities. The company is ready to make huge investments, bring new talent, discover new product categories, and use new business models to stay ahead of the competition.(Android Headlines, Samsung, SamMobile)

Microsoft is ready to invest a jaw-dropping USD80B in AI-driven data centers in fiscal year 2025. In Nov 2024, they launched an AI service that processes multimodal data, including text and images, all at once. On top of that, Microsoft’s global strategy is expanding too. In Apr 2024, they invested USD1.7B in AI and cloud development in Indonesia, building data centers and supporting local talent to tap into Southeast Asia’s growing tech scene. Meanwhile, OpenAI wrapped up a USD6.6B funding round, bringing their valuation to USD157B. This will fuel even more cutting-edge AI research. (Neowin, Microsoft)

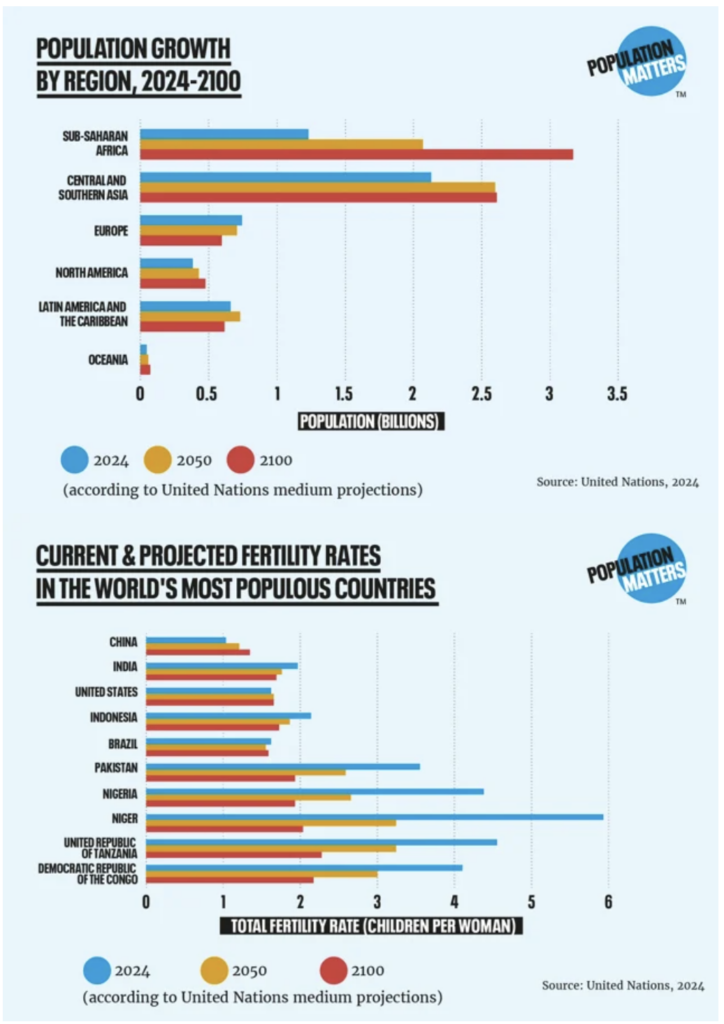

The world population increased by more than 71M people in 2024 and will be 8.09B people on 2025 New Year’s Day, according to U.S. Census Bureau estimates. The 0.9% increase in 2024 was a slight slowdown from 2023, when the world population grew by 75M people. In Jan 2025, 4.2 births and 2.0 deaths were expected worldwide every second, according to the estimates. (CN Beta, AP News, Yahoo, Bloomberg)